The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

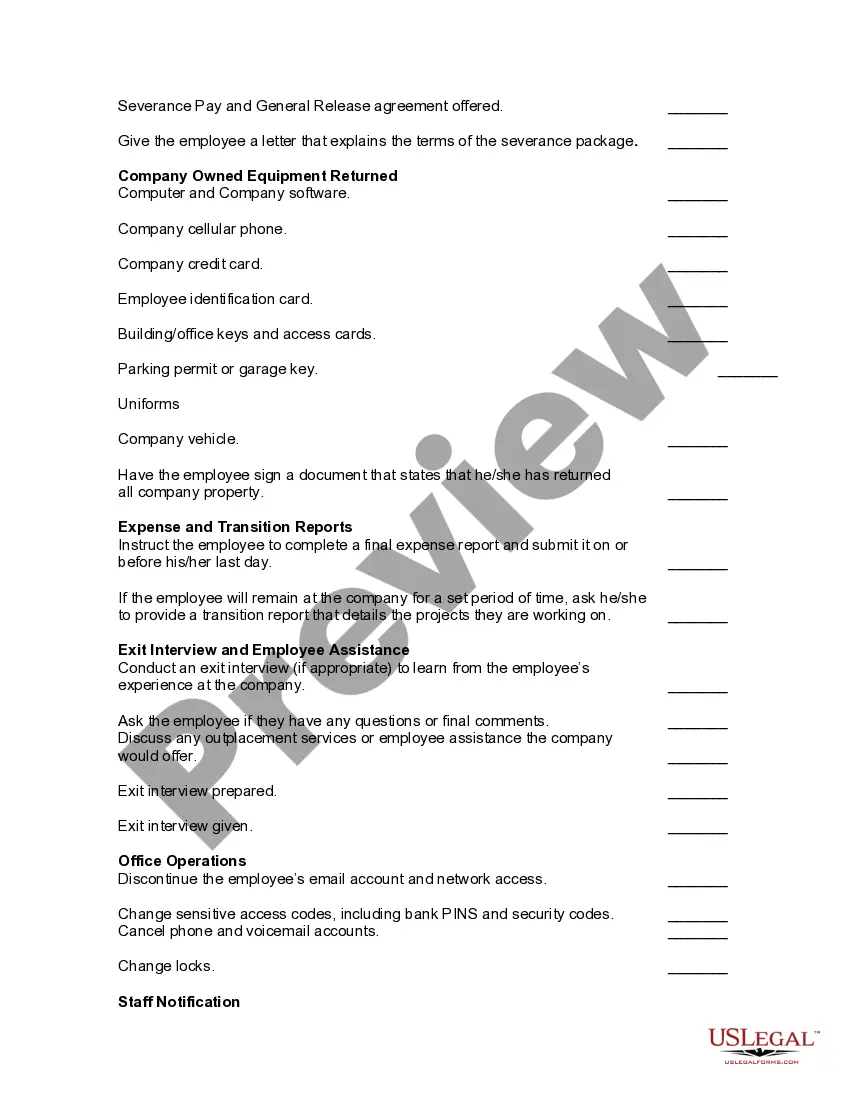

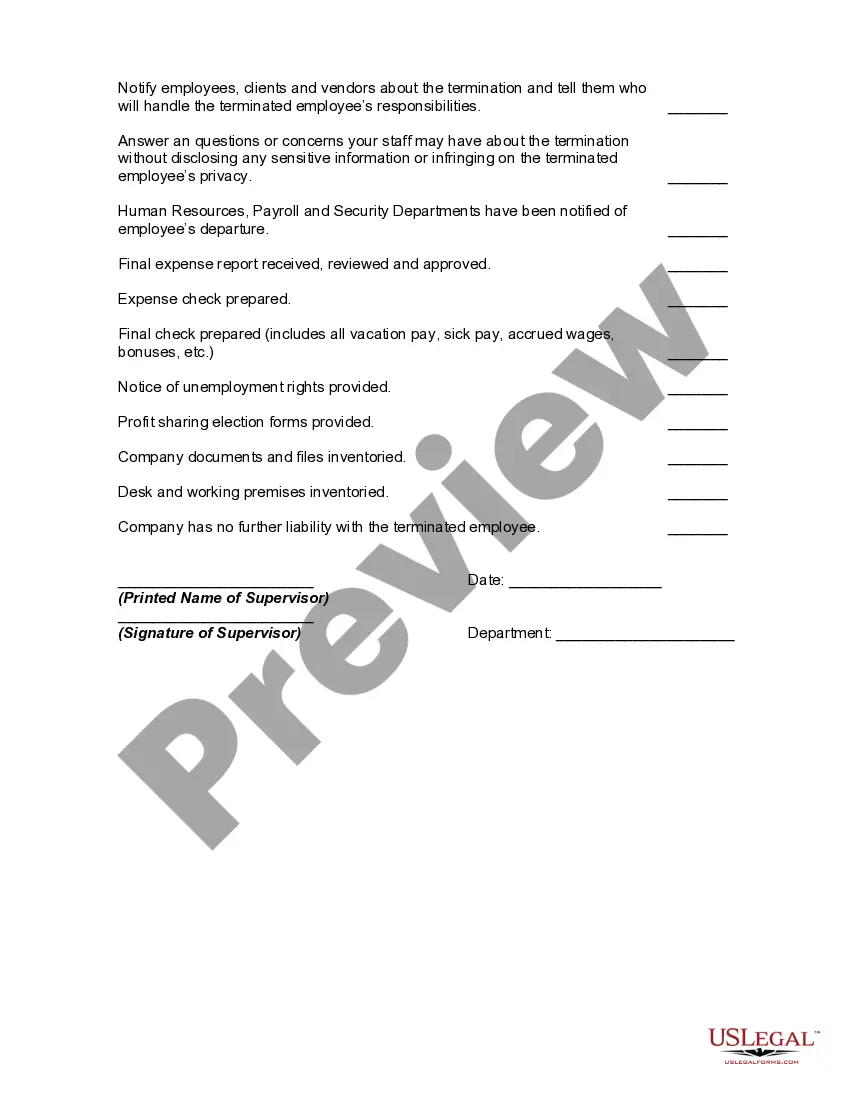

Virgin Islands Worksheet — Termination of Employment is a comprehensive form used in the Virgin Islands to record and process the termination of an employee's employment. This worksheet serves as a legal document that outlines the details and terms related to the termination of employment, ensuring compliance with labor laws and regulations in the Virgin Islands. The Virgin Islands Worksheet — Termination of Employment includes several sections that cover various aspects of the termination process: 1. Employee Information: This section collects relevant details about the terminated employee, such as their full name, employee identification number, position held, and department. 2. Termination Date: It is crucial to accurately record the date on which the termination takes effect. This section requires specifying the exact date to ensure compliance with labor regulations. 3. Cause for Termination: This part requires a description of the reason(s) for the termination. Whether it is due to misconduct, poor performance, layoffs, resignation, or any other legitimate grounds, this section provides space to provide a clear explanation. 4. Termination Benefits and Entitlements: Here, the worksheet outlines the benefits and entitlements that the terminated employee is eligible to receive. It covers matters such as accrued vacation or sick leave, severance pay (if applicable), unused paid time off, and any other compensation or benefits according to labor laws. 5. Return of Company Property: In this section, the worksheet includes a checklist of company-owned items that the employee must return upon termination. It typically includes equipment, access cards, keys, company credit cards, uniforms, or any other property entrusted to the employee during their employment. 6. Post-Termination Obligations and Restrictions: This part can vary based on the nature of the employment and contracts. It outlines any post-termination obligations, such as confidentiality agreements, non-compete clauses, or non-solicitation provisions. Different types of the Virgin Islands Worksheet — Termination of Employment may exist based on the organization's specific needs or industry. For instance: 1. Virgin Islands Worksheet — Termination of Employment for Government Employees: This version would incorporate additional sections and considerations specific to government employees, such as pension plans and civil service regulations. 2. Virgin Islands Worksheet — Termination of Employment for Unionized Workers: This type of worksheet would include sections detailing the process of terminating unionized employees, taking into account collective bargaining agreements, arbitration procedures, and union-specific benefits. 3. Virgin Islands Worksheet — Termination of Employment for Seasonal Workers: Seasonal employment often requires unique considerations, such as temporary layoff options, return-to-work schedules, or rehiring processes for subsequent seasons. Regardless of the specific type, the Virgin Islands Worksheet — Termination of Employment ensures a systematic and legally compliant process when terminating an employee's employment, protecting both the employer and the employee's rights under Virgin Islands labor laws.