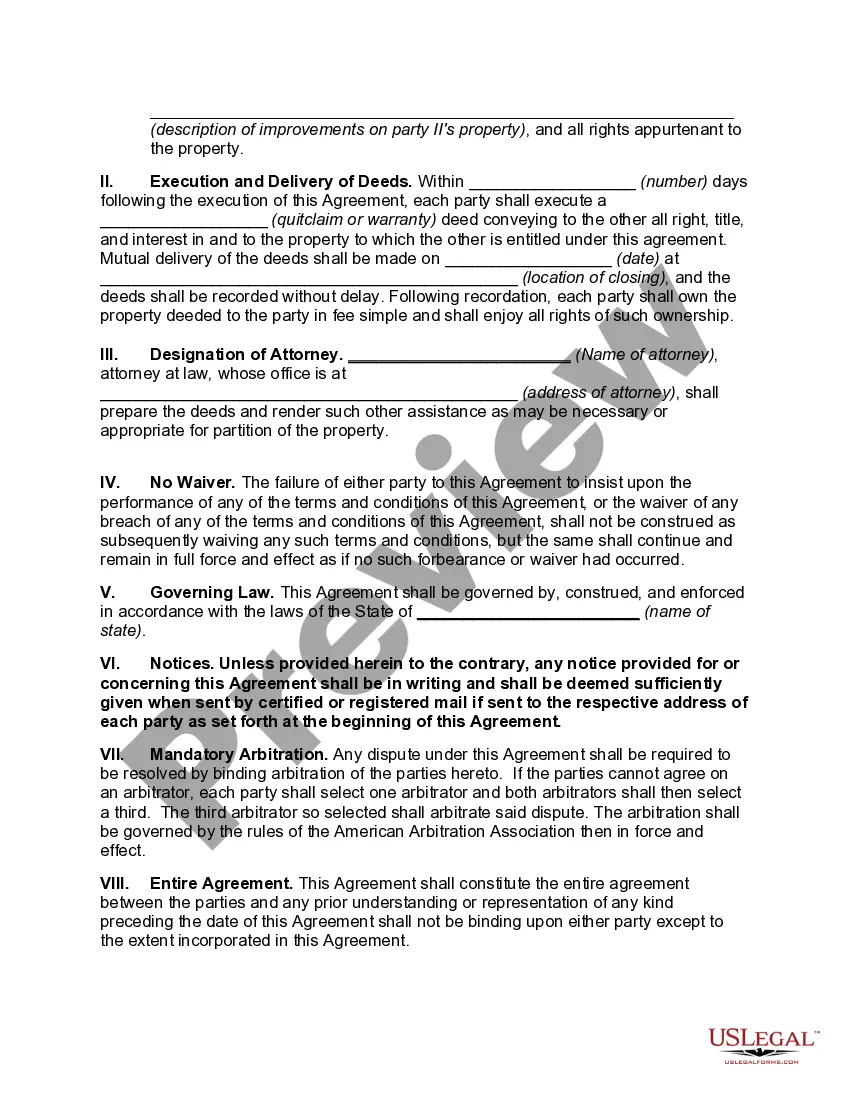

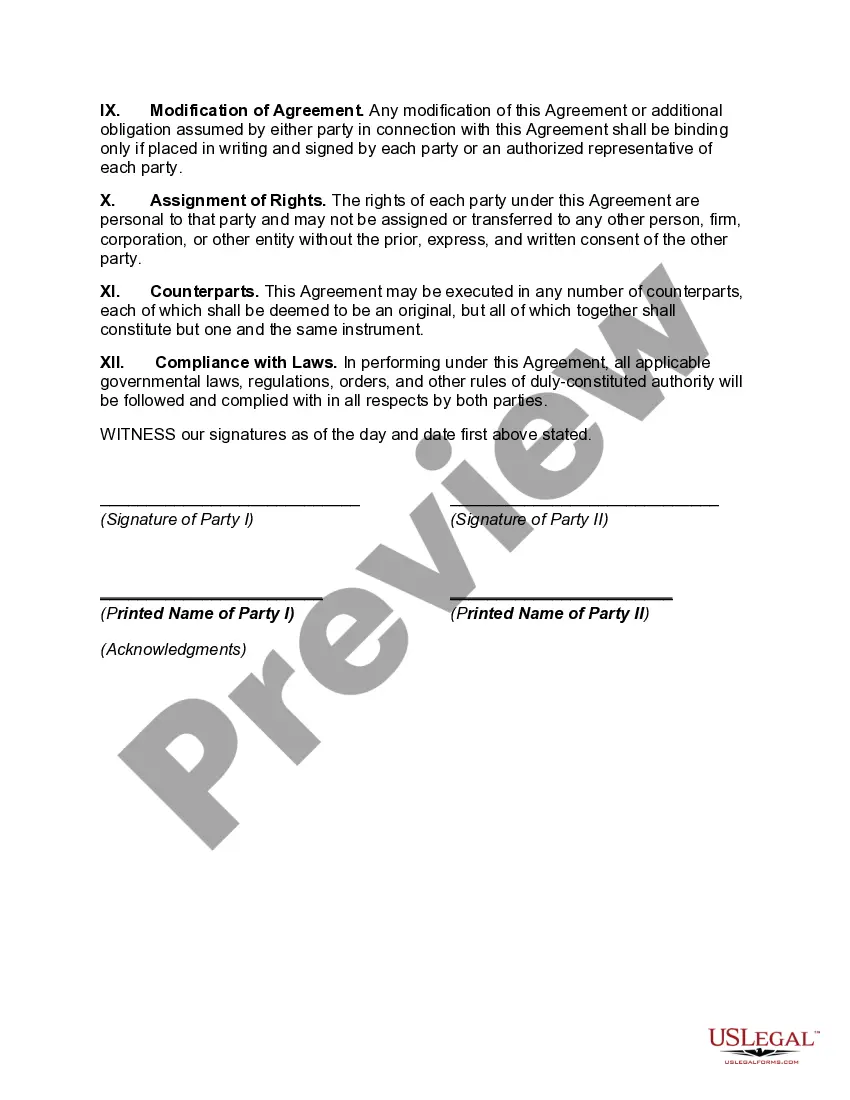

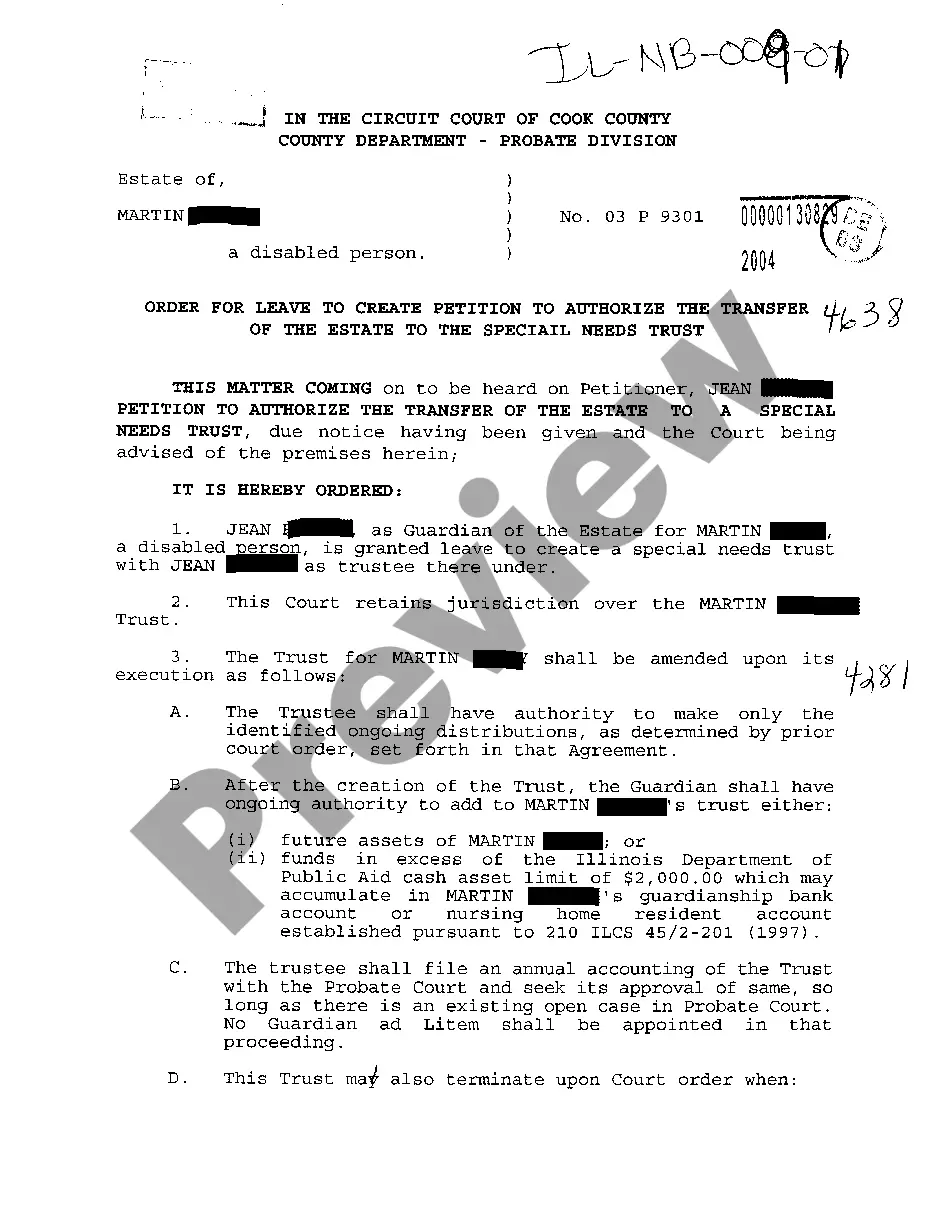

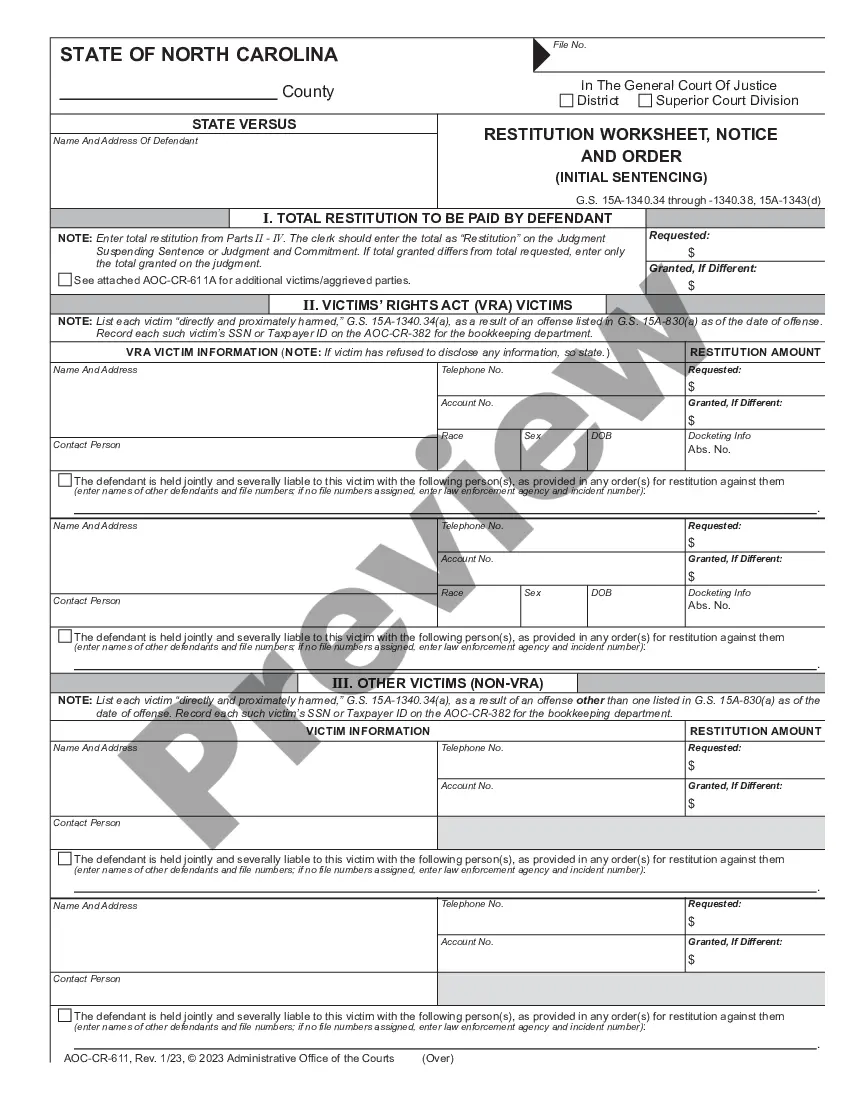

The Virgin Islands Agreement to Partition Real Property Between Children of Decedent is a legal document that outlines the process of dividing and assigning real estate assets among the children of a deceased individual in the Virgin Islands. This agreement is crucial in cases where multiple children inherit real property and need a fair and legally binding way to divide their interests. The agreement typically includes provisions regarding the identification and description of the real property being partitioned. It outlines the rights and ownership interests of each child and sets forth the terms and conditions for the partition. The document may also address any financial considerations, such as the sharing of costs for property maintenance or renovations. Keywords: Virgin Islands, agreement, partition, real property, children, decedent, legal document, dividing, assigning, real estate assets, inherit, fair, legally binding, divide, interests, identification, description, rights, ownership, terms and conditions, financial considerations, property maintenance, renovations. Types of Virgin Islands Agreement to Partition Real Property Between Children of Decedent: 1. Standard Agreement: This is the most common type of agreement used for partitioning real property among the children of a deceased individual. It follows the general guidelines and provisions necessary to ensure a fair division of assets. 2. Modified Agreement: In certain cases, there might be specific circumstances or unique requirements that call for modifications to the standard agreement. A modified agreement would include additional clauses or provisions tailored to address these individual needs. 3. Simplified Agreement: In situations where the children unanimously agree on the division of property without any complications or disputes, a simplified agreement could be used. This streamlined version of the agreement would entail fewer formalities and a simpler process, reflecting the amicable nature of the partition. 