Virgin Islands Assignment of Assets

Description

How to fill out Assignment Of Assets?

It is feasible to spend several hours online searching for the legal document template that complies with the state and federal requirements you require.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can either obtain or print the Virgin Islands Assignment of Assets from your service.

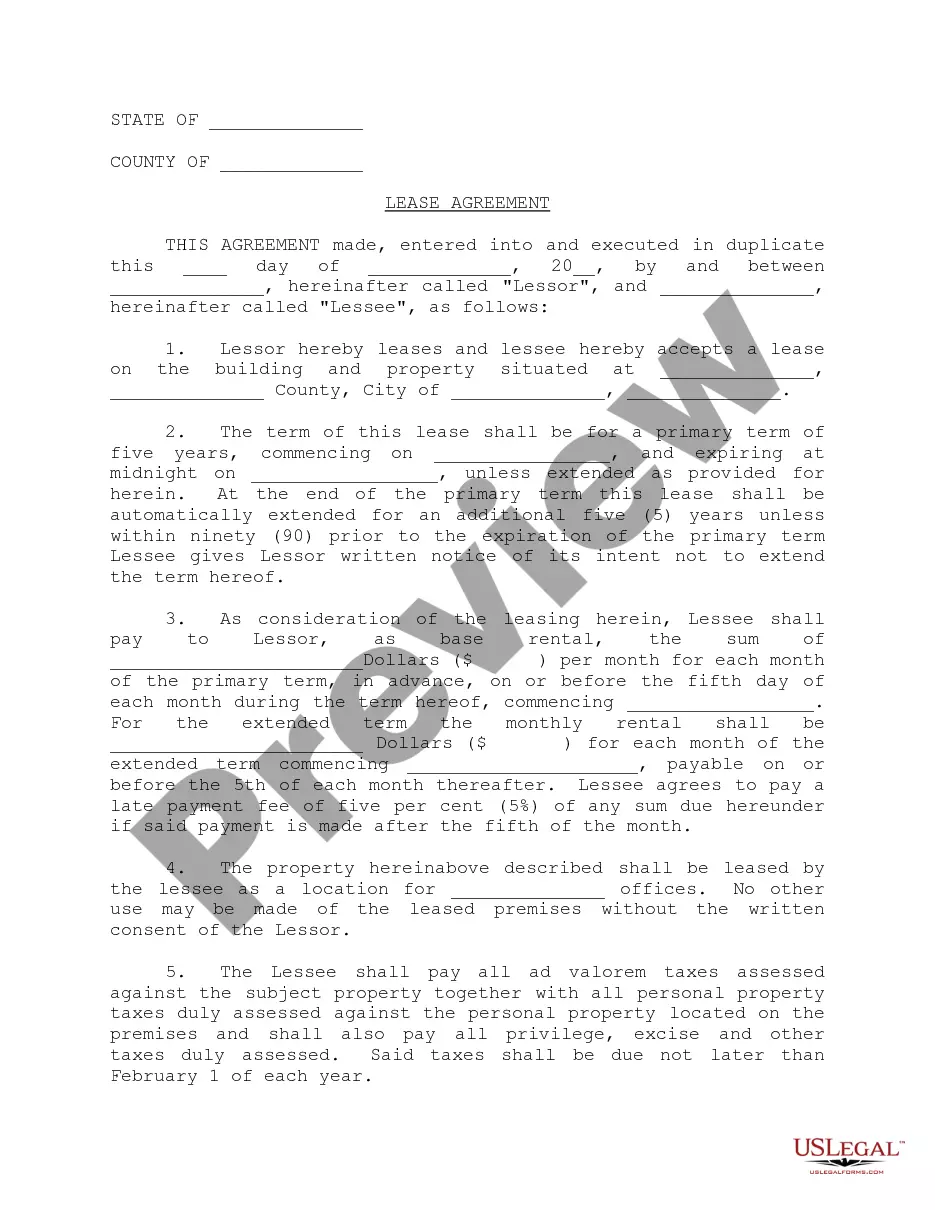

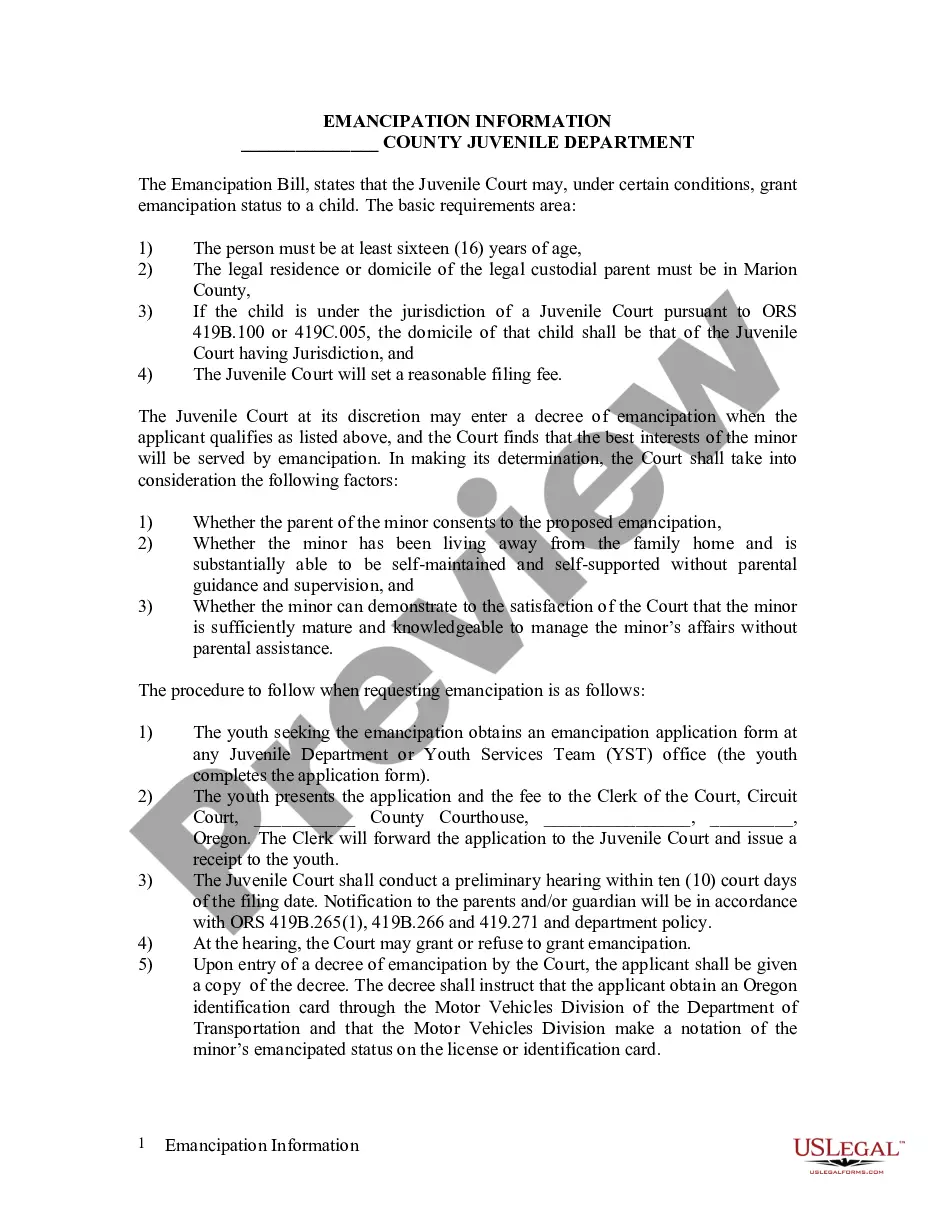

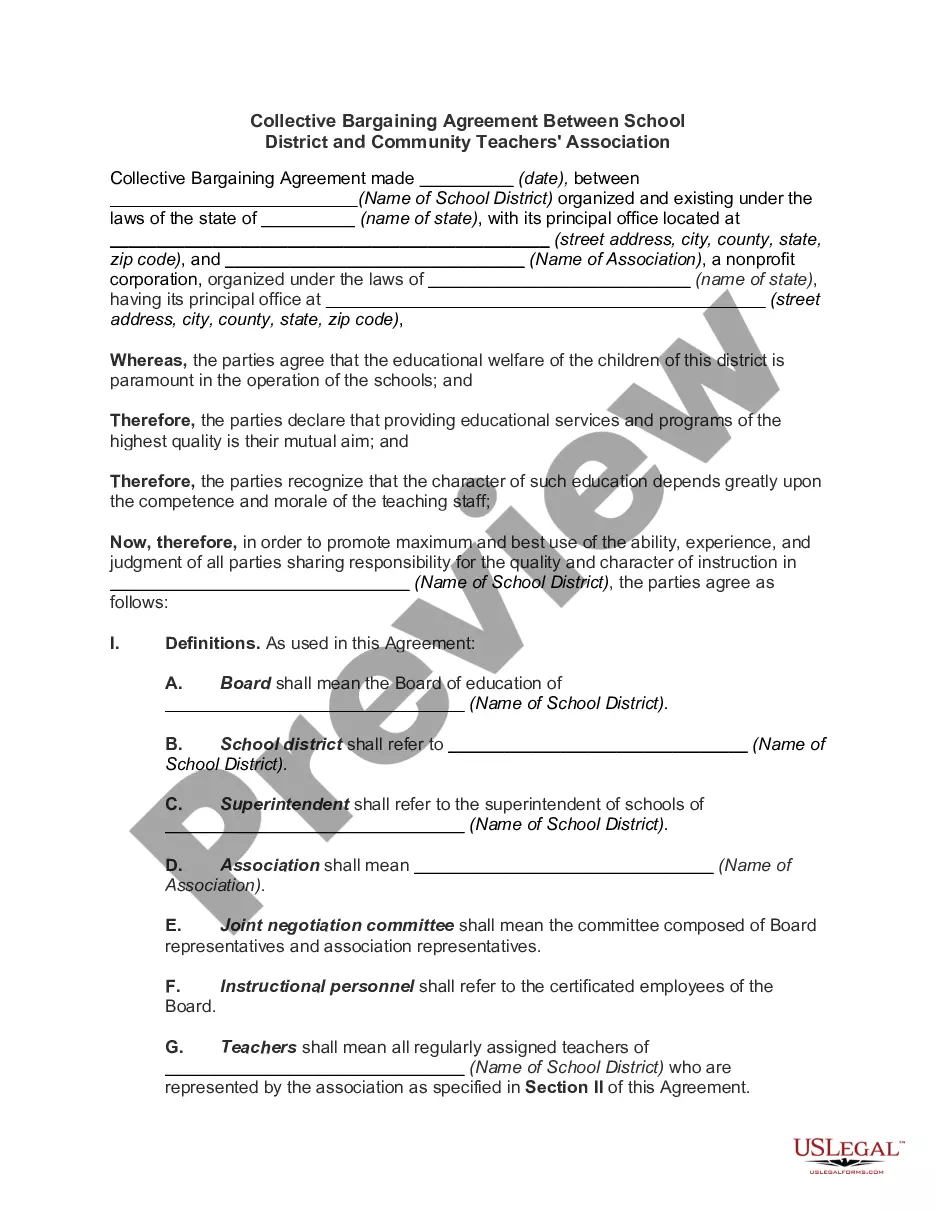

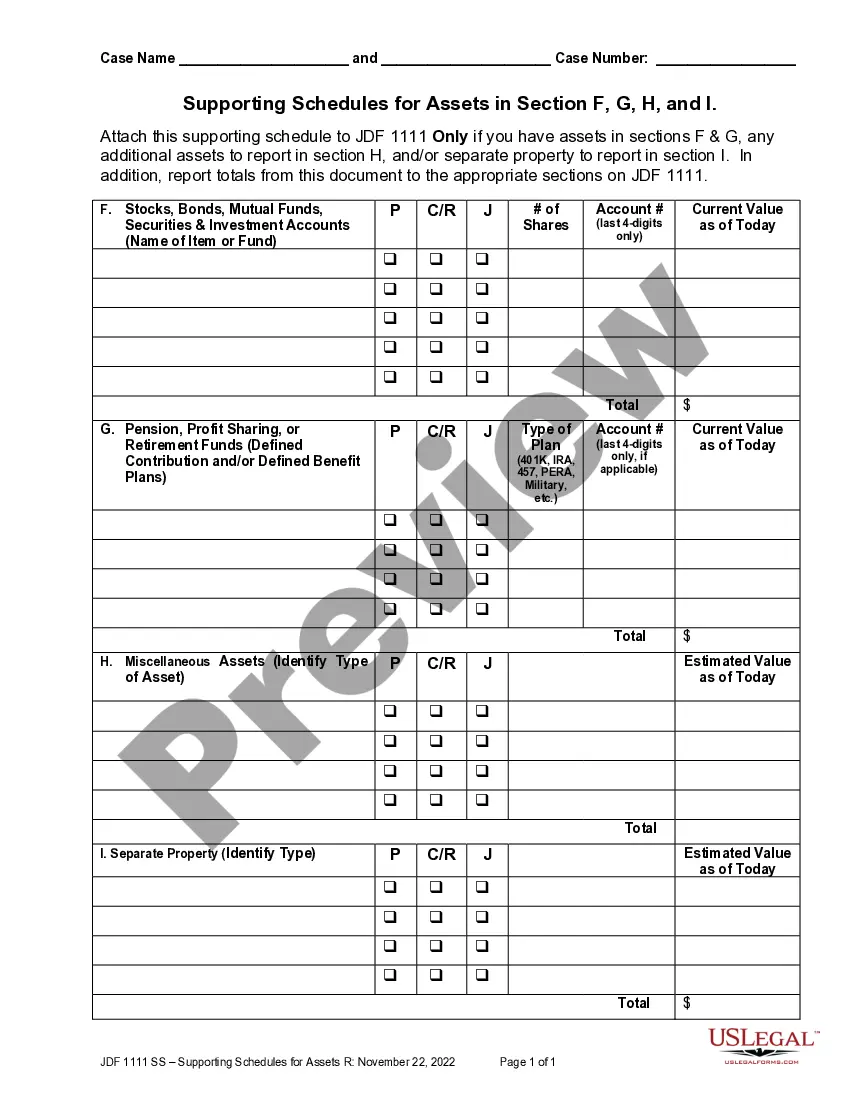

If available, use the Preview button to review the document template as well.

- If you hold a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Virgin Islands Assignment of Assets.

- Every legal document template you receive is yours permanently.

- To get another copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for your area/city of choice.

