Virgin Islands Affidavit of Domicile for Deceased

Description

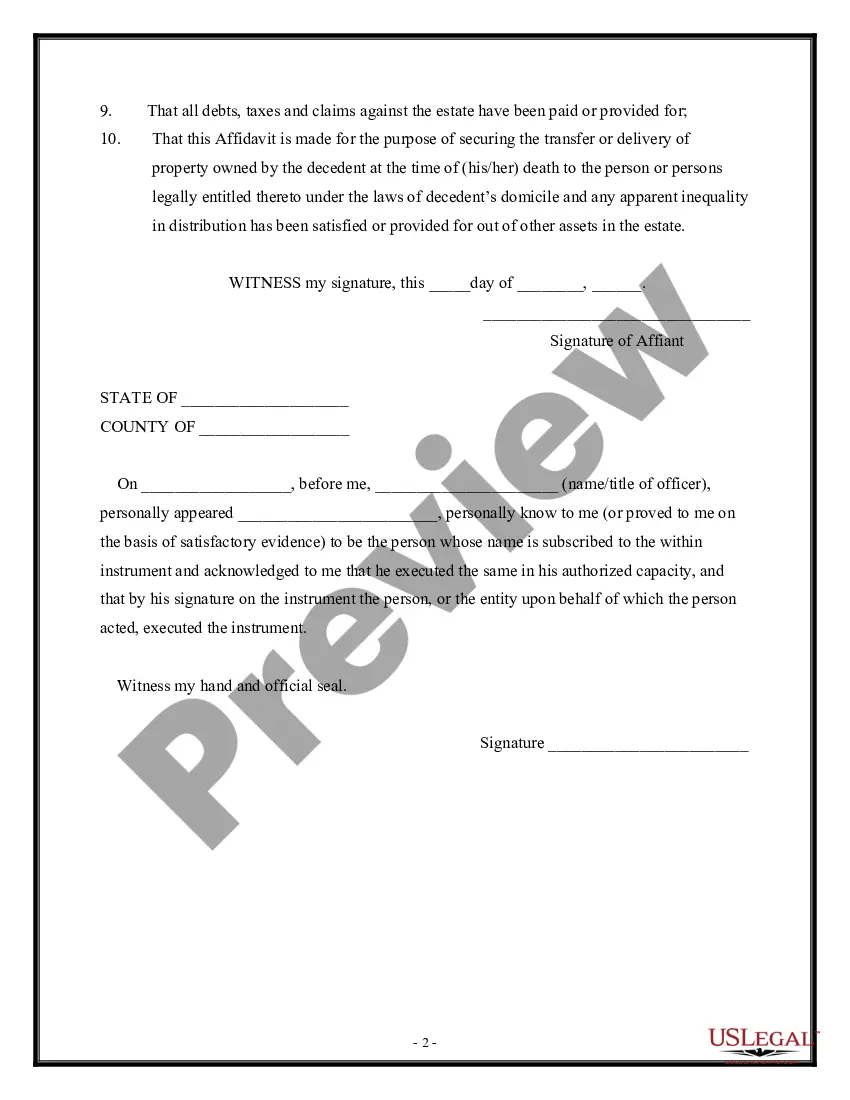

How to fill out Affidavit Of Domicile For Deceased?

US Legal Forms - one of many largest libraries of lawful varieties in the USA - offers a wide range of lawful papers layouts you are able to obtain or printing. While using web site, you may get thousands of varieties for organization and personal uses, sorted by classes, claims, or keywords.You can get the newest types of varieties much like the Virgin Islands Affidavit of Domicile for Deceased within minutes.

If you already possess a membership, log in and obtain Virgin Islands Affidavit of Domicile for Deceased through the US Legal Forms local library. The Down load switch will show up on every develop you look at. You have accessibility to all in the past acquired varieties inside the My Forms tab of your respective bank account.

If you would like use US Legal Forms the very first time, listed below are simple guidelines to get you started:

- Ensure you have picked out the right develop for your city/area. Click the Review switch to examine the form`s content. Browse the develop explanation to actually have selected the proper develop.

- In the event the develop does not match your needs, use the Lookup industry at the top of the monitor to obtain the the one that does.

- When you are happy with the shape, verify your choice by clicking on the Get now switch. Then, choose the pricing prepare you want and provide your references to register for an bank account.

- Process the transaction. Make use of credit card or PayPal bank account to perform the transaction.

- Choose the file format and obtain the shape on the gadget.

- Make changes. Load, edit and printing and indication the acquired Virgin Islands Affidavit of Domicile for Deceased.

Every single design you added to your account lacks an expiration particular date and is yours permanently. So, if you want to obtain or printing another copy, just check out the My Forms area and then click on the develop you will need.

Obtain access to the Virgin Islands Affidavit of Domicile for Deceased with US Legal Forms, probably the most extensive local library of lawful papers layouts. Use thousands of expert and express-specific layouts that fulfill your small business or personal requirements and needs.

Form popularity

FAQ

The main feature of the joint tenancy is the right of survivorship ? a survivor automatically becomes the owner of the property on the other person's death.

A grant of probate is obtained where the deceased left a will which contains a valid appointment of an executor. Where there is a will, the executor applies for the grant. A grant of letters of administration is obtained where the deceased died intestate (ie where there is no will).

The fees are dependent on the value of the estate and each document filed with the court and can be upwards of US$7,000. The application is not subjected to inheritance tax as there are no taxes in the BVI.

A BVI grant of probate, or letters of administration, is required to validly deal with BVI assets held by a deceased person. This is most commonly required for shares in a BVI company (or other entity).

BVI does not impose estate or inheritance taxes, facilitating wealth transfer to beneficiaries. Trust income is tax-free for non-resident trusts without real estate in BVI conducting commercial operations.