Virgin Islands Employment Agreement with Chief Financial Officer (CFO) The Virgin Islands Employment Agreement with Chief Financial Officer (CFO) is a legally binding contract that outlines the terms and conditions of the employment relationship between a company based in the Virgin Islands and its CFO. This agreement serves to protect the rights and obligations of both parties and ensures clarity in the expectations and responsibilities of the CFO. Key components of the Virgin Islands Employment Agreement with CFO include: 1. Position and Responsibilities: The agreement defines the role and specific responsibilities of the CFO within the organization. This may include financial planning, budgeting, financial analysis, risk management, and overseeing financial reporting processes. 2. Compensation and Benefits: The agreement stipulates the CFO's salary, bonuses, incentives, and any other forms of remuneration. It also outlines additional benefits such as health insurance, retirement plans, vacation days, and any other perks provided by the company. 3. Employment Term: This section specifies the length of the employment term, whether it is an indefinite period or a fixed-term agreement. In case of a fixed-term agreement, the start and end dates are clearly mentioned. 4. Termination Conditions: The agreement defines the conditions under which either party can terminate the employment relationship. It may include termination for cause (such as misconduct or breach of contract) or termination without cause (with appropriate notice or severance pay). 5. Non-Disclosure and Non-Compete Clauses: To protect the company's sensitive information and trade secrets, the agreement may include clauses that restrict the CFO from disclosing confidential information to third parties or engaging in activities that compete directly with the company's business during and after employment. 6. Intellectual Property Rights: This section ensures that any intellectual property or innovations developed by the CFO during their employment belong to the company. 7. Dispute Resolution: The agreement may specify the preferred method of resolving any disputes, such as arbitration or mediation, instead of litigation. Types of Virgin Islands Employment Agreements with CFO: 1. Full-Time Permanent Employment Agreement: This is the most common type of employment agreement, where the CFO is hired on a permanent, full-time basis. 2. Fixed-Term Employment Agreement: In certain cases, companies may enter into a fixed-term agreement with the CFO for a specified duration, such as a specific project or a temporary period. 3. Part-Time Employment Agreement: Companies looking for flexibility may opt for a part-time employment agreement with the CFO, where the working hours and benefits are prorated accordingly. 4. Consultancy Agreement: Instead of hiring a CFO as a regular employee, some companies may engage them as independent consultants, on a project-by-project basis. In conclusion, the Virgin Islands Employment Agreement with Chief Financial Officer is a crucial legal document that outlines the terms and conditions of the CFO's employment. It ensures compliance with labor laws, protects the interests of both parties, and provides a clear framework for the CFO's role, compensation, termination, confidentiality, and dispute resolution.

