Title: Understanding Virgin Islands' Sample Letter for Ad Valor em Tax Exemption Introduction: Virgin Islands is a stunning Caribbean archipelago known for its picturesque beaches, crystal-clear waters, and vibrant local culture. To promote business growth and economic development, the Virgin Islands government offers various tax exemptions, including the Ad Valor em Tax Exemption. This article will provide a detailed description of what a Sample Letter for Ad Valor em Tax Exemption looks like, outlining its purpose, content, and potential types. Keywords: Virgin Islands, Sample Letter, Ad Valor em Tax Exemption, tax exemption, Caribbean archipelago, business growth, economic development. 1. Purpose of the Sample Letter for Ad Valor em Tax Exemption: The purpose of the Sample Letter for Ad Valor em Tax Exemption is to formally request exemption from paying ad valor em taxes on specific imported or exported goods. Ad valor em taxes are levied based on the value of merchandise being imported or exported, and this letter serves as an application to waive such taxes. Keywords: purpose, Sample Letter, Ad Valor em Tax Exemption, exemption request, ad valor em taxes, imported goods, exported goods. 2. Content of the Sample Letter for Ad Valor em Tax Exemption: The Sample Letter for Ad Valor em Tax Exemption typically includes the following key elements: a. Sender's information: Business name, address, contact details (phone, email). b. Recipient's information: Relevant government department or official responsible for tax exemptions. c. Salutation: Formal greeting. d. Introduction: Statement explaining the purpose of the letter and the specific type of ad valor em tax exemption being requested. e. Business description: Detailed overview of the business, including the products being imported or exported. f. Justification: Valid reasons for qualifying for the tax exemption, such as job creation, promoting economic growth, supporting local industries, or enhancing the tourism sector. g. Supporting documents: Attachments, if any, providing further evidence of eligibility. h. Conclusion: Expressing gratitude for considering the application and providing contact information for further communication. i. Closing: Formal closing, such as "Yours sincerely" or "Best regards." j. Signature: Handwritten or digital signature of the sender. Keywords: content, Sample Letter, Ad Valor em Tax Exemption, sender's information, recipient's information, business description, justification, supporting documents, conclusion, closing, signature. 3. Types of Virgin Islands' Sample Letter for Ad Valor em Tax Exemption: Different types of Sample Letters for Ad Valor em Tax Exemption may exist based on the specific sector, purpose, or requirements. Some potential examples include: a. Manufacturing sector exemption: Industries involved in manufacturing or producing goods for export could apply for this type of exemption to boost local production and encourage exports. b. Tourism sector exemption: Businesses related to hospitality, tourism, or cruise ship services may seek this exemption to attract more tourists and develop the tourism infrastructure. c. Renewable energy sector exemption: Companies engaged in renewable energy projects, such as solar or wind power, could apply for this exemption to encourage sustainable practices and reduce carbon emissions. d. Agriculture sector exemption: Farming or agricultural enterprises might request this exemption to support local food production, enhance food security, and stimulate rural economies. Keywords: types, Virgin Islands, Sample Letter, Ad Valor em Tax Exemption, manufacturing sector, tourism sector, renewable energy sector, agriculture sector, exports, hospitality, local production, sustainable practices. In conclusion, the Virgin Islands' Sample Letter for Ad Valor em Tax Exemption plays a vital role in requesting tax exemptions related to importing or exporting goods. Understanding its purpose, content, and potential types allows businesses to navigate the tax regulations effectively and leverage opportunities for growth and economic development in the beautiful Virgin Islands.

Virgin Islands Sample Letter for Ad Valorem Tax Exemption

Description

How to fill out Virgin Islands Sample Letter For Ad Valorem Tax Exemption?

Choosing the right legitimate document web template can be a have a problem. Needless to say, there are a lot of templates available on the Internet, but how would you discover the legitimate kind you want? Take advantage of the US Legal Forms website. The service offers a large number of templates, including the Virgin Islands Sample Letter for Ad Valorem Tax Exemption, that you can use for company and personal needs. All of the types are checked out by specialists and fulfill federal and state requirements.

Should you be previously listed, log in for your accounts and then click the Down load switch to get the Virgin Islands Sample Letter for Ad Valorem Tax Exemption. Make use of accounts to search from the legitimate types you might have bought previously. Visit the My Forms tab of your respective accounts and have one more version in the document you want.

