Virgin Islands Private Client General Asset Management Agreement

Description

How to fill out Private Client General Asset Management Agreement?

Are you currently in a circumstance where you require documents for both professional and personal purposes nearly all the time.

There are numerous legal document templates available online, but finding reliable versions isn’t easy.

US Legal Forms offers a vast array of form templates, such as the Virgin Islands Private Client General Asset Management Agreement, designed to comply with federal and state regulations.

If you locate the right form, click on Buy now.

Choose the pricing plan you want, input the required information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient file format and download your copy. Access all the form templates you have purchased in the My documents section. You can obtain another copy of the Virgin Islands Private Client General Asset Management Agreement whenever necessary—just select the appropriate form to download or print the template. Utilize US Legal Forms, the largest selection of legal forms, to save time and reduce mistakes. The service provides professionally crafted legal document templates suitable for various purposes. Set up your account on US Legal Forms and start making your life a bit easier.

- If you are now familiar with the US Legal Forms website and have an account, just sign in.

- Then, you can download the Virgin Islands Private Client General Asset Management Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

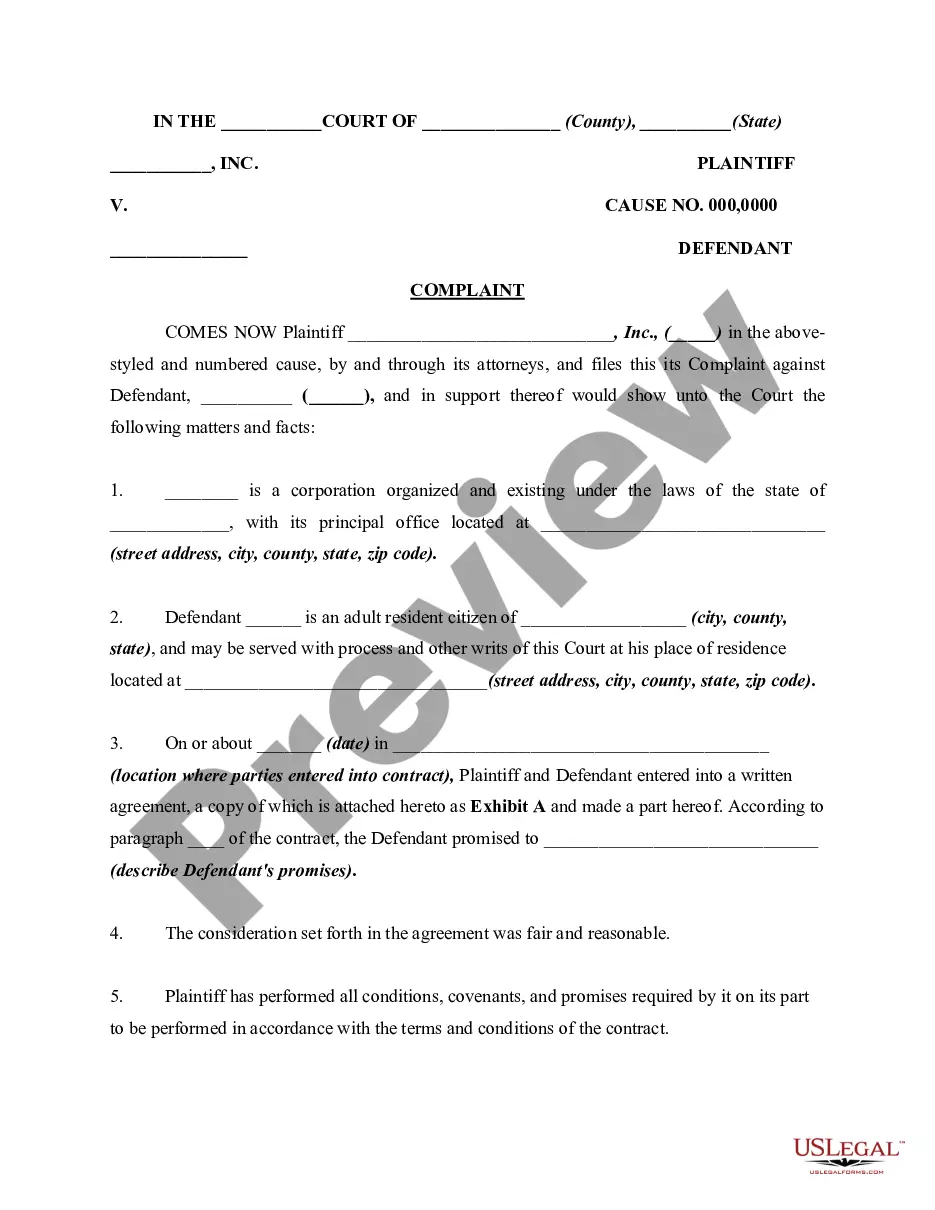

- Use the Preview button to review the form.

- Check the description to make sure you have selected the right form.

- If the form isn’t what you are looking for, utilize the Search area to find the form that meets your needs.

Form popularity

FAQ

A BVI fund is an investment vehicle established under the laws of the British Virgin Islands. It is designed to pool capital from various investors and invest in diversified asset classes, ensuring effective asset management. A Virgin Islands Private Client General Asset Management Agreement can help you define your investment strategy and objectives, making it easier to achieve your financial goals.

A BVI fund typically offers a lighter regulatory burden compared to a Cayman fund, making it an appealing option for certain investors. Both funds serve similar purposes, focusing on asset management and investment growth. However, the specifics of a Virgin Islands Private Client General Asset Management Agreement can provide tailored benefits that might not be available in a similar agreement with a Cayman fund.

The British Virgin Islands serve as a key financial center, attracting businesses and investors with their favorable regulatory environment. This jurisdiction provides a secure framework for asset management and investment opportunities. By entering into a Virgin Islands Private Client General Asset Management Agreement, clients can leverage BVI’s unique advantages to enhance their wealth and investment strategies.

