Virgin Islands Investment Letter is a publication that provides detailed information and analysis regarding Intrastate Offering opportunities in the Virgin Islands. It offers valuable insights and guidance to investors who are interested in exploring investment options within the Virgin Islands jurisdiction. The Intrastate Offering refers to the sale of securities to investors within a specific state or territory, such as the Virgin Islands. Virgin Islands Investment Letter focuses on this type of offering, providing comprehensive coverage of various investment opportunities and regulations related to Intrastate Offerings. The publication covers a wide range of topics related to Intrastate Offerings, including the legal framework, eligibility requirements, benefits and risks associated with investing in the Virgin Islands. It includes in-depth analysis of specific investment opportunities, such as local startups, businesses, and real estate projects. Virgin Islands Investment Letter aims to educate investors about the potential advantages of Intrastate Offerings within the Virgin Islands. It delves into the regulatory aspects of such investments, highlighting compliance requirements, filing procedures, and legal safeguards for both issuers and investors. The publication also explores the different types of Intrastate Offering programs available in the Virgin Islands. These may include exemption-based offerings, crowdfunding platforms, and local investment promotion programs. Each type of offering is explained in detail, with a focus on how investors can participate and the potential returns they may expect. Moreover, the Virgin Islands Investment Letter provides case studies and success stories of investors who have successfully participated in Intrastate Offerings in the Virgin Islands. It shares real-world experiences and investment strategies that can serve as a useful reference for individuals seeking investment opportunities within the region. Overall, the Virgin Islands Investment Letter serves as a comprehensive resource for investors interested in Intrastate Offerings within the Virgin Islands. It equips readers with the necessary knowledge, insights, and tools to make informed investment decisions, while also staying up-to-date with the latest developments and opportunities in the region's investment landscape. Examples of different types of Virgin Islands Investment Letter regarding Intrastate Offering may include: 1. Virgin Islands Crowdfunding Investment Letter: This publication focuses specifically on Intrastate Offerings conducted through crowdfunding platforms within the Virgin Islands. It provides insights into the latest crowdfunding campaigns, investment strategies, and success stories within the region. 2. Virgin Islands Real Estate Investment Letter: This publication hones in on Intrastate Offerings in the Virgin Islands' real estate sector. It covers investment opportunities in local housing developments, commercial properties, and tourism-related projects. The letter presents data, market trends, and expert analysis to guide investors in making informed decisions. 3. Virgin Islands Startup Investment Letter: This publication concentrates on Intrastate Offerings related to startup companies within the Virgin Islands. It showcases emerging businesses, entrepreneurial ventures, and investment opportunities for those interested in supporting local innovation and economic growth. The letter provides detailed information on industry sectors and potential returns for investors. These are just a few examples showcasing the diversity of Virgin Islands Investment Letter editions, each tailored to address specific interests and aspects of Intrastate Offerings within the Virgin Islands jurisdiction.

