Virgin Islands Small Business Administration Loan Application Form and Checklist

Description

How to fill out Small Business Administration Loan Application Form And Checklist?

Choosing the right legal papers web template can be quite a struggle. Needless to say, there are plenty of web templates available online, but how do you obtain the legal kind you require? Utilize the US Legal Forms site. The support offers thousands of web templates, such as the Virgin Islands Small Business Administration Loan Application Form and Checklist, that you can use for company and private demands. Every one of the kinds are checked by experts and fulfill state and federal demands.

In case you are currently authorized, log in for your bank account and click on the Obtain button to find the Virgin Islands Small Business Administration Loan Application Form and Checklist. Use your bank account to search with the legal kinds you have acquired in the past. Check out the My Forms tab of the bank account and obtain an additional version in the papers you require.

In case you are a fresh customer of US Legal Forms, listed here are straightforward directions so that you can stick to:

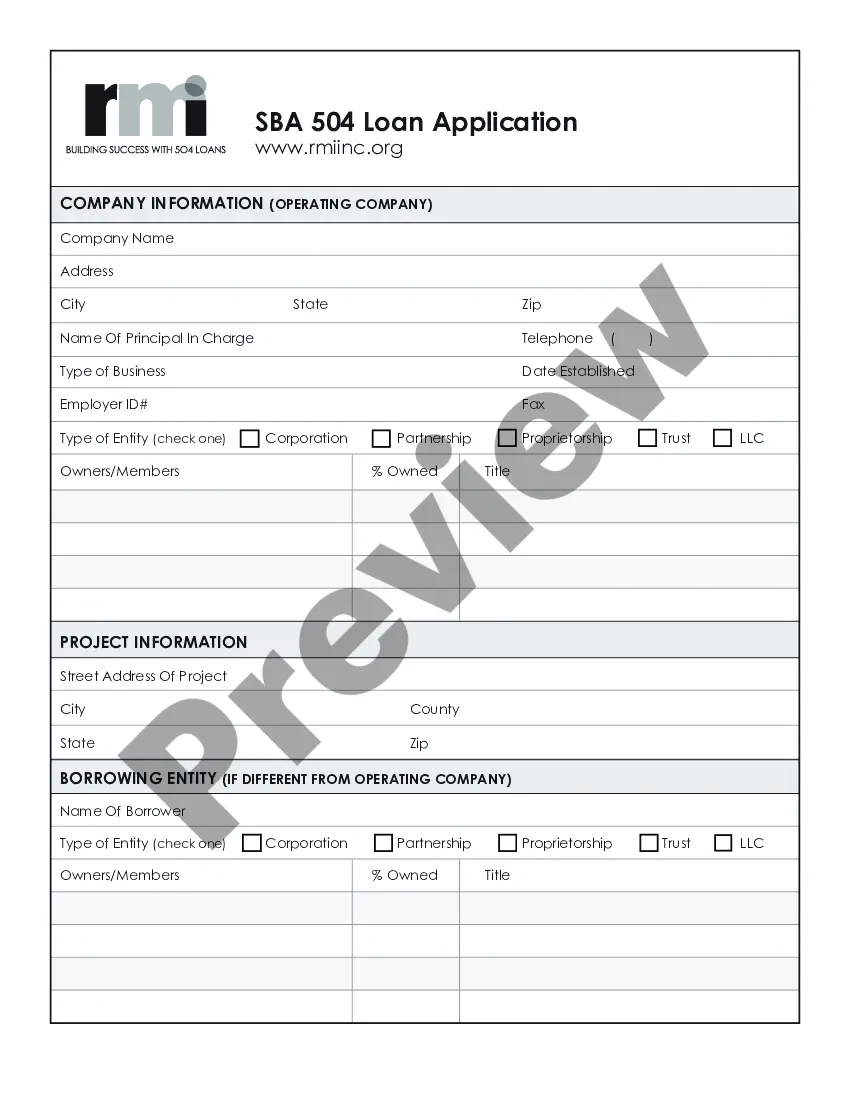

- Initial, be sure you have selected the correct kind for the town/county. You can examine the shape making use of the Review button and study the shape description to make certain this is the best for you.

