Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years refer to the legal provisions governing the establishment and operation of this specific type of trust in the U.S. Virgin Islands. These provisions are designed to promote charitable giving and provide individuals with the opportunity to support charitable organizations while receiving income for a specified term of years. A Charitable Remainder Annuity Trust (CAT) is a planned giving instrument that allows a donor to transfer assets to a trust, receive a fixed-income stream for a predetermined term, and designate a charitable organization as the ultimate beneficiary. In the U.S. Virgin Islands, testamentary provisions for Cats for the term of years must adhere to certain legal requirements. Key provisions that may be found within the Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trusts include: 1. Testator's Intent: These provisions establish the donor's intent to create a charitable trust as part of their estate plan. The testamentary document should clearly indicate the creation of a CAT. 2. Trustee Appointment: The provisions should identify the trustee who will be responsible for managing the trust's assets and making distributions to the donor during the term of years. 3. Charitable Organization Selection: The testator should specify the charitable organization(s) that will ultimately receive the remaining assets of the trust after the donor's income interest ends. 4. Annuity Payment Amount: These provisions define the fixed annual annuity payment that the donor will receive during the term of years. The amount must be at least 5% of the initial fair market value of the assets transferred to the trust. 5. Term of Years Determination: The provisions should define the specific duration or term for which the donor will receive income payments. It can be a fixed number of years or based on the donor's life expectancy. Additionally, there may be different types of the Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trusts for the term of years, such as: 1. Simple CAT for Term of Years: This type of trust provides a fixed annuity payment to the donor for a predetermined term, with the remaining assets passing to the charitable organization(s) at the end of the term. 2. Flip CAT for Term of Years: In this type of trust, the annuity payment to the donor is initially set at a low amount, but if certain conditions are met (e.g., assets appreciate), the annuity can "flip" to a higher fixed amount, ensuring increased income for the donor during the term. In conclusion, Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trusts for the term of years establishes the legal framework for individuals to create trusts that provide fixed income payments for a specified term while supporting charitable causes. These provisions ensure the donor's intent is clearly outlined and that the trust operates in compliance with applicable laws and regulations.

Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years

Description

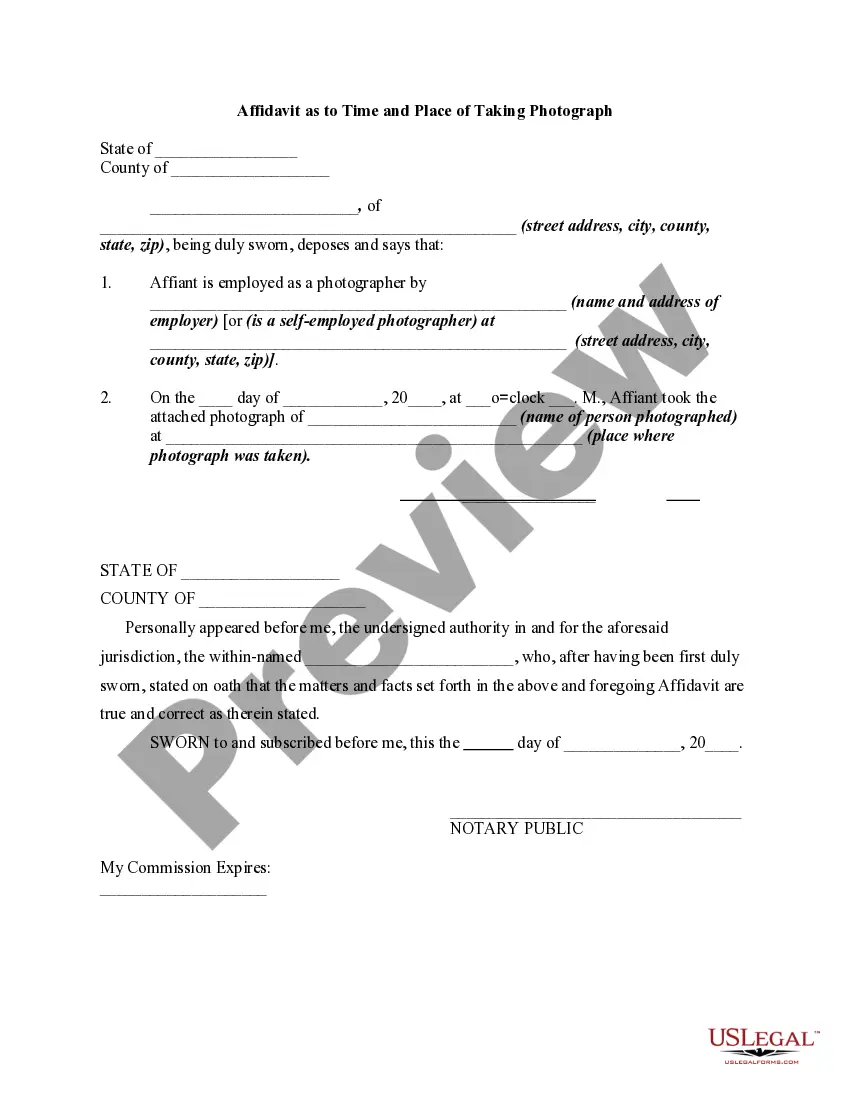

How to fill out Virgin Islands Testamentary Provisions For Charitable Remainder Annuity Trust For Term Of Years?

You are able to commit hours online trying to find the legal record web template that fits the state and federal demands you will need. US Legal Forms offers thousands of legal varieties which are analyzed by pros. It is possible to download or printing the Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years from your assistance.

If you have a US Legal Forms profile, it is possible to log in and click on the Down load button. Afterward, it is possible to comprehensive, revise, printing, or signal the Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years. Every single legal record web template you buy is your own forever. To get another copy of the acquired develop, check out the My Forms tab and click on the related button.

If you are using the US Legal Forms website the first time, stick to the basic recommendations under:

- Initially, be sure that you have chosen the best record web template for that county/area of your choosing. See the develop information to make sure you have selected the proper develop. If offered, make use of the Preview button to appear throughout the record web template at the same time.

- If you want to find another edition in the develop, make use of the Research discipline to obtain the web template that meets your needs and demands.

- After you have discovered the web template you would like, just click Acquire now to move forward.

- Pick the rates plan you would like, type your accreditations, and register for an account on US Legal Forms.

- Comprehensive the financial transaction. You may use your Visa or Mastercard or PayPal profile to cover the legal develop.

- Pick the file format in the record and download it to your gadget.

- Make modifications to your record if possible. You are able to comprehensive, revise and signal and printing Virgin Islands Testamentary Provisions for Charitable Remainder Annuity Trust for Term of Years.

Down load and printing thousands of record layouts utilizing the US Legal Forms site, which provides the greatest assortment of legal varieties. Use skilled and express-particular layouts to handle your business or personal requires.