Virgin Islands Investment Letter regarding Intrastate Offering

Description

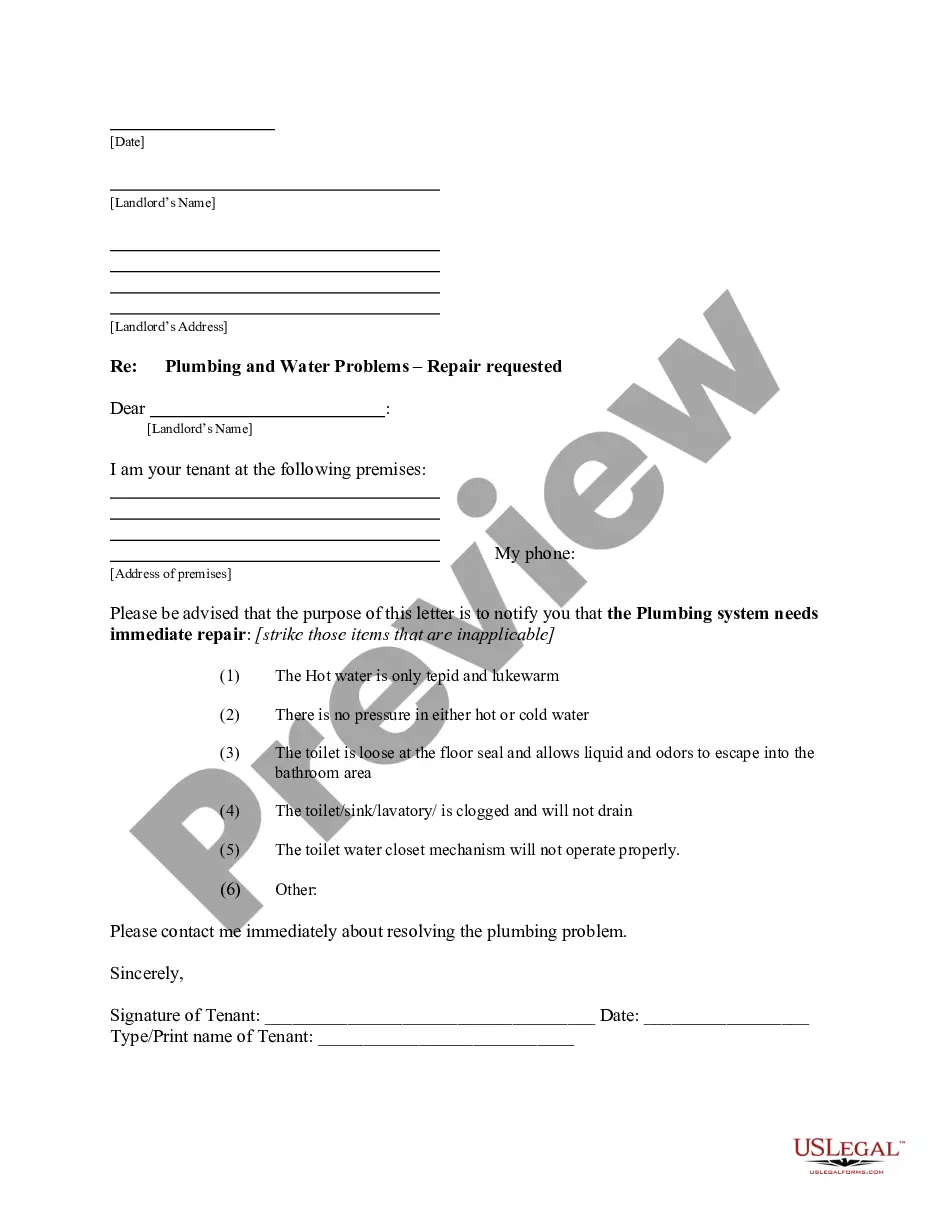

How to fill out Investment Letter Regarding Intrastate Offering?

Are you currently in a situation where you require documents for both professional and specific purposes nearly all the time.

There are numerous authentic document templates accessible online, but finding reliable ones can be challenging.

US Legal Forms offers many form templates, such as the Virgin Islands Investment Letter for Intrastate Offering, designed to meet state and federal standards.

Once you find the correct form, click Get now.

Select your desired pricing plan, fill in the required information to create your account, and pay for the order using PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you've purchased in the My documents section. You can download an additional copy of the Virgin Islands Investment Letter for Intrastate Offering whenever necessary. Just click on the necessary form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. This service offers professionally crafted legal document templates that you can utilize for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Virgin Islands Investment Letter for Intrastate Offering template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to check the form.

- Read the description to confirm that you've selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your requirements.

Form popularity

FAQ

Yes, U.S. citizens must go through customs when traveling to the Virgin Islands. Despite being a U.S. territory, customs regulations require travelers to declare items. Familiarity with these processes can ease your journey, especially if you plan to invest or explore opportunities involving the Virgin Islands Investment Letter regarding Intrastate Offering.

Most U.S. laws apply in the Virgin Islands, following the relationship established with the federal government. Some local laws may differ, impacting various sectors, including business and investment. For those looking into the Virgin Islands Investment Letter regarding Intrastate Offering, understanding these laws is crucial for compliance and success.

Abortion is legal in the U.S. Virgin Islands, with certain restrictions in place. The local law reflects a balance between individual rights and public policy. If you're an investor or resident considering the implications of this issue, it's advisable to consult legal resources or professionals.

Yes, U.S. laws generally apply to U.S. territories, including the Virgin Islands. However, there are some exceptions and specific local laws that may differ. It's important for investors to familiarize themselves with these unique regulations, particularly those involving the Virgin Islands Investment Letter regarding Intrastate Offering.

Yes, the U.S. governs the Virgin Islands as a U.S. territory. This means that certain federal laws and regulations apply, including those related to the Virgin Islands Investment Letter regarding Intrastate Offering. Governing authority helps ensure a stable legal framework for residents and investors alike.

BVI regulation encompasses a range of laws governing business operations, investment practices, and financial services. These regulations aim to foster a stable and secure investment climate. To understand how these regulations apply to you, the Virgin Islands Investment Letter regarding Intrastate Offering offers essential information and guidance.

The Investment Act in the BVI governs foreign investments and establishes criteria for business operations. It aims to attract and facilitate investment while ensuring compliance with relevant regulations. Utilizing the Virgin Islands Investment Letter regarding Intrastate Offering can provide you with clear insights into how this Act affects your investment options.

The minimum investment in the BVI largely depends on the project or business type you wish to pursue. For real estate, for instance, you should plan for at least $200,000 in investments. The Virgin Islands Investment Letter regarding Intrastate Offering can guide you through specific investment levels, ensuring alignment with local regulations.

The minimum share capital required to incorporate a company in the BVI is usually $1. However, depending on the business type, higher amounts might be advisable. To navigate these requirements effectively, consider utilizing the Virgin Islands Investment Letter regarding Intrastate Offering for tailored advice.

The Securities and Investment Business Act 2010 regulates the investment and securities sector in the British Virgin Islands. Its purpose is to ensure investor protection and the integrity of the financial system. When pursuing investments, the Virgin Islands Investment Letter regarding Intrastate Offering can help clarify how this Act impacts your investment decisions.