Virgin Islands Sample Letter for Request of State Attorney's opinion concerning Taxes

Description

How to fill out Sample Letter For Request Of State Attorney's Opinion Concerning Taxes?

Have you been in a situation in which you need documents for possibly business or individual functions almost every time? There are plenty of legal record layouts accessible on the Internet, but finding versions you can rely on isn`t simple. US Legal Forms offers a large number of kind layouts, such as the Virgin Islands Sample Letter for Request of State Attorney's opinion concerning Taxes, which can be published to fulfill state and federal requirements.

In case you are already acquainted with US Legal Forms website and have a free account, basically log in. Next, you can acquire the Virgin Islands Sample Letter for Request of State Attorney's opinion concerning Taxes template.

Unless you have an account and want to begin using US Legal Forms, abide by these steps:

- Discover the kind you will need and make sure it is for that appropriate city/region.

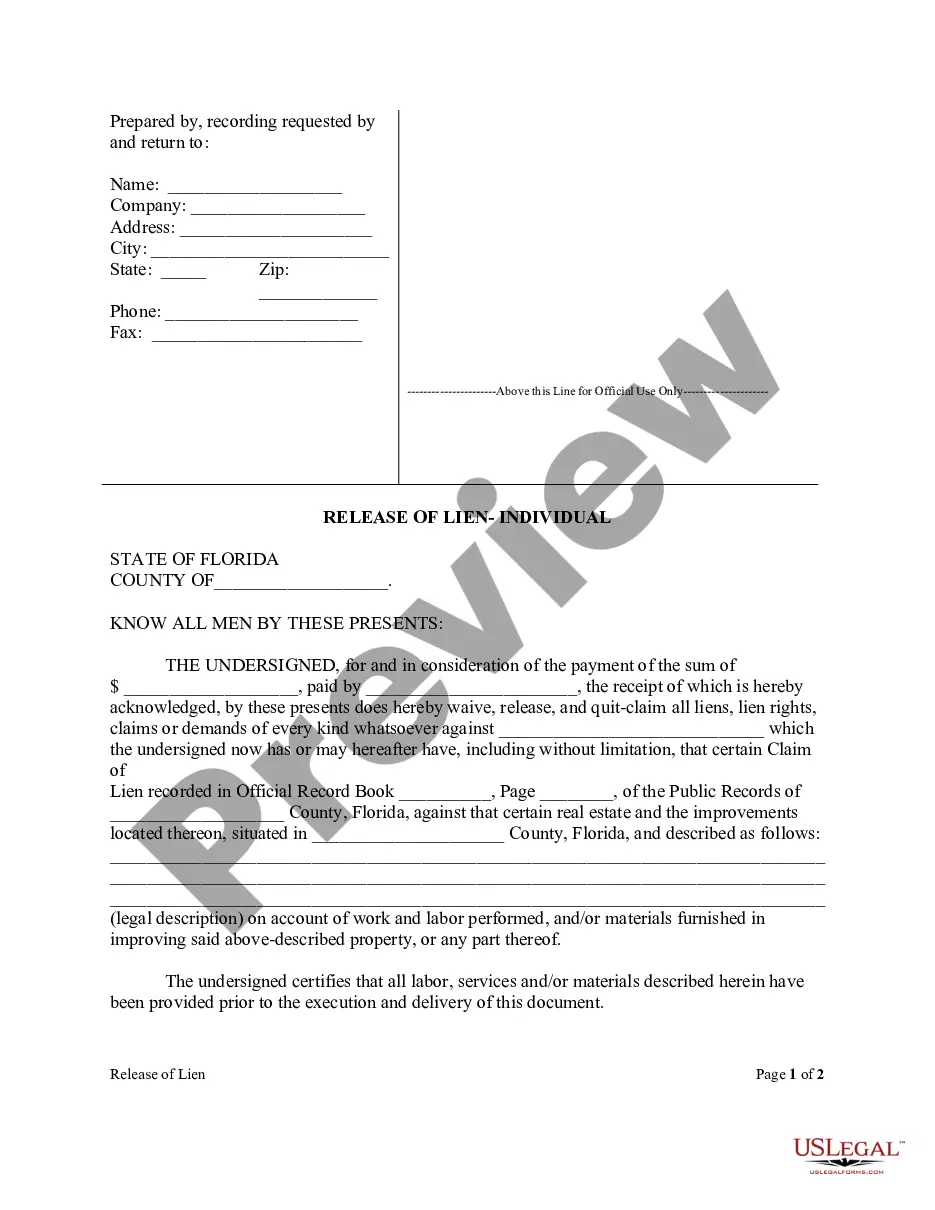

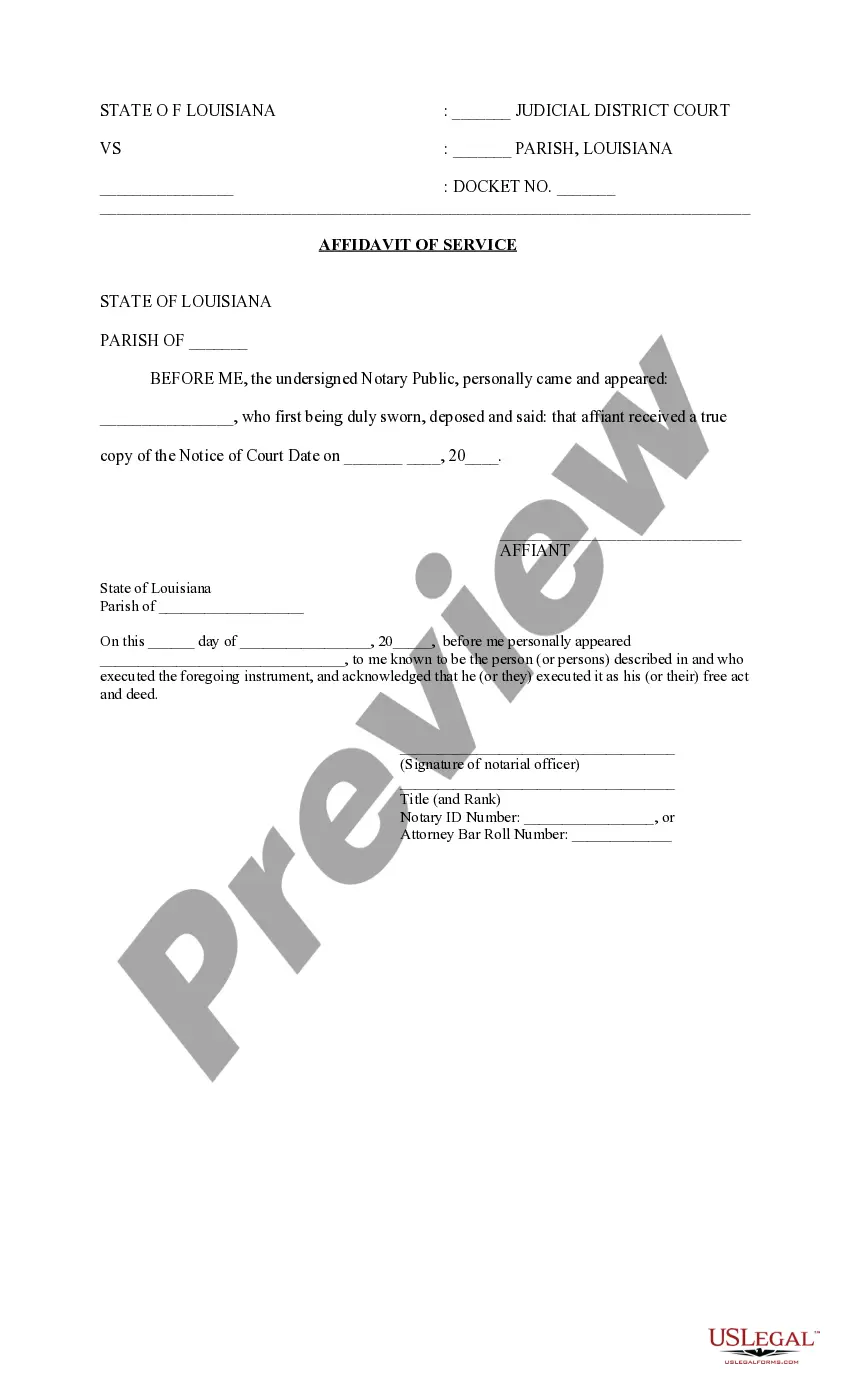

- Use the Review option to analyze the form.

- Read the outline to ensure that you have chosen the proper kind.

- In the event the kind isn`t what you`re searching for, take advantage of the Search discipline to discover the kind that meets your needs and requirements.

- Once you get the appropriate kind, simply click Acquire now.

- Select the rates plan you want, complete the desired information and facts to produce your money, and buy an order using your PayPal or charge card.

- Select a handy document structure and acquire your copy.

Discover all of the record layouts you might have purchased in the My Forms menus. You may get a further copy of Virgin Islands Sample Letter for Request of State Attorney's opinion concerning Taxes any time, if required. Just click on the essential kind to acquire or produce the record template.

