Virgin Islands Rule 144 Sellers Representation Letter Non-Affiliate is a legal document used in the Virgin Islands region to fulfill the requirements of Rule 144 under the Securities Act of 1933. It is specifically designed for non-affiliate sellers who wish to sell restricted securities to the public. This letter helps ensure compliance and transparency during the sale process. The primary purpose of the Virgin Islands Rule 144 Sellers Representation Letter Non-Affiliate is to provide a written representation from the non-affiliate seller to the buyer, confirming their eligibility to sell restricted securities under Rule 144. This letter serves as evidence that the seller meets the necessary criteria and intends to act in compliance with the rule's provisions. By using this representation letter, the non-affiliate seller attests that they are not an affiliate of the issuer, has held the securities for the required holding period, and is not engaging in any illegal stock manipulation or fraudulent activities. This document also highlights any material information regarding the securities being sold. It is essential to understand that there might be variations in the Virgin Islands Rule 144 Sellers Representation Letter Non-Affiliate, depending on specific circumstances. Some possible types or variations may include: 1. Individual Seller's Representation Letter: This type of letter is used when an individual non-affiliate seller intends to sell restricted securities under Rule 144. It includes personal details, such as name, address, contact information, and other relevant information to establish the seller's eligibility. 2. Corporate Seller's Representation Letter: When a non-affiliate seller is a corporation or any other business entity, they would use this type of representation letter. It includes the corporation's name, registered address, contact information, and any necessary supporting documents. 3. Partnership Seller's Representation Letter: If the non-affiliate seller is a partnership, a specific representation letter for partnerships is utilized. It discloses partnership details, such as name, registered address, partners' information, and any relevant supporting documentation. 4. Trust Seller's Representation Letter: In cases where the non-affiliate seller is a trust, a trust-specific representation letter is employed. This letter includes the trust's name, details of the trustee(s), beneficiaries, and any required supporting documents. In conclusion, the Virgin Islands Rule 144 Sellers Representation Letter Non-Affiliate is a crucial legal document that ensures compliance with Rule 144 regulations. Its purpose is to establish the eligibility of non-affiliate sellers to sell restricted securities and maintain transparency during the sale process. Different types of this letter may exist depending on the seller's status, such as individual, corporate, partnership, or trust.

