Virgin Islands Acceptance of Claim by Collection Agency and Report of Experience with Debtor In the Virgin Islands, the acceptance of a claim by a collection agency and the subsequent report of experience with the debtor are crucial aspects of the debt collection process. When a creditor assigns a delinquent account to a collection agency, it represents their acceptance of the claim that the debtor owes a certain amount of money. This action initiates the collection agency's responsibility to pursue the debtor in order to recover the outstanding debt on behalf of the creditor. There are certain types of Virgin Islands Acceptance of Claim by Collection Agency and Report of Experience with Debtor that are important to be aware of: 1. Statutory Acceptance of Claim: The statutory acceptance of claim by a collection agency refers to the legal acknowledgement and recognition of the outstanding debt owed by the debtor in accordance with the Virgin Islands' relevant laws and regulations. This formal acceptance enhances the collection agency's authority to pursue the debtor and utilize various debt recovery strategies. 2. Written Agreement Acceptance of Claim: In some cases, the acceptance of claim can be established through a written agreement between the creditor and the collection agency. This agreement outlines the terms and conditions under which the collection agency is authorized to act on behalf of the creditor. It specifies the rights, responsibilities, and limitations of both parties involved in the debt collection process. 3. Validation of Debt: Before a collection agency can report their experience with the debtor, they must validate the debt. This involves verifying the legitimacy and accuracy of the claimed amount owed by the debtor. The agency gathers relevant documentation and communicates with the creditor to ensure that the debt being pursued is valid. 4. Reporting of Experience with Debtor: Once the claim has been accepted and the debt validated, the collection agency maintains a comprehensive record of their experience with the debtor. This record documents every interaction, communication, and action taken to recover the outstanding debt. It includes details such as dates and times of contact, communication methods employed (phone calls, emails, letters, etc.), and any progress made towards debt resolution. 5. Progress Reports: Collection agencies periodically provide progress reports to creditors, keeping them updated on the ongoing efforts and outcomes of their collection activities. These reports outline the actions taken, responses received, and any payments or arrangements made by the debtor. Progress reports assist creditors in assessing the effectiveness of the collection agency's strategies and determining the next steps in the debt recovery process. In summary, the Virgin Islands Acceptance of Claim by Collection Agency and Report of Experience with Debtor are critical components of debt collection. They establish the legal recognition of the debt, empower the collection agency to act on behalf of the creditor, validate the debt's authenticity, and document all interactions with the debtor. Effective monitoring and documentation enable creditors to make informed decisions to resolve outstanding debts successfully.

Virgin Islands Acceptance of Claim by Collection Agency and Report of Experience with Debtor

Description

How to fill out Virgin Islands Acceptance Of Claim By Collection Agency And Report Of Experience With Debtor?

