Virgin Islands Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance

Description

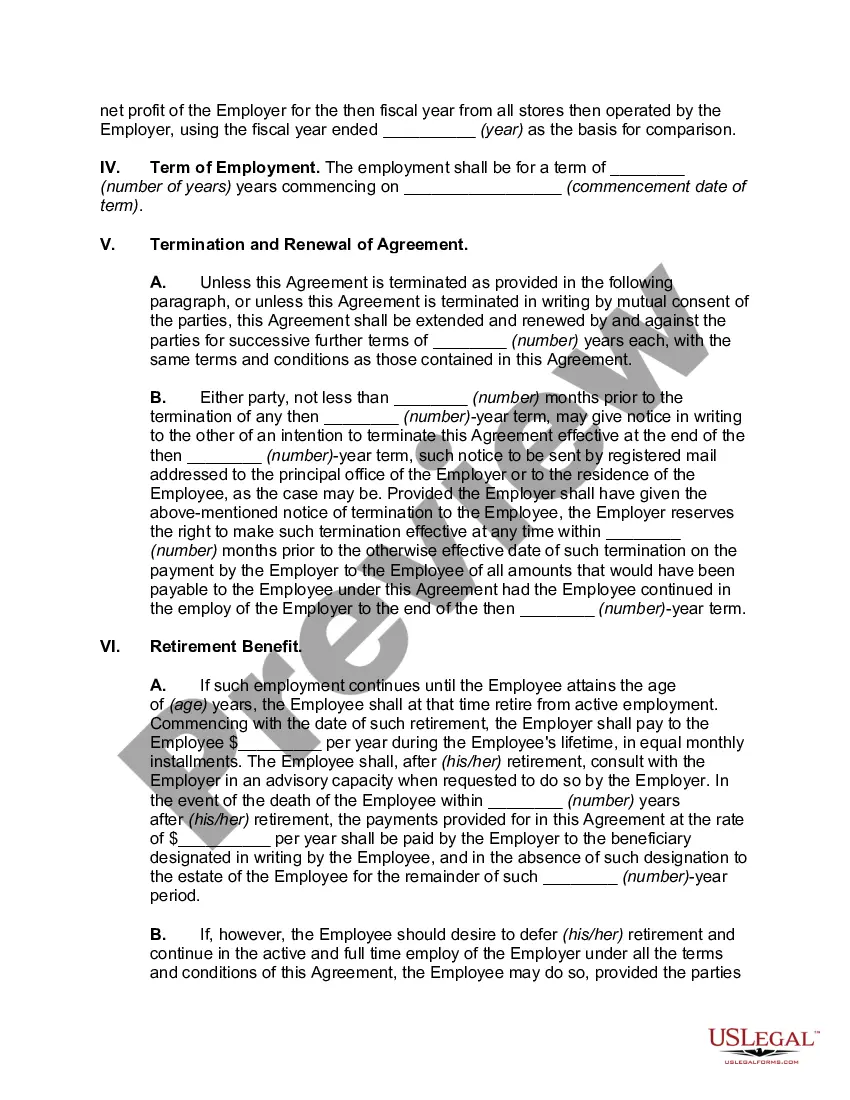

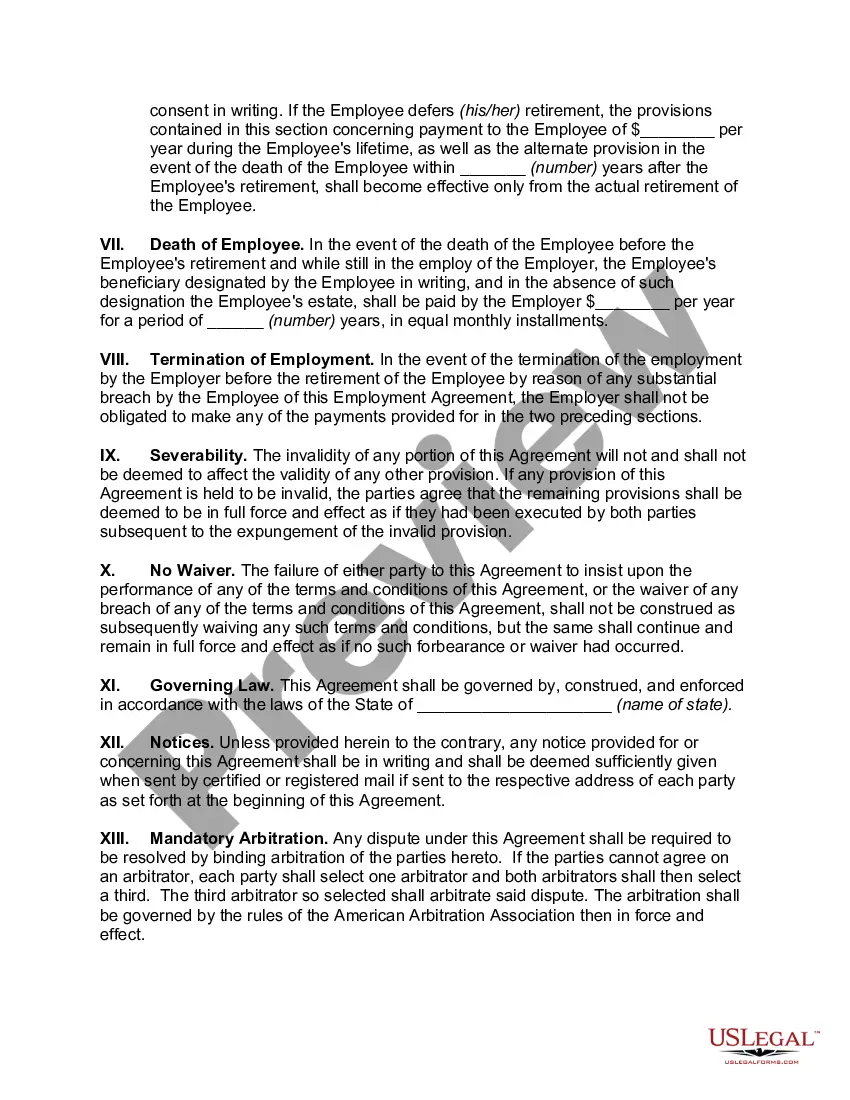

How to fill out Employment Agreement With Nonqualified Retirement Plan Funded With Life Insurance?

US Legal Forms - one of several largest libraries of legitimate kinds in the United States - offers an array of legitimate file themes you are able to obtain or print. While using internet site, you will get a huge number of kinds for business and specific functions, categorized by categories, says, or keywords.You can find the latest types of kinds much like the Virgin Islands Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance within minutes.

If you have a subscription, log in and obtain Virgin Islands Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance in the US Legal Forms collection. The Acquire key can look on every type you perspective. You have accessibility to all formerly delivered electronically kinds within the My Forms tab of your own bank account.

