Virgin Islands Finance Lease of Equipment refers to a specific leasing arrangement prevalent in the U.S. Virgin Islands, where businesses or individuals can obtain essential equipment needed for their operations without having to undertake the substantial upfront costs associated with purchasing the equipment outright. This type of financial agreement allows lessees to occupy and use the equipment for a fixed period while making regular lease payments to the lessor. Virgin Islands Finance Lease of Equipment offers several advantages to businesses, such as allowing them to conserve their cash flow by avoiding large capital expenditures. It provides flexibility as it enables companies to acquire the required equipment quickly, keeping up with industry needs and technological advancements. Additionally, the lessor typically retains the responsibilities associated with maintenance, repairs, and equipment management, relieving lessees of those obligations. There are several types of Virgin Islands Finance Lease of Equipment available to suit different business needs: 1. Operating Lease: An operating lease is a short-term lease suitable for equipment that has a shorter lifespan, such as office furniture or technology assets. This type of lease facilitates the use of equipment without the intent of ownership. 2. Capital Lease: A capital lease is a long-term lease option that may eventually lead to the ownership of the leased equipment. This type of lease is more suitable for equipment that has a longer lifespan, such as heavy machinery or vehicles. 3. Sale and Leaseback: Sale and leaseback is a unique type of finance lease where an entity sells its owned equipment to a lessor and then leases it back for continued use. This arrangement provides businesses with immediate cash flow while still maintaining access to the necessary equipment. 4. Single Investor Lease: In this type of lease, a single individual or entity finances the equipment, typically with the intent to own it eventually. The lessor may be a bank, a finance company, or even the equipment manufacturer. 5. Master Lease: A master lease allows businesses to lease multiple pieces of equipment from a lessor under a single lease agreement. This type of lease simplifies the administrative process and offers flexibility in adding or removing equipment as needed. When considering a Virgin Islands Finance Lease of Equipment, it is essential for lessees to carefully analyze their business requirements, the equipment's useful life, and the financial implications before selecting the most suitable lease type. Consulting with financial advisors or leasing experts can provide valuable insights to ensure optimum decision-making.