Virgin Islands Employment Agreement with Chief Financial Officer

Description

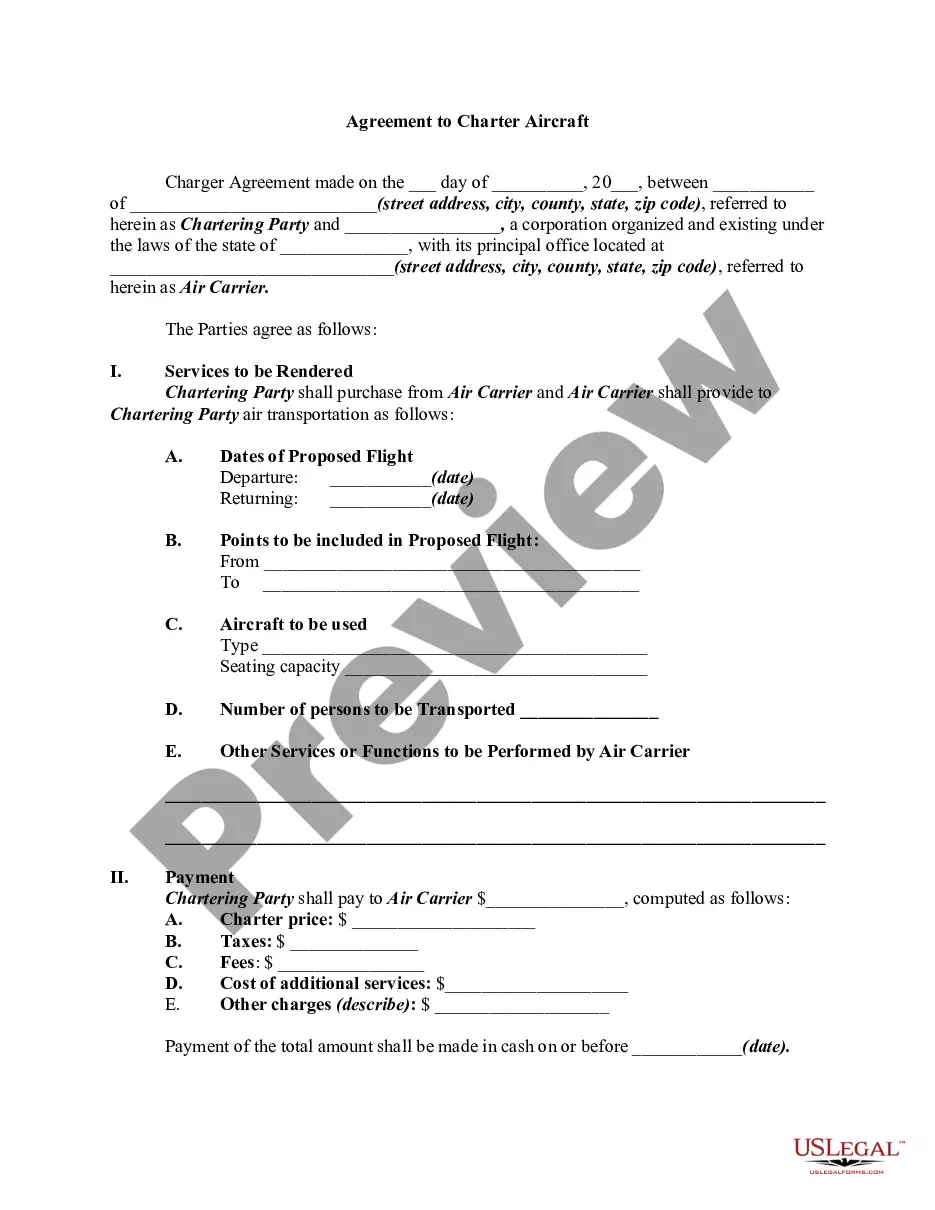

How to fill out Virgin Islands Employment Agreement With Chief Financial Officer?

US Legal Forms - one of the largest collections of valid documents in the United States - offers a selection of legal document templates you can download or print.

By using the website, you can locate thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can obtain the latest versions of documents such as the Virgin Islands Employment Contract with Chief Financial Officer within moments.

If the form does not meet your needs, use the Search area at the top of the screen to find one that does.

If you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, choose the payment plan you prefer and provide your details to create an account.

- If you already have a monthly subscription, sign in and download Virgin Islands Employment Contract with Chief Financial Officer from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously obtained documents from the My documents section of your account.

- If you are new to US Legal Forms, here are easy instructions to help you get started.

- Ensure you have selected the correct form for your city/state. Click the Review button to examine the content of the form.

- Check the form summary to confirm you have chosen the right document.

