A Virgin Islands Partnership Buy-Sell Agreement with Purchase on Death, Retirement, or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death serves as a legal document governing the terms and conditions of a partnership in the event of a partner's death, retirement, or withdrawal. It ensures a smooth transition of ownership and financial stability within the partnership. Here are some types of Partnership Buy-Sell Agreements commonly used in the Virgin Islands: 1. Cross-Purchase Agreement: In this type of agreement, each partner purchases a life insurance policy on the life of every other partner. Upon the death of a partner, the surviving partners use the insurance proceeds to buy the deceased partner's interest in the partnership. 2. Entity Redemption Agreement: Under this agreement, the partnership itself buys a life insurance policy on the life of each partner. In case a partner dies, the partnership uses the insurance proceeds to purchase the deceased partner's interest. 3. Wait-and-See Agreement: This agreement combines elements of both cross-purchase and entity redemption agreements. Initially, each partner purchases a life insurance policy on the other partners' lives. When a partner passes away, the surviving partners have the option to buy the deceased partner's interest. If they don't exercise this option, the partnership can purchase the interest using the insurance proceeds. 4. Retirement or Withdrawal Agreement: This provision in the Partnership Buy-Sell Agreement outlines the terms and conditions for a partner's retirement or voluntary withdrawal from the partnership. Life insurance policies are used to fund the purchase of the departing partner's interest. 5. Purchase on Disability Agreement: This type of agreement includes provisions for the purchase of a partner's interest if they become permanently disabled. It ensures a smooth transition and financial support for the disabled partner. 6. Guaranteed Insurability Agreement: This provision allows for the periodic updates and adjustments of the life insurance policies owned by partners, ensuring that coverage is adequate based on changes in their financial circumstances and partnership interests. A Partnership Buy-Sell Agreement is a crucial document for any partnership as it protects the interests of both the surviving partners and the estate of a deceased or withdrawing partner. It provides financial security, maintains the continuity of the partnership, and allows for an orderly transfer of ownership.

Virgin Islands Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death

Description

How to fill out Virgin Islands Partnership Buy-Sell Agreement With Purchase On Death, Retirement Or Withdrawal Of Partner With Life Insurance On Each Partner To Fund Purchase In Case Of Death?

