If you find yourself spending lots of time every month reconciling your bank statement and still are not able to nail it down to the penny, this monthly bank reconciliation form might be able to help you.

Virgin Islands Monthly Bank Reconciliation Worksheet

Description

How to fill out Monthly Bank Reconciliation Worksheet?

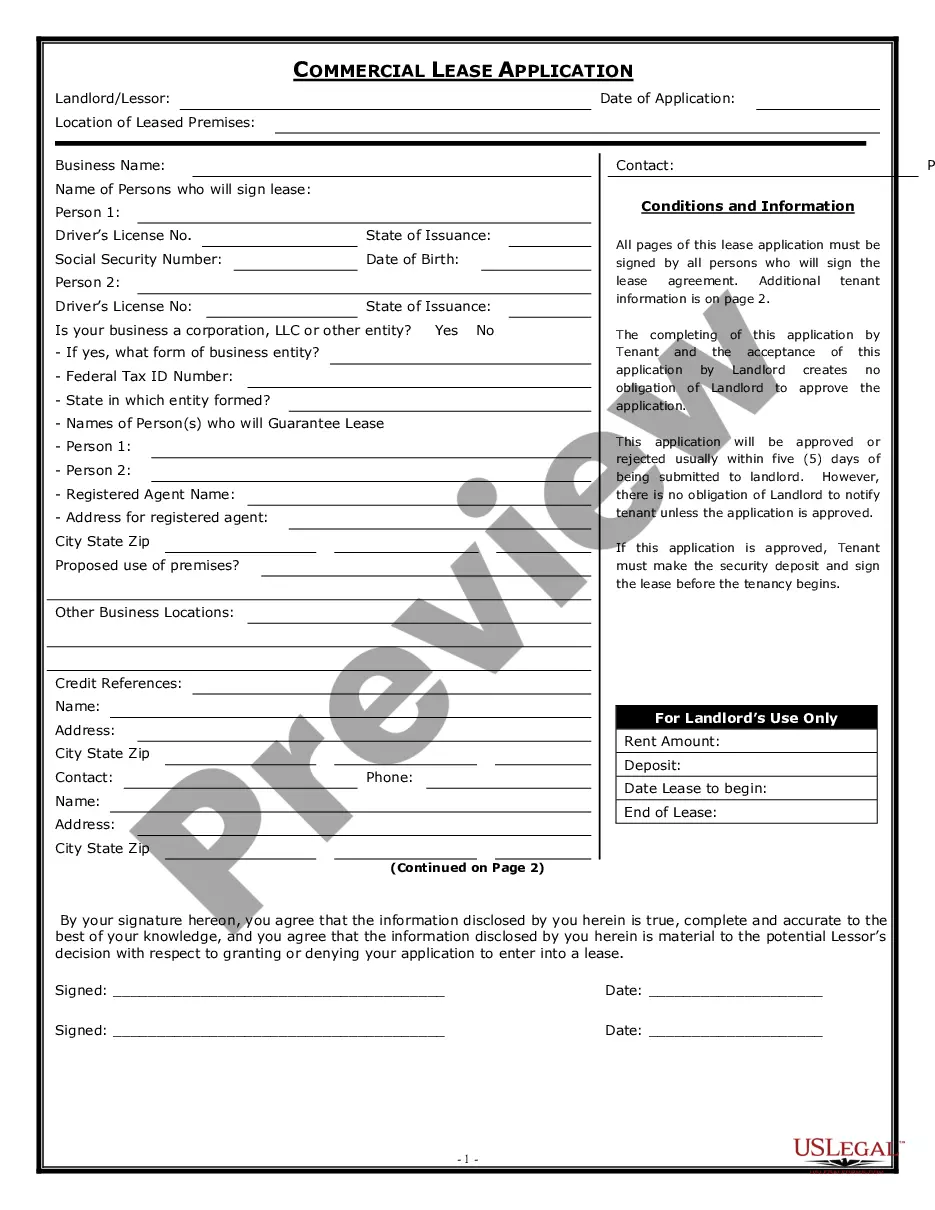

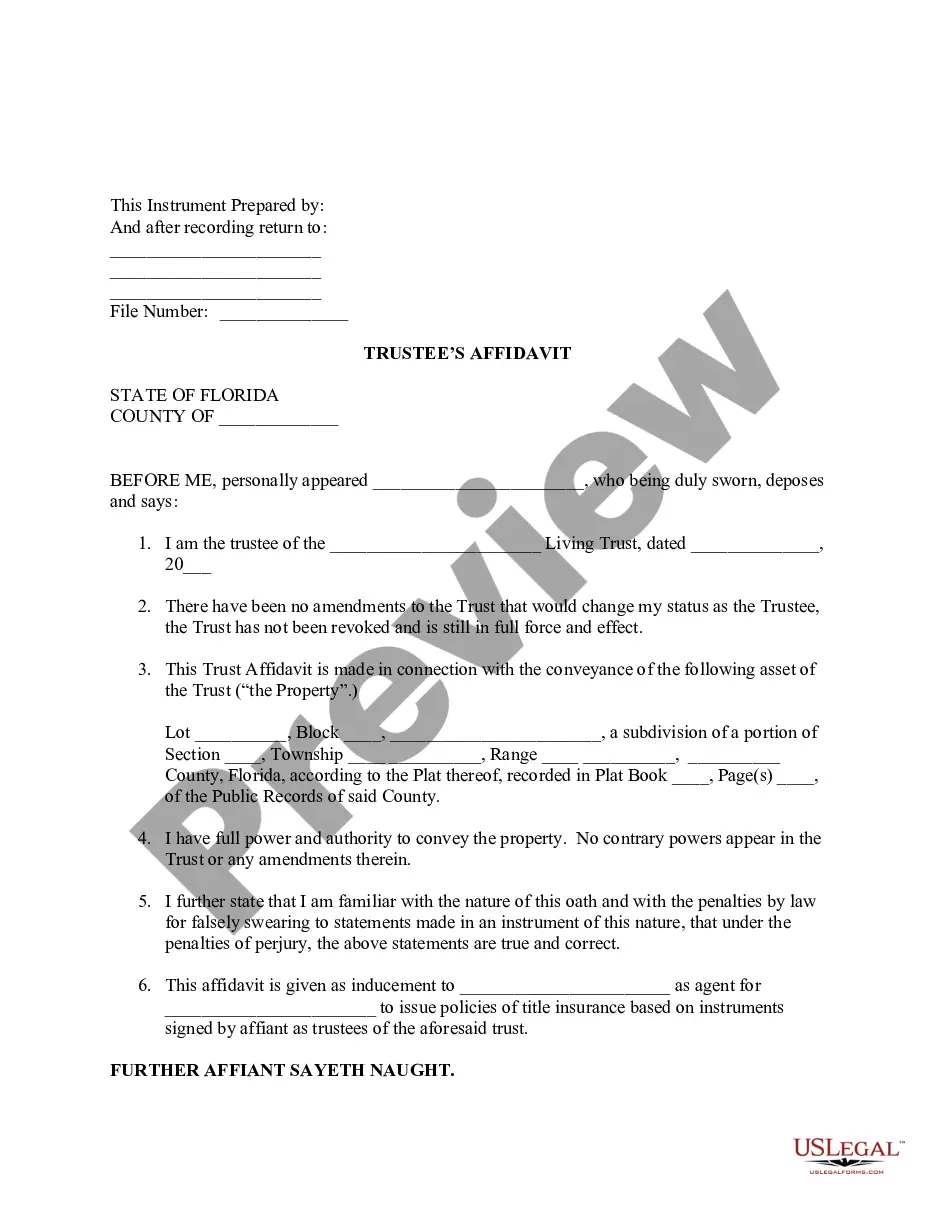

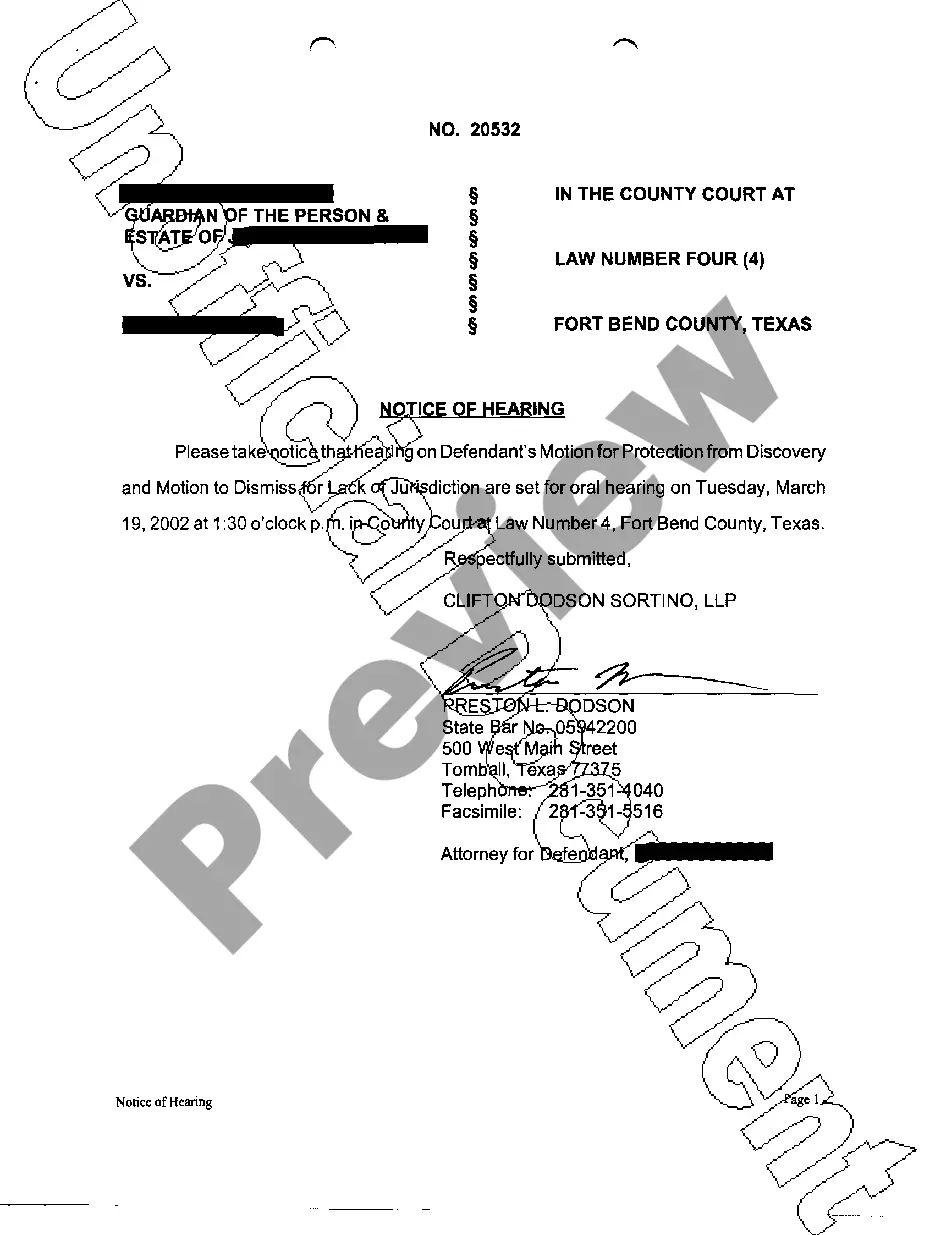

Selecting the appropriate legal document template can be a challenge. Indeed, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Virgin Islands Monthly Bank Reconciliation Worksheet, suitable for both business and personal purposes.

All documents are reviewed by professionals and meet state and federal regulations.

