Virgin Islands Balance Sheet Notes Payable

Description

How to fill out Balance Sheet Notes Payable?

If you need to thoroughly obtain or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s simple and user-friendly search to find the documents you require. Various templates for business and personal purposes are grouped by categories, states, or keywords.

Use US Legal Forms to quickly locate the Virgin Islands Balance Sheet Notes Payable with just a few clicks.

Complete and download, and print the Virgin Islands Balance Sheet Notes Payable with US Legal Forms. There are countless professional and region-specific templates you can utilize for your business or personal needs.

- If you are already a US Legal Forms client, sign in to your account and select the Download button to access the Virgin Islands Balance Sheet Notes Payable.

- You can also retrieve documents you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

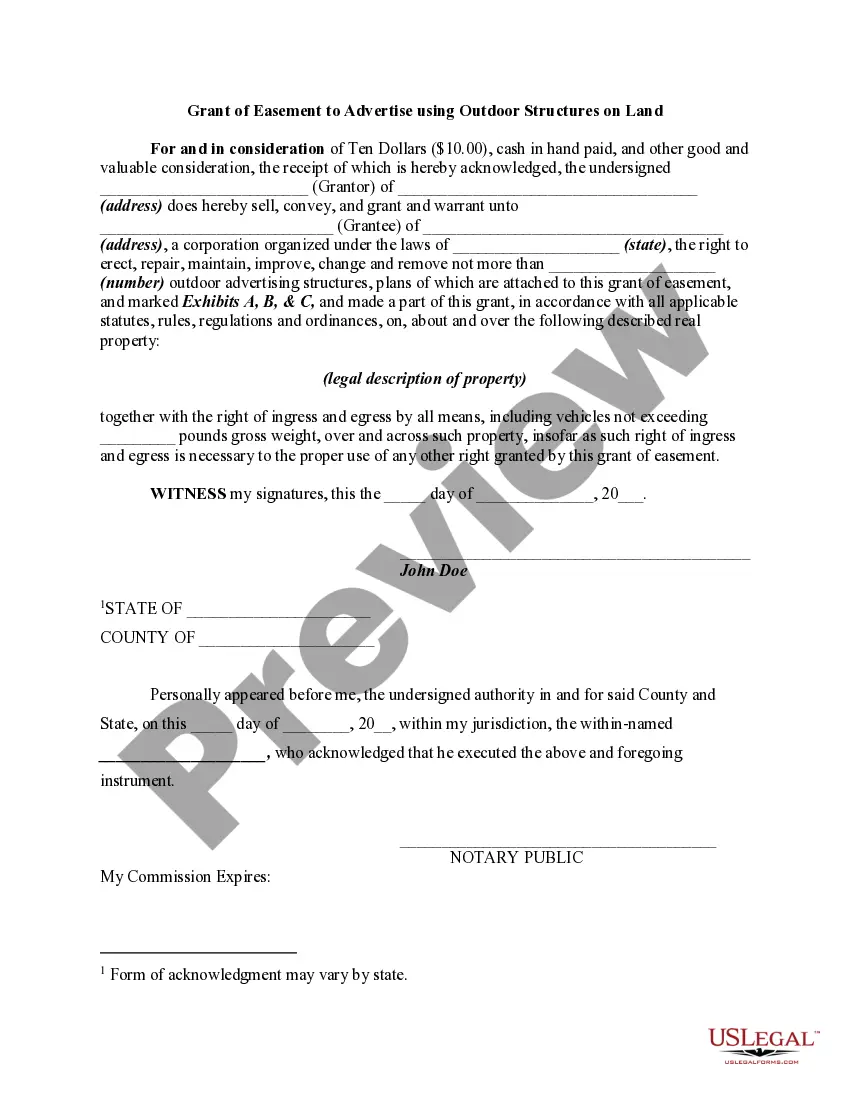

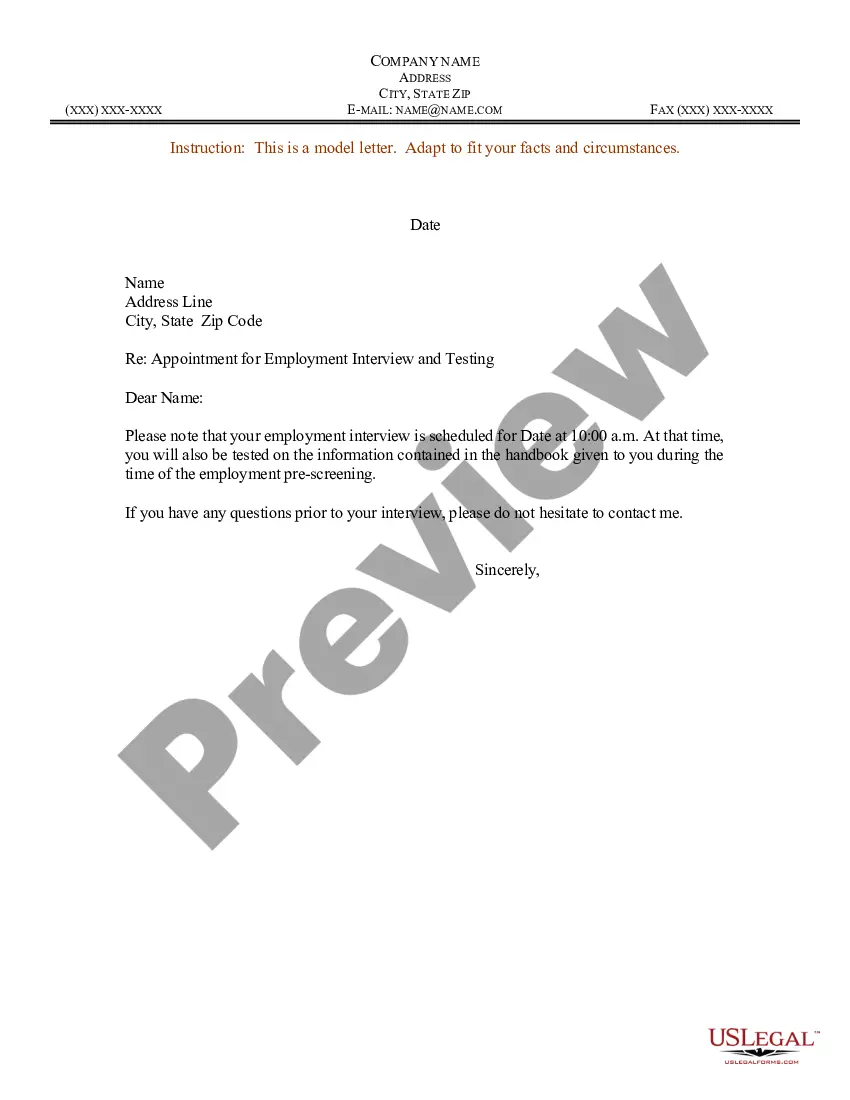

- Step 2. Utilize the Preview feature to review the document’s content. Always remember to read through the summary.

- Step 3. If you are not satisfied with the form, use the Search box located at the top of the screen to find alternative forms in the legal format.

- Step 4. Once you have identified the form you need, click the Buy Now button. Choose your preferred pricing plan and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Virgin Islands Balance Sheet Notes Payable.

- Every legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Go to the My documents section and choose a form to print or download again.

Form popularity

FAQ

The notes are used to make important disclosures that explain the assumptions used to prepare the financial statements of a company. Common notes to the financial statements include accounting policies, depreciation of assets, inventory valuation, subsequent events, etc.

