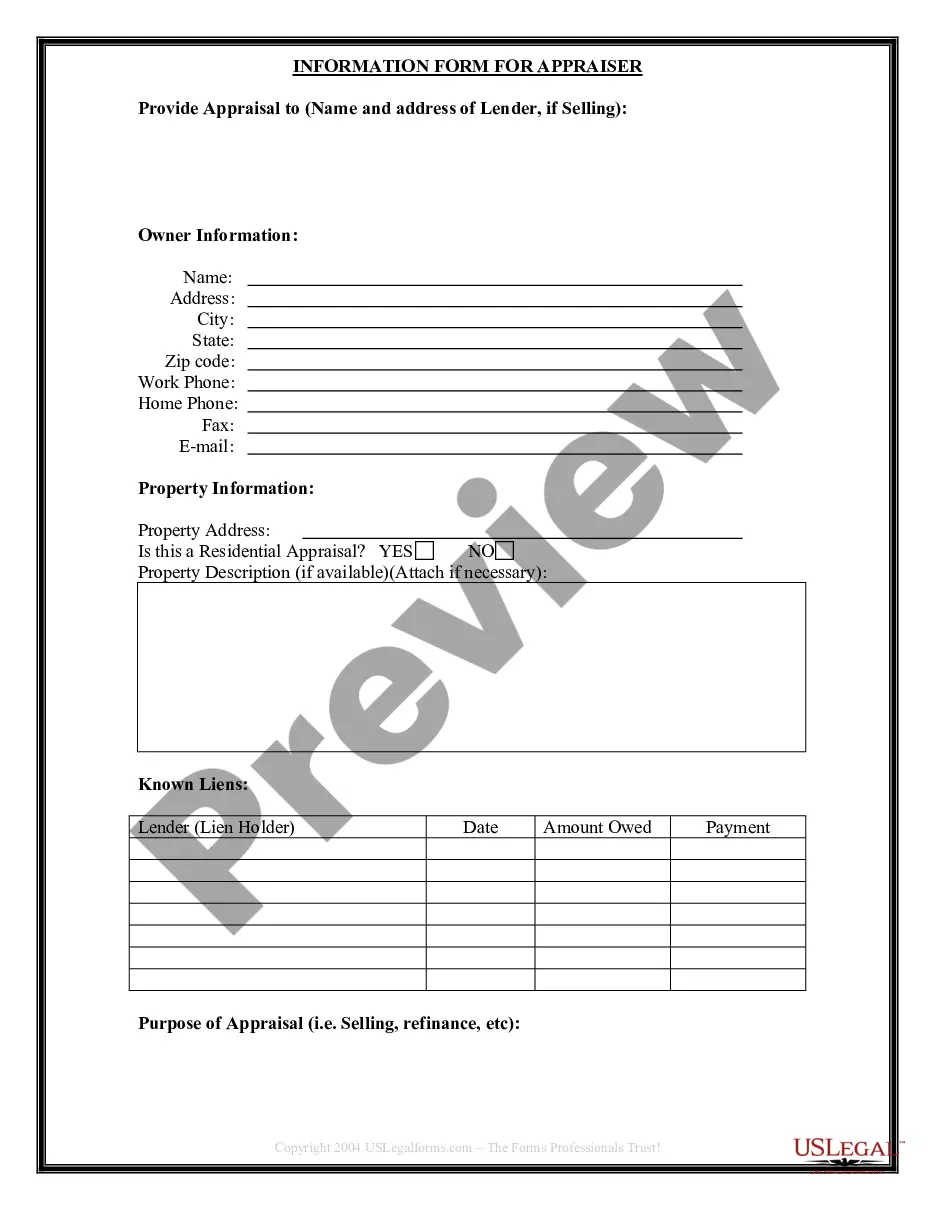

Virgin Islands Credit Approval Form is a document used to assess and approve credit requests in the Virgin Islands. It is a crucial step in determining an individual or business's eligibility for credit from financial institutions operating within the region. This form is designed to gather essential information about the applicant's credit history, financial standing, and other relevant details that help the lender make an informed decision. The Virgin Islands Credit Approval Form typically consists of several sections that require the applicant to provide personal and financial data, including their full name, contact information, social security number, employment history, and income sources. Additionally, the form may also ask for details about the applicant's current debts, assets, and liabilities, which helps the lender ascertain the individual or business's current financial obligations and their ability to fulfill these commitments. This form is essential in evaluating the creditworthiness of applicants and determining the loan amount, interest rate, and repayment terms offered to them. It assists the lender in minimizing potential risks associated with extending credit and ensures that the decision-making process is fair and objective, based on the provided information. Different types of Virgin Islands Credit Approval Forms may exist based on the specific loan or credit product being applied for. Some common variants include: 1. Personal Credit Approval Form: This form is specifically designed for individuals seeking personal loans or credit cards. It focuses on personal financial information such as income, expenses, credit history, and employment details. 2. Business Credit Approval Form: This form is tailored for businesses or organizations applying for credit facilities or loans. It typically requires details about the business's financial performance, ownership structure, industry, and projected revenue. 3. Mortgage Credit Approval Form: This form is used specifically for individuals or couples applying for a mortgage loan. It collects information related to the property being mortgaged, employment history, income, and other relevant details required for the mortgage approval process. 4. Auto Loan Credit Approval Form: This form is employed by individuals seeking credit to finance the purchase of a vehicle. It typically gathers information such as the desired vehicle's make, model, price, income, and employment details to assess the applicant's ability to repay the loan. Overall, the Virgin Islands Credit Approval Form plays a pivotal role in the credit evaluation process, serving as a standardized means to collect crucial information and aid lenders in assessing an applicant's creditworthiness accurately. Its utilization ensures transparency, compliance, and fairness throughout the credit approval procedure.