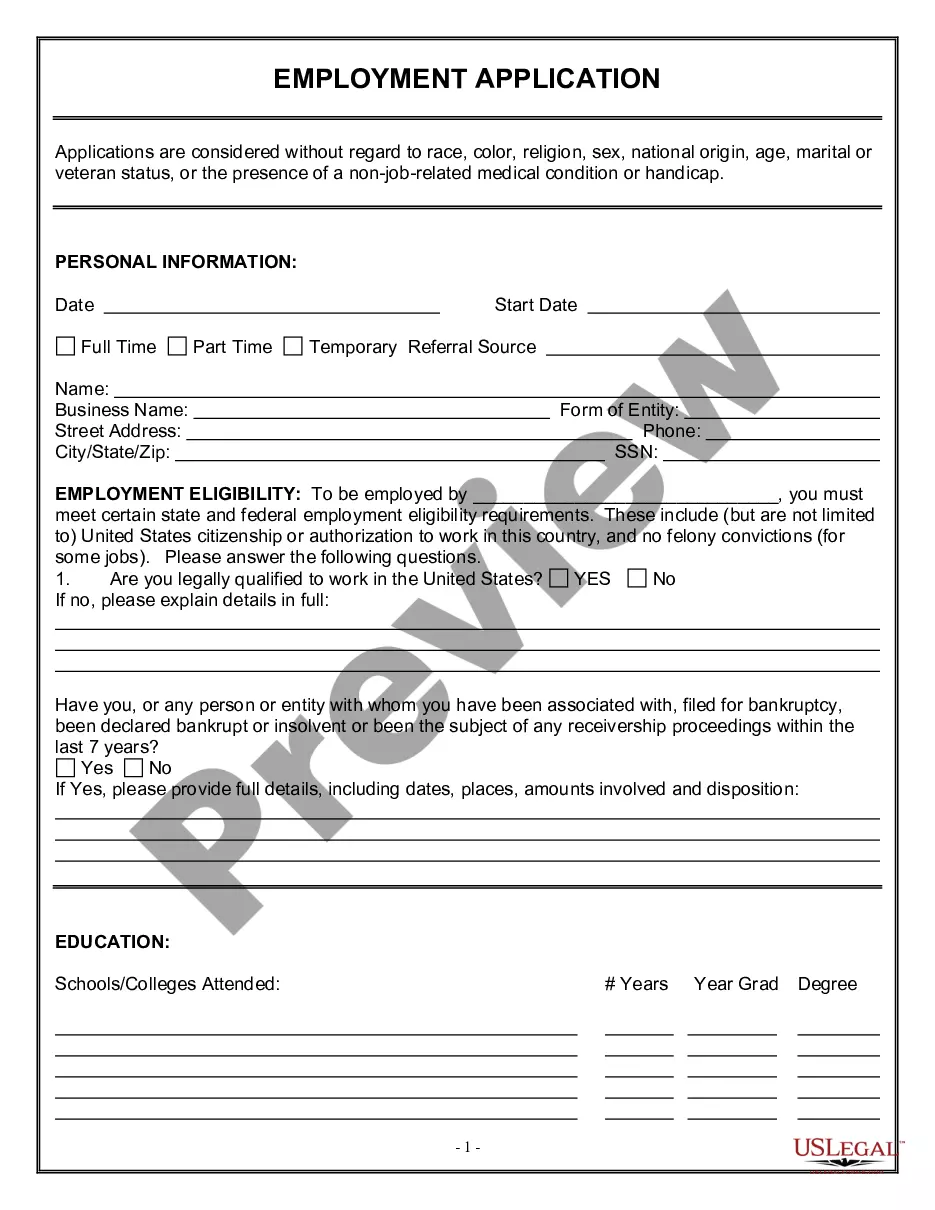

If you want to use US Legal Forms initially, allow me to share straightforward guidelines to get you started off:

- Be sure to have picked out the best type for the town/area. Click the Review key to examine the form`s information. Read the type information to ensure that you have chosen the appropriate type.

- In the event the type does not fit your specifications, make use of the Look for discipline towards the top of the display screen to find the one which does.

- Should you be satisfied with the shape, verify your choice by clicking the Get now key. Then, choose the rates strategy you like and supply your accreditations to register to have an bank account.

- Method the deal. Use your credit card or PayPal bank account to complete the deal.

- Find the structure and obtain the shape on the device.

- Make adjustments. Fill up, modify and print and indication the delivered electronically Virgin Islands Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance.

Every template you added to your money does not have an expiration day and it is your own eternally. So, if you wish to obtain or print another backup, just visit the My Forms section and click on the type you want.

Gain access to the Virgin Islands Employment Agreement with Nonqualified Retirement Plan Funded with Life Insurance with US Legal Forms, by far the most considerable collection of legitimate file themes. Use a huge number of professional and status-certain themes that meet up with your company or specific requirements and specifications.

Form popularity

FAQ

A NQDC plan is unfunded if either assets have not been set aside by your employer to pay plan benefits (that is, your employer pays benefits from its general assets on a "pay as you go" basis), or assets have been set aside but those assets remain subject to the claims of your employer's creditors (often referred to as

Traditionally, most benefits used to fall under one of the four major types of employee benefits, namely: medical insurance, life insurance, retirement plans, and disability insurance.