The notes to the financial statements communicate information necessary for a fair presentation of financial position and results of operations that is not readily apparent from, or not included in, the financial statements themselves.

Notes to the accounts detail and comment on the information presented in the Balance sheet, Income statement, and Cash flow statement. Notes to the accounts reflect the accounting principles and the facts that can have a significant impact on the judgment of the reader of accounting information.

A balance sheet (also known as a statement of financial position) is a summary of all your business assets (what your business owns) and liabilities (what your business owes). At any point in time, it shows you how much money you would have left over if you sold all your assets and paid off all your debts.

How to Prepare a Basic Balance SheetDetermine the Reporting Date and Period.Identify Your Assets.Identify Your Liabilities.Calculate Shareholders' Equity.Add Total Liabilities to Total Shareholders' Equity and Compare to Assets.10-Sept-2019

A company's balance sheet provides a tremendous amount of insight into its solvency and business dealings. 1 A balance sheet consists of three primary sections: assets, liabilities, and equity.

Notes to the financial statements disclose the detailed assumptions made by accountants when preparing a company's: income statement, balance sheet, statement of changes of financial position or statement of retained earnings. The notes are essential to fully understanding these documents.

Notes Payable on a Balance SheetNotes payable appear as liabilities on a balance sheet. The financial statements are key to both financial modeling and accounting.. Additionally, they are classified as current liabilities when the amounts are due within a year.

A company's balance sheet, also known as a "statement of financial position," reveals the firm's assets, liabilities and owners' equity (net worth).

Also known notes to financial statements, footnotes, notes to accounts are supporting information that is usually provided along with a company's final accounts or financial statements.