Virgin Islands Simple Equipment Lease

Description

How to fill out Simple Equipment Lease?

US Legal Forms - one of several largest collections of valid documents in America - provides a vast array of legitimate file formats you can download or print.

By using the website, you can acquire thousands of documents for business and personal purposes, categorized by sectors, states, or keywords. You will find the most recent versions of documents such as the Virgin Islands Simple Equipment Lease within moments.

If you already have a monthly subscription, Log In and download the Virgin Islands Simple Equipment Lease from the US Legal Forms collection. The Acquire button will appear on each document you view. You can access all previously saved documents from the My documents section of your account.

Process the transaction. Use a Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the document on your device. Edit. Fill out, modify and print, and sign the saved Virgin Islands Simple Equipment Lease. Each template you add to your account does not expire and is yours permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you need. Access the Virgin Islands Simple Equipment Lease with US Legal Forms, one of the most extensive libraries of valid document formats. Utilize thousands of professional and state-specific formats that meet your business or personal needs and requirements.

- Ensure you have selected the correct document for the city/state.

- Click the Preview button to examine the document’s content.

- Review the document details to confirm you have chosen the right form.

- If the document does not meet your needs, utilize the Search field at the top of the page to find one that does.

- Once you are satisfied with the document, confirm your selection by clicking on the Get now button.

- Then, choose the payment plan that suits you and provide your information to register for an account.

Form popularity

FAQ

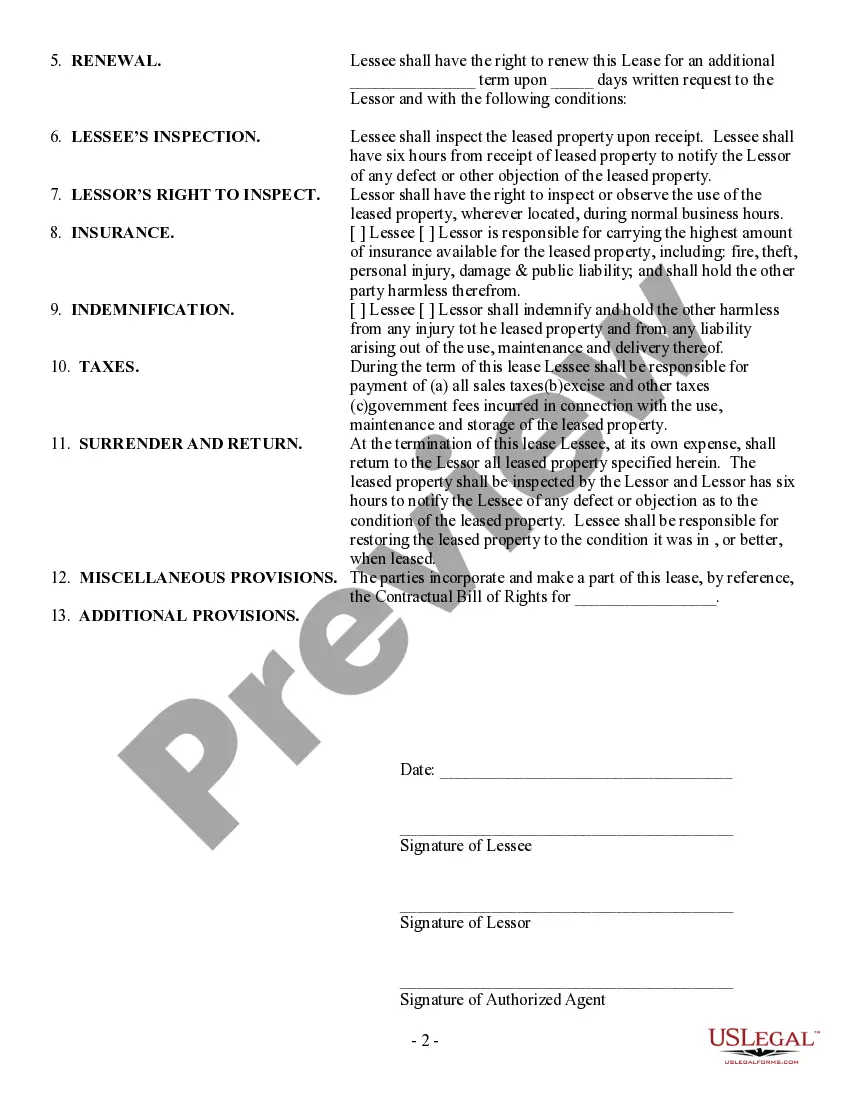

To create an equipment rental contract, start by defining the terms of the lease, including the duration, rental payments, and the specific equipment being leased. It is essential to include responsibilities for maintenance and insurance, as well as clauses relating to damages or losses. Using the Virgin Islands Simple Equipment Lease, you can easily draft a comprehensive agreement tailored to your needs, ensuring both parties understand their obligations and rights.

An agreement to lease equipment is a contract where one party allows another party to use their equipment for a specified period in exchange for payment. This type of contract is critical for businesses looking to use equipment without the upfront costs of purchasing it. The Virgin Islands Simple Equipment Lease outlines the terms, conditions, and responsibilities of both parties, ensuring clarity and protection throughout the leasing duration.

Defaulting on a Virgin Islands Simple Equipment Lease can lead to consequences like penalties or repossession of the leased equipment. It's crucial to communicate with your leasing company if you foresee any issues. Exploring your options early can often help mitigate negative outcomes.

Filing taxes in the Virgin Islands involves gathering relevant documents and filling out the appropriate forms. You can either file online or by mail, depending on your preference. Consider consulting with a tax professional to ensure that you meet all requirements, particularly if you engage in a Virgin Islands Simple Equipment Lease.

At the end of a Virgin Islands Simple Equipment Lease, you typically have several options, such as returning the equipment, renewing the lease, or purchasing the equipment. Review your lease agreement for specifics. Understanding these options helps you make an informed decision about what to do next.

To mail your U.S. Virgin Islands tax return, send it to the Office of the Virgin Islands Commissioner of Internal Revenue. Ensure your return is correctly filled out and sent to the right address as specified in the guidelines. This attention to detail avoids delays and potential issues.

Getting out of an equipment lease is possible, but it often depends on the terms of your Virgin Islands Simple Equipment Lease. Negotiate with the leasing company, as they may offer options like lease buyouts or early termination agreements. A professional legal service can strengthen your position.

Yes, you can create your own rental agreement, including terms for a Virgin Islands Simple Equipment Lease. However, it's beneficial to ensure that your document meets all legal requirements. Utilizing platforms like uslegalforms can help streamline the process and ensure completeness.

Many consider the U.S. Virgin Islands a tax haven due to its unique tax incentives. However, it's essential to understand local laws when entering into arrangements like a Virgin Islands Simple Equipment Lease. Researching these aspects can guide you in making informed decisions that align with your financial goals.

The U.S. Virgin Islands is considered a separate tax jurisdiction from the United States for most purposes. This means specific tax rules apply to residents and businesses, including those engaging in a Virgin Islands Simple Equipment Lease. Consulting a tax expert can clarify any obligations.