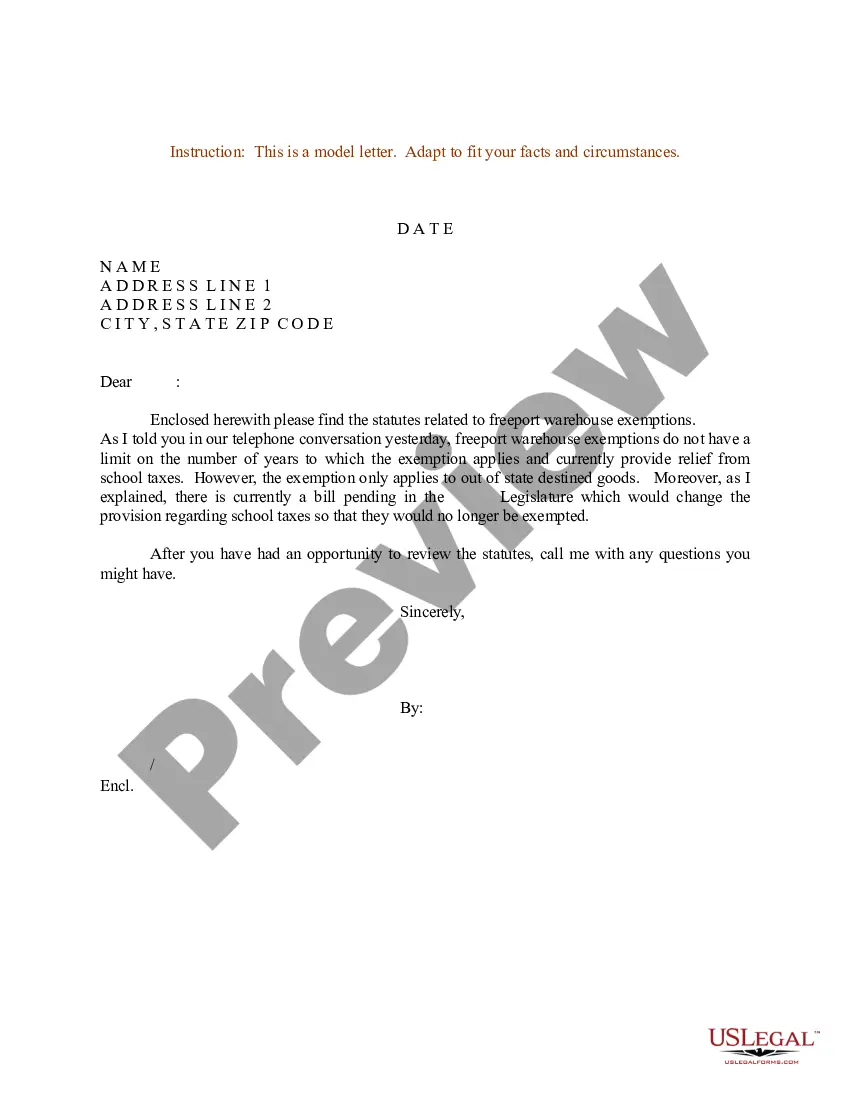

Virgin Islands Sample Letter for Freeport Warehouse Exemptions

Description

How to fill out Sample Letter For Freeport Warehouse Exemptions?

You are able to spend hours on the web attempting to find the legal record template that suits the federal and state demands you require. US Legal Forms supplies 1000s of legal forms that are examined by pros. It is possible to obtain or print out the Virgin Islands Sample Letter for Freeport Warehouse Exemptions from your assistance.

If you have a US Legal Forms account, you are able to log in and click the Down load switch. Next, you are able to comprehensive, revise, print out, or sign the Virgin Islands Sample Letter for Freeport Warehouse Exemptions. Every legal record template you buy is your own permanently. To obtain another version of any acquired form, check out the My Forms tab and click the related switch.

If you work with the US Legal Forms internet site initially, keep to the straightforward recommendations under:

- Very first, ensure that you have chosen the best record template for that county/area of your choosing. Read the form information to make sure you have picked the correct form. If readily available, use the Preview switch to check throughout the record template also.

- If you would like find another model of the form, use the Lookup field to get the template that meets your requirements and demands.

- When you have located the template you want, simply click Get now to continue.

- Find the pricing prepare you want, key in your credentials, and sign up for a free account on US Legal Forms.

- Complete the purchase. You may use your charge card or PayPal account to pay for the legal form.

- Find the format of the record and obtain it for your gadget.

- Make modifications for your record if needed. You are able to comprehensive, revise and sign and print out Virgin Islands Sample Letter for Freeport Warehouse Exemptions.

Down load and print out 1000s of record layouts while using US Legal Forms Internet site, which offers the largest variety of legal forms. Use skilled and status-particular layouts to take on your small business or specific requirements.