A Virgin Islands Invoice Template for Consultants is a professionally-designed document that serves as a robust tool to ensure accurate and effective billing for consulting services rendered in the Virgin Islands. This template is specifically tailored to meet the unique invoicing requirements applicable to consultants operating in the Virgin Islands region. The Virgin Islands Invoice Template for Consultants is an essential resource, enabling consultants to provide detailed and comprehensive invoices to their clients. It offers a well-structured format, allowing consultants to outline their professional services in a clear and concise manner. Key Features: 1. Professional Layout: The template boasts a polished and professional design with a consistent format that enhances readability and visual appeal. 2. Consultant Details: In this section, the template allows consultants to include their business name, address, contact information, and logo, ensuring brand representation. 3. Client Information: Essential details of the client, such as the name, address, and contact information, can be easily added for accurate correspondence. 4. Invoice Numbering: Consultants can assign and track invoice numbers for efficient record-keeping and organizing purposes. 5. Date and Invoice Terms: The template provides dedicated fields to enter the date of the invoice and related payment terms, facilitating clear communication between the consultant and the client. 6. Itemized Services: This section enables consultants to itemize the services provided along with descriptions, quantities, rates, and subtotals, providing transparency and clarity regarding the scope of work performed. 7. Taxes and Discounts: The Virgin Islands Invoice Template for Consultants is flexible enough to accommodate any applicable taxes or discounts, ensuring accurate calculations. 8. Totals and Payment Details: Consultants can conveniently include subtotals, taxes, discounts, and calculate the overall invoice total. Additionally, the template allows space for clients to specify the preferred payment method and due date. Variant Types: 1. Basic Virgin Islands Invoice Template for Consultants: A simplified version designed for consultants offering straightforward services without the need for complex itemization or additional features. 2. Comprehensive Virgin Islands Invoice Template for Consultants: Specially designed for consultants offering a wide range of services, this template includes more detailed sections for itemization, hourly rates, expenses, and additional customization options. 3. Recurring Virgin Islands Invoice Template for Consultants: A variation of the template that facilitates recurring billing, ideal for consultants providing ongoing services with regular intervals. By utilizing the Virgin Islands Invoice Template for Consultants, professionals operating in the Virgin Islands can streamline their billing processes, present professional invoices, and ensure timely and accurate payment while maintaining compliance with the region's invoicing regulations.

Virgin Islands Invoice Template for Consultant

Description

How to fill out Virgin Islands Invoice Template For Consultant?

If you wish to comprehensive, down load, or print authorized document templates, use US Legal Forms, the most important selection of authorized kinds, that can be found on-line. Use the site`s simple and handy look for to get the documents you need. Various templates for company and person purposes are categorized by classes and states, or key phrases. Use US Legal Forms to get the Virgin Islands Invoice Template for Consultant with a number of click throughs.

When you are already a US Legal Forms customer, log in to the profile and click the Download option to have the Virgin Islands Invoice Template for Consultant. Also you can access kinds you earlier delivered electronically inside the My Forms tab of your profile.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for your proper area/nation.

