Virgin Islands Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder

Description

How to fill out Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder?

You may invest hours on the web attempting to find the legal file design that fits the federal and state requirements you will need. US Legal Forms gives a large number of legal types which can be reviewed by pros. You can actually down load or print out the Virgin Islands Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder from your support.

If you currently have a US Legal Forms bank account, you are able to log in and click on the Download button. After that, you are able to comprehensive, change, print out, or indicator the Virgin Islands Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder. Each and every legal file design you purchase is your own forever. To have yet another duplicate of any acquired form, proceed to the My Forms tab and click on the related button.

If you work with the US Legal Forms internet site for the first time, keep to the simple recommendations listed below:

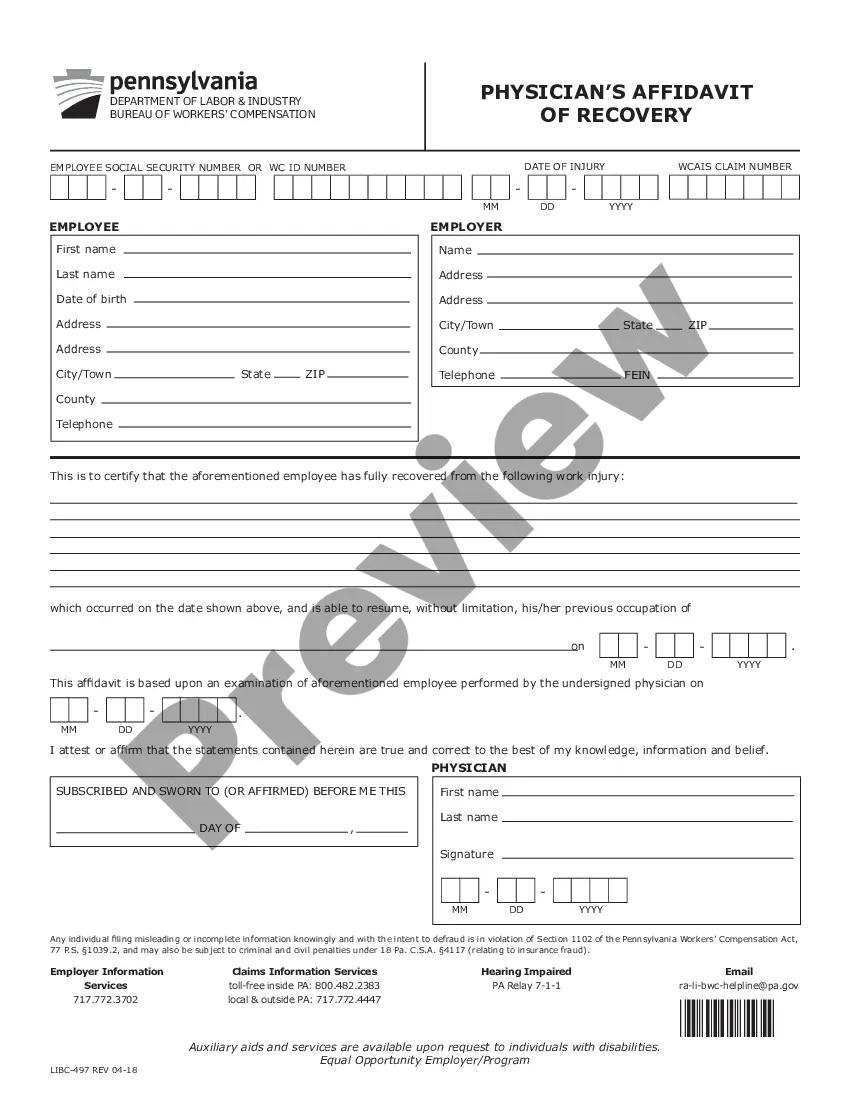

- Initially, be sure that you have selected the correct file design for your state/metropolis of your liking. See the form outline to ensure you have picked the proper form. If readily available, use the Review button to check through the file design too.

- If you would like get yet another edition from the form, use the Search industry to obtain the design that meets your needs and requirements.

- After you have identified the design you would like, click Get now to proceed.

- Choose the prices prepare you would like, enter your accreditations, and register for a free account on US Legal Forms.

- Total the transaction. You can use your bank card or PayPal bank account to cover the legal form.

- Choose the file format from the file and down load it to your device.

- Make alterations to your file if needed. You may comprehensive, change and indicator and print out Virgin Islands Jury Instruction - 1.9.5.1 Corporation As Alter Ego Of Stockholder.

Download and print out a large number of file themes using the US Legal Forms web site, that provides the greatest variety of legal types. Use specialist and condition-distinct themes to tackle your business or personal requirements.