- In the event the kind fails to fulfill your expectations, utilize the Seach discipline to obtain the correct kind.

- Once you are certain that the shape is suitable, select the Get now button to find the kind.

- Opt for the prices strategy you want and enter in the necessary info. Build your bank account and buy the order utilizing your PayPal bank account or credit card.

- Choose the document formatting and down load the legal papers web template for your system.

- Comprehensive, revise and produce and sign the obtained Virgin Islands Small Business Administration Loan Application Form and Checklist.

US Legal Forms will be the greatest local library of legal kinds that you can discover different papers web templates. Utilize the service to down load skillfully-produced paperwork that stick to status demands.

Form popularity

FAQ

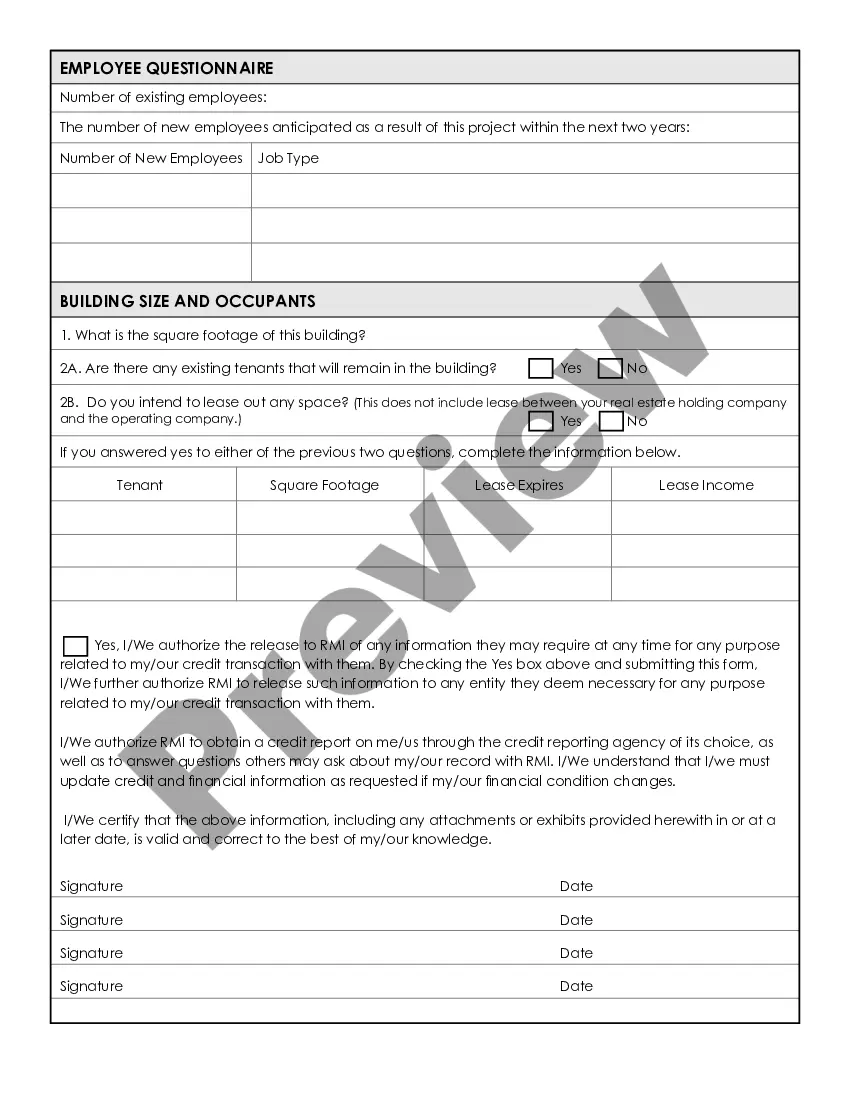

Although the SBA Form 912 is no longer required, if an individual owner answers ?yes? to question 18 or 19, the individual must provide the details to Page 3 PAGE 3 of 6 EXPIRES: 9-1-21 SBA Form 1353.3 (4-93) MS Word Edition; previous editions obsolete Must be accompanied by SBA Form 58 Federal Recycling Program ...