- Review the form details to confirm you have chosen the right one.

Form popularity

FAQ

Land ownership in the Virgin Islands can be held by individuals, corporations, or even trusts. When considering a Virgin Islands Assignment of Assets, it's important to be aware of who holds the title and any restrictions that might apply. Foreigners can own property, but they should research local laws and regulations. Consulting with USLegalForms can provide clarity on ownership rights and streamline the legal process.

Recording fees in the Virgin Islands usually range from $50 to $150, depending on the document's nature and the property value. As part of the Virgin Islands Assignment of Assets process, understanding these fees will help you budget your expenses accurately. The fees can vary significantly, so it’s wise to verify the exact amount with local authorities. USLegalForms offers tools to help you prepare necessary documents and understand associated costs.

Kenny Chesney's residence on the U.S. Virgin Island of St. John has been destroyed by Hurricane Irma. The country singer, 49, who was not in the area at the time of the storm, described the devastation to HLN's Morning Express with Robin Meade, calling it biblical in nature.

John Properties Announces $10 Million Bonus for All 198 Employees.

USVI Transfer Tax2% for property worth up to $350,000. 5% for property worth $350,000 to 1 million. 3% for property worth $1 million to $5 million. 5% for property worth over $5 million.

An applicant for permanent residence must reside in the Virgin Islands consecutively for a period of 20 years before application can be considered. An applicant can only be absent from the Territory for 90 days in any calendar year except when pursuing further education or as a result of illness.

8 Ways To Find The Owner Of A PropertyCheck Your Local Assessor's Office.Check With The County Clerk.Go To Your Local Library.Ask A Real Estate Agent.Talk To A Title Company.Use The Internet.Talk To A Lawyer.Knock On Their Door Or Leave A Note.

Dominica has no property taxes and is a major contender in the second citizenship world, offering one of the most cost-effective citizenship by investment programs. This Caribbean island nation is known as the nature island and is English-speaking, having obtained independence from the United Kingdom in 1978.

US Virgin Is.: Capital gains taxes (%). They have owned it for 10 years; It is their only source of capital gains in the country. It has appreciated in value by 100% over the 10 years to sale.

The U.S. Virgin Islands is unique among offshore tax planning jurisdictions: it is the only jurisdiction which can offer a tax-free entity under the U.S. flag.