Virgin Islands Change of Beneficiary refers to the legal process that allows an individual to modify the designated beneficiary of a specific asset or insurance policy located in the Virgin Islands. This process is often undertaken to ensure the seamless transfer of the asset or policy's benefits to the intended recipient in accordance with the wishes of the account or policyholder. A Virgin Islands Change of Beneficiary is typically initiated when the account or policy owner wishes to update or amend the current beneficiary designation. There are various scenarios where a Virgin Islands Change of Beneficiary might be required. These include marriage, divorce, death of a beneficiary, birth or adoption of a child, or simply a change in the account or policyholder's personal circumstances or preferences. By making the necessary changes to the beneficiary designation, individuals aim to prevent any potential issues or disputes that may arise in the event of their passing. Regarding the different types of Virgin Islands Change of Beneficiary, they can be categorized based on the specific financial asset or insurance policy being modified. These may include but are not limited to: 1. Virgin Islands Change of Beneficiary for Life Insurance Policies: This type of change involves updating the beneficiary designation for life insurance policies held by individuals in the Virgin Islands, ensuring that the policy proceeds are directed to the intended person(s) in case of the policyholder's demise. 2. Virgin Islands Change of Beneficiary for Retirement Accounts: This type of change pertains to modifying the beneficiary designation for retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k) plans, enabling the account holder to designate who will inherit the remaining funds upon their death. 3. Virgin Islands Change of Beneficiary for Trusts: In this case, the change refers to altering the designated beneficiaries of a trust located in the Virgin Islands. Trusts are commonly used to manage and distribute assets, and a change in beneficiary may be necessary due to changing family dynamics or legal considerations. 4. Virgin Islands Change of Beneficiary for Investment Accounts: Investment accounts, such as brokerage or investment portfolios, may require a change in beneficiaries to ensure a smooth transition of investments upon the account holder's death. It is crucial to note that the specific requirements and procedures for a Virgin Islands Change of Beneficiary may vary based on the nature of the asset or policy involved, as well as the jurisdiction's legal framework. Therefore, it is recommended to consult with an experienced attorney specializing in estate planning or financial advisors familiar with the Virgin Islands laws to navigate the process accurately and efficiently.

Virgin Islands Change of Beneficiary

Description

How to fill out Virgin Islands Change Of Beneficiary?

It is possible to commit time on the Internet trying to find the legal record design that suits the state and federal requirements you will need. US Legal Forms provides a large number of legal types that happen to be evaluated by professionals. It is possible to acquire or printing the Virgin Islands Change of Beneficiary from our assistance.

If you have a US Legal Forms accounts, it is possible to log in and click on the Obtain option. Following that, it is possible to full, modify, printing, or indicator the Virgin Islands Change of Beneficiary. Each and every legal record design you get is the one you have forever. To have another version of any acquired kind, go to the My Forms tab and click on the corresponding option.

If you are using the US Legal Forms website for the first time, follow the simple instructions listed below:

