An IOU is usually an informal document acknowledging a debt. The term is derived from the phrases I owe unto and I owe you. An IOU differs from a promissory note in that an IOU is not a negotiable instrument as defined by the Uniform Commercial Code and generally does not specify repayment terms such as the time of repayment. IOUs usually specify the debtor, the amount owed, and sometimes the creditor.

Virgin Islands Debt Acknowledgment - IOU

Description

How to fill out Debt Acknowledgment - IOU?

Are you within a position where you need to have documents for either company or specific purposes almost every working day? There are a lot of authorized document web templates available online, but finding ones you can depend on isn`t easy. US Legal Forms provides thousands of develop web templates, such as the Virgin Islands Debt Acknowledgment - IOU, which can be composed in order to meet state and federal needs.

In case you are presently informed about US Legal Forms website and possess your account, merely log in. After that, you can download the Virgin Islands Debt Acknowledgment - IOU format.

If you do not have an account and want to begin using US Legal Forms, abide by these steps:

- Discover the develop you want and make sure it is for that right area/state.

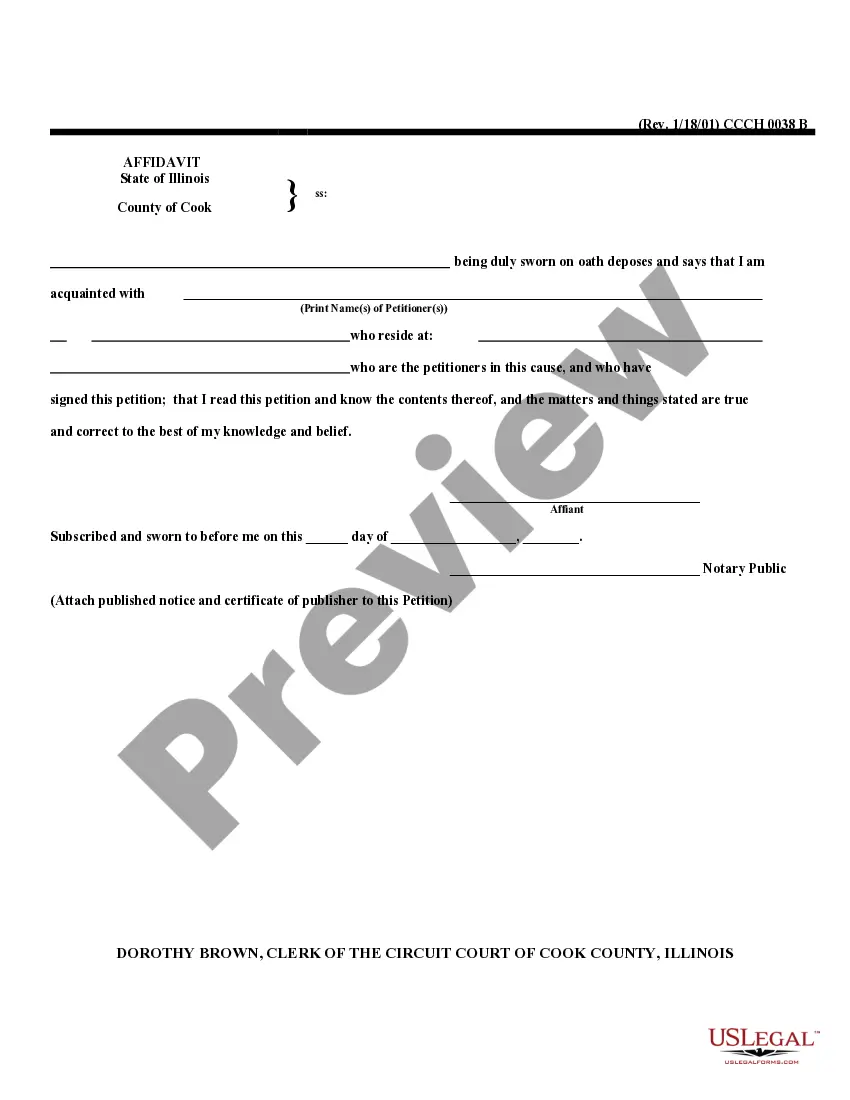

- Take advantage of the Review switch to review the form.

- Read the description to actually have selected the correct develop.

- When the develop isn`t what you`re searching for, use the Lookup discipline to get the develop that suits you and needs.

- Whenever you find the right develop, click on Acquire now.

- Select the prices program you desire, submit the desired details to create your account, and buy an order with your PayPal or Visa or Mastercard.

- Pick a handy paper format and download your backup.

Get each of the document web templates you might have purchased in the My Forms food list. You can aquire a further backup of Virgin Islands Debt Acknowledgment - IOU whenever, if necessary. Just select the essential develop to download or produce the document format.

Use US Legal Forms, the most comprehensive collection of authorized forms, in order to save time and avoid faults. The assistance provides appropriately manufactured authorized document web templates which you can use for a variety of purposes. Create your account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

An IOU (abbreviated from the phrase "I owe you") is usually an informal document acknowledging debt. An IOU differs from a promissory note in that an IOU is not a negotiable instrument and does not specify repayment terms such as the time of repayment.

An IOU is a written promise that you will pay back some money that you have borrowed. IOU is an abbreviation for 'I owe you'.

An IOU, a phonetic acronym of the words "I owe you," is a document that acknowledges the existence of a debt. An IOU is often viewed as an informal written agreement rather than a legally binding commitment.

An IOU is a written promise that you will pay back some money that you have borrowed. IOU is an abbreviation for 'I owe you'.

An IOU is a legal document that can be introduced in a court of law?though whether or not it is binding is open to dispute. Some authorities feel an IOU isn't binding at all; it's merely the acknowledgement that a debt exists.

I, the undersigned [BORROWER NAME] (the ?Borrower?), hereby confirm and acknowledge to [LENDER NAME] (the ?Lender?) that I am indebted to said Lender in the amount of $[AMOUNT] (the ?Debt?) as of the date set forth below.

An IOU merely acknowledges a debt and the amount one party owes another. A promissory note includes a promise to pay on demand or at a specified future date, and steps required for repayment (like the repayment schedule).

Cash typically includes coins, currency, funds on deposit with a bank, checks, and money orders. Items like postdated checks, certificates of deposit, IOUs, stamps, and travel advances are not classified as cash.