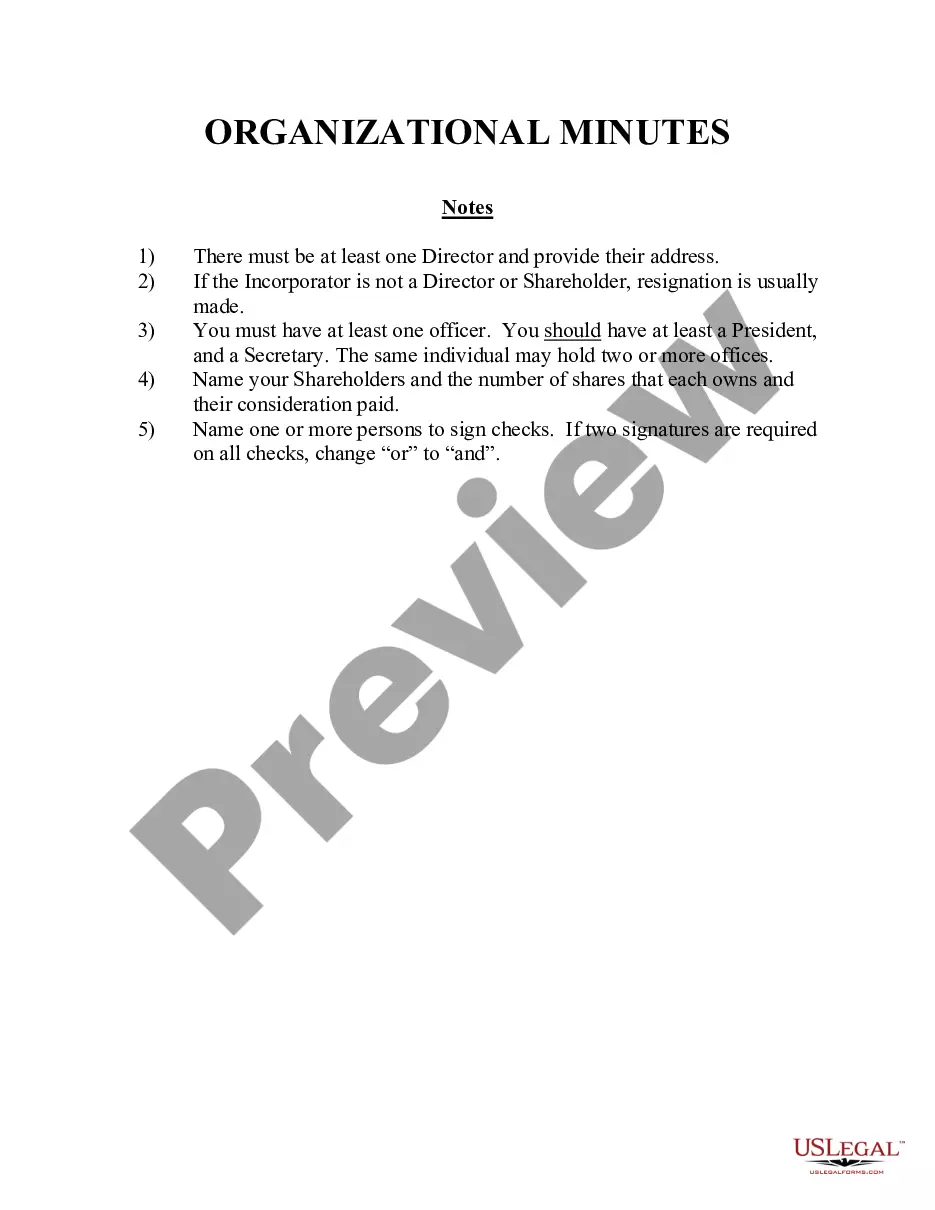

Should you be a fresh end user of US Legal Forms, here are basic directions for you to comply with:

- Initial, make sure you have chosen the appropriate kind for your personal area/state. It is possible to look over the form while using Preview switch and browse the form explanation to make certain this is basically the best for you.

- In case the kind fails to fulfill your expectations, utilize the Seach area to obtain the appropriate kind.

- Once you are certain that the form is suitable, select the Acquire now switch to get the kind.

- Choose the prices program you need and enter in the required details. Create your accounts and pay money for the order utilizing your PayPal accounts or charge card.

- Select the data file structure and download the legitimate document web template for your device.

- Full, modify and produce and signal the attained Virgin Islands Sample Letter for Ad Valorem Tax Exemption.

US Legal Forms will be the greatest library of legitimate types for which you will find different document templates. Take advantage of the service to download skillfully-made files that comply with status requirements.