Virgin Islands Worksheet for Making a Budget

Description

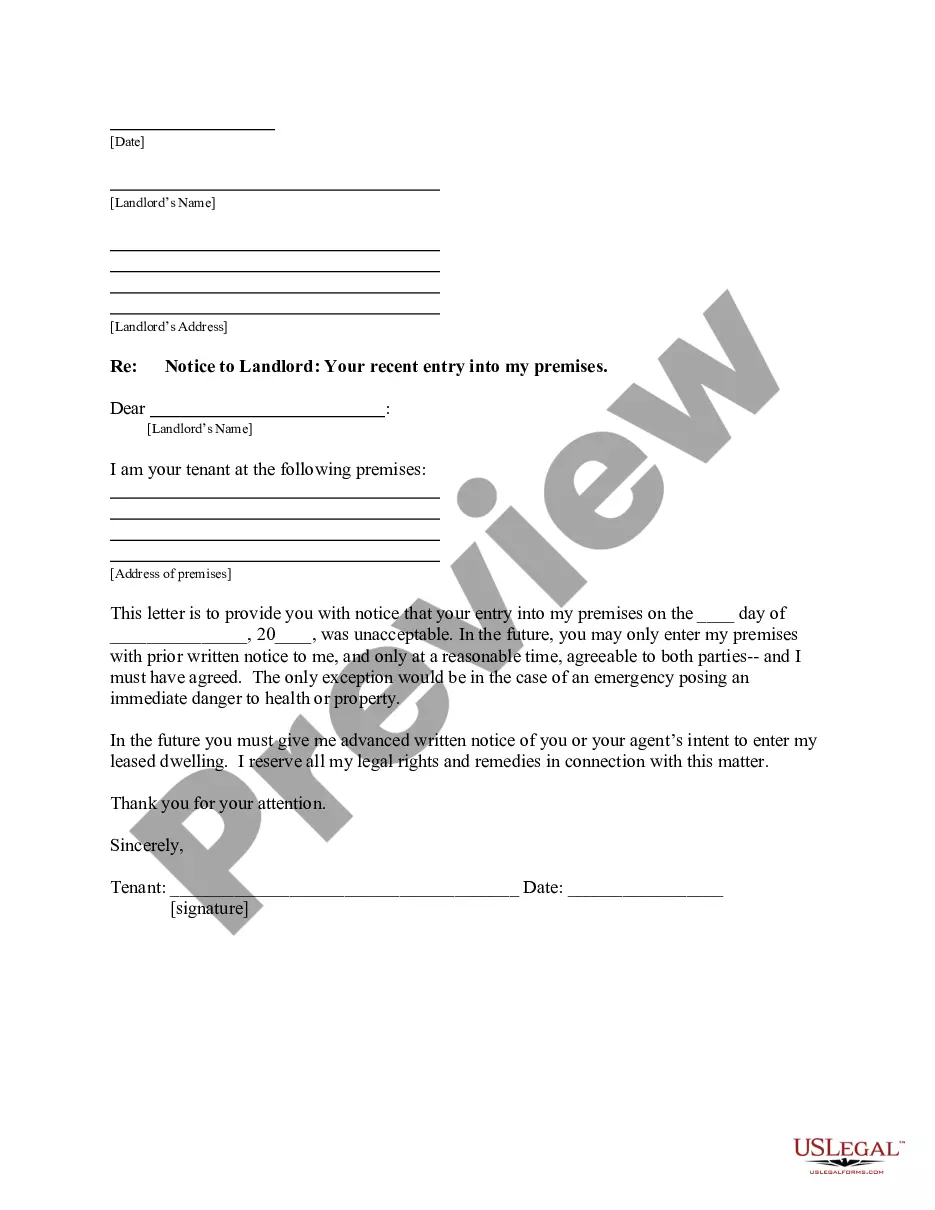

How to fill out Worksheet For Making A Budget?