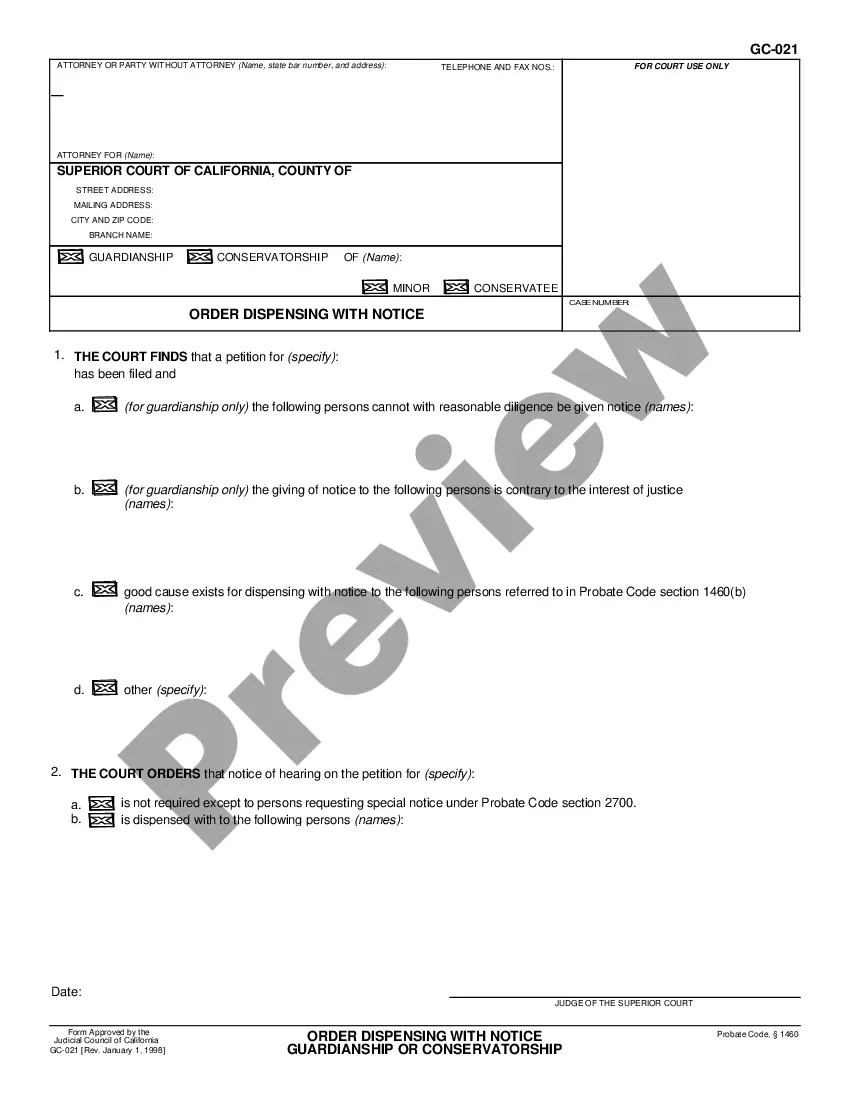

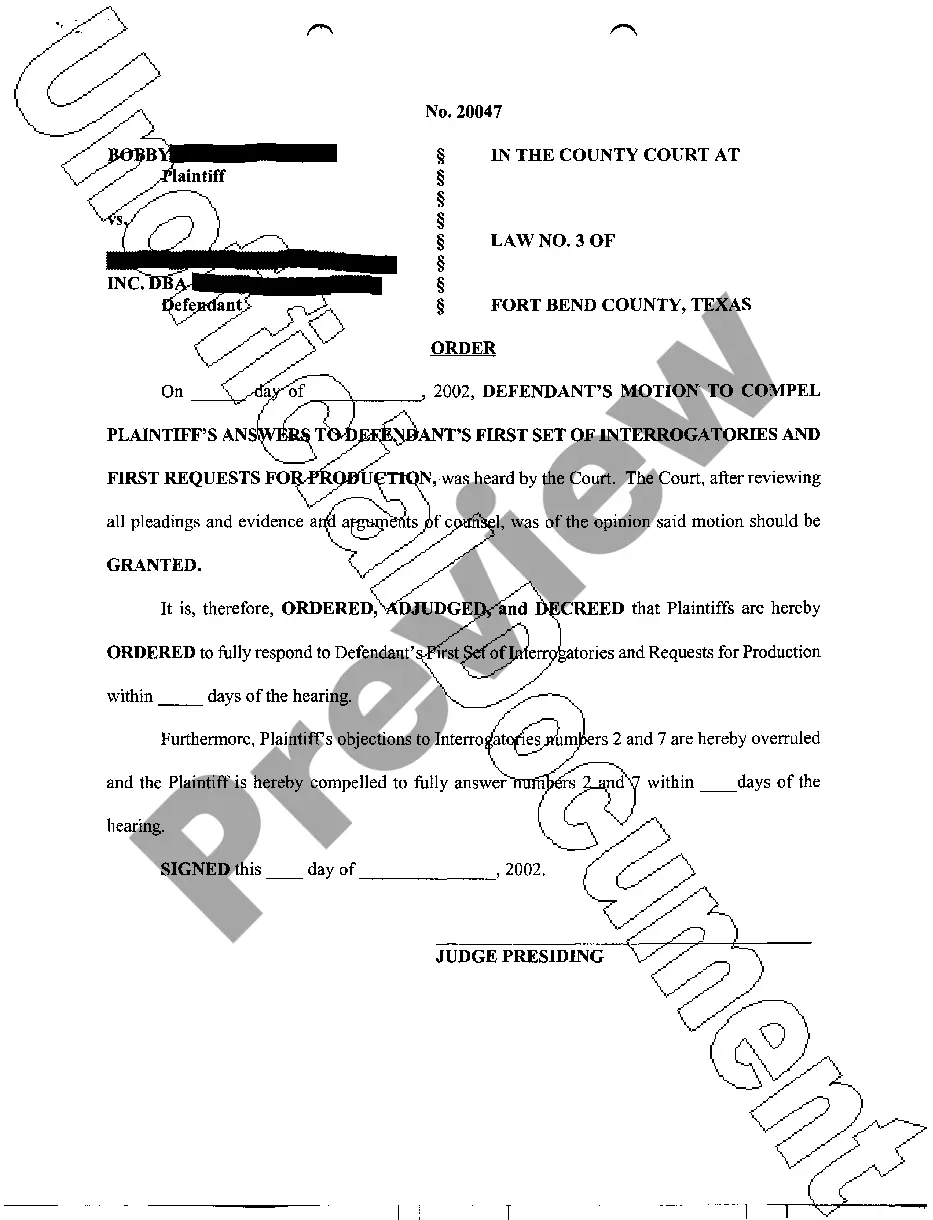

- Initially, make certain you have selected the proper record design for your county/metropolis of your choice. See the kind description to ensure you have picked out the right kind. If available, utilize the Review option to appear through the record design also.

- In order to find another variation of the kind, utilize the Look for discipline to discover the design that meets your needs and requirements.

- When you have identified the design you desire, click Purchase now to carry on.

- Pick the prices prepare you desire, type your references, and register for a free account on US Legal Forms.

- Total the transaction. You can utilize your bank card or PayPal accounts to purchase the legal kind.

- Pick the file format of the record and acquire it to your system.

- Make modifications to your record if needed. It is possible to full, modify and indicator and printing Virgin Islands Change of Beneficiary.

Obtain and printing a large number of record templates making use of the US Legal Forms Internet site, which provides the biggest selection of legal types. Use professional and state-certain templates to handle your small business or person requirements.

Form popularity

FAQ

The rule against perpetuities stipulates that a will, estate plan or other legal document intending to transfer property ownership more than twenty-one years after the death of the primary recipient is void.

The rule itself, simply stated, makes a future interest in property void if it can be logically proven that there is some possibility of the interest not vesting or failing within 21 years after the end of a life in being at the time the interest is created.

As the BVI is a British Overseas Territory, legislation made in the UK Parliament can be applicable in the BVI. In such cases a statue may specifically state that it applies to the territory, or it may be extended to the BVI by way of an Order in Council or by direct subsidiary legislation in the UK.

Bearer shares will be phased out in the BVI, and from 1 January 2023 it is no longer permissible to issue bearer shares, or to convert or exchange registered shares into bearer shares.

2.1. 1 The rule against perpetuities, in so far as it applies to trusts, is a rule invalidating interests which vest at too remote a time in the future and indeed the rule is often referred to as the rule against the remoteness of vesting.