Title: Exploring Virgin Islands Sample Letter for Tax Deeds: Types and Detailed Description Introduction: In the stunning Virgin Islands, tax deed sales provide a unique opportunity for individuals and investors to acquire properties with delinquent tax obligations. This article aims to provide a comprehensive overview of the Virgin Islands Sample Letters for Tax Deeds, highlighting their significance, types, and practical suggestions for writing them. 1. Virgin Islands Sample Letter for Tax Deeds: An Overview Tax deed sales, conducted by local governments, allow the public to bid on properties with unpaid taxes. The Virgin Islands Sample Letter for Tax Deeds serves as an essential communication tool between potential bidders and the government, outlining the bidder's intent to participate in the auction and confirming their eligibility. 2. Types of the Virgin Islands Sample Letter for Tax Deeds: a. Intent to Participate Letter: This type of letter is written by prospective bidders, expressing their interest in participating in the tax deed auction conducted by the Virgin Islands government. It includes personal details, bidder qualifications, and any necessary documents for registration. b. Bidder Registration Letter: Upon acceptance of the Intent to Participate Letter, the Bidder Registration Letter is submitted. This letter officially registers the bidder's intent to engage in the auction and signifies their agreement to comply with the rules and regulations set forth by the Virgin Islands government. c. Redemption Notification Letter: When a property owner wants to redeem their property and settle their unpaid taxes, they may use a redemption notification letter. This letter notifies the government that the owner intends to pay off their delinquent taxes, potentially halting the tax deed auction process. d. Post-Tax Auction Letter: Once a bidder successfully wins a property through the tax deed auction, they may need to draft a post-tax auction letter. This letter serves as a formal communication to the Virgin Islands government, acknowledging the bidder's successful acquisition of the property and initiating the necessary processes for title transfer. 3. Writing a Comprehensive Virgin Islands Sample Letter for Tax Deeds: a. Clear Identification: Start with a clear identification of the letter type, including the intended recipient and purpose of the communication. b. Personal and Property Information: Provide relevant personal information, such as name, address, contact details, and tax identification, and include property specifics, including parcel numbers, addresses, and tax delinquency status. c. Statement of Intent: Clearly state the purpose of the letter, whether it's expressing the intent to participate, registering as a bidder, notifying property redemption, or acknowledging post-auction requirements. d. Compliance and Inclusions: Ensure compliance with the Virgin Islands government's requirements and attach all necessary documents, such as identification proofs, bid amounts, certified funds, or redemption payment details. e. Formal Conclusion: End the letter with a formal closing, expressing gratitude and leaving contact information for any further correspondence or clarifications. Conclusion: Understanding various types of the Virgin Islands Sample Letters for Tax Deeds is essential for individuals interested in participating in tax deed auctions. By following the mentioned guidelines, prospective bidders can submit well-crafted letters, effectively communicating their intentions, complying with regulations, and optimizing their chances of successfully acquiring valuable properties.