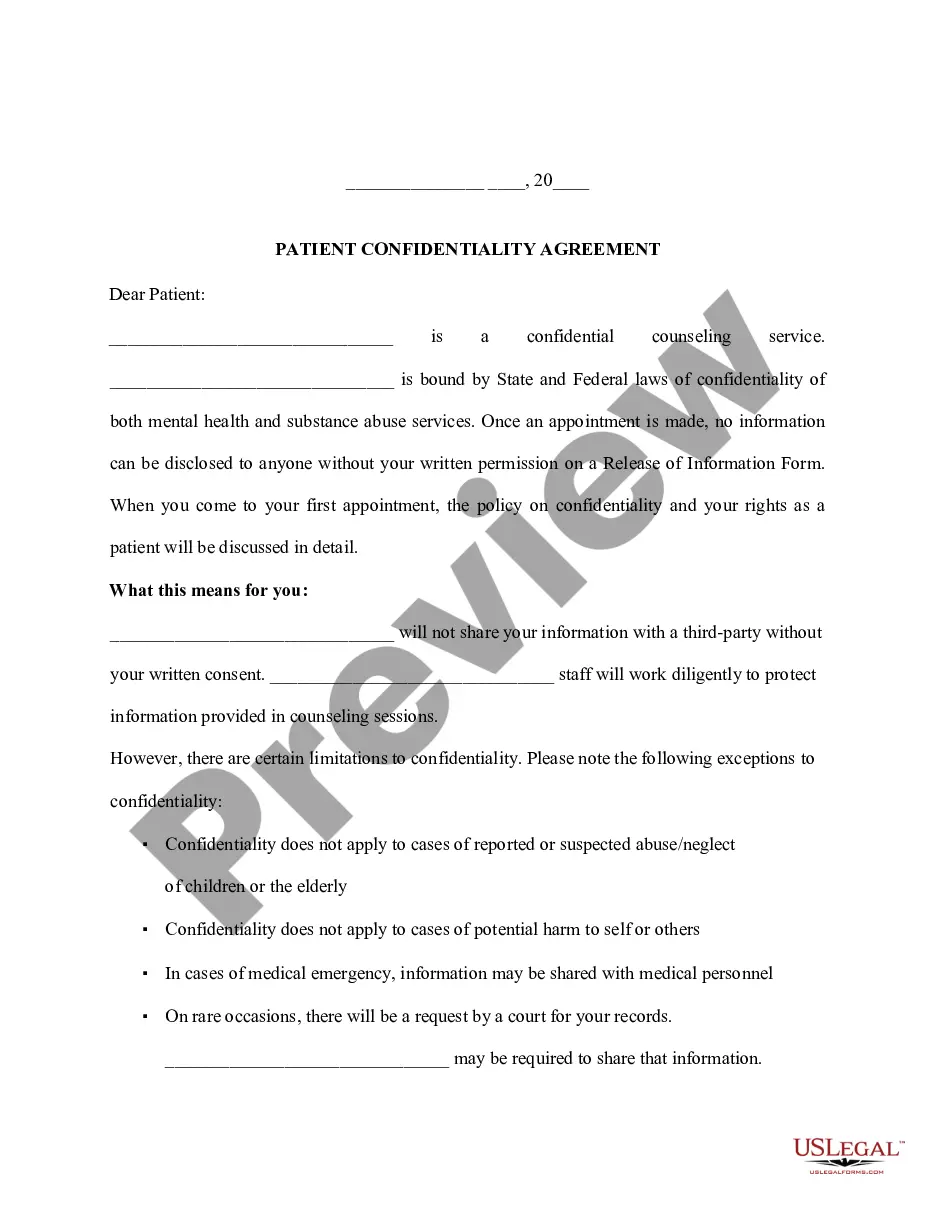

- Step 2. Use the Preview method to examine the form`s content material. Do not forget to read the explanation.

- Step 3. When you are not happy using the type, use the Research area towards the top of the display screen to discover other types in the authorized type web template.

- Step 4. Once you have discovered the form you need, select the Acquire now option. Select the pricing strategy you like and put your accreditations to sign up for the profile.

- Step 5. Method the financial transaction. You can use your charge card or PayPal profile to accomplish the financial transaction.

- Step 6. Choose the file format in the authorized type and down load it on the product.

- Step 7. Comprehensive, revise and print or sign the Virgin Islands Invoice Template for Consultant.

Each authorized document web template you buy is your own property eternally. You have acces to each and every type you delivered electronically in your acccount. Click the My Forms portion and choose a type to print or down load again.

Be competitive and down load, and print the Virgin Islands Invoice Template for Consultant with US Legal Forms. There are thousands of expert and condition-particular kinds you may use for your personal company or person requirements.