4. Complex Agreement: In complex cases where there are multiple properties, significant financial considerations, or disagreements among the children, a more elaborate agreement might be necessary. This type of agreement would address various intricate aspects and provide detailed protocols for resolution, including potential arbitration or mediation proceedings. 5. Staggered Agreement: In instances where the partitioning of real property needs to be carried out over an extended period due to various factors like legal constraints or unresolved issues, a staggered agreement may be utilized. It would outline a step-by-step approach and milestones to be achieved at different stages of the partition process. 6. Contingency Agreement: A contingency agreement is employed when certain conditions must be met or tasks completed before the partitioning can occur. This type of agreement ensures that prerequisites, such as obtaining necessary permits or resolving pending legal matters, are fulfilled before the transfer of property can take place. In summary, the Virgin Islands Agreement to Partition Real Property Between Children of Decedent is a versatile legal document that caters to the specific needs and circumstances of the children inheriting real estate assets. By providing a structured framework for property division, this agreement ensures fairness, clarity, and compliance with Virgin Islands laws.

Virgin Islands Agreement to Partition Real Property Between Children of Decedent

Description

How to fill out Virgin Islands Agreement To Partition Real Property Between Children Of Decedent?

If you have to comprehensive, obtain, or print out lawful document themes, use US Legal Forms, the largest assortment of lawful varieties, that can be found on-line. Use the site`s simple and convenient lookup to discover the papers you will need. Numerous themes for company and personal uses are categorized by groups and says, or keywords and phrases. Use US Legal Forms to discover the Virgin Islands Agreement to Partition Real Property Between Children of Decedent in a few click throughs.

