A limited review of financial statements is an audit restricted to an examination either for a limited period or of a limited part of the records. A review does not contemplate obtaining an understanding of the entity's internal control; assessing fraud risk; tests of accounting records by obtaining sufficient appropriate audit evidence through inspection, observation, confirmation, or the examination of source documents (for example, cancelled checks or bank images); and other procedures ordinarily performed in an audit. Accordingly, a review does not provide assurance that we will become aware of all significant matters that would be disclosed in an audit. Therefore, a review provides only limited assurance that there are no material modifications that should be made to the financial statements in order for the statements to be in conformity with generally accepted accounting principles.

The definition of nonattest services is very inclusive. It includes, for example, preparation of the client's depreciation schedule and preparation of journal entries even if management has approved the journal entries. I have confirmed these examples directly with the AICPA ethics division. The definition of nonattest services includes preparation of tax returns.

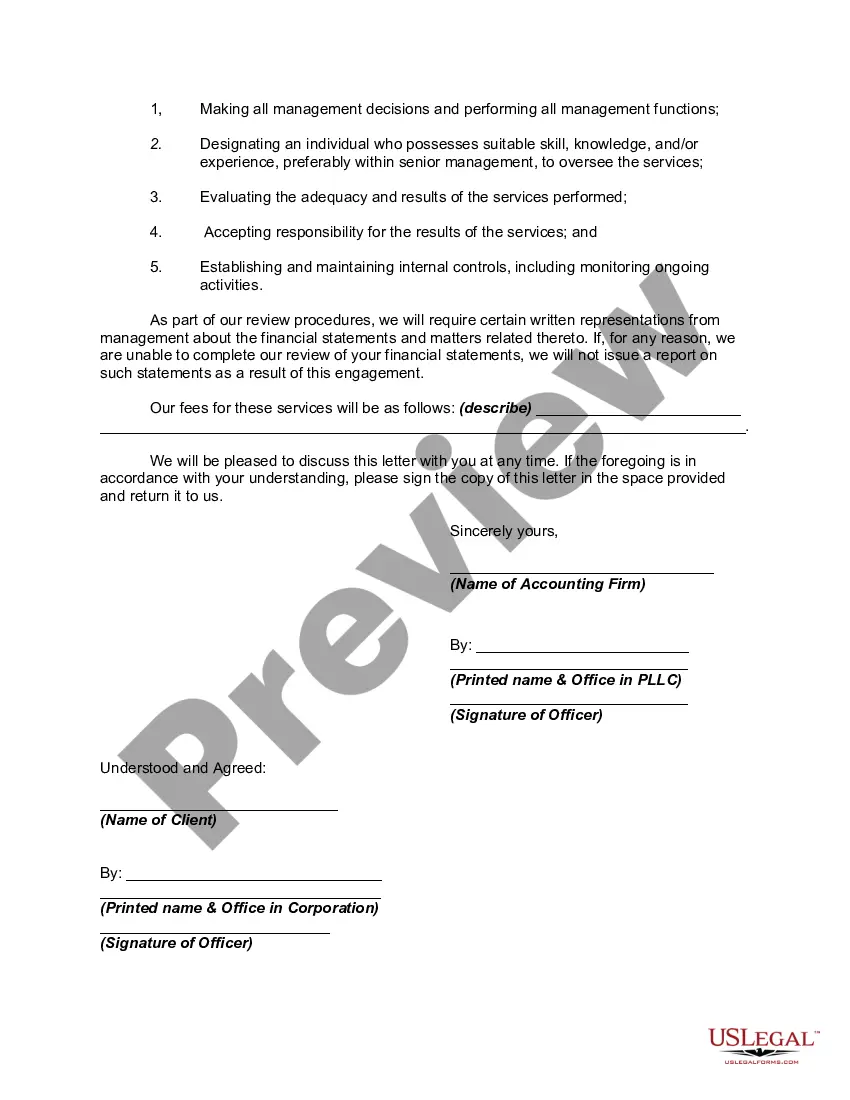

The Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that outlines the terms and conditions agreed upon between the accounting firm and its client. This letter specifies the scope of the review engagement, ensuring both parties have a clear understanding of their responsibilities and expectations in the financial reporting process. Keywords: Virgin Islands, engagement letter, review of financial statements, accounting firm. The Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm plays a vital role in establishing a professional relationship between the accounting firm and its client. It serves as a legal contract that protects the interests of both parties involved in the financial reporting process. By signing this engagement letter, the client signals their agreement to allow the accounting firm to review their financial statements and provide relevant assurance. Within the Virgin Islands, there may be variations of the engagement letter for the review of financial statements, depending on specific requirements or regulations. However, the core purpose of these variations remains the same: to outline the terms and conditions under which the accounting firm will perform the review of financial statements. Some possible types of the Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm may include: 1. Standard Engagement Letter: This is the most common type of engagement letter used for reviewing financial statements in the Virgin Islands. It outlines the general scope of the review, the responsibilities of both parties, and sometimes specifies the reporting framework to be followed. 2. Limited Scope Engagement Letter: In some cases, the client may require a review of specific sections or areas of their financial statements, rather than the entire set. In such cases, a limited scope engagement letter is used to clearly define the boundaries of the review. 3. Compliance Engagement Letter: Certain industries or regulatory bodies in the Virgin Islands may have specific requirements that a company must meet in its financial reporting. In such cases, a compliance engagement letter focuses on ensuring the financial statements align with these specific regulations. 