The Virgin Islands Certificate of Borrower regarding Commercial Loan serves as an essential document in the lending process for commercial loans in the Virgin Islands. This detailed description will provide information about the purpose, requirements, and different types of the Virgin Islands Certificate of Borrower regarding Commercial Loan. The Virgin Islands Certificate of Borrower is a legal document that borrowers must submit to the lending institution when applying for a commercial loan in the Virgin Islands. It acts as a declaration by the borrower, providing essential information about their financial situation, assets, liabilities, and creditworthiness. This certificate is a crucial component for lenders to assess the borrower's ability to repay the loan and make sound credit decisions. Key elements included in the Virgin Islands Certificate of Borrower regarding Commercial Loan are as follows: 1. Identification: The certificate begins by stating the full name, address, and contact information of the borrower, ensuring accurate identification. 2. Business Information: The borrower is required to provide detailed information about their business, including its legal structure, industry type, years in operation, and description of primary activities. 3. Financial Statements: To gauge the borrower's financial stability, the certificate includes the requirement to submit financial statements such as balance sheets, income statements, and cash flow statements for the past few years. These statements give lenders an overview of the borrower's financial performance and their ability to generate sufficient income to repay the loan. 4. Assets and Liabilities: This section of the certificate requires the borrower to list their assets and liabilities, including real estate properties, vehicles, equipment, investments, outstanding loans, and other debts. The lender evaluates the borrower’s net worth and debt-to-asset ratio to assess their creditworthiness. 5. Credit History: The Virgin Islands Certificate of Borrower includes a section dedicated to the borrower's credit history. It requires the borrower to disclose information regarding their previous and current debts, late payments, bankruptcies, and any judgments or legal actions. Information regarding personal and business credit scores, obtained from credit bureaus, might also be required. 6. Loan Purpose and Repayment Plan: The borrower must clearly state the purpose of the commercial loan and how they intend to utilize the funds. Additionally, the repayment plan, including the proposed repayment schedule, interest rate, and any collateral offered, needs to be outlined. Different types of the Virgin Islands Certificate of Borrower regarding Commercial Loan might include: 1. Individual Borrower: This type of certificate is completed by the individual borrower who personally guarantees the commercial loan on behalf of their business. It includes personal financial information alongside the business-related details. 2. Corporate Borrower: This certificate variant applies when the borrower is a registered corporation. It requires disclosure of the corporation's financial statements, including balance sheets, income statements, and cash flow statements. 3. Partnership or LLC Borrower: When the borrower is a partnership or a limited liability company (LLC), they need to provide detailed information about the partnership/LLC's financials, including capital contributions, distributive shares, and partner/member liabilities. It is important to note that the specific requirements and content of the Virgin Islands Certificate of Borrower regarding Commercial Loan may vary based on the lending institution's guidelines and the complexity of the loan application. Borrowers are advised to consult with their lender or legal advisors to ensure they provide accurate and thorough information in their certificate.