The approved manager regime in the British Virgin Islands (BVI) allows fund managers to operate under a simplified regulatory framework. This framework facilitates the management of investment funds while ensuring compliance with local laws. If you are considering a Virgin Islands Private Client General Asset Management Agreement, this regime enables a streamlined process for managing client assets effectively.

The British Virgin Islands (BVI) follows a legal framework that is based largely on common law principles, which means that contract law is generally straightforward. Contracts are enforceable if they meet certain criteria, such as having clear terms and mutual consent. In the context of a Virgin Islands Private Client General Asset Management Agreement, understanding local contract law is essential for ensuring compliance and protecting your rights. Consulting with legal professionals can further enhance your contract's robustness and enforceability.

An asset management agreement is a formal contract that defines the relationship between a client and a manager regarding investment or property assets. This agreement indicates how the assets will be managed, including investment strategies and risk management. With a Virgin Islands Private Client General Asset Management Agreement, you receive tailored strategies that align with your financial goals. It acts as a vital tool for ensuring that your assets are optimized for growth while minimizing risks.

Yes, BVI funds are regulated by the BVI Financial Services Commission, which ensures compliance with relevant laws and best practices. This regulation provides a layer of protection for investors, enhancing transparency and accountability. When you engage in a Virgin Islands Private Client General Asset Management Agreement, you can rest assured that your investment is managed within a well-regulated framework. This oversight helps promote trust and security in your investment decisions.

A BVI fund refers to an investment vehicle established in the British Virgin Islands, offering a flexible structure for pooling investor capital. These funds can cater to various investment strategies, ranging from hedge funds to private equity. By utilizing a Virgin Islands Private Client General Asset Management Agreement, investors can take advantage of the unique regulatory environment in the BVI, enhancing returns while managing risks effectively. This makes BVI funds an attractive option for diversified investment portfolios.

An approved manager in the British Virgin Islands (BVI) is a licensed individual or entity responsible for managing investments on behalf of clients. They comply with the regulatory requirements set forth by the BVI Financial Services Commission. When considering a Virgin Islands Private Client General Asset Management Agreement, selecting an approved manager ensures that your assets are handled by a qualified professional. This helps you navigate the complexities of asset management while focusing on your financial goals.