A Virgin Islands Surety Agreement is a legal contract that involves three parties: the principal, the surety, and the obliged. This agreement ensures that the principal (typically a contractor or a party involved in a business transaction) fulfills their obligations and responsibilities towards the obliged (often a project owner or a party with a financial interest in the transaction). The surety, usually an insurance company or a bonding agency, guarantees the performance or payment of the principal's obligations. In the event that the principal fails to meet their commitments, the surety steps in to ensure that the obliged is compensated for any resulting losses. The Virgin Islands Surety Agreement is designed to protect the interests of all parties involved. It provides a legal framework to establish the terms and conditions of the surety's obligation, including the coverage amount, duration, and specific actions required in case of default. There are different types of the Virgin Islands Surety Agreements, each catering to various needs and situations. Some notable types include: 1. Performance Surety Agreement: This type of agreement ensures that the principal completes a construction project or fulfills contractual obligations as per the terms agreed upon. It covers any losses incurred by the obliged due to the principal's failure to perform. 2. Payment Surety Agreement: This agreement guarantees that the principal will make the necessary payments to subcontractors, suppliers, and laborers involved in a project. It protects the obliged from any non-payment issues that may arise during the course of the project. 3. Bid Surety Agreement: Prior to a project commencement, contractors may be required to submit bid bonds as part of the tendering process. This agreement ensures that the principal's bid is genuine and that they will enter into a contract if awarded the project. 4. License and Permit Surety Agreement: This agreement is often required by licensing authorities to guarantee compliance with laws, regulations, and financial obligations while granting professional or business licenses. In conclusion, a Virgin Islands Surety Agreement is a crucial legal document that provides financial security and assurance to involved parties. It safeguards the interests of the obliged and ensures that the principal fulfills their obligations. Various types of surety agreements cater to specific needs such as performance, payment, bid, and license and permit requirements.

Virgin Islands Surety Agreement

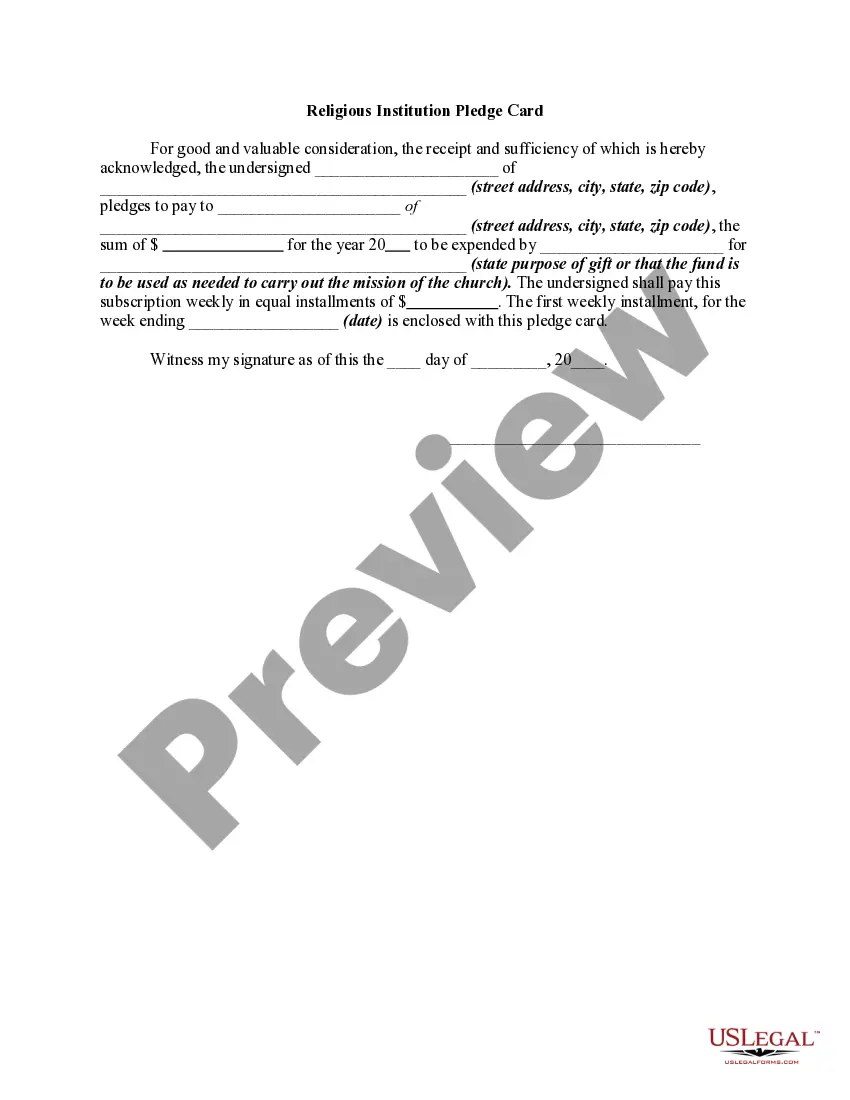

Description

How to fill out Virgin Islands Surety Agreement?

If you want to full, download, or print legitimate record layouts, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found online. Take advantage of the site`s basic and convenient search to discover the documents you want. Various layouts for business and person reasons are categorized by groups and says, or keywords and phrases. Use US Legal Forms to discover the Virgin Islands Surety Agreement within a number of clicks.

When you are currently a US Legal Forms client, log in to the accounts and click the Down load option to obtain the Virgin Islands Surety Agreement. You may also access kinds you in the past saved inside the My Forms tab of your own accounts.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for your right city/nation.

- Step 2. Make use of the Review choice to look over the form`s articles. Never neglect to read the explanation.

- Step 3. When you are not happy using the develop, take advantage of the Research area at the top of the screen to locate other versions of your legitimate develop design.

- Step 4. After you have found the form you want, click the Purchase now option. Pick the prices prepare you prefer and include your credentials to sign up to have an accounts.

- Step 5. Method the financial transaction. You may use your Мisa or Ьastercard or PayPal accounts to finish the financial transaction.

- Step 6. Select the file format of your legitimate develop and download it on your system.

- Step 7. Full, revise and print or sign the Virgin Islands Surety Agreement.

Every legitimate record design you acquire is the one you have eternally. You may have acces to every develop you saved inside your acccount. Go through the My Forms area and pick a develop to print or download yet again.

Contend and download, and print the Virgin Islands Surety Agreement with US Legal Forms. There are millions of specialist and status-certain kinds you can utilize for the business or person needs.