The Virgin Islands Liquidation of Partnership is a legal process that involves the winding up and dissolution of a partnership entity registered in the Virgin Islands. During this process, the partnership's assets are liquidated, and its affairs are settled. The authority to initiate the liquidation process lies with the partners themselves or a court-appointed liquidator. Once the decision to liquidate is made, several rights and obligations come into play. 1. Authority to Liquidate: The partners or the court-appointed liquidator have the authority to oversee the liquidation process. They are responsible for ensuring all necessary legal and administrative tasks are completed. 2. Winding Up of Affairs: During the liquidation process, the partnership's affairs are brought to an end. This includes settling outstanding obligations, collecting receivables, and paying off debts. The partners must act in the best interest of the partnership, adhering to the agreed-upon partnership agreement, and comply with the governing laws of the Virgin Islands. 3. Distribution of Assets: The partnership's assets, after satisfying outstanding obligations, are distributed among the partners according to their respective ownership interests or as agreed upon in the partnership agreement. This distribution may involve either cash payments or the transfer of specific assets. 4. Debts and Liabilities: Partners are jointly and severally liable for the partnership's debts and obligations. The liquidation process ensures that all creditors are paid from the partnership's assets. In case the assets are insufficient to settle all obligations, partners may need to contribute additional funds as per their shares or as per any agreed arrangements. 5. Dissolution and Termination: Once the liquidation process is complete, the partnership is dissolved, and its existence ceases. It is important to follow the formal dissolution requirements under the Virgin Islands laws, which may include filing dissolution documents with the appropriate government authorities. Different types of Virgin Islands Liquidation of Partnership with Authority, Rights, and Obligations during Liquidation may include: 1. Voluntary Liquidation: When the partners voluntarily decide to dissolve the partnership due to various reasons such as retirement, change in circumstances, or achievement of specific goals. 2. Court-Ordered Liquidation: In certain circumstances, a court may order the liquidation of a partnership following a dissolution petition filed by a partner or on the grounds of misconduct, fraud, or other serious issues. 3. Insolvent Liquidation: If the partnership is unable to pay its debts and obligations, an insolvent liquidation may be initiated. In such cases, a liquidator is appointed to manage the winding up process and distribution of assets fairly among creditors. In conclusion, the Virgin Islands Liquidation of Partnership with Authority, Rights, and Obligations during Liquidation involves the winding up and dissolution of a partnership entity. The partners or court-appointed liquidators have the authority to initiate and oversee the liquidation process, settle obligations, distribute assets, and ultimately dissolve the partnership entity. Different types of liquidation can include voluntary, court-ordered, or insolvent liquidations.

