Title: Virgin Islands Recommended Spending Percentages: A Comprehensive Guide for Financial Planning Introduction: Planning your finances is crucial for securing a stable future, and understanding recommended spending percentages is a fundamental step towards achieving financial well-being. This article delves into the Virgin Islands recommended spending percentages, providing a comprehensive overview to help you make informed decisions. Whether you're a resident or a visitor, understanding these spending categories can enhance your financial health while enjoying the beauty of the Virgin Islands. 1. Housing Expenses Recommendations: Housing is one of the most significant expenditures for individuals and families. In the Virgin Islands, it is recommended to allocate around 25-35% of your total income towards housing expenses. These expenses typically include rent or mortgage payments, property taxes, insurance, maintenance costs, and utility bills. 2. Transportation Costs Recommendations: Transportation costs should also be factored into your monthly budget. Allocate approximately 10-15% of your total income for transportation expenses in the Virgin Islands. This includes vehicle maintenance, fuel, public transportation fares, parking fees, and related costs. 3. Food and Grocery Recommendations: To ensure a balanced and healthy budget, it is recommended to spend approximately 10-15% of your income on food and grocery expenses in the Virgin Islands. This includes groceries purchased at supermarkets, dining out, takeaway meals, and occasional indulgences at local eateries. 4. Healthcare and Insurance Recommendations: Healthcare and insurance are vital aspects of any budget. Allocate around 5-10% of your income for health-related expenses, including insurance premiums, medical bills, medications, regular check-ups, and the occasional unexpected medical costs. 5. Savings and Investments Recommendations: Planning for the future is essential. Aim to save approximately 10-15% of your income for savings and investments. This can be achieved through contributions to retirement accounts, emergency funds, savings accounts, or investment opportunities in the Virgin Islands. 6. Entertainment and Recreation Recommendations: Maintaining a balanced lifestyle is crucial. Allocate around 5-10% of your income towards entertainment and recreation. This includes expenses for hobbies, vacations, dining out, concerts, sports activities, and exploring the diverse experiences offered by the Virgin Islands. 7. Debt Repayments Recommendations: If you have debts, it's important to allocate a certain percentage of your income towards repayment. Aim to allocate 5-10% of your income to paying off debts, such as loans, credit cards, or other financial obligations. 8. Miscellaneous Expenses Recommendations: Allow yourself flexibility in your budget by allocating around 5-10% of your income for miscellaneous expenses. This category covers various unexpected costs, such as gifts, personal care items, subscriptions, and other unforeseen expenditures. Conclusion: Understanding and implementing the recommended spending percentages for the Virgin Islands can provide a solid foundation for financial planning. By allocating your income wisely across different categories, you can prioritize essential expenses while enjoying the beauty and experiences that the Virgin Islands have to offer. Remember, these percentages are general guidelines, and personal circumstances may require adjustments.

