Title: Virgin Islands Joint Trust with Income Payable to Trustees During Joint Lives: Explained Introduction: In estate planning, the Virgin Islands Joint Trust with Income Payable to Trustees During Joint Lives is a unique legal instrument designed to provide financial security for individuals while they are alive. This comprehensive trust arrangement allows multiple trustees to establish a flexible and effective structure to manage their assets during their joint lifetimes. In this article, we will delve into the intricacies and benefits of the Virgin Islands Joint Trust, exploring its provisions, advantages, and potential types. Key Points: 1. Understanding the Virgin Islands Joint Trust: The Virgin Islands Joint Trust is a versatile legal vehicle rooted in the islands' trust laws, providing trustees with the option to pool their assets together for joint management and income distribution during their lifetimes. This trust safeguards their financial well-being, offering the trustees control, flexibility, and the potential for steady income. 2. Provisions and Features: a) Joint Trustees: The Virgin Islands Joint Trust allows multiple individuals (spouses, partners, family members, etc.) to establish a trust where their assets are collectively placed. b) Income Payable to Trustees: With this type of trust, the trustees receive income generated from the trust assets during their joint lifetimes, ensuring financial stability. c) Control and Flexibility: The trust agreement can outline the distribution of income, as well as rules for making decisions regarding trust assets, investment strategies, and possible modifications. d) Estate Planning Benefits: By setting up a Virgin Islands Joint Trust, trustees can enhance tax efficiency, protect assets from creditors, and efficiently transfer wealth to beneficiaries upon trust or(s) passing away. 3. Naming Variations: While the core concept remains the same, Virgin Islands Joint Trust with Income Payable to Trustees During Joint Lives can be referred to by various names, incorporating specific aspects or purposes. Some possible variations may include: a) Joint Income Trust Agreement b) Virgin Islands Living Joint Trust c) Joint Income Payable Trust d) Virgin Islands Joint Life Trust Conclusion: The Virgin Islands Joint Trust with Income Payable to Trustees During Joint Lives serves as a powerful financial tool in estate planning, offering trustees the benefits of joint asset management and steady income during their lifetimes. This type of trust structure provides control, flexibility, and potential tax advantages, making it an attractive option for individuals seeking to secure their financial future alongside trusted family members or partners. Efficiently structured, the Virgin Islands Joint Trust can significantly contribute to an individual's overall wealth management and estate planning strategy.

Virgin Islands Joint Trust with Income Payable to Trustors During Joint Lives

Description

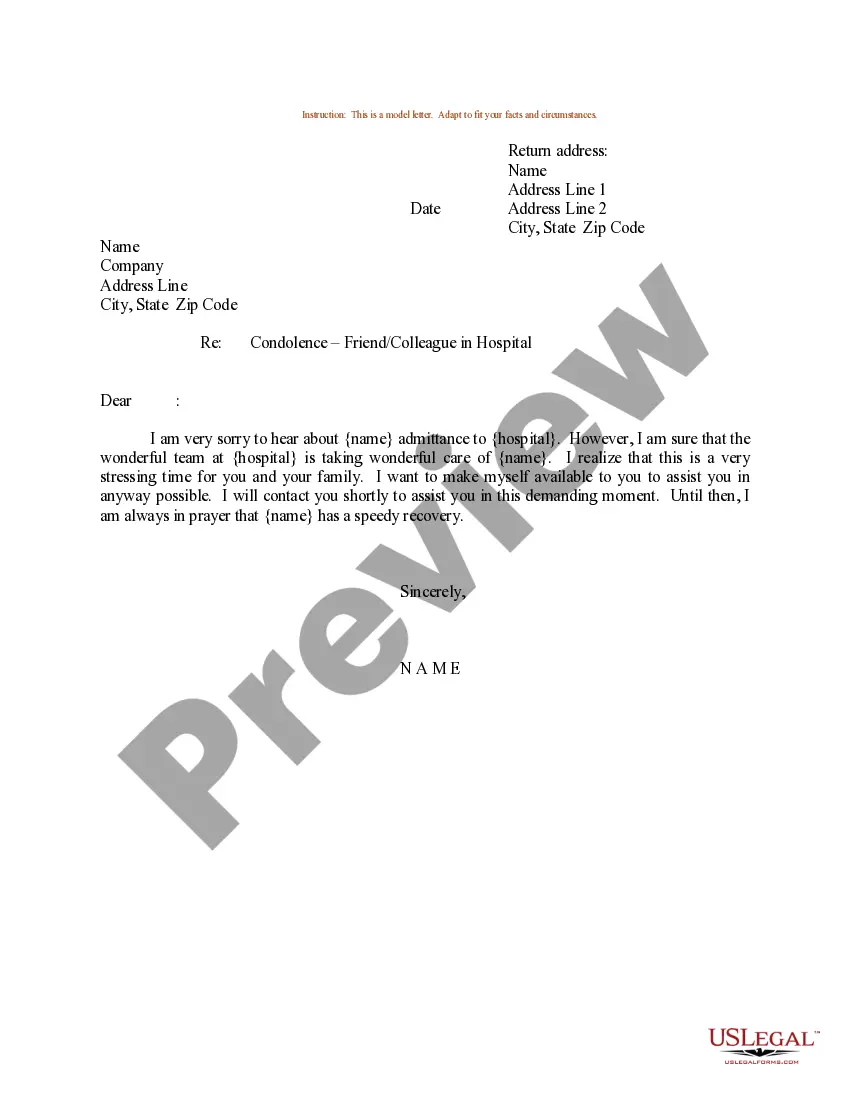

How to fill out Virgin Islands Joint Trust With Income Payable To Trustors During Joint Lives?

Choosing the best lawful record format can be quite a have difficulties. Naturally, there are plenty of web templates available on the Internet, but how do you find the lawful type you will need? Make use of the US Legal Forms site. The support offers a huge number of web templates, for example the Virgin Islands Joint Trust with Income Payable to Trustors During Joint Lives, that you can use for organization and personal requires. All of the types are checked out by professionals and meet federal and state demands.

When you are presently registered, log in in your account and click the Down load switch to obtain the Virgin Islands Joint Trust with Income Payable to Trustors During Joint Lives. Make use of your account to look throughout the lawful types you have acquired earlier. Visit the My Forms tab of your account and get one more version in the record you will need.

When you are a new user of US Legal Forms, here are simple directions that you can comply with:

- Initial, ensure you have chosen the proper type for the town/state. You are able to look over the form while using Preview switch and read the form explanation to make certain it will be the right one for you.

- In case the type fails to meet your needs, use the Seach field to obtain the correct type.

- Once you are positive that the form is suitable, click the Acquire now switch to obtain the type.

- Select the pricing program you desire and type in the needed information. Make your account and buy an order utilizing your PayPal account or credit card.

- Pick the submit file format and acquire the lawful record format in your device.

- Comprehensive, change and printing and indicator the received Virgin Islands Joint Trust with Income Payable to Trustors During Joint Lives.

US Legal Forms will be the most significant catalogue of lawful types for which you can see numerous record web templates. Make use of the service to acquire expertly-created papers that comply with condition demands.