Virgin Islands Certificate of Borrower regarding Commercial Loan

Description

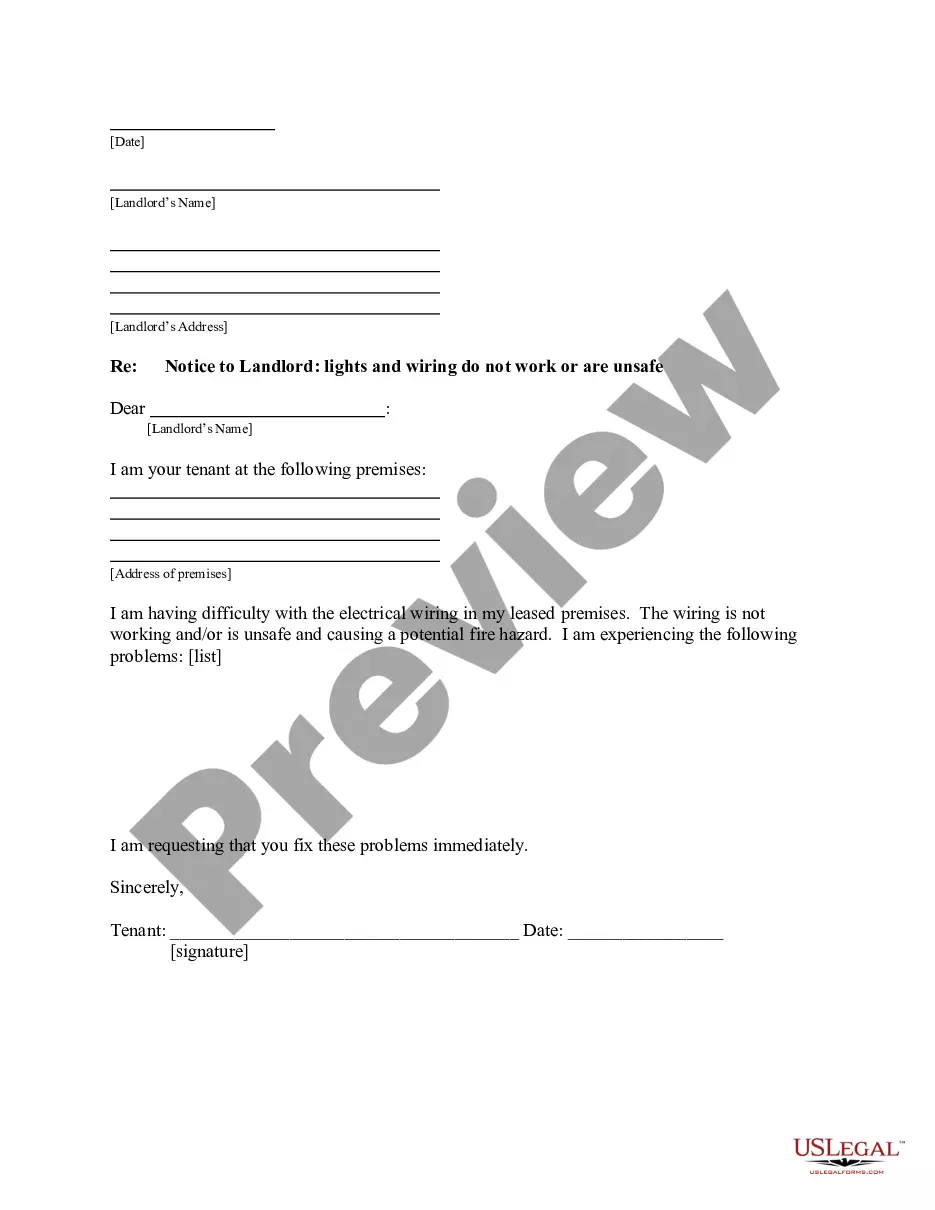

How to fill out Virgin Islands Certificate Of Borrower Regarding Commercial Loan?

You may commit hrs on the web searching for the authorized file template that meets the federal and state specifications you will need. US Legal Forms gives thousands of authorized types which can be reviewed by professionals. It is simple to down load or print out the Virgin Islands Certificate of Borrower regarding Commercial Loan from the support.

If you currently have a US Legal Forms accounts, you may log in and click the Obtain option. Next, you may complete, edit, print out, or indicator the Virgin Islands Certificate of Borrower regarding Commercial Loan. Each and every authorized file template you purchase is yours permanently. To acquire yet another copy for any bought type, check out the My Forms tab and click the related option.

If you use the US Legal Forms website the very first time, stick to the simple guidelines below:

- Initial, make certain you have chosen the correct file template for that region/city of your choice. Browse the type description to ensure you have selected the proper type. If offered, use the Review option to check through the file template too.

- If you wish to get yet another model of the type, use the Research field to get the template that suits you and specifications.

- Upon having identified the template you would like, simply click Acquire now to move forward.

- Choose the prices strategy you would like, key in your qualifications, and sign up for your account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal accounts to fund the authorized type.

- Choose the file format of the file and down load it to the product.

- Make changes to the file if required. You may complete, edit and indicator and print out Virgin Islands Certificate of Borrower regarding Commercial Loan.

Obtain and print out thousands of file web templates while using US Legal Forms website, which offers the most important selection of authorized types. Use skilled and status-particular web templates to take on your business or individual needs.