Have you been within a situation where you need papers for both business or individual reasons almost every day time? There are tons of authorized papers themes available on the net, but discovering ones you can depend on isn`t effortless. US Legal Forms gives a large number of type themes, just like the Virgin Islands Worksheet for Making a Budget, which are composed to meet federal and state demands.

If you are presently familiar with US Legal Forms website and get a merchant account, merely log in. Following that, you are able to acquire the Virgin Islands Worksheet for Making a Budget template.

Unless you offer an accounts and would like to begin using US Legal Forms, follow these steps:

- Find the type you need and make sure it is for your right town/region.

- Take advantage of the Review option to analyze the form.

- Look at the description to actually have chosen the proper type.

- In case the type isn`t what you`re searching for, take advantage of the Look for area to get the type that fits your needs and demands.

- If you get the right type, simply click Get now.

- Select the rates prepare you would like, fill in the required information to make your account, and purchase the order with your PayPal or credit card.

- Select a convenient data file structure and acquire your version.

Locate all of the papers themes you may have bought in the My Forms food list. You may get a extra version of Virgin Islands Worksheet for Making a Budget whenever, if required. Just click the needed type to acquire or produce the papers template.

Use US Legal Forms, probably the most substantial collection of authorized types, to save lots of some time and avoid faults. The service gives expertly created authorized papers themes which you can use for a selection of reasons. Make a merchant account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

5 Steps to Creating a BudgetStep 1: Determine Your Income. This amount should be your monthly take-home pay after taxes and other deductions.Step 2: Determine Your Expenses.Step 3: Choose Your Budget Plan.Step 4: Adjust Your Habits.Step 5: Live the Plan.

Components of a budgetEstimated revenue. This is the money you expect your business to make from the sale of goods and services.Fixed cost. When your business pays the same amount regularly for a particular expense, that is classified as a fixed cost.Variable costs.One-time expenses.Cash flow.Profit.

How to Fill Out a Budget SheetPick Your Budget Sheet & Budget Duration.Gather Your Income & Resources Information.Gather Your Expense Categories Spending & Bills.Fill In Your Savings, Investing, and Debt Amounts.Subtract to Make Sure You're in the Positive.Rework, if Necessary.Keep an Eye on Your Percentages.More items...?

Open a New Spreadsheet. The first thing you'll need to do is create a new spreadsheet file for your budget planner.Decide Your Budget Planner Organization. Figure out which organization strategy works best for how you like to budget.Track Your Income Sources.Enter Your Expenses.Compare Your Income and Expenses.

Your needs about 50% of your after-tax income should include:Groceries.Housing.Basic utilities.Transportation.Insurance.Minimum loan payments. Anything beyond the minimum goes into the savings and debt repayment category.Child care or other expenses you need so you can work.

5 Steps to Successful BudgetingStep 1: Automate essential, recurring living expenses.Step 2: Automate savings.Step 3: Establish a debt reduction plan.Step 4: Commit to a spending plan.Step 5: Account for irregular expenses.

Housing. One of the most important budget categories is what you spend on the place you live.Other Living Expenses. Other living expenses, which are predominantly discretionary expenses, should take up to 25% of your income.Savings. The saying "pay yourself first" is a good motto.Debt Payoff.

What is a Personal Budget Spreadsheet? A personal budget spreadsheet offers an individual a way to determine the state of his finances and help him or her plan spending over the course of a period of usually a month or a year.

The Essential Budget CategoriesHousing (25-35 percent)Transportation (10-15 percent)Food (10-15 percent)Utilities (5-10 percent)Insurance (10-25 percent)Medical & Healthcare (5-10 percent)Saving, Investing, & Debt Payments (10-20 percent)

Your needs about 50% of your after-tax income should include:Groceries.Housing.Basic utilities.Transportation.Insurance.Minimum loan payments. Anything beyond the minimum goes into the savings and debt repayment category.Child care or other expenses you need so you can work.