Virgin Islands Triple Net Lease for Residential Property

Description

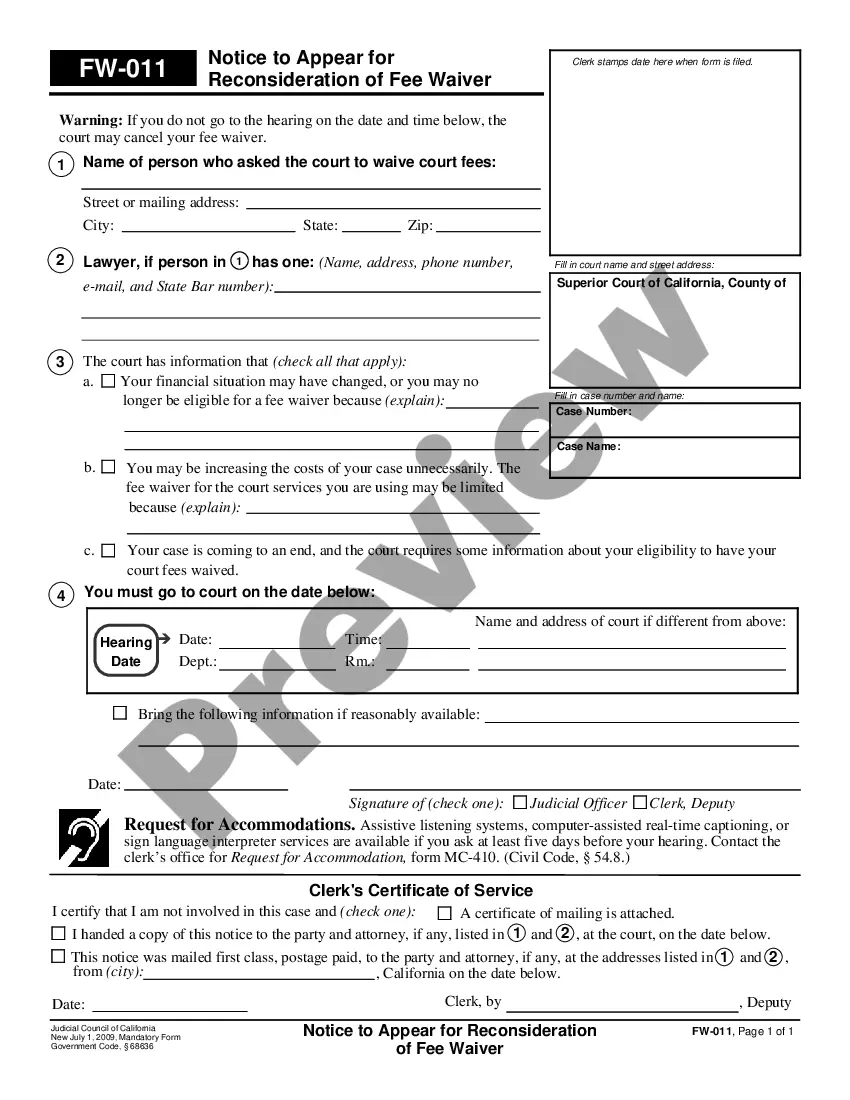

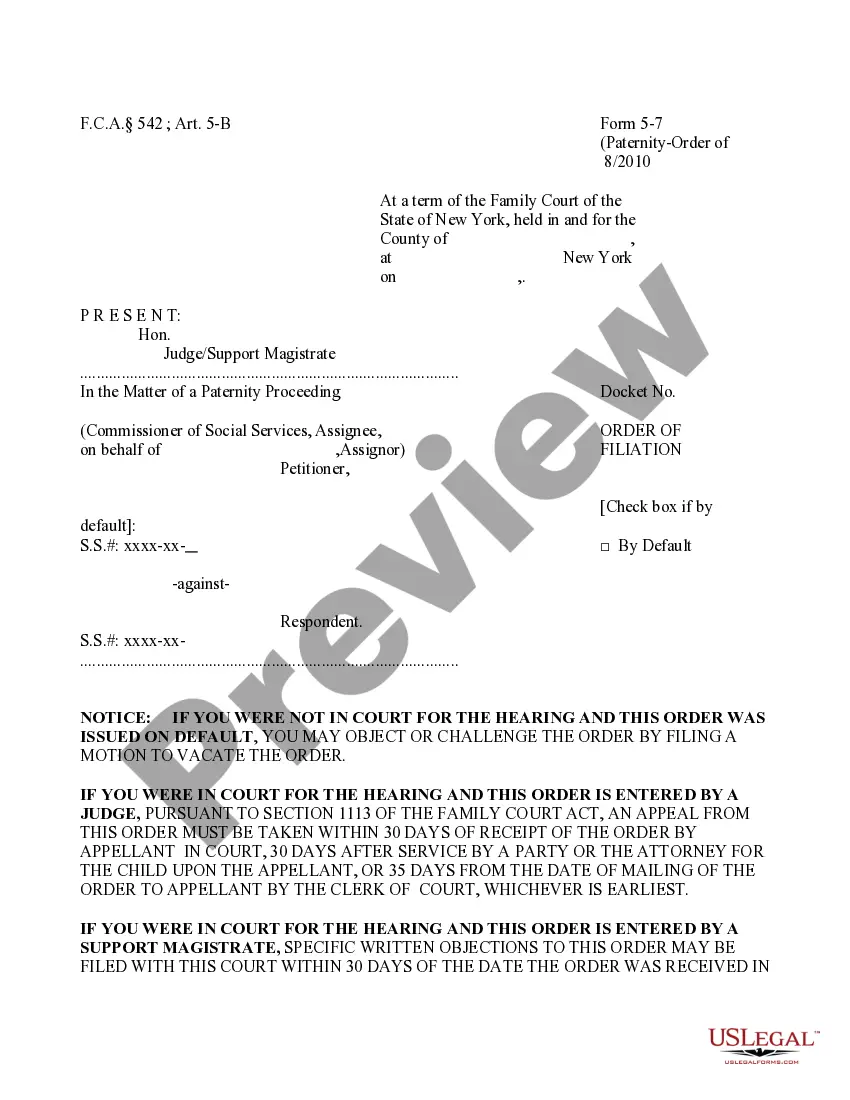

How to fill out Triple Net Lease For Residential Property?

US Legal Forms - one of the largest repositories of legitimate templates in the States - provides a variety of legal document formats that you can download or print.

While using the website, you can discover thousands of templates for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Virgin Islands Triple Net Lease for Residential Property within seconds.

Review the form details to confirm you have selected the appropriate template.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- If you already hold a subscription, Log In and download the Virgin Islands Triple Net Lease for Residential Property from the US Legal Forms collection.

- The Download option will appear on every form you view.

- You have access to all previously acquired forms from the My documents tab in your account.

- If you are a new user of US Legal Forms, here are straightforward steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview option to examine the form's content.

Form popularity

FAQ

Structuring a Virgin Islands Triple Net Lease for Residential Property typically involves three main components: rent, property taxes, and insurance. As the property owner, you can specify the rent amount, while the tenant becomes responsible for additional costs like property taxes and insurance premiums. This arrangement helps maintain a clear understanding of financial responsibilities between both parties. For detailed guidance, consider using the US Legal Forms platform, which offers resources to help you draft an effective lease agreement.

