Virgin Islands Market Planning Checklist

Description

How to fill out Market Planning Checklist?

Are you currently in the situation where you need documents for both business or personal needs almost every day.

There are many legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of template forms, like the Virgin Islands Market Planning Checklist, designed to comply with state and federal regulations.

Select the pricing plan you prefer, enter the required details to create your account, and complete the purchase using your PayPal or Visa/Mastercard.

Choose a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then you can download the Virgin Islands Market Planning Checklist template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and confirm it is for the correct state/region.

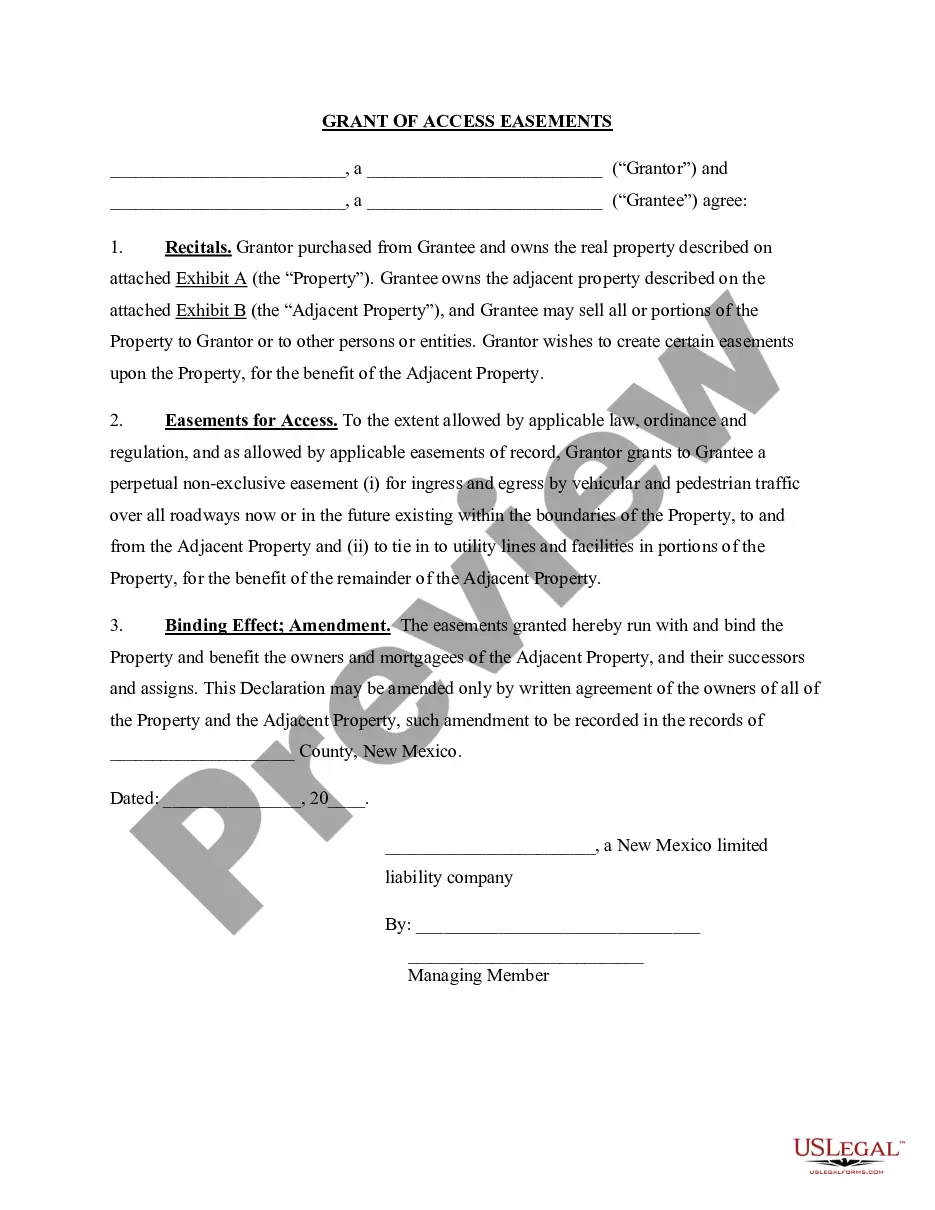

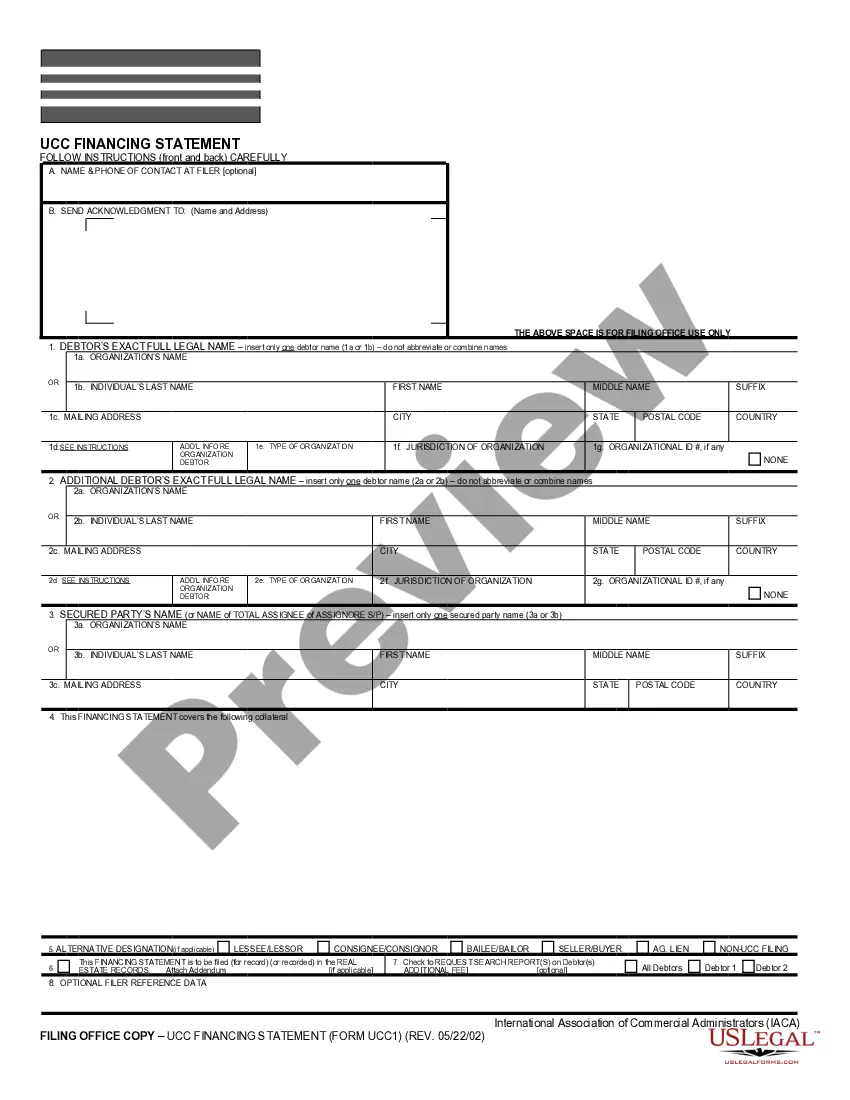

- Use the Preview feature to review the form.

- Read the description to ensure you have selected the correct form.

- If the form does not meet your needs, utilize the Search field to find the appropriate form.

- Once you locate the correct form, click Purchase now.

Form popularity

FAQ

Yes, US citizens must go through customs when traveling to the US Virgin Islands. While the islands are a US territory, there are still specific regulations and processes in place. Understanding these procedures can help you prepare for a smooth travel experience. A comprehensive Virgin Islands Market Planning Checklist can provide you with all necessary travel insights and customs regulations.

The median income in the Virgin Islands varies depending on several factors, including the specific island and economic conditions. Generally, income levels in the Virgin Islands can be competitive, but they may not match those of major mainland cities. If you're considering moving or investing, having a solid Virgin Islands Market Planning Checklist can help you plan financially for your needs and expectations.

Yes, living in the Virgin Islands offers several tax advantages that can benefit residents and business owners alike. The tax laws are designed to attract new business and investment, allowing lower corporate tax rates and potential exemptions. These advantages make the Virgin Islands an appealing option for those looking to enhance their financial positions. Incorporating these benefits into your Virgin Islands Market Planning Checklist is essential for maximizing your overall wealth.