Virgin Islands Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

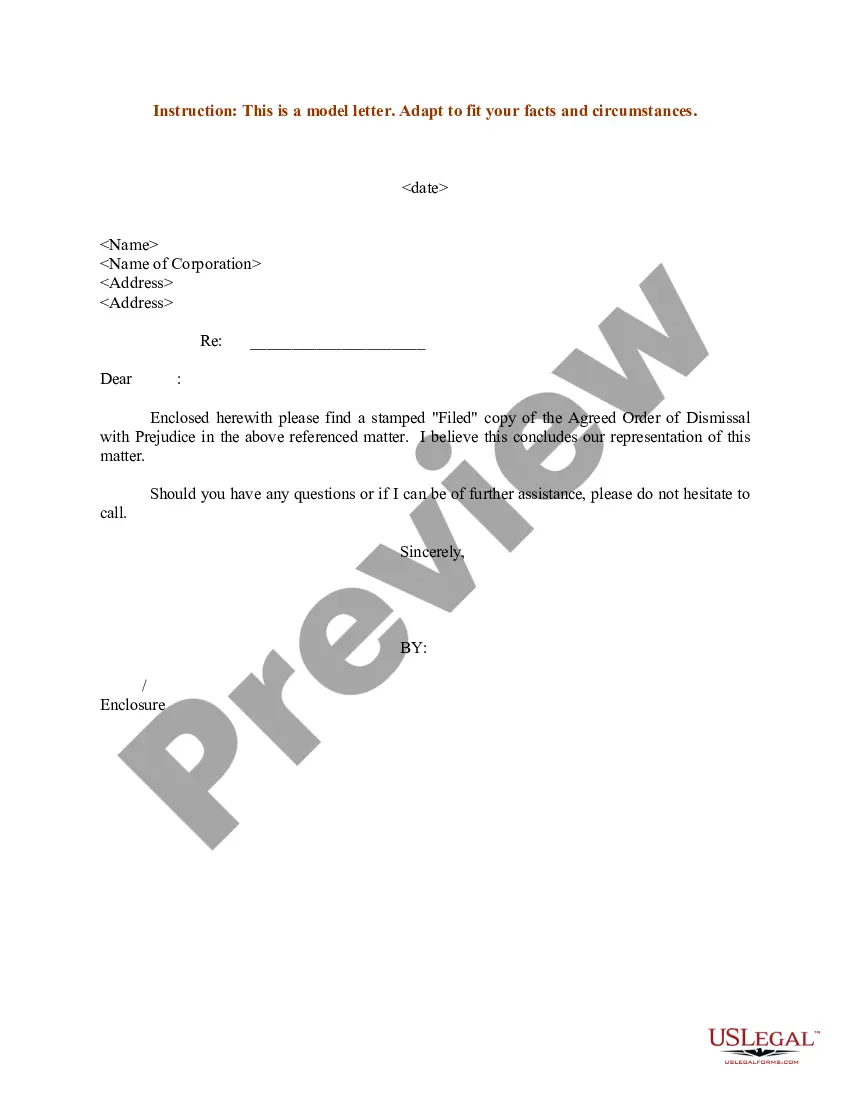

How to fill out Virgin Islands Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

US Legal Forms - among the greatest libraries of lawful kinds in America - provides a variety of lawful record layouts you may down load or print. Making use of the internet site, you may get a huge number of kinds for enterprise and personal purposes, sorted by types, says, or key phrases.You can find the latest variations of kinds like the Virgin Islands Liquidation of Partnership with Authority, Rights and Obligations during Liquidation in seconds.

If you currently have a membership, log in and down load Virgin Islands Liquidation of Partnership with Authority, Rights and Obligations during Liquidation from your US Legal Forms catalogue. The Acquire option will appear on each and every develop you see. You gain access to all formerly delivered electronically kinds inside the My Forms tab of your respective bank account.

If you wish to use US Legal Forms the first time, here are basic directions to help you get started:

- Make sure you have picked the correct develop to your town/state. Click on the Review option to analyze the form`s content. See the develop explanation to actually have selected the proper develop.

- If the develop doesn`t satisfy your requirements, use the Search area towards the top of the display screen to discover the one who does.

- If you are pleased with the form, validate your decision by simply clicking the Acquire now option. Then, select the prices strategy you prefer and offer your qualifications to sign up for the bank account.

- Process the deal. Make use of Visa or Mastercard or PayPal bank account to accomplish the deal.

- Choose the structure and down load the form on your own gadget.

- Make changes. Fill out, change and print and sign the delivered electronically Virgin Islands Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Each and every design you put into your money lacks an expiration date and it is your own property forever. So, in order to down load or print another version, just visit the My Forms area and then click on the develop you need.

Get access to the Virgin Islands Liquidation of Partnership with Authority, Rights and Obligations during Liquidation with US Legal Forms, probably the most comprehensive catalogue of lawful record layouts. Use a huge number of specialist and status-specific layouts that meet your business or personal requirements and requirements.

Form popularity

FAQ

If the debtor company is in possession of goods belonging to a creditor, and the creditor can prove ownership, they have the right to make a claim for their return, or reimbursement via the liquidator. Unsecured creditors can claim interest on the debt up to the date of liquidation under certain circumstances.

A liquidator must be a natural person and cannot be a corporate entity. However, certain individuals are restricted from acting as liquidators including undischarged bankrupts and persons (and their close relatives) involved in the management of the company in the previous two years.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

If a contract with a dissolved company exists, the contract will stay legally valid. The only exception to this rule is if there was a lease termination clause negotiated into your contract that specifically addresses your business closing.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

The rules require an insolvency professional to be independent of the corporate debtor in order to act as a liquidator for the company. Under IBC, a liquidator attempts to realise the assets of the company at the best possible value under the supervision of the National Company Law Tribunal (NCLT).

(2) A secured creditor participating in the meetings of the creditors and voting in relation to the repayment plan shall forfeit his right to enforce the security during the period of the repayment plan in accordance with the terms of the repayment plan. (b) the estimated value of the unsecured part of the debt.

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.

Contracts When a Business is Bought or Sold As part of the buy/sell process, a new contract may be substituted for a previous contract, with the agreement of both parties.

Effect of liquidation on uncompleted contracts The liquidator cannot be compelled by the other contracting party to render specific performance in terms of the contract; however, the other contracting party remains vested with its normal common law contractual rights to cancel the contract after liquidation.