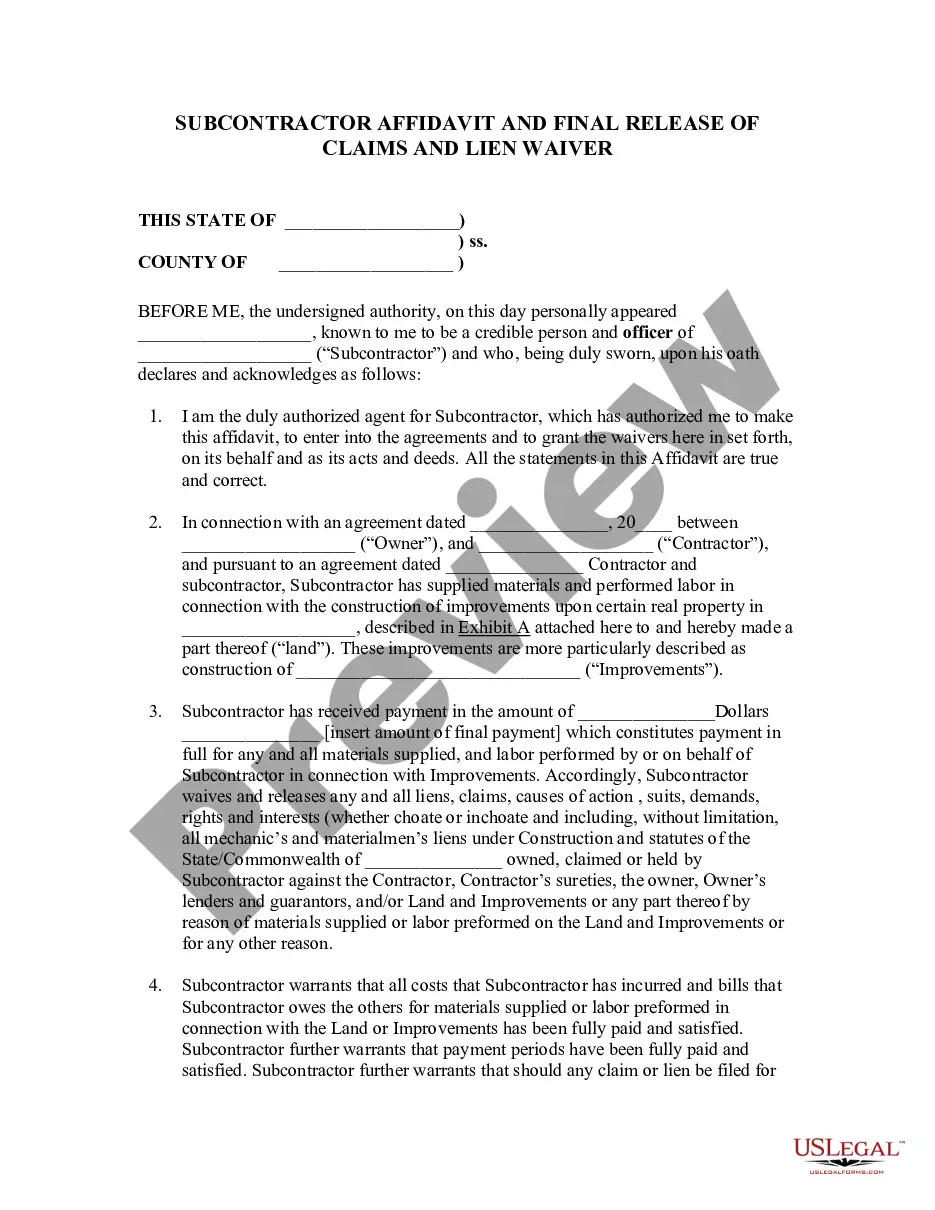

Virgin Islands Sample Letter for Tax Deeds

Description

How to fill out Virgin Islands Sample Letter For Tax Deeds?

Are you currently within a place the place you need to have documents for possibly business or specific purposes just about every time? There are a lot of legitimate document themes available on the Internet, but locating kinds you can depend on is not effortless. US Legal Forms delivers a huge number of type themes, such as the Virgin Islands Sample Letter for Tax Deeds, which can be published to satisfy federal and state demands.

If you are previously informed about US Legal Forms internet site and have your account, merely log in. Following that, you are able to obtain the Virgin Islands Sample Letter for Tax Deeds design.

Should you not provide an profile and wish to start using US Legal Forms, follow these steps:

- Discover the type you will need and make sure it is to the appropriate area/state.

- Take advantage of the Review key to review the form.

- Browse the explanation to ensure that you have chosen the appropriate type.

- In case the type is not what you are looking for, use the Research area to discover the type that suits you and demands.

- When you obtain the appropriate type, just click Acquire now.

- Pick the rates strategy you need, complete the required information and facts to make your bank account, and pay money for the transaction with your PayPal or charge card.

- Choose a hassle-free file formatting and obtain your version.

Find all the document themes you might have purchased in the My Forms menu. You can get a extra version of Virgin Islands Sample Letter for Tax Deeds any time, if necessary. Just go through the essential type to obtain or print the document design.

Use US Legal Forms, the most extensive assortment of legitimate forms, to save lots of time and prevent mistakes. The service delivers appropriately produced legitimate document themes which can be used for an array of purposes. Make your account on US Legal Forms and begin generating your way of life easier.