If the form does not meet your requirements, use the Search field to find the accurate template. Once you are confident that the form is suitable, choose the Get now option to proceed with the download. Select the payment plan you desire and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, edit, print, and sign the acquired Virgin Islands Monthly Bank Reconciliation Worksheet. US Legal Forms is the largest repository of legal documents where you can find a variety of template papers. Utilize the service to obtain professionally crafted documents that meet state regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Virgin Islands Monthly Bank Reconciliation Worksheet.

- Use your account to browse the legal forms you have previously ordered.

- Navigate to the My documents section of your account and download an additional copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- Firstly, ensure you have selected the correct form for your city/region.

- You can preview the form using the Preview option and check the form details to confirm it’s the right one for you.

Form popularity

FAQ

To create a BRS document, first assemble your monthly bank data and any relevant internal financial records. Structure your report by listing all transactions alongside any discrepancies you identify. The Virgin Islands Monthly Bank Reconciliation Worksheet is an excellent resource to simplify this task, allowing you to ensure accuracy and compliance.

Writing a functional requirements document starts with defining the scope and goals of the project. Identify key functionalities needed for your banking processes, ensuring that they align with user needs. The Virgin Islands Monthly Bank Reconciliation Worksheet can guide you by providing clarity on the essential functions for bank reconciliations.

To prepare a Bank Reconciliation Statement, begin by compiling all bank transactions for the period in question. Next, compare these transactions with your accounting records to discover any mismatches. Using the Virgin Islands Monthly Bank Reconciliation Worksheet can help you format this statement neatly and present your financial status clearly.

Creating a .brd file generally requires specific software designed for these types of documents. After ensuring you have the right application, you can start by outlining your banking data clearly. Utilizing the Virgin Islands Monthly Bank Reconciliation Worksheet as a reference can help streamline the creation of your .brd file efficiently.

Preparing a Bank Reconciliation Statement (BRS) document involves collecting relevant financial records from both your bank and your accounting system. Begin by listing all transactions and comparing them systematically. The Virgin Islands Monthly Bank Reconciliation Worksheet can serve as an effective tool to organize this data, simplifying the reconciliation process.

To perform month-end bank reconciliation, gather your bank statement and your records. Compare your bank statement transactions with your internal records to identify discrepancies. Ensure that you reconcile all differences accurately, making adjustments as necessary, and finalize with the Virgin Islands Monthly Bank Reconciliation Worksheet to verify your results.

To obtain a bank reconciliation statement, you typically request it from your bank either online or by visiting a branch. Most banks provide a summary of your reconciled transactions through their online banking platform. You can also manually prepare your own reconciliation statement by comparing your records against the bank’s statement, making sure to include any adjustments. For enhanced efficiency, consider using tools like the Virgin Islands Monthly Bank Reconciliation Worksheet to help facilitate this process.

To create a bank reconciliation sheet, start by listing all transactions from your financial records alongside the corresponding entries from your bank statement. Highlight any discrepancies, such as outstanding checks or deposits in transit. Utilize the Virgin Islands Monthly Bank Reconciliation Worksheet, which provides a template that simplifies tracking these entries and ensures that your final balances align perfectly by the end of the reconciliation process.

The five steps to reconcile your account include gathering your bank statements, checking your entries against the statement, documenting any discrepancies, adjusting your records for any missed transactions, and ensuring both your statement and records match. This methodical approach not only ensures accuracy but also helps you understand your overall financial status. Incorporating the Virgin Islands Monthly Bank Reconciliation Worksheet helps maintain clarity and organization throughout the reconciliation process.

To do a monthly bank reconciliation, first, collect all bank statements for the month. Then, systematically enter transactions from your statement into your financial records, ensuring that each transaction matches your records. Resolve any differences by adjusting your records for any outstanding checks or bank fees. Utilizing the Virgin Islands Monthly Bank Reconciliation Worksheet can simplify this process by providing a structured way to track and reconcile your balances.