The Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan is an important legal document that verifies the authority and authenticity of a corporation's secretary in relation to a commercial loan transaction in the Virgin Islands. This document serves as evidence that the corporation has provided accurate and complete information to the lending institution, promoting transparency and accountability in the business world. Keywords: Virgin Islands, Certificate of Secretary of Corporation, Commercial Loan, legal document, authority, authenticity, corporation, lending institution, transparency, accountability. Different types of the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan: 1. Standard Certificate: This type of certificate is issued by the secretary of a corporation to demonstrate compliance with all legal requirements and the corporation's eligibility to receive a commercial loan in the Virgin Islands. It verifies that the secretary has reviewed and approved all loan-related documentation and that the corporation intends to repay the loan as agreed. 2. Amended Certificate: In case there are any modifications to the initial terms and conditions of a commercial loan, an amended certificate may be required. This certificate updates the previous certificate of the secretary, reflecting the changes made to the loan agreement. It ensures that the lending institution has accurate and up-to-date information about the corporation's commitment to the loan. 3. Extension Certificate: If the repayment period of a commercial loan needs to be extended, an extension certificate may be necessary. This type of certificate confirms the secretary's approval of the loan's renewal and provides updated terms and conditions for the extended period. It ensures that the lending institution is informed about the corporation's ongoing commitment to the loan and its repayment obligations. 4. Termination Certificate: When a commercial loan is fully repaid by a corporation, a termination certificate is issued by the secretary to confirm the closure of the loan. This certificate serves as proof that the corporation has fulfilled its financial obligations and the lending arrangement has been successfully concluded. It allows the corporation to free up its assets and establish a positive credit history, making it easier for future loan applications. 5. Non-Compliance Certificate: In rare cases of non-compliance or breach of loan agreement terms, a non-compliance certificate may be issued by the secretary. This certificate notes any defaults or violation of the loan agreement by the corporation. It is crucial for lenders and potential business partners to be aware of non-compliance issues when considering a corporation for further financial transactions. Overall, the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan, regardless of its specific type, plays a vital role in ensuring transparency, trust, and legal compliance in commercial loan arrangements. It provides a reliable record of the corporation's authority and commitment, allowing lending institutions and other parties to make informed decisions.

Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan

Description

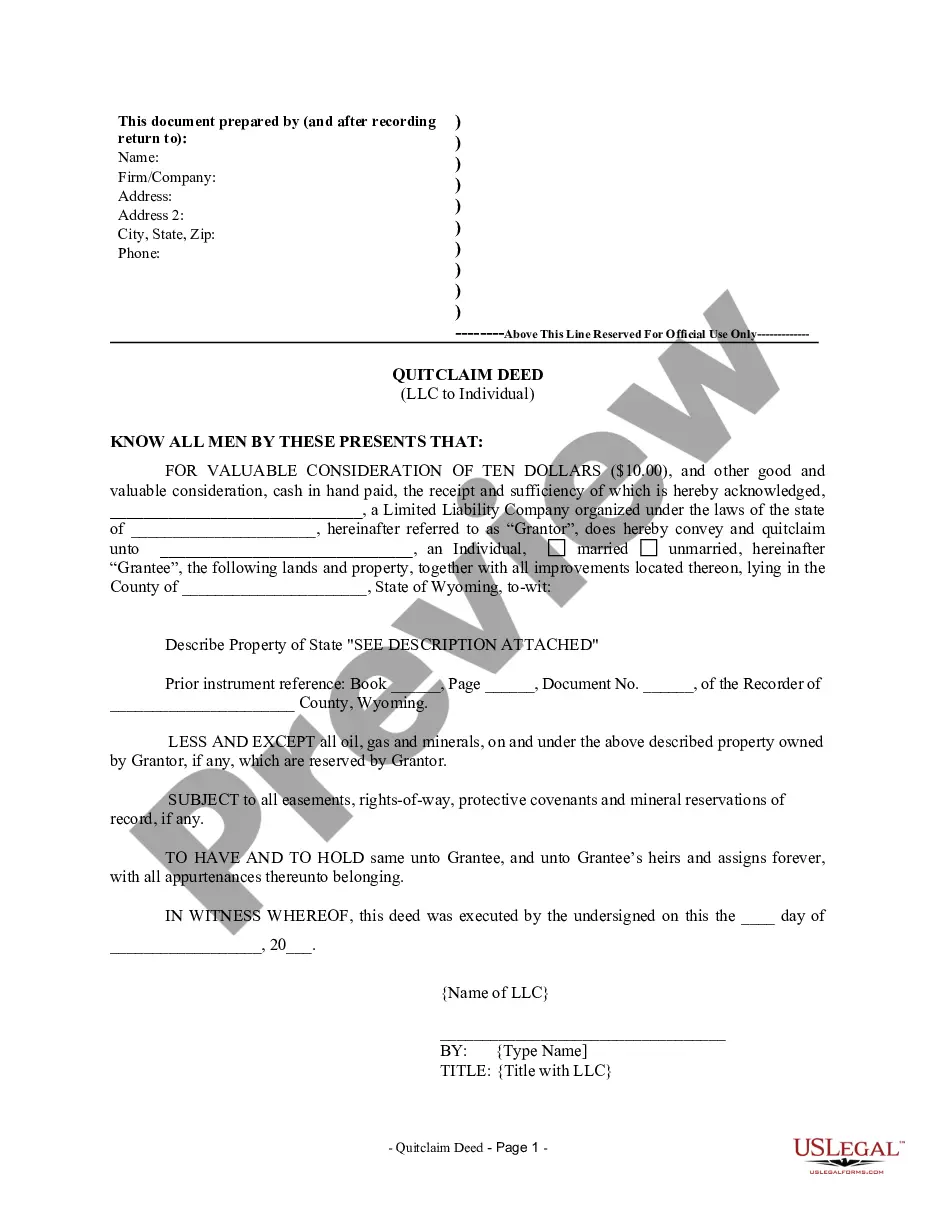

How to fill out Virgin Islands Certificate Of Secretary Of Corporation As To Commercial Loan?

If you need to total, obtain, or print out lawful record templates, use US Legal Forms, the biggest variety of lawful varieties, that can be found on the web. Use the site`s basic and convenient search to get the paperwork you require. Numerous templates for business and individual reasons are sorted by types and suggests, or search phrases. Use US Legal Forms to get the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan within a couple of mouse clicks.

In case you are currently a US Legal Forms customer, log in in your account and then click the Download key to obtain the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan. You can even access varieties you in the past saved in the My Forms tab of the account.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the form for that correct area/land.

- Step 2. Utilize the Preview solution to check out the form`s content material. Never neglect to read the explanation.

- Step 3. In case you are not happy together with the develop, use the Lookup industry at the top of the display screen to find other variations of your lawful develop format.

- Step 4. When you have identified the form you require, click the Buy now key. Choose the costs program you choose and add your qualifications to register for an account.

- Step 5. Method the deal. You should use your bank card or PayPal account to perform the deal.

- Step 6. Pick the formatting of your lawful develop and obtain it on your own gadget.

- Step 7. Full, change and print out or sign the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan.

Every lawful record format you purchase is yours for a long time. You may have acces to each develop you saved inside your acccount. Go through the My Forms area and decide on a develop to print out or obtain once more.

Be competitive and obtain, and print out the Virgin Islands Certificate of Secretary of Corporation as to Commercial Loan with US Legal Forms. There are thousands of skilled and status-specific varieties you may use for your personal business or individual demands.