A Virgin Islands Commission Buyout Agreement Insurance Agent is an insurance professional who specializes in facilitating commission buyout agreements in the Virgin Islands. These agreements are typically structured to allow insurance agents or brokers to sell their future commission income to a third-party company, thereby receiving a lump sum payment upfront instead of waiting for the commission payments to be received over time. The Virgin Islands Commission Buyout Agreement Insurance Agent acts as an intermediary between insurance agents and potential buyers of their commissions. They provide expertise in assessing the value of commissions, negotiating purchase terms, and ensuring a smooth transaction process. Some key responsibilities of a Virgin Islands Commission Buyout Agreement Insurance Agent include: 1. Valuation: Conducting a thorough analysis of the commission income stream to determine its present value and potential growth trajectory. 2. Marketing: Promoting commission buyout opportunities to insurance agents within the Virgin Islands, highlighting the benefits of immediate cashflow and financial flexibility. 3. Due Diligence: Assessing the creditworthiness and reputation of potential commission buyers to ensure a trustworthy transaction. 4. Negotiation: Negotiating favorable terms and conditions for commission buyout agreements, protecting the interests of both the selling agent and the buyer. 5. Contracts and Documentation: Preparing legally binding agreements and all necessary documentation to formalize the commission buyout transaction. 6. Compliance: Ensuring compliance with all relevant regulations and laws governing commission buyouts within the Virgin Islands. Different types of Virgin Islands Commission Buyout Agreement Insurance Agents may specialize in specific insurance fields, such as life insurance, health insurance, property insurance, or casualty insurance. Additionally, some Commission Buyout Agreement Insurance Agents may focus on particular segments within the insurance industry, such as individual policies, corporate policies, or government contracts. Keywords: Virgin Islands, Commission Buyout Agreement, Insurance Agent, Commission Income, Lump Sum Payment, Upfront, Third-Party, Valuation, Marketing, Due Diligence, Negotiation, Contracts, Documentation, Compliance, Life Insurance, Health Insurance, Property Insurance, Casualty Insurance, Individual Policies, Corporate Policies, Government Contracts