Virgin Islands Rule 144 Seller's Representation Letter Non-Affiliate

Description

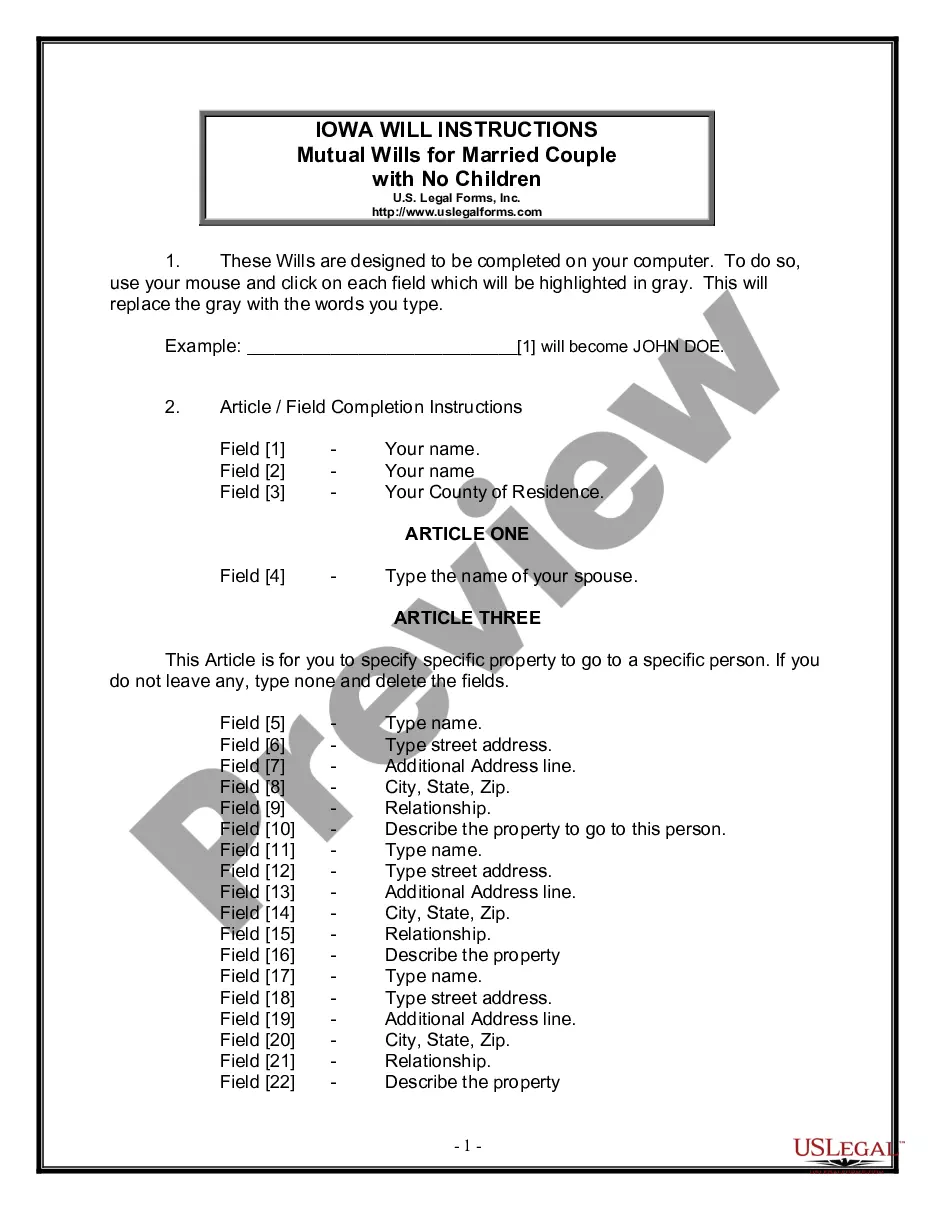

How to fill out Virgin Islands Rule 144 Seller's Representation Letter Non-Affiliate?

If you have to complete, download, or print legal file web templates, use US Legal Forms, the largest assortment of legal kinds, that can be found on the Internet. Take advantage of the site`s simple and convenient lookup to discover the files you require. Various web templates for business and individual reasons are categorized by categories and suggests, or keywords and phrases. Use US Legal Forms to discover the Virgin Islands Rule 144 Seller's Representation Letter Non-Affiliate within a couple of clicks.

If you are currently a US Legal Forms customer, log in to the accounts and click the Download key to obtain the Virgin Islands Rule 144 Seller's Representation Letter Non-Affiliate. Also you can gain access to kinds you earlier delivered electronically inside the My Forms tab of the accounts.

If you are using US Legal Forms the very first time, refer to the instructions under:

- Step 1. Make sure you have chosen the shape for that right metropolis/land.

- Step 2. Take advantage of the Review method to examine the form`s information. Never forget to read the information.

- Step 3. If you are not satisfied with the develop, make use of the Research discipline at the top of the monitor to get other models of the legal develop web template.

- Step 4. After you have found the shape you require, select the Acquire now key. Select the rates prepare you like and add your references to sign up for the accounts.

- Step 5. Process the transaction. You may use your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Select the structure of the legal develop and download it in your gadget.

- Step 7. Full, edit and print or signal the Virgin Islands Rule 144 Seller's Representation Letter Non-Affiliate.

Every single legal file web template you purchase is your own permanently. You might have acces to each develop you delivered electronically within your acccount. Select the My Forms portion and decide on a develop to print or download once more.

Contend and download, and print the Virgin Islands Rule 144 Seller's Representation Letter Non-Affiliate with US Legal Forms. There are millions of skilled and status-distinct kinds you can use for the business or individual requires.