Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client

Description

How to fill out Resignation Letter From Accounting Firm To Client As Auditors For Client?

If you aim to finish, acquire, or print valid document templates, utilize US Legal Forms, the largest range of valid forms available online.

Utilize the site’s straightforward and user-friendly search to locate the documents you require.

A selection of templates for commercial and personal purposes are sorted by categories and jurisdictions, or keywords.

Step 4. Once you’ve located the form you need, click the Get now button. Select your preferred pricing plan and enter your information to create an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, edit, and print or sign the Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client. Each legal document template you purchase is yours permanently. You have access to every form you saved in your account. Check the My documents section to select a form to print or download again. Stay competitive and download and print the Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client with US Legal Forms. There are countless professional and state-specific forms you can utilize for your business or personal needs.

- Use US Legal Forms to find the Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to obtain the Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client.

- You can also access forms you have previously saved in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Confirm you have selected the form for the correct city/state.

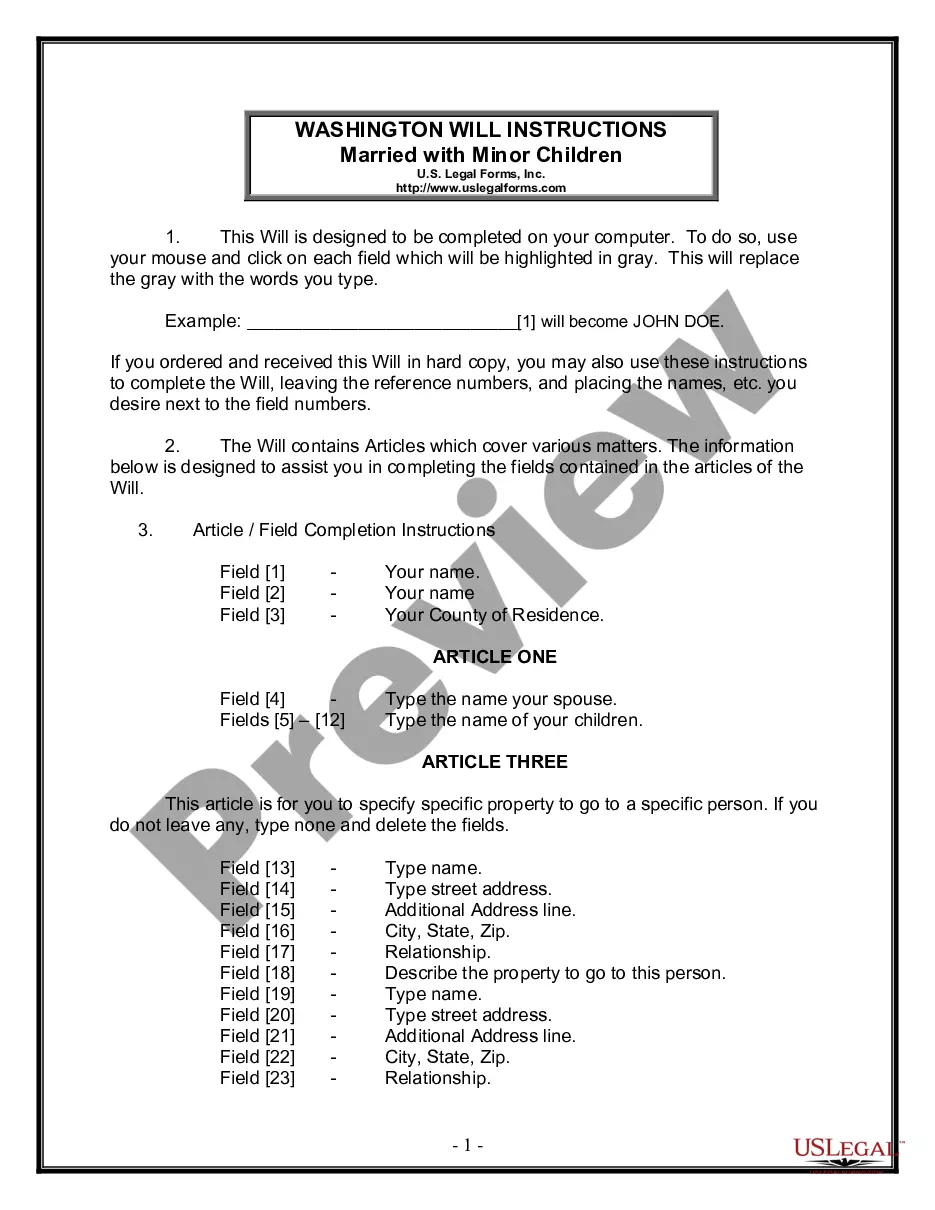

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

To politely end a contract with a client, maintain a tone of respect and professionalism throughout your communication. Clearly express your reasons while remaining courteous. A Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client is an effective tool to facilitate this process, ensuring that both parties can part ways on friendly terms.

Writing a letter to terminate a client as an accountant should be straightforward yet considerate. Start with a polite introduction, expressing your appreciation for their partnership. Include the reasons for your decision and any necessary transition information in a Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client, ensuring clarity and professionalism.

Respectfully terminating a contract requires clear communication and a thoughtful tone. It is essential to explain the reasons for your termination while also expressing appreciation for the client’s business. Delivering your decision through a Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client can help convey professionalism throughout the process.

Politely terminating a contract with a client involves a careful approach. Begin by discussing the reasons for your decision, highlighting that this is in the best interest of both parties. A well-crafted Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client will formalize the termination and provide reassurance that the relationship will end on good terms.

A disengagement letter from accountant to client serves as a formal notice that the accountant will no longer provide services. This letter outlines the reasons for disengagement and can include essential details, such as the final billing and transition of materials. Utilizing a Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client ensures clear communication and documentation of the process.

Breaking up with a client professionally requires diplomacy and honesty. Start by acknowledging the positive aspects of your work together and mention any reasons for ending the relationship. A Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client can formalize this decision, making it easier for both parties to agree on the next steps.

To resign from a client, clearly outline your intention in a direct yet tactful manner. Drafting a Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client is an effective way to communicate your resignation formally. Ensure you provide any necessary details, including transition plans, to support a smooth separation and maintain professionalism.

To cancel a client respectfully, begin by expressing genuine gratitude for the opportunity to work together. Then, clearly explain your decision and the reasons behind it. Using a Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client helps formalize this process. This letter will provide clarity, ensuring the client understands your decision is professional rather than personal.

Letting go of a client professionally requires a thoughtful approach. Be candid about your reasons, while emphasizing the importance of their business. A Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client can help formalize your message, reinforcing your respect for the client and your commitment to professionalism throughout the process.

Politely disengaging a client involves clear communication and empathy. Start by expressing your appreciation for the partnership and then explain your decision to step back. By using a Virgin Islands Resignation Letter from Accounting Firm to Client as Auditors for Client, you can detail your reasoning while maintaining a positive relationship moving forward.