Virgin Islands Commission Buyout Agreement Insurance Agent

Description

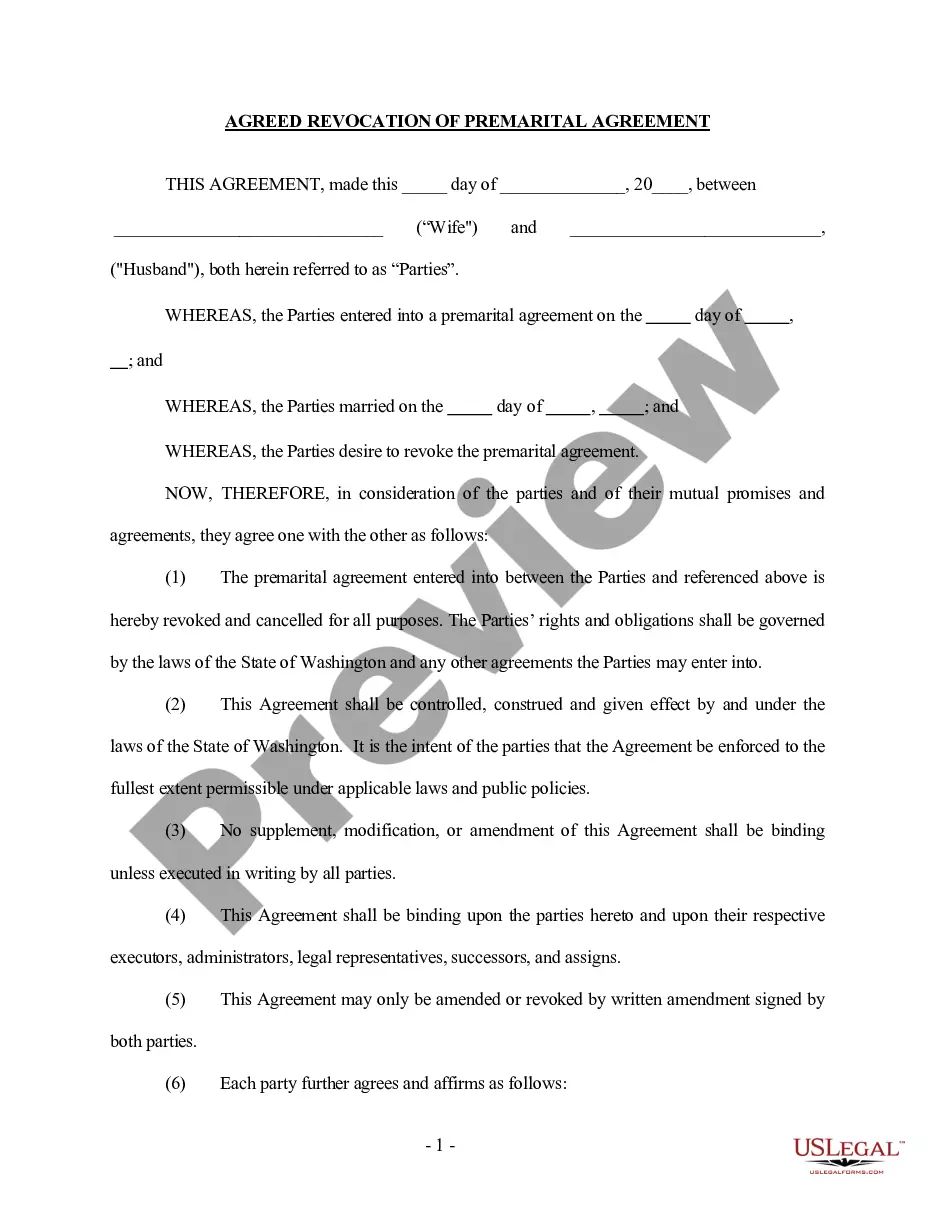

How to fill out Virgin Islands Commission Buyout Agreement Insurance Agent?

It is possible to commit hours on the web trying to find the legitimate file format that fits the federal and state specifications you need. US Legal Forms offers thousands of legitimate varieties which can be reviewed by experts. It is possible to obtain or produce the Virgin Islands Commission Buyout Agreement Insurance Agent from our services.

If you already possess a US Legal Forms account, you may log in and click on the Download key. Afterward, you may comprehensive, edit, produce, or indicator the Virgin Islands Commission Buyout Agreement Insurance Agent. Each legitimate file format you buy is yours forever. To acquire one more version of the purchased kind, proceed to the My Forms tab and click on the related key.

Should you use the US Legal Forms site for the first time, adhere to the easy directions below:

- Initial, be sure that you have chosen the proper file format to the region/area of your choosing. See the kind outline to make sure you have selected the proper kind. If offered, take advantage of the Review key to look with the file format at the same time.

- In order to get one more variation from the kind, take advantage of the Research discipline to get the format that fits your needs and specifications.

- Once you have identified the format you want, click Buy now to continue.

- Select the pricing program you want, enter your accreditations, and register for your account on US Legal Forms.

- Full the deal. You may use your bank card or PayPal account to cover the legitimate kind.

- Select the file format from the file and obtain it for your product.

- Make alterations for your file if needed. It is possible to comprehensive, edit and indicator and produce Virgin Islands Commission Buyout Agreement Insurance Agent.

Download and produce thousands of file templates utilizing the US Legal Forms website, which offers the largest assortment of legitimate varieties. Use professional and express-specific templates to take on your business or individual demands.

Form popularity

FAQ

The islands remained under Danish rule until 1917, when the United States purchased them for $25 million in gold in an effort to improve military positioning during critical times of World War I. St. Croix, St.

History & Political Status The Danish part had been in economic decline for quite some time, owing to losses in sugarcane production after slavery was abolished in 1848. In 1917, the United States purchased the Danish part for $25 million, mainly for strategic reasons to assure tranquility in the Caribbean Ocean.

To qualify as a bona fide resident of the U.S Virgin Islands, a person must meet the physical presence test. They cannot have a tax home outside of the Virgin Islands or have a closer connection to the mainland U.S. or another country than they do with the U.S. Virgin Islands.

The US purchased the islands in 1917, when they were known as the Danish West Indies, hoping that they'd be an ideal strategic location for a naval base and would help secure the region surrounding the Panama Canal.

This territory of the United States was a territory of Denmark from the 1600s until 1917. The U.S. Virgin Islands, St. Croix, St.

The US Congress has granted USVI the authority to allow a lowered tax rate to bona fide residents of the USVI. Any income related to a USVI business is also taxed at a lower rate. Bona fide USVI residents pay taxes to the Virgin Islands Bureau of Internal Revenue (BIR) instead of the IRS.