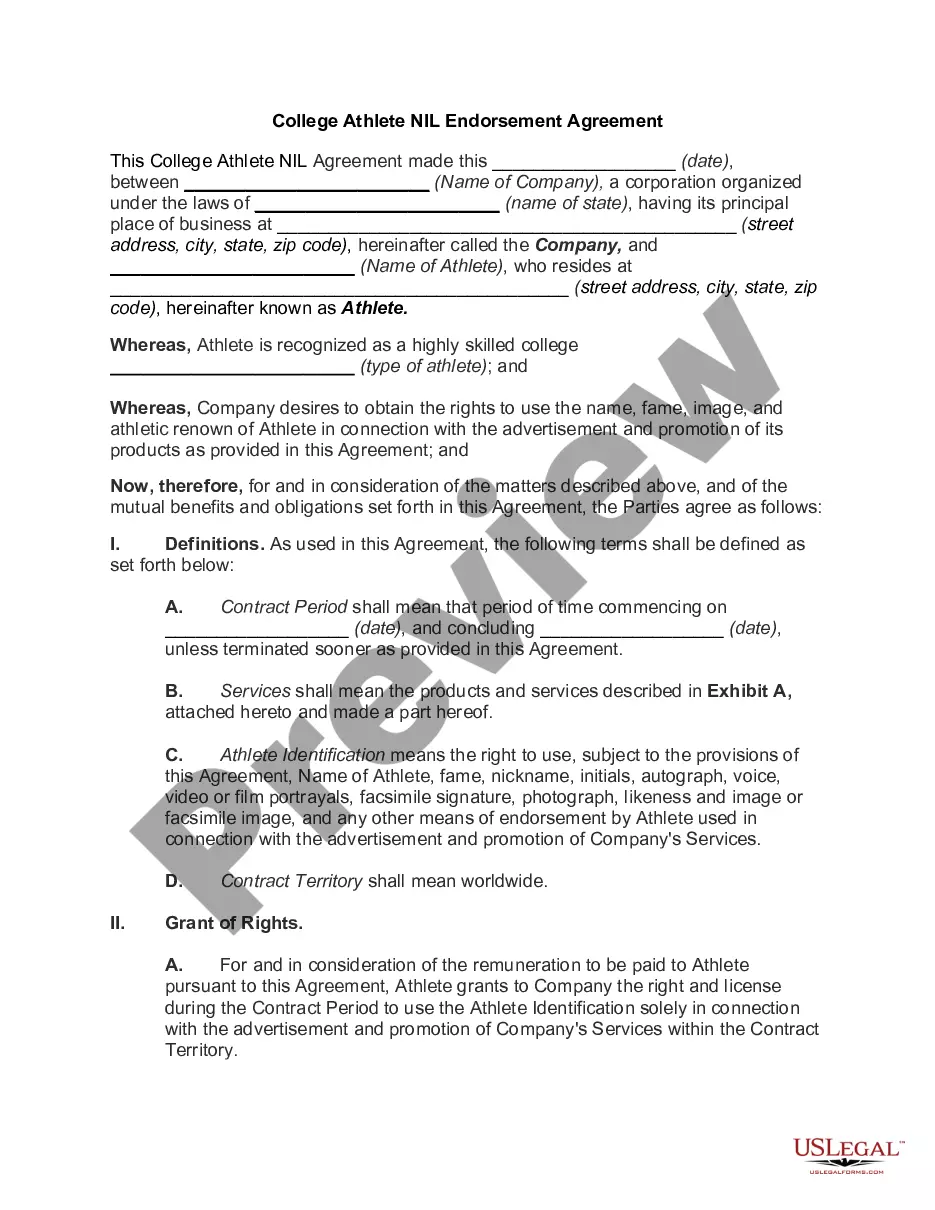

Finding the right legitimate file template might be a have difficulties. Naturally, there are a variety of layouts accessible on the Internet, but how can you get the legitimate type you will need? Make use of the US Legal Forms site. The support provides 1000s of layouts, for example the Virgin Islands Acceptance of Claim by Collection Agency and Report of Experience with Debtor, which can be used for enterprise and personal needs. Each of the kinds are checked by specialists and fulfill federal and state specifications.

If you are previously registered, log in for your profile and click the Down load key to find the Virgin Islands Acceptance of Claim by Collection Agency and Report of Experience with Debtor. Make use of your profile to search with the legitimate kinds you might have purchased in the past. Go to the My Forms tab of the profile and obtain an additional copy of your file you will need.

If you are a new end user of US Legal Forms, listed here are simple guidelines that you can comply with:

- Initially, be sure you have selected the proper type for your area/county. You can look over the shape utilizing the Preview key and browse the shape information to make certain it is the best for you.

- When the type fails to fulfill your expectations, take advantage of the Seach field to discover the correct type.

- When you are certain that the shape is proper, go through the Get now key to find the type.

- Pick the rates program you want and enter in the required information. Create your profile and purchase the order utilizing your PayPal profile or bank card.

- Opt for the submit file format and download the legitimate file template for your gadget.

- Complete, change and produce and sign the attained Virgin Islands Acceptance of Claim by Collection Agency and Report of Experience with Debtor.

US Legal Forms is the largest collection of legitimate kinds that you can see numerous file layouts. Make use of the company to download professionally-manufactured documents that comply with condition specifications.