Virgin Islands Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

It is feasible to spend several hours online trying to locate the approved document template that meets the federal and state criteria you require.

US Legal Forms offers thousands of legal templates which can be vetted by experts.

You can easily obtain or print the Virgin Islands Pledge of Personal Property as Collateral Security from the platform.

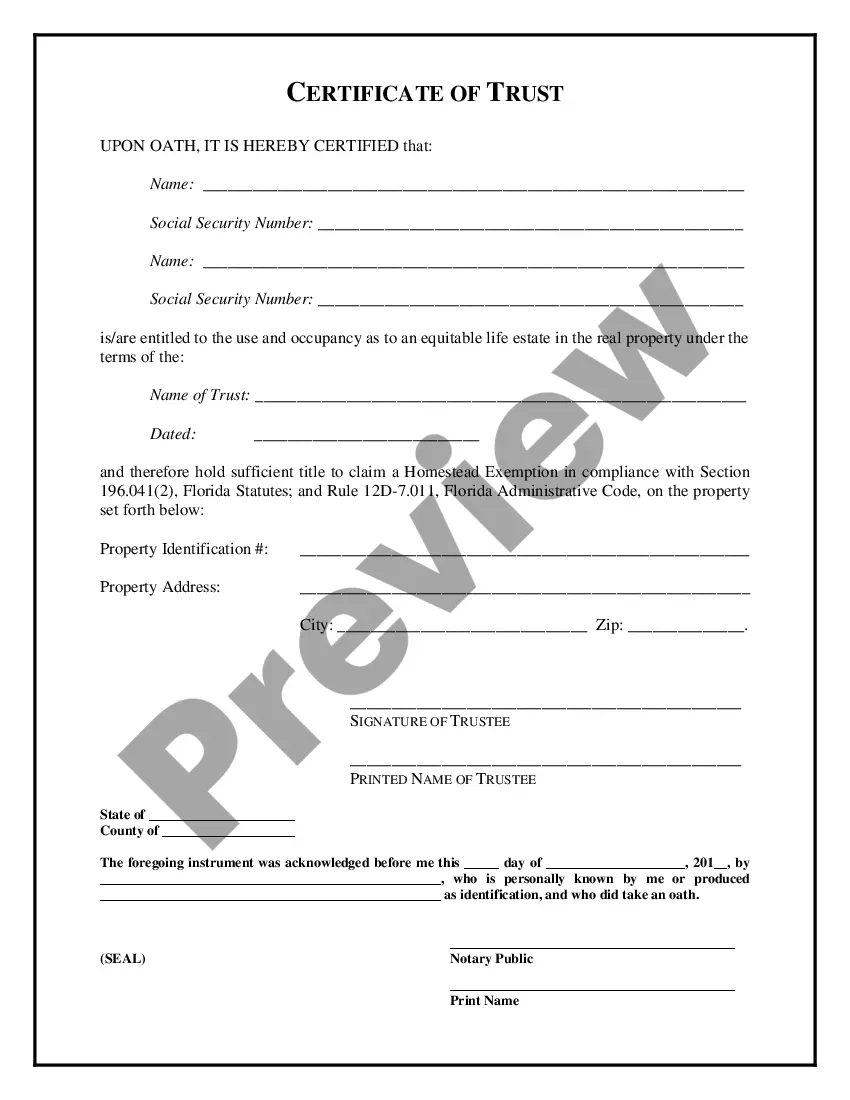

If available, utilize the Preview button to review the document template as well. When you wish to acquire another version of the form, make use of the Search section to find the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Virgin Islands Pledge of Personal Property as Collateral Security.

- Every legal document template you receive is yours to keep indefinitely.

- To get another copy of any acquired form, navigate to the My documents tab and click the respective button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions provided below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Review the template details to ensure you have selected the appropriate one.

Form popularity

FAQ

For a security interest to be enforceable, it must be properly attached according to the UCC, which includes having a valid security agreement and the debtor’s rights in the collateral. Additionally, the creditor must have provided value for the interest. In the context of the Virgin Islands Pledge of Personal Property as Collateral Security, meeting these conditions ensures that the security interest remains legally binding and actionable.

Creating a valid security interest requires several elements: a security agreement, collateral rights, and value given by the secured party. This process establishes the legal claim that protects the interests of the creditor. Within the framework of the Virgin Islands Pledge of Personal Property as Collateral Security, knowing these requirements supports a solid financial arrangement.

To achieve a valid enforceable security interest under the UCC, the parties must have a security agreement, value must be given, and the debtor must possess rights in the collateral. These steps are crucial in order to establish a formal agreement. The Virgin Islands Pledge of Personal Property as Collateral Security follows these principles, ensuring that both lenders and borrowers understand their rights.

To have an enforceable security interest, a creditor must meet three key requirements: the debtor must grant a security interest, the creditor must give value, and the debtor must have rights in the collateral. These elements work together to form a legal basis for the creditor's claim. In the case of the Virgin Islands Pledge of Personal Property as Collateral Security, successfully meeting these criteria makes the security interest valid and enforceable.

A security interest in personal property represents a legal claim that a creditor has over a debtor's assets, allowing the creditor to seize those assets if the debtor fails to meet their obligations. This interest serves as a form of collateral that adds a layer of protection for lenders. In the Virgin Islands Pledge of Personal Property as Collateral Security, this concept is critical, as it ensures the creditor's investment is secured.

For a security interest to attach under UCC Article 9, the creditor must have a security agreement, the debtor must have rights in the collateral, and the value must be given by the creditor. This ensures that the security interest is granted and enforceable. When applying this to the Virgin Islands Pledge of Personal Property as Collateral Security, understanding these requirements is essential for both parties involved.

The pledging of collateral by a financial institution is necessary to protect the Federal Government against risk of loss.

A pledge agreement must be in writing. The same formalities as for a mortgage agreement apply. Pledge must be certified as a deed before a notary public. The same formalities as for a mortgage agreement apply.

A pledge and security agreement is a legal document that outlines an arrangement in which one party (the pledgor) unconditionally transfers the title to a specific property or asset to another person or entity (the pledgee), who accepts it for safekeeping, usually in return for some form of compensation.

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).