To obtain an Employer Identification Number (EIN) in the Virgin Islands, you can apply directly through the IRS website or via a local tax office. You will need to provide essential information about your business, including its legal structure and ownership details. Once you complete the application process, you will receive your EIN, which is crucial for various business activities. This step is an essential part of your Virgin Islands Market Planning Checklist, ensuring you comply with all federal tax regulations.

Yes, the U.S. federal government governs the U.S. Virgin Islands, although local laws and regulations also apply. This unique governance structure can affect how businesses operate. As you create your Virgin Islands Market Planning Checklist, explore both federal and local laws, as they can have significant implications for your business. Staying informed will enhance your planning and decision-making.

The U.S. Virgin Islands are a U.S. territory but are not considered part of the 50 states. This distinction impacts various legal and economic aspects you should consider. As you work through your Virgin Islands Market Planning Checklist, it is important to recognize this difference. This understanding is crucial for compliance and planning.

Yes, you usually need a business license to operate in the U.S. Virgin Islands. The specific requirements can vary based on your business type and location. By including this information in your Virgin Islands Market Planning Checklist, you can streamline your setup process. It’s wise to consult local guidelines or use platforms like uslegalforms to ensure you cover all legal bases.

U.S. citizens typically do not go through customs when traveling to U.S. territories like the Virgin Islands. However, you should carry proper identification and be aware of any restrictions on personal items or goods. Including this consideration in your Virgin Islands Market Planning Checklist ensures a smooth travel experience. Knowledge here can save you time and hassle.

Yes, U.S. laws do apply to U.S. territories, including the Virgin Islands. However, there are exceptions and local adaptations you should be aware of. As part of your Virgin Islands Market Planning Checklist, ensure you review these variations. This way, you can avoid legal pitfalls and successfully establish your business in the islands.

U.S. laws generally apply to the U.S. Virgin Islands, but there are unique aspects to consider. The Virgin Islands Market Planning Checklist should address specific local regulations that may differ from mainland laws. Understanding these distinctions helps you navigate legal obligations effectively. Always refer to updated resources or consult legal experts for compliance.