Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

Virgin Islands Declaration of Cash Gift with Condition

Description

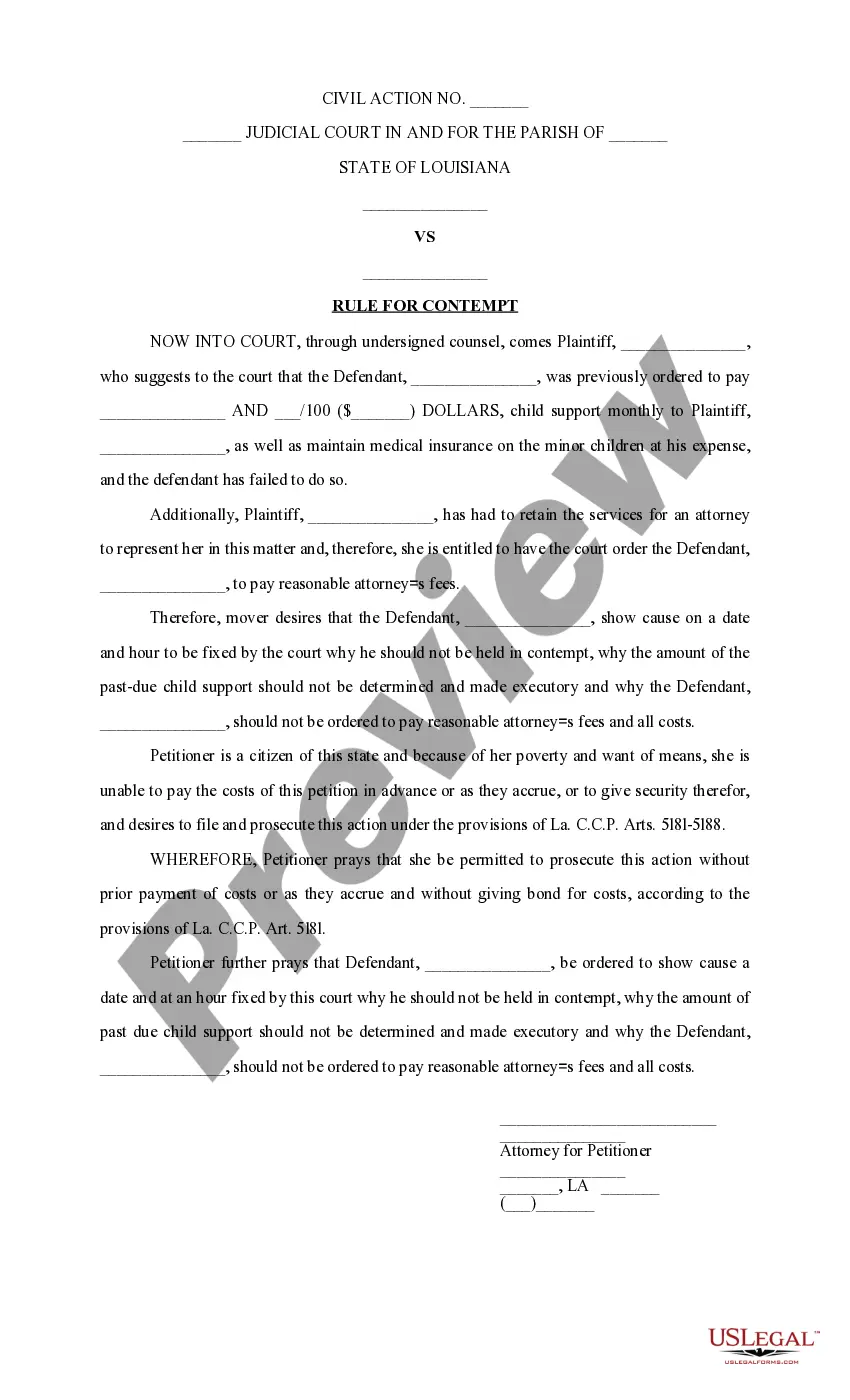

How to fill out Declaration Of Cash Gift With Condition?

US Legal Forms - one of the most notable collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for both business and personal purposes, categorized by type, state, or keywords. You can find the most recent versions of forms such as the Virgin Islands Declaration of Cash Gift with Condition in just moments.

If you have an account, Log In and download the Virgin Islands Declaration of Cash Gift with Condition from the US Legal Forms library. The Download option will appear on every form you view. You can access all previously downloaded forms from the My documents tab in your account.

Process the transaction. Use your credit card or PayPal account to finalize the payment.

Select the format and download the form to your device.

- If you're using US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the correct form for your area/county. Click the Review option to examine the form's content.

- Check the form description to confirm you've chosen the right document.

- If the form doesn't meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan that suits you and provide your details to register for an account.