Form popularity

FAQ

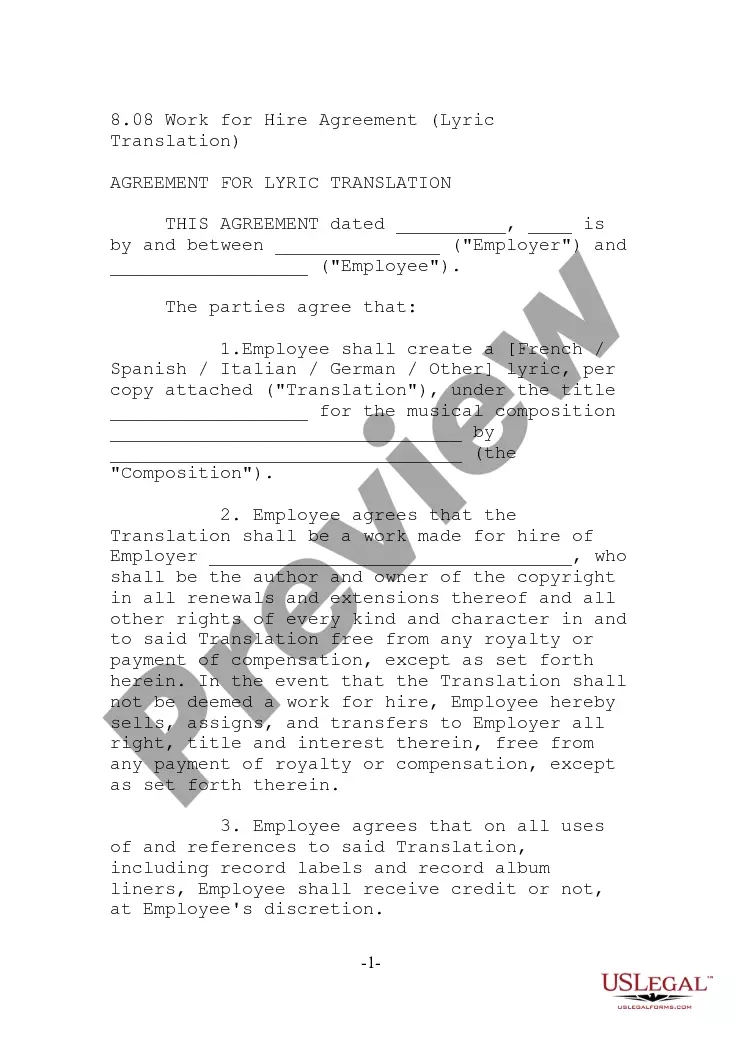

The CFO Act and the Sarbanes-Oxley Act both impose specific requirements on an organization's Chief Financial Officer. These acts collectively stress the need for leadership in financial oversight and accountability. By incorporating these elements into a Virgin Islands Employment Agreement with Chief Financial Officer, organizations can reinforce their commitment to ethical financial management.

The Sarbanes-Oxley Act requires a Chief Financial Officer to personally guarantee the accuracy of all financial reporting. This act ensures that the CFO is held accountable for the integrity of financial disclosures. When crafting a Virgin Islands Employment Agreement with Chief Financial Officer, it's vital to highlight these legal obligations that may impact decision-making and credibility.

The Sarbanes-Oxley Act of 2002 mandates that the Chief Financial Officer must certify the accuracy of the company’s financial statements. This certification is crucial for maintaining investor trust and requires strong internal controls. In a Virgin Islands Employment Agreement with Chief Financial Officer, this responsibility emphasizes the importance of transparency and reliability in financial reporting.

The CFO Act of 1990 established the role of the Chief Financial Officer in federal agencies. This act aimed to enhance the integrity and accountability of financial management by requiring CFOs to lead financial reforms. As part of a Virgin Islands Employment Agreement with Chief Financial Officer, understanding these responsibilities can be crucial for ensuring compliance and effective governance.