Obtaining a triple net lease for residential property typically involves a few clear steps. First, identify the properties in the Virgin Islands that meet your needs, then discuss lease terms with landlords or property managers. It’s wise to consult with real estate professionals or legal experts to understand the lease terms fully. Utilizing uslegalforms, you can find relevant documents and resources tailored to establish a solid Virgin Islands triple net lease for residential property.

While a triple net lease offers predictability for landlords, it can present challenges for tenants. As a tenant, you may face fluctuating costs tied to property taxes, insurance premiums, and maintenance fees. This financial responsibility can lead to unexpected expenses that most tenants do not initially consider. If you are looking at a Virgin Islands triple net lease for residential property, evaluate your budget to ensure it aligns with these potential costs.

Yes, some residential leases can be structured as triple net leases, including those in the Virgin Islands. In a triple net lease, tenants cover property expenses such as taxes, insurance, and maintenance on top of their rent. This structure benefits landlords by providing steady income while minimizing their expenses. If you're exploring a Virgin Islands triple net lease for residential property, it’s essential to understand how these costs impact your overall rent.

Entering into a triple net lease involves careful consideration and agreement on the terms between the landlord and tenant. First, you should identify properties suitable for a Virgin Islands Triple Net Lease for Residential Property. Next, consult a qualified real estate agent or legal advisor to understand the specific requirements and implications. Finally, ensure all lease details are clearly outlined in the lease agreement to protect both parties' interests.