Virgin Islands Credit Approval Form

Description

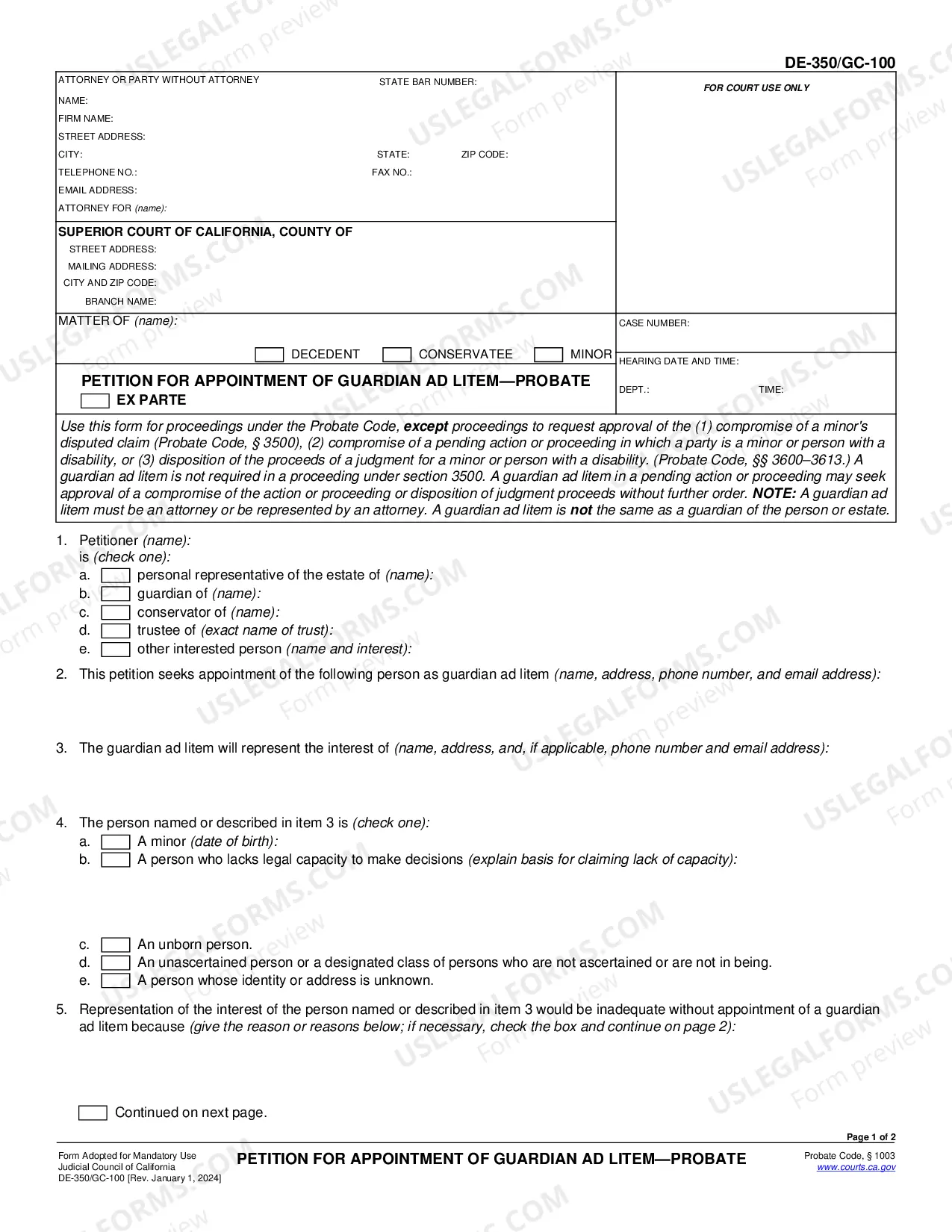

How to fill out Virgin Islands Credit Approval Form?

Have you been inside a position in which you need paperwork for both enterprise or specific purposes virtually every day time? There are plenty of legitimate document themes available on the Internet, but discovering types you can trust isn`t easy. US Legal Forms gives a large number of kind themes, just like the Virgin Islands Credit Approval Form, which can be created to satisfy federal and state needs.

In case you are previously knowledgeable about US Legal Forms site and have your account, just log in. Following that, you can obtain the Virgin Islands Credit Approval Form web template.

If you do not provide an accounts and want to begin to use US Legal Forms, follow these steps:

- Discover the kind you will need and ensure it is for the appropriate town/county.

- Take advantage of the Preview switch to examine the form.

- Read the information to ensure that you have selected the appropriate kind.

- If the kind isn`t what you are looking for, utilize the Search field to discover the kind that fits your needs and needs.

- When you find the appropriate kind, just click Acquire now.

- Opt for the costs strategy you would like, complete the necessary information and facts to produce your bank account, and pay money for an order with your PayPal or charge card.

- Choose a practical document file format and obtain your version.

Get each of the document themes you might have purchased in the My Forms food selection. You may get a more version of Virgin Islands Credit Approval Form whenever, if possible. Just click the necessary kind to obtain or printing the document web template.

Use US Legal Forms, one of the most substantial selection of legitimate kinds, to conserve time and prevent mistakes. The services gives skillfully produced legitimate document themes that can be used for a range of purposes. Produce your account on US Legal Forms and begin producing your lifestyle easier.