Employee welfare plans or welfare benefit plans These plans provide medical, health, and hospitalization benefits or income in the event of sickness, accident, or death. participants and/or employers to make tax-deferred contributions, that plan participants can access later (e.g., after they are 59½ years old).

Under ERISA, a welfare plan is any plan, program, or fund that an employer maintains to provide: medical, surgical, or hospital care. benefits for sickness, accident, disability, or death. unemployment benefits.

The term "employee benefit plan" is defined in section 3(3) of Title I of ERISA to include "an employee welfare benefit plan or an employee pension benefit plan or a plan which is both an employee welfare benefit plan and an employee pension benefit plan." Section 3(1) of ERISA defines "employee welfare benefit plan"

Qualified plans allow employees to put their money into a trust that's separate from your business' assets. An example would be 401(k) plans. Nonqualified deferred compensation plans let your employees put a portion of their pay into a permanent trust, where it grows tax deferred.

qualified deferred compensation (NQDC) plan allows a service provider (e.g., an employee) to earn wages, bonuses, or other compensation in one year but receive the earningsand defer the income tax on themin a later year.

Key Takeaways. Most employer-sponsored plans, such as a 401(k), fall under ERISA. Government employee plans and IRAs do not.

NQDC plans (sometimes known as deferred compensation programs, or DCPs, or elective deferral programs, or EDPs) allow executives to defer a much larger portion of their compensation and to defer taxes on the money until the deferral is paid.

Nonqualified plans are retirement savings plans. They are called nonqualified because unlike qualified plans they do not adhere to Employee Retirement Income Security Act (ERISA) guidelines. Nonqualified plans are generally used to provide high-paid executives with an additional retirement savings option.