Virgin Islands Sample Letter of Credit is a legal document that outlines a commitment to payment issued by a financial institution on behalf of a buyer in the Virgin Islands to a seller located elsewhere. It guarantees that the seller will receive the agreed-upon funds once certain conditions are met. This instrument serves as a widely accepted method of payment in international trade, providing security to both the buyer and the seller. The Virgin Islands Sample Letter of Credit minimizes risks such as non-payment or non-performance by ensuring that specific criteria are fulfilled before releasing the funds. There are various types of the Virgin Islands Sample Letter of Credit, each serving distinct purposes based on the needs of the parties involved. Some commonly used types include: 1. Revocable Letter of Credit: This type of letter of credit can be modified or canceled by the issuing bank without prior notice to the seller. It offers little security to the seller and is seldom used in international trade. 2. Irrevocable Letter of Credit: This is the most prevalent type of letter of credit. It cannot be altered or canceled without mutual agreement between the buyer, seller, and issuing bank. It provides a higher level of security for the seller. 3. Confirmed Letter of Credit: In addition to the issuing bank's guarantee, a confirming bank also adds its confirmation to the letter of credit. This type of letter of credit further ensures payment to the seller, reducing the risk associated with the issuing bank's potential default or political instability in the Virgin Islands. 4. Standby Letter of Credit: A standby letter of credit acts as a secondary or backup payment method. It is typically used when another primary form of payment fails. The standby letter of credit guarantees compensation to the beneficiary if the buyer does not fulfill their contractual obligations. 5. Transferable Letter of Credit: This type allows the beneficiary to transfer the credit in whole or part to another party. It is commonly used when the beneficiary is acting as an intermediary in the trade transaction. Virgin Islands Sample Letter of Credit is an essential tool in international trade, providing security for both buyers and sellers. It enables smooth and secure transactions, minimizing the risks associated with cross-border trade. It is crucial for parties involved in the Virgin Islands trade industry to understand the different types of letters of credit available to choose the appropriate one for their specific trade requirements.

