Virgin Islands Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion

Description

How to fill out Sample Letter For Debtor's Motion For Hardship Discharge And Notice Of Motion?

Are you in a circumstance that requires you to have documentation for either business or personal purposes almost every time.

There are numerous valid document templates accessible online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, such as the Virgin Islands Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion, that are designed to comply with federal and state regulations.

Find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Virgin Islands Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion at any time if needed. Just click on the required form to download or print the document template.

Use US Legal Forms, the largest collection of legitimate forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Virgin Islands Sample Letter for Debtor's Motion for Hardship Discharge and Notice of Motion template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the details to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search section to find the form that meets your needs and criteria.

- Once you find the right form, click Get now.

- Choose the pricing plan you desire, fill in the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- Select a convenient document format and download your copy.

Form popularity

FAQ

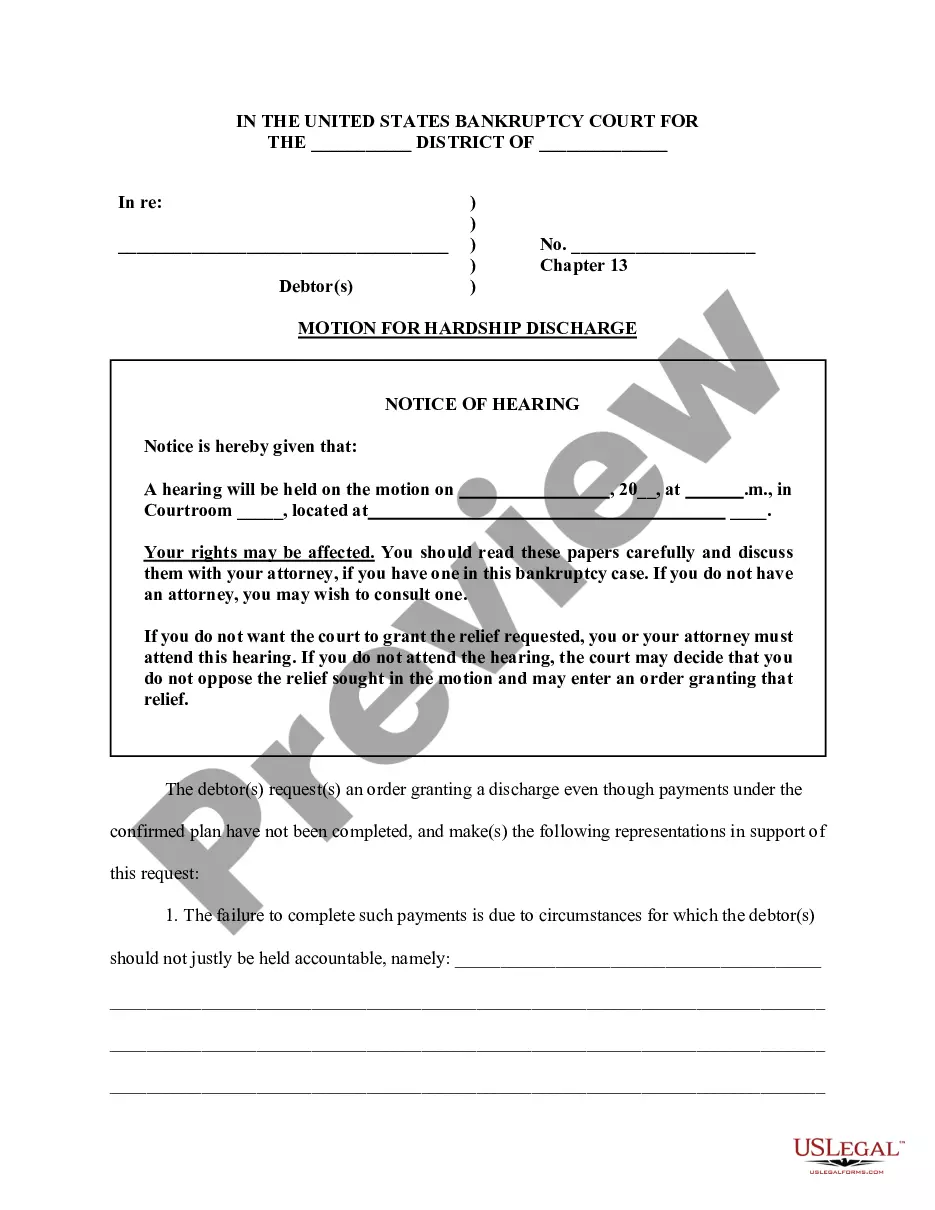

How Long Does Chapter 13 Discharge Take? Discharging debt through Chapter 13 may take 6 to 8 weeks after the final payment is made on your 3 to 5-year repayment plan (whichever was approved by the bankruptcy court).

For restitution, or damages, awarded in a civil action against the debtor as a result of willful or malicious injury by the debtor that caused personal injury to an individual or the death of an individual.

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.

Creditors who persistently try to collect on discharged debts are breaking the law, specifically section 524 of Title 11 of the United States Code. If the creditor in question does not voluntarily stop, you should consider legal action.

Sanctions, Punitive Awards and Attorneys Fees. Bankruptcy case law provides that a debtor may collect costs, reasonable attorneys fees, sanctions, punitive damages, and compensatory damages against creditors and their attorneys who violate the order of discharge.

What happens when a creditor files an objection? A creditor's objection does not automatically prevent a discharge of debt. The debtor gets a chance to file an answer to the objection, and the court may hold a hearing to decide the issue. This is called an adversary proceeding, and it works much like any other lawsuit.

An objection to the debtor's discharge may be filed by a creditor, by the trustee in the case, or by the U.S. trustee. Creditors receive a notice shortly after the case is filed that sets forth much important information, including the deadline for objecting to the discharge.

A hardship discharge is granted to help a debtor who cannot complete a Chapter 13 debt repayment plan for reasons that are completely outside the debtor's control. It will not be granted to debtors who cause their own difficulties, such as debtors who quit their jobs while making payments in a Chapter 13 plan.