Virgin Islands Sample Letter for Notice to Disregard Letter Indicating Inability to Ship

Description

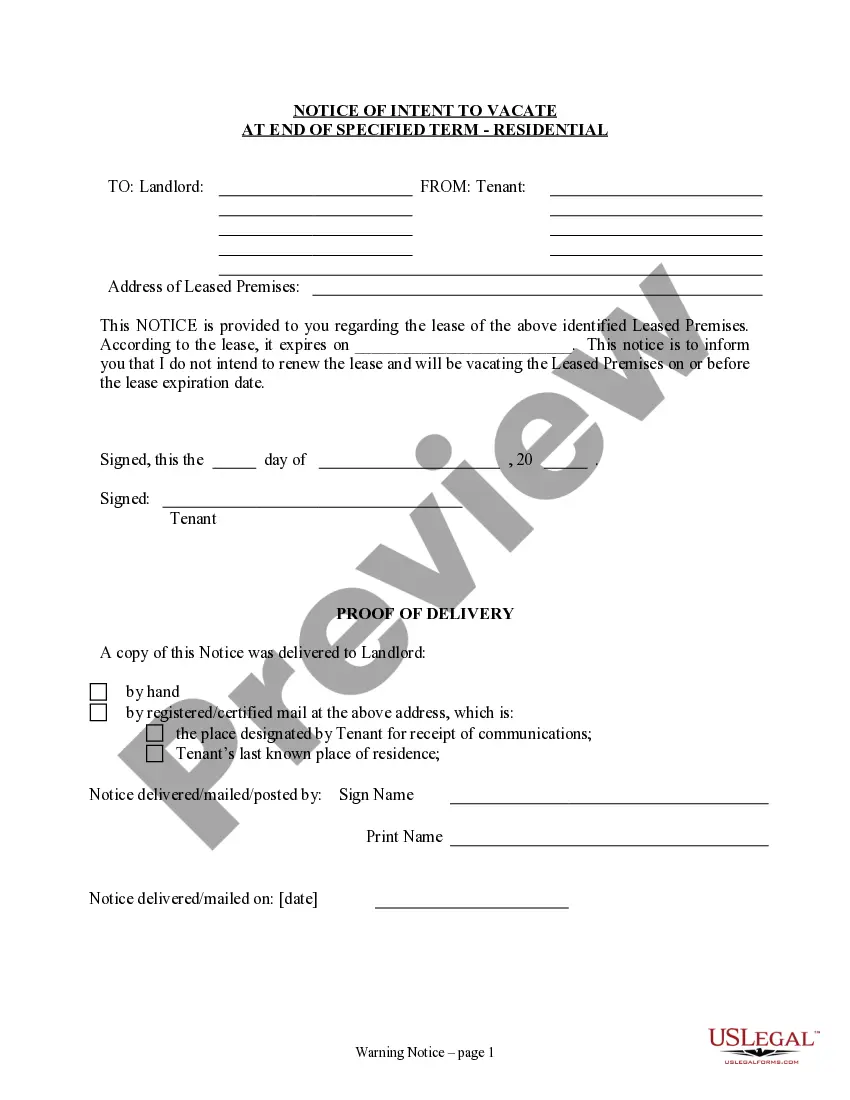

How to fill out Sample Letter For Notice To Disregard Letter Indicating Inability To Ship?

If you aim to finalize, acquire, or generate authentic document templates, make use of US Legal Forms, the biggest assortment of legitimate forms available online.

Utilize the site's straightforward and user-friendly search to obtain the documents you require.

An assortment of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click on the Get now button. Choose your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Employ US Legal Forms to acquire the Virgin Islands Sample Letter for Notice to Disregard Letter Indicating Inability to Ship with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and hit the Get button to obtain the Virgin Islands Sample Letter for Notice to Disregard Letter Indicating Inability to Ship.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Verify that you have selected the form for your correct city/state.

- Step 2. Use the Preview option to review the contents of the form. Remember to examine the summary.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of the legit form template.

Form popularity

FAQ

9 Form InstructionsLine 1 Name.Line 2 Business name.Line 3 Federal tax classification.Line 4 Exemptions.Lines 5 & 6 Address, city, state, and ZIP code.Line 7 Account number(s)Part I Taxpayer Identification Number (TIN)Part II Certification.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

What action does the 90-day letter provide a taxpayer if the taxpayer does NOT agree with an assessment after being audited by the IRS and participating in the appeals conference? The taxpayer should petition the U.S. Tax Court to hear the case.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

Form W-2, also known as the Wage and Tax Statement, is the document an employer is required to send to each employee and the Internal Revenue Service (IRS) at the end of the year. A W-2 reports employees' annual wages and the amount of taxes withheld from their paychecks.

IRS Definition A notice of deficiency, also called a statutory notice of deficiency or 90-day letter, is a legal notice in which the IRS Commissioner determines the taxpayer's tax deficiency.

How to fill out Form W-2Box A: Employee's Social Security number.Box B: Employer Identification Number (EIN)Box C: Employer's name, address, and ZIP code.Box D:Boxes E and F: Employee's name, address, and ZIP code.Box 1: Wages, tips, other compensation.Box 2: Federal income tax withheld.Box 3: Social Security wages.More items...?

What you must doRead the notice carefully.You can submit your response by:If you agree with the changes, sign the enclosed Form 5564 and return it to us.If you don't agree, you have the right to challenge the proposed changes by filing a petition with the U.S. Tax Court no later than the date shown on the notice.More items...?

Request an Audit Reconsideration, Pay the amount of tax due and then file a formal claim for refund by submitting a Form 1040X, Amended U.S. Individual Income Tax Return, or. Pay the balance due and then file a suit for refund in the United States District Court or United States Court of Federal Claims.

Form W-2 shows an employee's gross wages and withheld taxes. It can also include other information such as deferred compensation, dependent care benefits, contributions to a health savings account, and tip income. If you paid an employee during the year, you must complete a Form W-2.