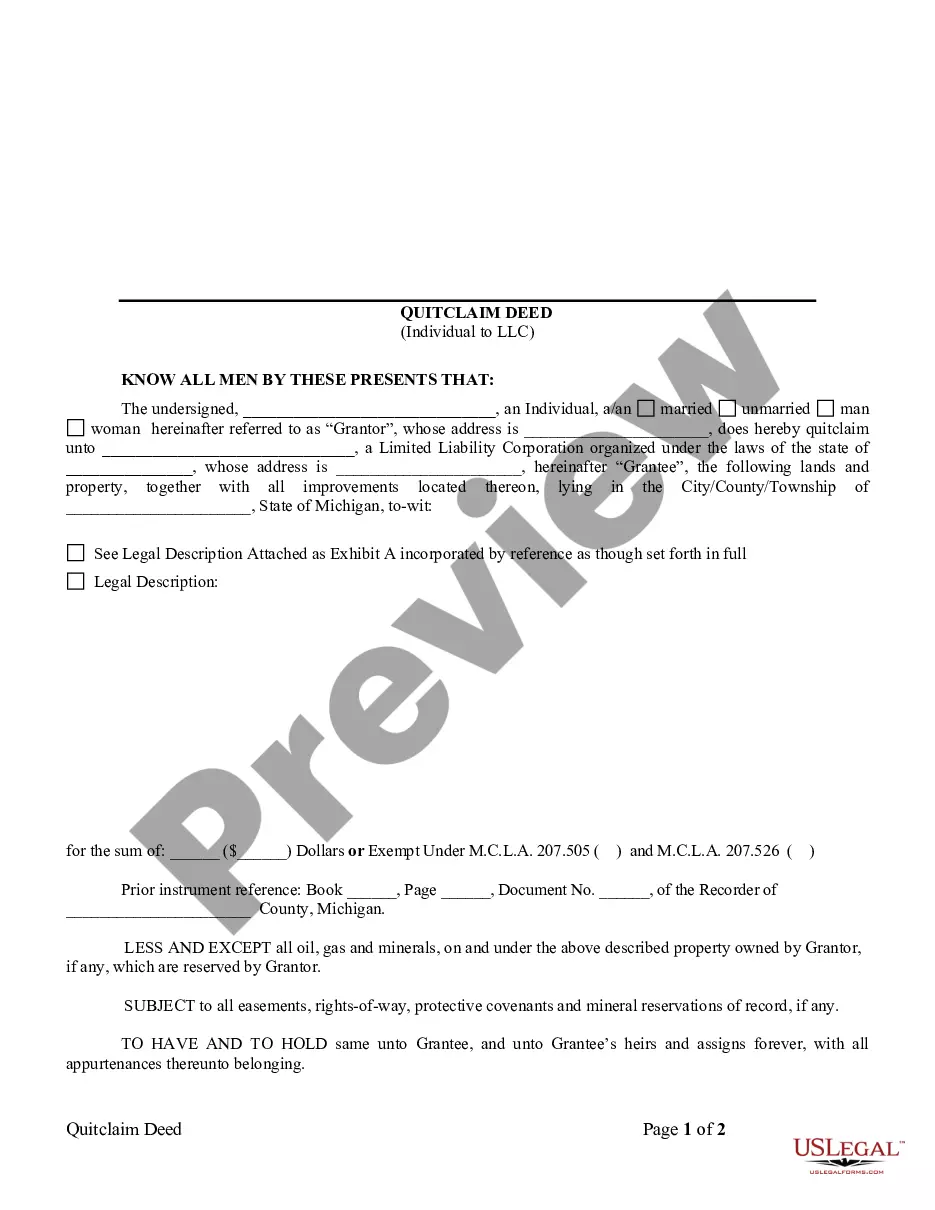

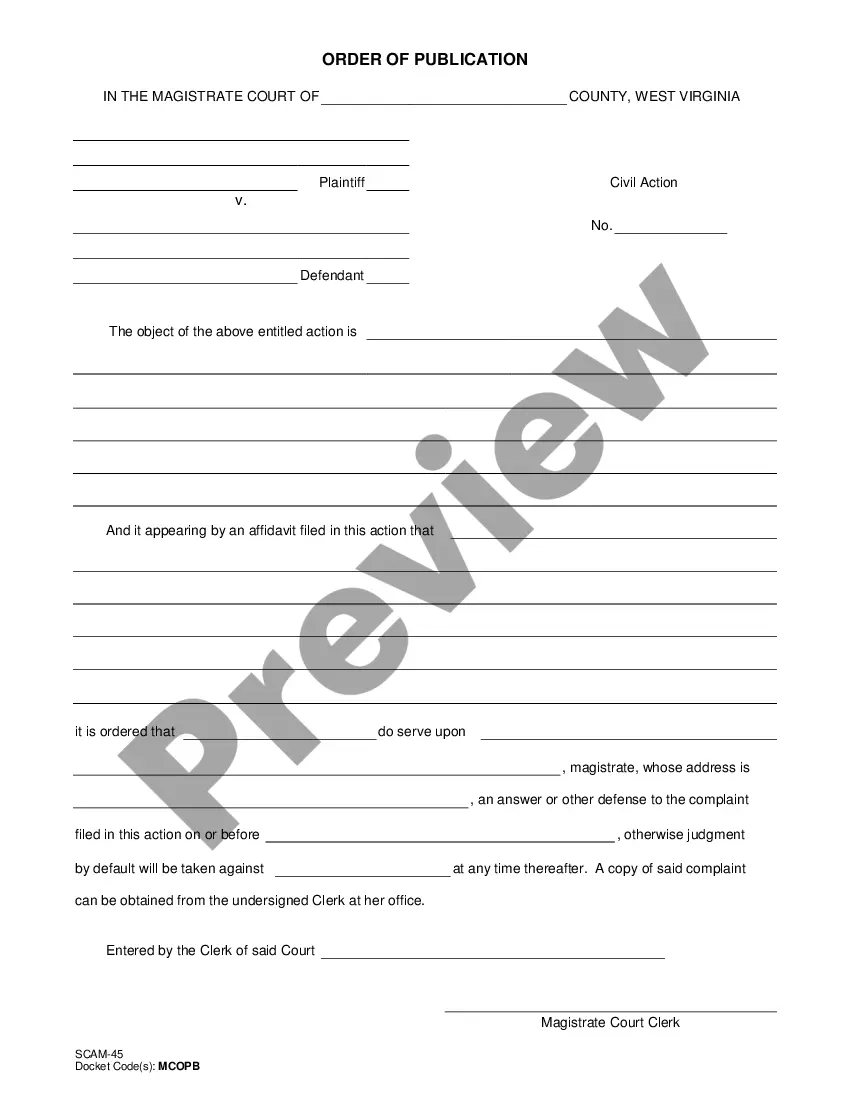

Have you been within a place in which you require papers for possibly company or personal functions virtually every day? There are a variety of authorized document themes available on the net, but locating kinds you can trust isn`t easy. US Legal Forms provides thousands of type themes, such as the Virgin Islands Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death, that are created in order to meet federal and state demands.

If you are previously knowledgeable about US Legal Forms internet site and have your account, simply log in. After that, it is possible to down load the Virgin Islands Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death design.

If you do not come with an account and would like to begin to use US Legal Forms, follow these steps:

- Get the type you want and make sure it is for that proper metropolis/county.

- Utilize the Preview key to review the form.

- Read the description to actually have chosen the correct type.

- When the type isn`t what you are looking for, use the Lookup field to get the type that suits you and demands.

- When you discover the proper type, simply click Get now.

- Select the prices strategy you need, fill out the specified information and facts to generate your money, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free file file format and down load your copy.

Discover each of the document themes you might have purchased in the My Forms food list. You can obtain a additional copy of Virgin Islands Partnership Buy-Sell Agreement with Purchase on Death, Retirement or Withdrawal of Partner with Life Insurance on Each Partner to Fund Purchase in Case of Death any time, if needed. Just click on the necessary type to down load or print out the document design.

Use US Legal Forms, the most substantial selection of authorized forms, to save some time and prevent mistakes. The service provides appropriately produced authorized document themes that can be used for a variety of functions. Create your account on US Legal Forms and begin generating your lifestyle a little easier.