4. Agreed-Upon Procedures Engagement Letter: Sometimes, a client may require an accounting firm to perform specific procedures on their financial statements, usually to address specific concerns or risks. An agreed-upon procedures engagement letter discusses the scope and nature of these particular procedures. It is important for both the accounting firm and client in the Virgin Islands to carefully review and understand the engagement letter before signing it. This ensures clarity and prevents any misunderstandings regarding the expectations, responsibilities, and limitations of the review engagement. In conclusion, the Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that establishes the terms and conditions for the review of financial statements. By using different types such as the standard, limited scope, compliance, and agreed-upon procedures engagement letters, this document ensures a clear understanding between the accounting firm and the client, and helps maintain the integrity and accuracy of financial reporting.The Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that outlines the terms and conditions agreed upon between the accounting firm and its client. This letter specifies the scope of the review engagement, ensuring both parties have a clear understanding of their responsibilities and expectations in the financial reporting process. Keywords: Virgin Islands, engagement letter, review of financial statements, accounting firm. The Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm plays a vital role in establishing a professional relationship between the accounting firm and its client. It serves as a legal contract that protects the interests of both parties involved in the financial reporting process. By signing this engagement letter, the client signals their agreement to allow the accounting firm to review their financial statements and provide relevant assurance. Within the Virgin Islands, there may be variations of the engagement letter for the review of financial statements, depending on specific requirements or regulations. However, the core purpose of these variations remains the same: to outline the terms and conditions under which the accounting firm will perform the review of financial statements. Some possible types of the Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm may include: 1. Standard Engagement Letter: This is the most common type of engagement letter used for reviewing financial statements in the Virgin Islands. It outlines the general scope of the review, the responsibilities of both parties, and sometimes specifies the reporting framework to be followed. 2. Limited Scope Engagement Letter: In some cases, the client may require a review of specific sections or areas of their financial statements, rather than the entire set. In such cases, a limited scope engagement letter is used to clearly define the boundaries of the review. 3. Compliance Engagement Letter: Certain industries or regulatory bodies in the Virgin Islands may have specific requirements that a company must meet in its financial reporting. In such cases, a compliance engagement letter focuses on ensuring the financial statements align with these specific regulations. 4. Agreed-Upon Procedures Engagement Letter: Sometimes, a client may require an accounting firm to perform specific procedures on their financial statements, usually to address specific concerns or risks. An agreed-upon procedures engagement letter discusses the scope and nature of these particular procedures. It is important for both the accounting firm and client in the Virgin Islands to carefully review and understand the engagement letter before signing it. This ensures clarity and prevents any misunderstandings regarding the expectations, responsibilities, and limitations of the review engagement. In conclusion, the Virgin Islands Engagement Letter for Review of Financial Statements by an Accounting Firm is a crucial document that establishes the terms and conditions for the review of financial statements. By using different types such as the standard, limited scope, compliance, and agreed-upon procedures engagement letters, this document ensures a clear understanding between the accounting firm and the client, and helps maintain the integrity and accuracy of financial reporting.