If you are presently a US Legal Forms buyer, log in to your account and click on the Down load key to find the Virgin Islands Agreement to Partition Real Property Between Children of Decedent. You can also gain access to varieties you earlier downloaded within the My Forms tab of your account.

If you are using US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that correct town/region.

- Step 2. Make use of the Preview method to look over the form`s content material. Do not overlook to read the description.

- Step 3. If you are unhappy with the form, make use of the Look for discipline on top of the display screen to find other variations of your lawful form template.

- Step 4. Once you have identified the shape you will need, click the Purchase now key. Pick the costs plan you like and include your references to sign up for an account.

- Step 5. Method the purchase. You can use your charge card or PayPal account to perform the purchase.

- Step 6. Find the formatting of your lawful form and obtain it on the system.

- Step 7. Total, change and print out or indication the Virgin Islands Agreement to Partition Real Property Between Children of Decedent.

Each lawful document template you purchase is the one you have for a long time. You might have acces to each and every form you downloaded in your acccount. Select the My Forms portion and pick a form to print out or obtain once more.

Contend and obtain, and print out the Virgin Islands Agreement to Partition Real Property Between Children of Decedent with US Legal Forms. There are many specialist and state-certain varieties you can use for your personal company or personal requirements.

Form popularity

FAQ

An heir is someone who is set to inherit the property of the deceased when no will or testament has been made. A beneficiary is someone who was chosen by the deceased to inherit their property as laid out in a will or testament. An heir is typically a close living relative whereas a beneficiary can be anyone.

In order for a party to establish title or ownership to property by adverse possession, the possession or use of such property must be actual, uninterrupted, exclusive, physical adverse, continuous and notorious for the statutorily prescribed period of time.

Heirs' property is property passed to family members by inheritance, usually without a will or estate planning strategy. It is typically created when land is passed on from someone who dies without a will (intestate) to those legally entitled to their property, such as a spouse, children, other relatives.

Heirs' property is land that has been passed down from one generation to the next, but in the absence of a Will or other type of estate planning document that can prove ownership. This creates legal implications for those who inherit heirs' property.

An heir is a person who may legally receive property or assets from a deceased person's estate when there is no will or trust in place; this is called dying intestate, and state laws then determine who the heirs are and how the assets are passed down.

As the heir was the universal successor of the deceased, he replaced him in all relations apart from those purely personal. Thus, he received not only the rights related to the property (both assets and debts), but he also had the duty to execute private religious acts (sacra privata).

The Uniform Partition of Heirs Property Act governs the partition of inherited property. The purpose of the Act is to protect heirs from unscrupulous speculators who acquire a small partial interest in real property owned by a group of heirs and then force the sale of the property at a below-market price.

A resident of the USVI is exempt from USVI inheritance tax pursuant to Section 5, Chapter 1, Title 33 of the Virgin Islands Code.