Virgin Islands Sample Letter for Exemption of Ad Valorem Taxes

Description

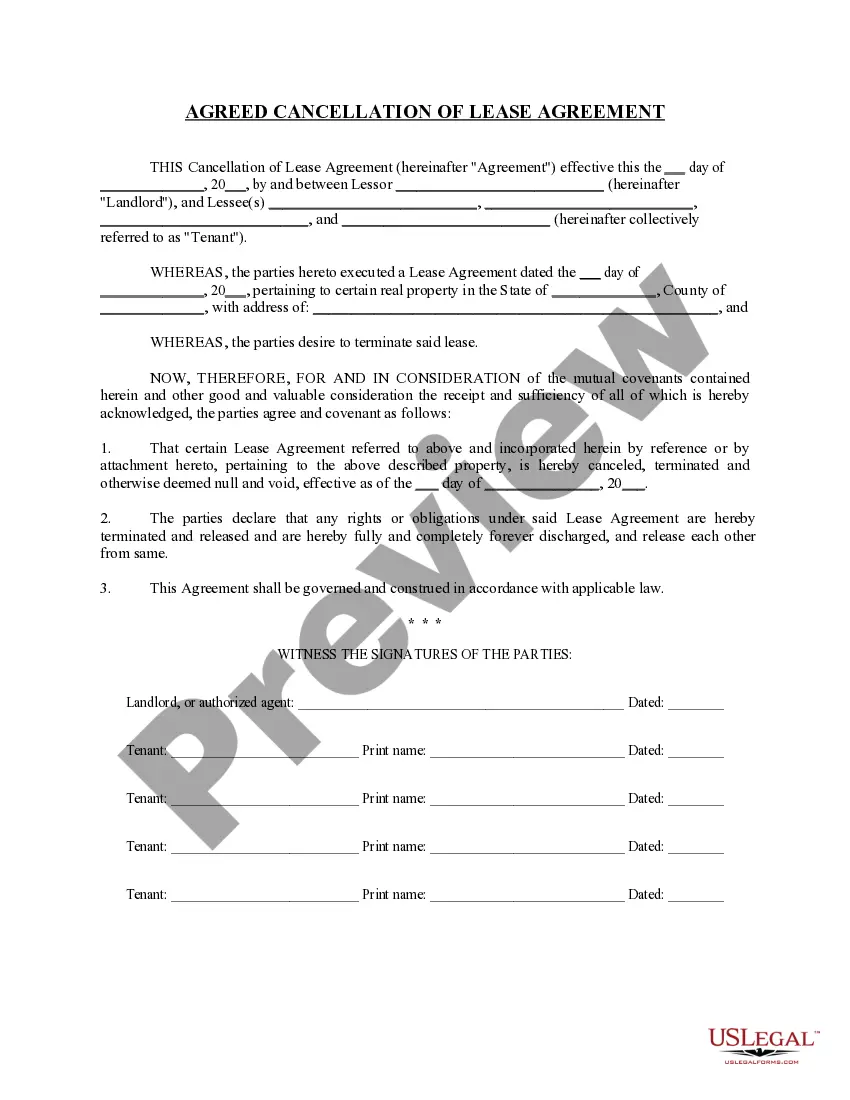

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

US Legal Forms - one of many largest libraries of legitimate kinds in the USA - provides a wide array of legitimate document themes it is possible to obtain or print out. Making use of the site, you can get thousands of kinds for business and specific purposes, categorized by groups, suggests, or key phrases.You will find the most up-to-date models of kinds like the Virgin Islands Sample Letter for Exemption of Ad Valorem Taxes in seconds.

If you already have a subscription, log in and obtain Virgin Islands Sample Letter for Exemption of Ad Valorem Taxes from the US Legal Forms catalogue. The Acquire key will appear on every single type you look at. You get access to all earlier downloaded kinds within the My Forms tab of your respective profile.

If you would like use US Legal Forms for the first time, listed below are easy instructions to help you get started:

- Ensure you have chosen the proper type to your area/state. Go through the Review key to analyze the form`s articles. See the type information to actually have chosen the right type.

- In case the type does not match your specifications, utilize the Research area near the top of the display to obtain the the one that does.

- In case you are pleased with the form, confirm your decision by clicking on the Purchase now key. Then, choose the costs plan you like and give your qualifications to register on an profile.

- Process the transaction. Make use of bank card or PayPal profile to finish the transaction.

- Choose the format and obtain the form in your product.

- Make changes. Fill up, change and print out and signal the downloaded Virgin Islands Sample Letter for Exemption of Ad Valorem Taxes.

Each template you included in your account does not have an expiry date which is your own property for a long time. So, in order to obtain or print out another version, just go to the My Forms segment and click on the type you want.

Gain access to the Virgin Islands Sample Letter for Exemption of Ad Valorem Taxes with US Legal Forms, one of the most comprehensive catalogue of legitimate document themes. Use thousands of skilled and express-particular themes that meet up with your small business or specific requirements and specifications.

Form popularity

FAQ

USVI Tax Incentives & The Economic Development Commission up to 90% reduction in corporate and personal income tax; 100% exemption on other taxes, including business property and gross receipt taxes; U.S. currency, courts, and flag protection; rental space at below market rates in sponsored industrial parks.

US Virgin Islands is not a tax haven or offshore jurisdiction, but USVI companies (or corporations) could be established as "USVI Exempt Companies" with partial or full exemption from local and US federal income taxes.

US Virgin Islands does not use a state withholding form because there is no personal income tax in US Virgin Islands.

The USVI has its own income tax system based on the same laws and tax rates that apply in the United States. An important factor in USVI taxation is whether, during the entire tax year, you are a bona fide resident of the USVI.

US Virgin Islands does not use a state withholding form because there is no personal income tax in US Virgin Islands.

The USVI has its own income tax system based on the same laws and tax rates that apply in the United States. An important factor in USVI taxation is whether, during the entire tax year, you are a bona fide resident of the USVI.

U.S. Virgin Islands The United States Virgin Islands are an unincorporated territory of the United States, meaning that only certain parts of the U.S. Constitution apply to its residents. Individuals born in the U.S. Virgin Islands are considered citizens of the United States.

Do you pay property taxes in USVI? Yes, property taxes are levied in the US Virgin Islands. The exact amount will depend on the assessed value of the property, but it is generally lower than in many US states. Additionally, the USVI offers a homestead exemption for primary residences.