Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement

Description

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

US Legal Forms - one of the most substantial collections of legal documents in the United States - offers a vast selection of legal template documents for you to download or print.

Using the website, you can discover thousands of templates for both personal and business purposes, organized by categories, states, or keywords. You can find the most current versions of documents such as the Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement in just minutes.

If you already have an account, Log In and download the Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement from the US Legal Forms library. The Download button will appear on every document you view. You can access all previously obtained templates within the My documents section of your account.

Choose the format and download the document to your device.

Make modifications. Fill out, edit, print, and sign the retrieved Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement. Every template you add to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the document you require.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

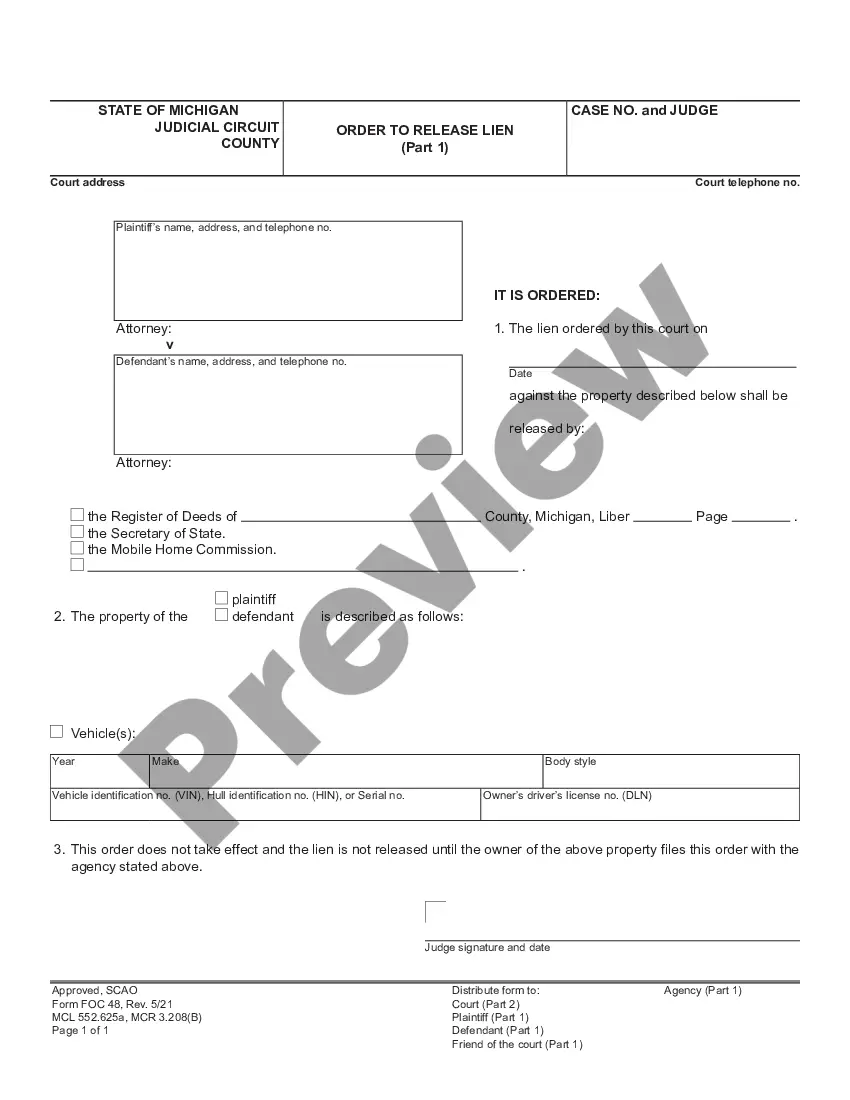

- Verify that you have selected the correct form for your city/state. Click the Preview button to review the contents of the document.

- Check the form summary to confirm you have selected the right one.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that fits your needs.

- When you are satisfied with the document, confirm your choice by clicking on the Buy Now button. Then, select the pricing plan you desire and provide your details to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

When asking for reimbursement of travel expenses, begin by organizing your documentation, including receipts and a completed reimbursement form. You can structure your request as a formal email or letter using the 'Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement' as a guide. Be sure to clearly state the total amount you are requesting and provide a brief overview of the travel purpose and expenditures. By being clear and concise, you enhance the chances of a quick approval.

To write a reimbursement form, start by including your name and contact information at the top. Clearly state the purpose of the form, such as 'Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement.' List the specific expenses you are claiming, along with the dates and any relevant receipts. Lastly, provide a space for signatures to confirm the expenses were incurred for business purposes.

Among the types of vehicle expenses, garage rent and property taxes based on vehicle weight are typically allowable. Estimated maintenance expenses and parking tickets, however, often do not qualify for reimbursement. It is essential to understand your company's policies on vehicle expense reimbursements fully. To create clarity around these policies, refer to the Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement as a valuable resource.

When filling in an expense form, begin by providing your contact information and the time period for the claimed expenses. Document each expense clearly, noting the purpose, date, and amount of each item, and attach relevant receipts as proof. Double-check your entries for accuracy before submitting. Using a Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement can offer clarity on format and required details.

To fill out a reimbursement claim form correctly, begin with your personal details and the claim period. List all expenses in a clear and organized manner, including dates and amounts, while attaching the corresponding receipts. After completing the required sections, sign and date the form before submitting it for approval. For best practices, refer to the Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement to ensure you follow company protocols.

Filling out an expense reimbursement form requires you to gather all relevant receipts and detailed information about your expenses. Start by entering your personal information, including name and employee ID, before listing each expense with accompanying dates and amounts. Ensure you provide a brief description of each expense and categorize them appropriately. For guidance, the Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement can serve as an excellent reference.

Companies typically reimburse travel expenses through a structured process that includes submitting receipts and a reimbursement request form. Employees provide necessary documentation, including meal receipts, lodging costs, and other travel-related expenses. Once approved, the reimbursement is processed through payroll or direct deposit. To streamline this process, utilizing a Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement can help standardize and clarify the company's approach.

When writing a letter for reimbursement of expenses, begin with a professional greeting and clearly state your purpose. Include specifics about the expenses incurred, such as dates and amounts, and attach relevant documentation. The Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement serves as an effective template to guide you through the process.

A formal letter for reimbursement should include your name and address at the top, followed by the recipient's details. Clearly outline the reasons for your request along with the relevant expenses you wish to claim. Referring to the Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement can help you maintain a formal tone while ensuring all necessary details are included.

To write a letter for refunding an amount, begin with your contact information and the date at the top. Clearly state the purpose of the letter and the amount you are requesting to be refunded. A well-structured Virgin Islands Sample Letter for Policy on Vehicle Expense Reimbursement can help you present your case firmly and professionally.