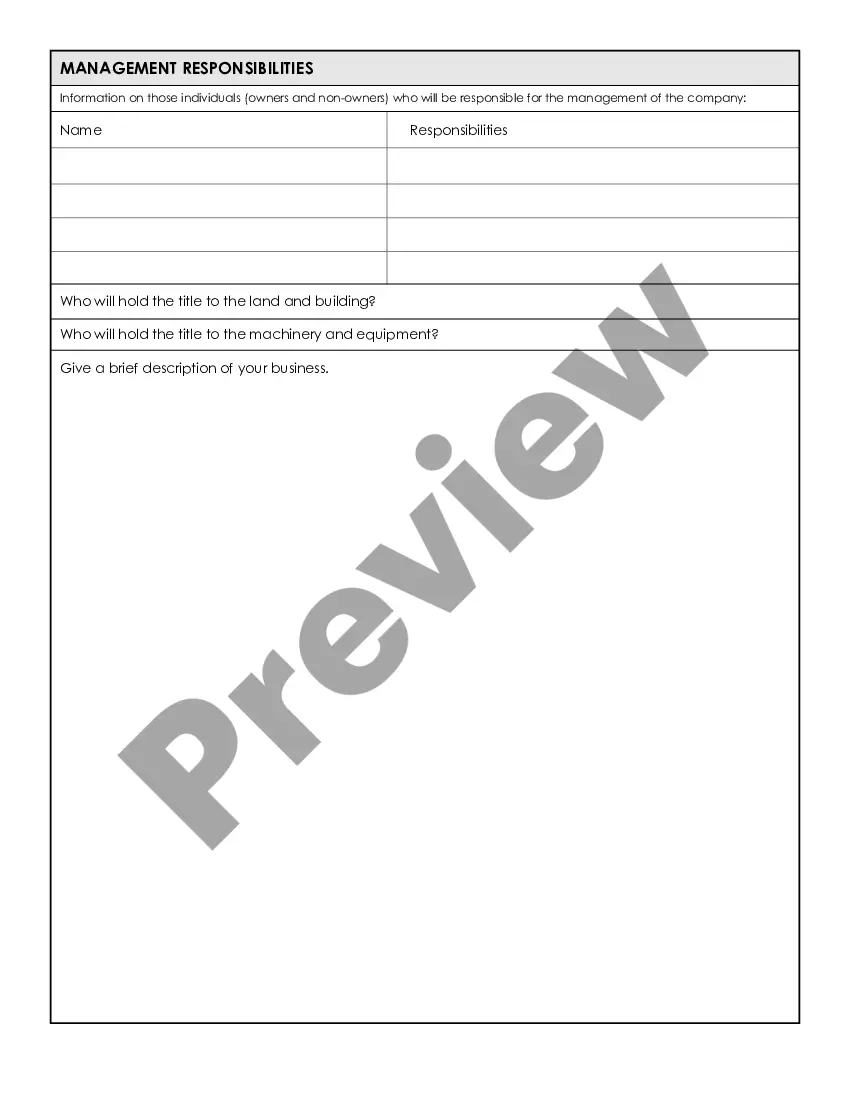

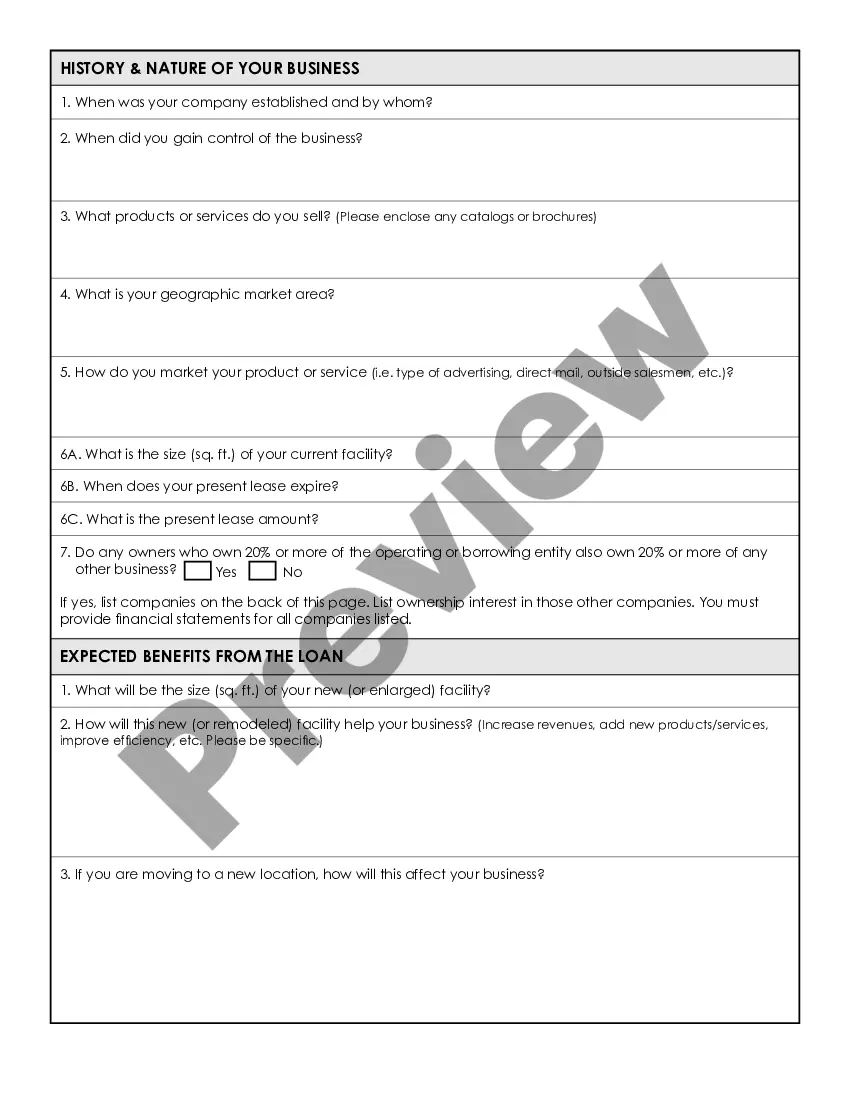

The SBA Checklist Borrower Information Form. Personal Background and Financial Statement. Business Financial Statements. Business Certificate/License. Loan Application History. Income Tax Returns. Resumes. Business Overview and History.

The minimum credit score required for an SBA loan depends on the type of loan. For SBA Microloans, the minimum credit score is typically between 620-640. For SBA 7(a) loans, the minimum credit score is typically 640, but borrowers may find greater success if they can boost their credit score into the 680+ range.

SBA Express It features the easiest SBA application process and accelerated approval times, plus it offers longer terms and lower down payment requirements than conventional loans.

In general, SBA loans are not as difficult to get as business bank loans. Because they're backed by the U.S. government, they're less risky for banks than issuing their own loans.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

You may get denied an SBA loan if your business could obtain financing elsewhere or has a wealth of assets above the loan amount requested. You also probably won't get approved if you've had a past default on a government loan. Finally, the SBA disqualifies specific industries, including: Financial institutions.

On average, most SBA loans take 30 to 90 days from applying to funding. 7(a) loan subtypes are backed directly by the SBA. Approval can take 30 to 60 days. Microloans are loans for smaller amounts of $50,000 or less.