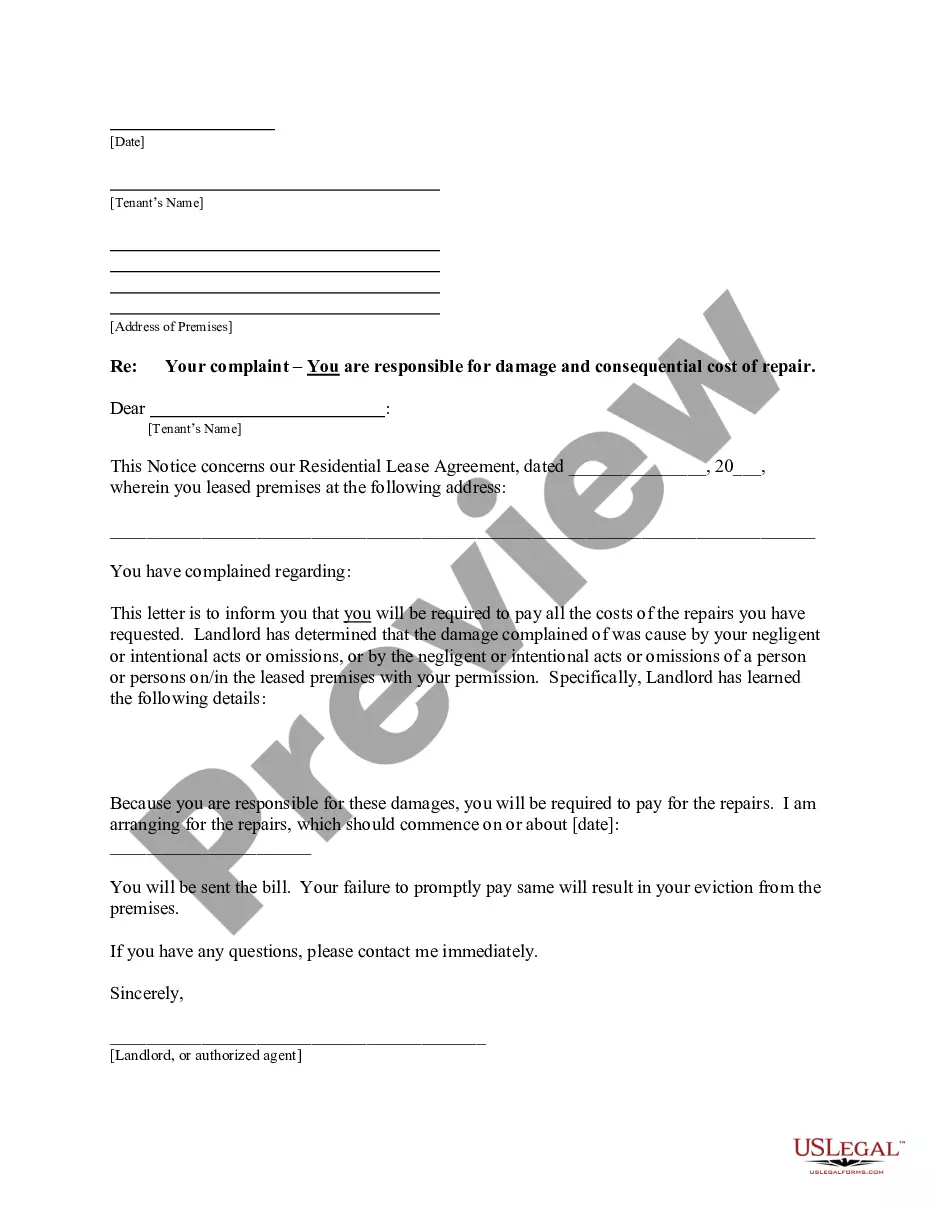

Virgin Islands Sample Letter of Credit

Description

How to fill out Virgin Islands Sample Letter Of Credit?

Choosing the best legitimate record format can be a have difficulties. Needless to say, there are plenty of themes accessible on the Internet, but how would you find the legitimate kind you will need? Take advantage of the US Legal Forms internet site. The support gives thousands of themes, such as the Virgin Islands Sample Letter of Credit, which you can use for business and private needs. All the types are checked by specialists and fulfill state and federal requirements.

If you are presently authorized, log in for your account and click the Down load key to get the Virgin Islands Sample Letter of Credit. Make use of account to look with the legitimate types you possess bought in the past. Visit the My Forms tab of your own account and acquire one more backup from the record you will need.

If you are a fresh user of US Legal Forms, listed below are simple recommendations so that you can adhere to:

- Initial, make certain you have selected the appropriate kind for the area/county. It is possible to look over the shape utilizing the Preview key and study the shape explanation to make sure this is basically the right one for you.

- In the event the kind does not fulfill your needs, take advantage of the Seach industry to find the correct kind.

- Once you are certain the shape is acceptable, select the Buy now key to get the kind.

- Select the costs prepare you need and type in the required info. Make your account and pay for the transaction utilizing your PayPal account or credit card.

- Select the file formatting and obtain the legitimate record format for your device.

- Complete, change and print out and sign the attained Virgin Islands Sample Letter of Credit.

US Legal Forms is definitely the most significant local library of legitimate types that you can see various record themes. Take advantage of the company to obtain professionally-created files that adhere to express requirements.

Form popularity

FAQ

A letter of credit, or a credit letter, is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. If the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Payment history information: Have the letter include information on your payment history, such as whether you made payments on time. Ask your reference to discuss your reliability for making payments. Account numbers: The letter may include numbers of accounts with the institution, which make tracing details easier.

How to write this credit letter: Make your request. State the reasons for your request. State why you are a good credit risk. If possible, give credit references. Ask for an immediate response.

Be brief; credit letters should be straightforward and businesslike. Be confident and persuasive. Be assertive but not overbearing. Assure your reader that any information he or she gives you will remain confidential.