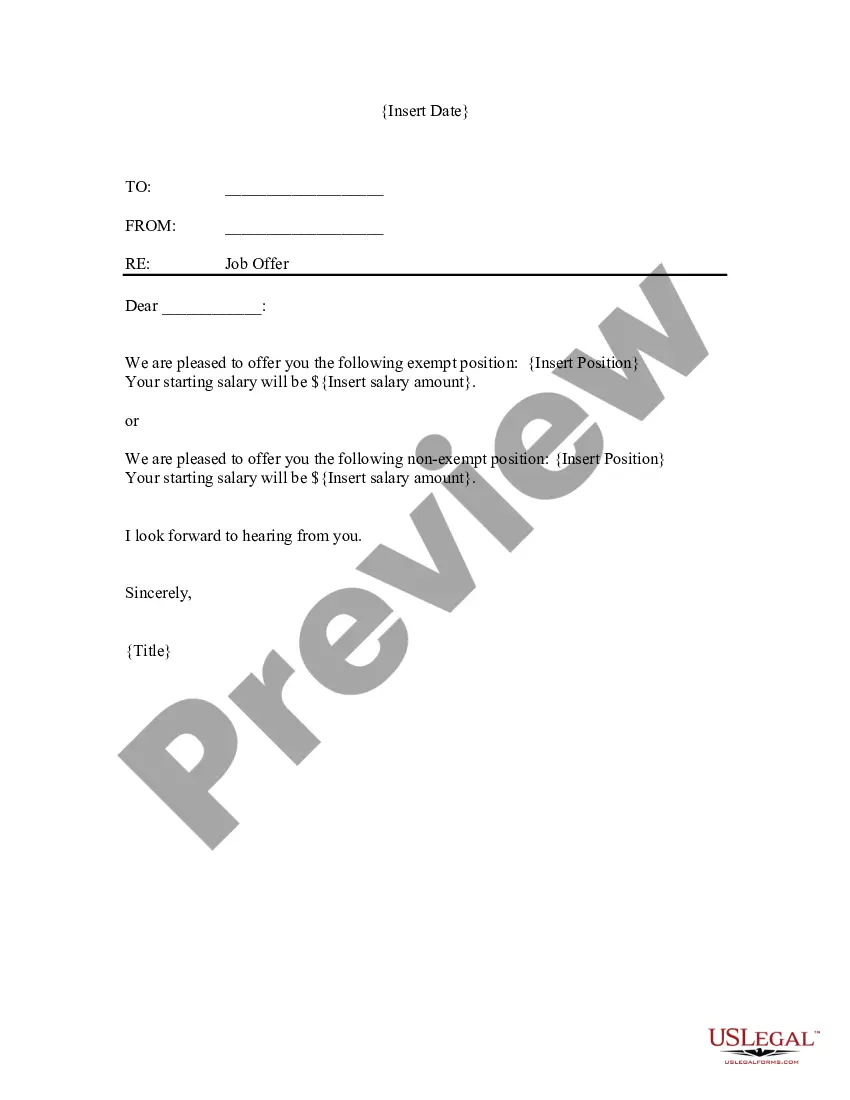

Absolutely, a CFO should have a well-defined employment agreement to outline their roles, responsibilities, and compensation. This agreement protects both the CFO and the organization by clarifying expectations and outlining potential contingencies. A Virgin Islands Employment Agreement with Chief Financial Officer can facilitate a smoother relationship and clearer communication.

Yes, having an employment contract for a CEO is advisable, as it delineates responsibilities, benefits, and the terms of employment. This contract serves as a safeguard for both the CEO and the organization, ensuring all parties are aligned. A well-structured Virgin Islands Employment Agreement with Chief Financial Officer can provide clarity and prevent potential disputes.

To write an effective employee contract agreement, such as a Virgin Islands Employment Agreement with Chief Financial Officer, start by outlining the essential terms including roles, responsibilities, and compensation. Utilize clear language to avoid misunderstandings, and ensure both parties agree to the terms. Tools like uslegalforms can provide templates and guidelines to streamline the process.

The three factors that define a contract are intention, terms, and capacity. In a Virgin Islands Employment Agreement with Chief Financial Officer, both parties must intend to create a legal obligation. Furthermore, the terms must be specific enough to avoid confusion, and each party must have the legal capacity to engage in the agreement.

To ensure a legally binding contract, like the Virgin Islands Employment Agreement with Chief Financial Officer, the agreement must have an offer, acceptance, and consideration. The offer is made by one party, accepted by the other, and consideration refers to the value exchanged. This framework protects both parties, providing a clear outline of expectations.

An employment contract becomes legally binding when it meets all essential elements of a valid contract like the Virgin Islands Employment Agreement with Chief Financial Officer. This includes clear terms, mutual consent, and legality. If any of these elements are missing, the contract might not hold up in court, so clarity and mutual understanding are crucial.

More info

The Executive Consultant will be responsible for assisting Segment Florida in executing plans of reorganization, financial review, and evaluation of the business, and also provide analysis, advice and recommendations on business strategies, and on overall business operations. During the time of employment, the Executive Consultant may be assigned any and all of Segment Florida's business and/or financial affairs. The Executive Consultant also will serve as a member of the Executive Management team for Segment Florida. Compensation for this position will include all benefits outlined in this Offer Letter. The Executive Consultant will be required to maintain a current driver's license, and insurance in the amount to be determined at the time of hire. A copy of the Executive Consultant's current driver's license and proof of insurance will be furnished by Segment Florida upon hire.