Virgin Islands Finance Lease of Equipment

Description

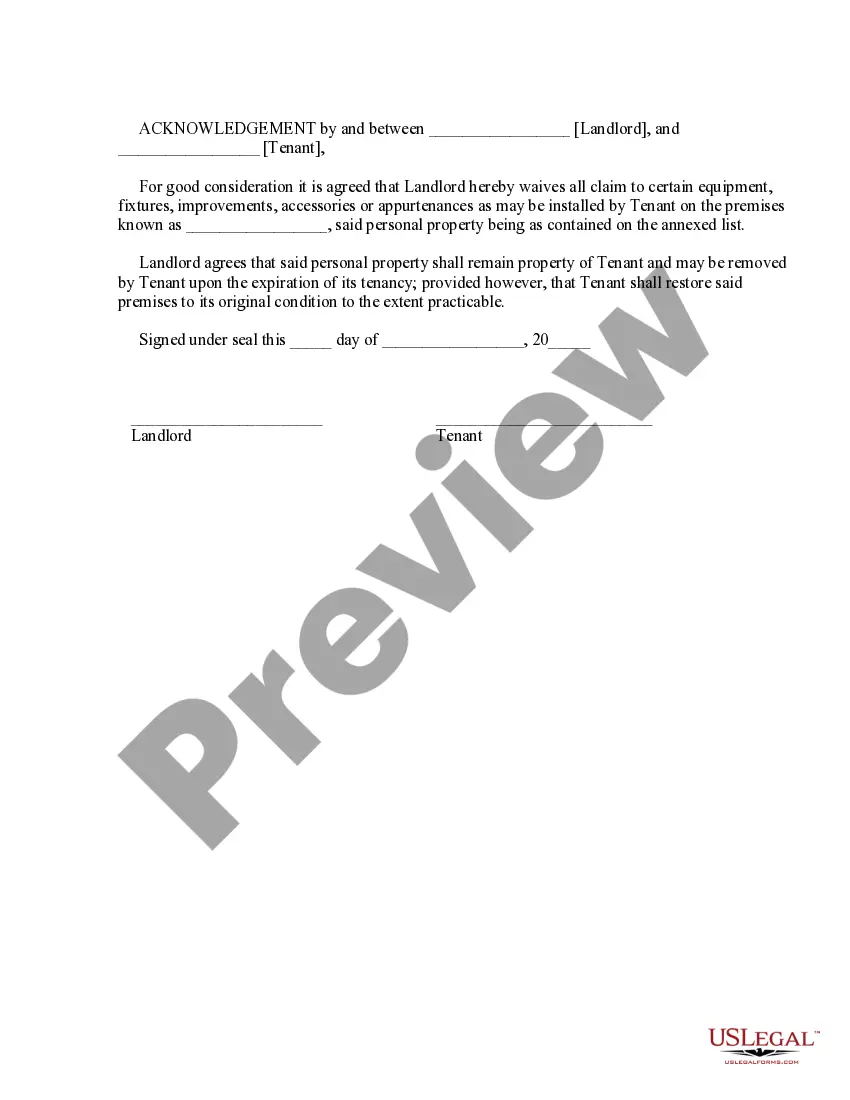

How to fill out Virgin Islands Finance Lease Of Equipment?

US Legal Forms - one of the greatest libraries of authorized forms in the States - offers a wide array of authorized papers templates you are able to down load or print out. Utilizing the site, you will get a large number of forms for business and individual uses, categorized by types, states, or key phrases.You can find the most up-to-date models of forms just like the Virgin Islands Finance Lease of Equipment in seconds.

If you already possess a membership, log in and down load Virgin Islands Finance Lease of Equipment in the US Legal Forms local library. The Download option can look on every single develop you view. You have accessibility to all previously acquired forms in the My Forms tab of your account.

If you want to use US Legal Forms initially, here are straightforward instructions to help you started off:

- Make sure you have picked the proper develop to your city/region. Click the Preview option to check the form`s information. Read the develop information to actually have chosen the correct develop.

- In the event the develop doesn`t match your requirements, utilize the Research field near the top of the display screen to find the one who does.

- In case you are happy with the form, confirm your decision by visiting the Get now option. Then, choose the costs program you want and supply your references to register on an account.

- Process the purchase. Make use of Visa or Mastercard or PayPal account to finish the purchase.

- Choose the format and down load the form on the gadget.

- Make alterations. Load, modify and print out and indicator the acquired Virgin Islands Finance Lease of Equipment.

Each template you put into your account does not have an expiration particular date and it is your own permanently. So, if you want to down load or print out yet another copy, just go to the My Forms area and click on about the develop you need.

Gain access to the Virgin Islands Finance Lease of Equipment with US Legal Forms, the most substantial local library of authorized papers templates. Use a large number of skilled and status-particular templates that satisfy your organization or individual requires and requirements.

Form popularity

FAQ

A lease will always have at least two parties: the lessor and the lessee. The lessor is the person or business that owns the equipment. The lessee is the person or business renting the equipment. The lessee will make payments to the lessor throughout the contract.

Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

How does an asset lease work? The financier purchases the equipment on behalf of the customer, who then pays the financier a fixed monthly lease rental for the term of the lease.

You can get an equipment loan from a traditional bank, an online lender or an equipment financing and leasing company. With an equipment loan, you can finance up to 100% of the equipment's value, Scott says.

Equipment financing refers to a credit facility that helps you finance all the equipment and machinery related needs of your business. Using machinery loans you can buy, lease, upgrade or repair equipment quickly.

A capital lease (or finance lease) is an agreement where the lessor has agreed that the ownership of the asset will be transferred to the lessee when the lease period is over. It allows the lessee the choice of buying the asset at a bargain price that is lower than the market value at the end of the lease period.

Debt financing of your equipment, such as computers and other technology that becomes obsolete in a short period of time, allows you to have the present use necessary to grow your business and upgrade quickly to newer technology in order to maintain your competitive advantage.

Higher Rates Than Traditional Loans According to US News, equipment loans typically offer favorable interest rates, as low as five percent. However, if you have an excellent business credit history, you'll likely be able to find a lower interest rate by taking out a traditional loan.

Qualifying for equipment financing is easier than you might think. Typically, you'll need to have been in business for at least a year, $50,000 or more in annual revenue, and a credit score of 650 or higher. Because the collateral is often part of your loan, it's not as difficult to obtain as other types of financing.

A finance lease is a contract between a lessor (a funder or finance company) and a lessee (your business), where the lessee requires the use of business equipment, vehicles, or machinery. The lessor provides the use of such equipment in exchange for pre-agreed regular payments.