Virgin Islands Recommended Spending Percentages

Description

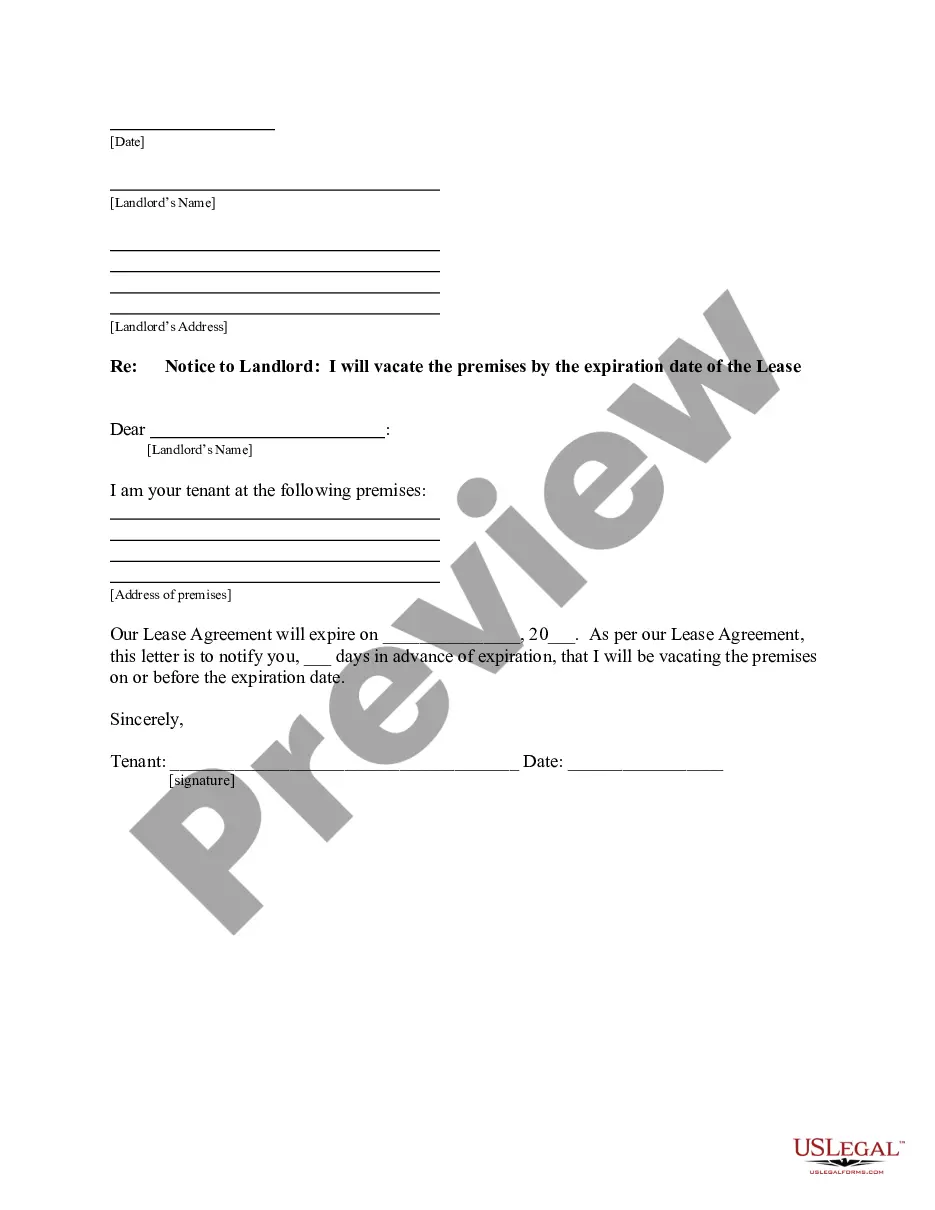

How to fill out Virgin Islands Recommended Spending Percentages?

US Legal Forms - one of several biggest libraries of authorized kinds in the United States - gives a wide range of authorized papers templates you are able to obtain or produce. Using the internet site, you can get 1000s of kinds for organization and individual reasons, sorted by classes, claims, or search phrases.You will find the newest types of kinds much like the Virgin Islands Recommended Spending Percentages in seconds.

If you already have a subscription, log in and obtain Virgin Islands Recommended Spending Percentages through the US Legal Forms collection. The Down load switch can look on each and every develop you look at. You get access to all previously acquired kinds in the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, listed below are basic directions to help you get started off:

- Be sure to have selected the proper develop for your metropolis/area. Go through the Review switch to review the form`s articles. Browse the develop outline to ensure that you have selected the correct develop.

- In the event the develop does not suit your needs, make use of the Lookup industry towards the top of the screen to find the one which does.

- In case you are pleased with the shape, validate your option by visiting the Acquire now switch. Then, choose the costs prepare you like and give your references to sign up for the accounts.

- Approach the financial transaction. Make use of your Visa or Mastercard or PayPal accounts to complete the financial transaction.

- Select the formatting and obtain the shape on your own device.

- Make alterations. Fill out, revise and produce and indicator the acquired Virgin Islands Recommended Spending Percentages.

Each format you included in your money lacks an expiration day which is the one you have for a long time. So, if you want to obtain or produce one more copy, just check out the My Forms area and click on around the develop you want.

Gain access to the Virgin Islands Recommended Spending Percentages with US Legal Forms, the most considerable collection of authorized papers templates. Use 1000s of expert and express-certain templates that meet your business or individual demands and needs.

Form popularity

FAQ

KNOW- In St. Thomas, The U.S. dollar is the only currency accepted. Credit cards are not accepted at all venues, so plan to carry cash.

Even groceries in the Virgin Islands don't exactly come cheap, but they are still less expensive than dining out all the time. We usually try to reserve the bulk of our dining out budget for dinner and occasional drinks at our favorite spots.

MasterCard and Visa are widely accepted on all the islands that cater to visitors, especially Virgin Gorda, Tortola, St. John, St. Croix, and, of course, St. Thomas.

The economy of the United States Virgin Islands is primarily dependent upon tourism, trade, and other services, accounting for nearly 60% of the Virgin Island's GDP and about half of total civilian employment. Close to two million tourists per year visit the islands.

How much money will you need for your trip to Saint Thomas? You should plan to spend around $175 per day on your vacation in Saint Thomas, which is the average daily price based on the expenses of other visitors. Past travelers have spent, on average, $43 on meals for one day and $29 on local transportation.

How much money will you need for your trip to the US Virgin Islands? You should plan to spend around $199 per day on your vacation in the US Virgin Islands, which is the average daily price based on the expenses of other visitors.

As a U.S. territory, the currency is the U.S. dollar. Automated teller machines (ATMs) can be found throughout all three islands. Most establishments accept credit cards and traveler's checks. The most widely accepted credit cards are Visa and MasterCard.

KNOW- In St. Thomas, The U.S. dollar is the only currency accepted. Credit cards are not accepted at all venues, so plan to carry cash. Tax is not added to any retail or dining purchases in St.

Home to roughly 105,000 people, the USVI's population faces an unknown level of poverty; the most recent data fails to account for the hurricane destruction. It was last reported in the 2010 U.S. Census Bureau that 22% of the USVI population lived below the poverty line.

Bermuda, Cayman and British virgin islands are the top richest and wealthiest islands in the caribbean. GDP per capita is often considered an indicator of the standard of living of a given country, as it reflects the average wealth of each person residing in a country.