US Legal Forms - one of many greatest libraries of authorized forms in the United States - gives a variety of authorized file themes you may download or printing. Utilizing the web site, you can get a huge number of forms for organization and person purposes, categorized by types, says, or key phrases.You can get the most up-to-date variations of forms like the Virgin Islands Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act within minutes.

If you already possess a registration, log in and download Virgin Islands Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act from your US Legal Forms catalogue. The Download key can look on every type you view. You have accessibility to all formerly downloaded forms in the My Forms tab of the account.

If you would like use US Legal Forms the first time, allow me to share easy instructions to help you started out:

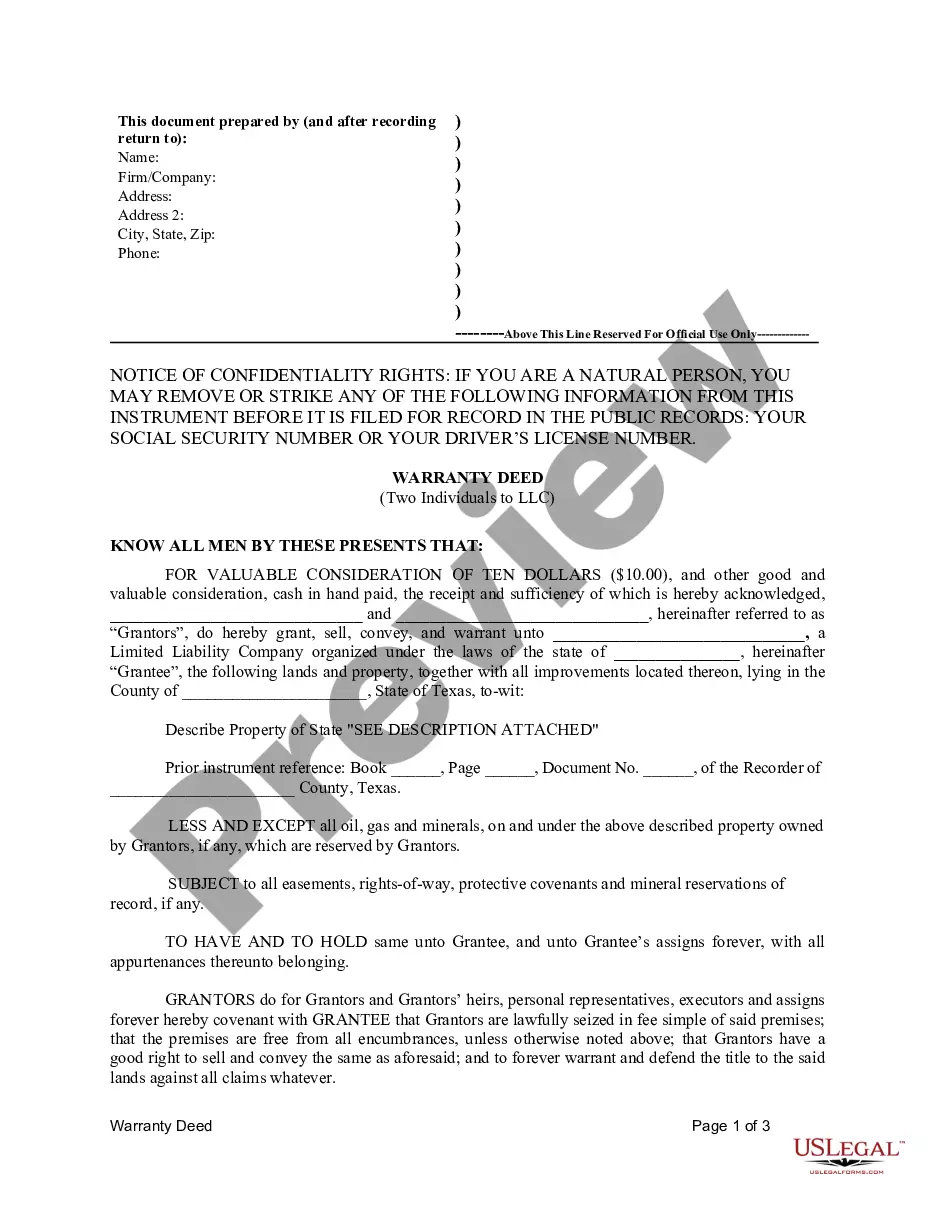

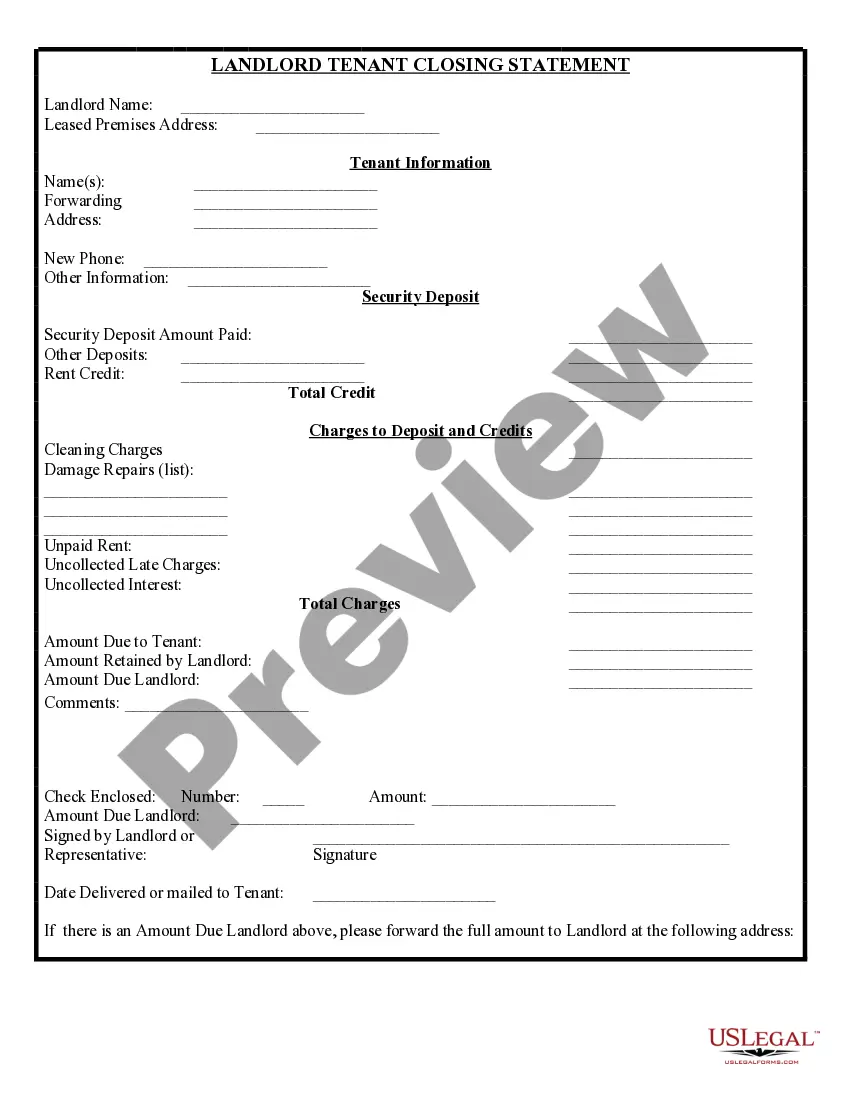

- Be sure to have picked out the correct type for your town/state. Click on the Review key to analyze the form`s content material. Look at the type description to ensure that you have selected the right type.

- In the event the type does not suit your specifications, take advantage of the Research industry near the top of the display screen to find the one that does.

- When you are pleased with the shape, validate your option by simply clicking the Buy now key. Then, pick the pricing program you favor and provide your accreditations to sign up to have an account.

- Process the transaction. Make use of bank card or PayPal account to perform the transaction.

- Choose the structure and download the shape in your system.

- Make modifications. Fill up, revise and printing and sign the downloaded Virgin Islands Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act.

Every web template you included with your bank account lacks an expiry time and is also your own property forever. So, in order to download or printing another version, just visit the My Forms portion and click on the type you will need.

Gain access to the Virgin Islands Letter Denying Consumer Credit and Notice of Rights under Equal Credit Opportunity Act with US Legal Forms, by far the most substantial catalogue of authorized file themes. Use a huge number of expert and state-particular themes that satisfy your small business or person requires and specifications.