Use US Legal Forms, one of the most considerable variety of legal forms, to save time as well as steer clear of faults. The assistance offers appropriately produced legal record layouts that you can use for an array of functions. Produce a free account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

The proper form of addressing a person holding the office is addressed Mister or Madam Attorney General, or just as Attorney General. The plural is "Attorneys General" or "Attorneys-General".

Sincerely,[Name of Tax Authority Representative] Subject: Notice of Income Tax Obligations Dear [Recipient's Name], I am writing to inform you of your income tax obligations for the tax year [year]. ing to our records, your taxable income for the year was [amount].

You are certainly within your rights to write directly to the prosecutor, but no good is likely to come of it. Either your letter will be ignored, or it will be used against you. In many cases, the prosecutor doesn't even care if you're innocent.

Address the letter appropriately. The salutation of the letter should be: Dear Attorney General (last name). For the Attorney General of a State address the envelop: The Honorable/(Full name)/Attorney General of (Name of State)/(Address). The salutation of the letter should read: Dear Attorney General (last name).

Information To Include in Your Letter Give the basics. Tell your story. Tell the company how you want to resolve the problem. Be reasonable. File your complaint. Your Address. Your City, State, Zip Code. [Your email address, if sending by email] Date.

Like other members of a governor's cabinet, all state attorneys general are addressed in writing as 'the Honorable (Full Name)'. 80% are elected in a general election. 20% are appointed by their governor.