Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities is a legal process wherein a partnership based in the Virgin Islands decides to dissolve and wind up its operations. This procedure involves selling off the partnership's assets and transferring its liabilities to another entity, thereby settling its outstanding obligations. Here, we will explore the various aspects of this process, including the different types of Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities. One type of Virgin Islands Liquidation of Partnership is the Voluntary Liquidation. This occurs when partners mutually agree to dissolve the partnership and initiate the liquidation process. It involves selling the partnership's assets, paying off creditors, distributing remaining funds among partners, and ultimately terminating the partnership's legal existence. This method allows partners to have more control over the liquidation process and encourages a more organized winding up of affairs. Another type is the Involuntary Liquidation, also known as Forced Liquidation. This occurs when an external party initiates the liquidation process due to legal proceedings or violations of partnership agreements. In such cases, the court appoints a liquidator to oversee the winding up of the partnership's operations, including the sale of assets and assumption of liabilities. It ensures that the partnership's affairs are handled impartially and transparently. During the Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities, the first step involves conducting a comprehensive inventory and valuation of the partnership's assets. This assessment helps determine the current value of assets and facilitates the subsequent sale or transfer process. The partnership may choose to sell the assets individually or as a bundle to a willing buyer. The proceeds from the asset sales are then utilized to settle outstanding liabilities and obligations. Furthermore, the assumption of liabilities is a crucial aspect of the liquidation process. As part of the sale of assets, the partnership needs to transfer any outstanding debts, loans, or contractual obligations to the buyer or a new entity willing to assume these liabilities. Transferring liabilities ensures that the partnership fulfills its commitments and allows for a seamless transition of responsibilities. It is important to note that the Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities process is subject to specific legal provisions, regulations, and tax considerations within the jurisdiction. Partnerships should consult with knowledgeable legal and financial professionals to ensure compliance with all legal requirements and maximize the benefits of the liquidation process. In conclusion, Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities involves dissolving a partnership through the sale of assets and the transfer of liabilities. The voluntary and involuntary liquidation methods offer different approaches to winding up the partnership's operations. It is crucial for partnerships to conduct thorough asset valuations, plan for liabilities, and seek professional advice to navigate this intricate process successfully.

Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities

Description

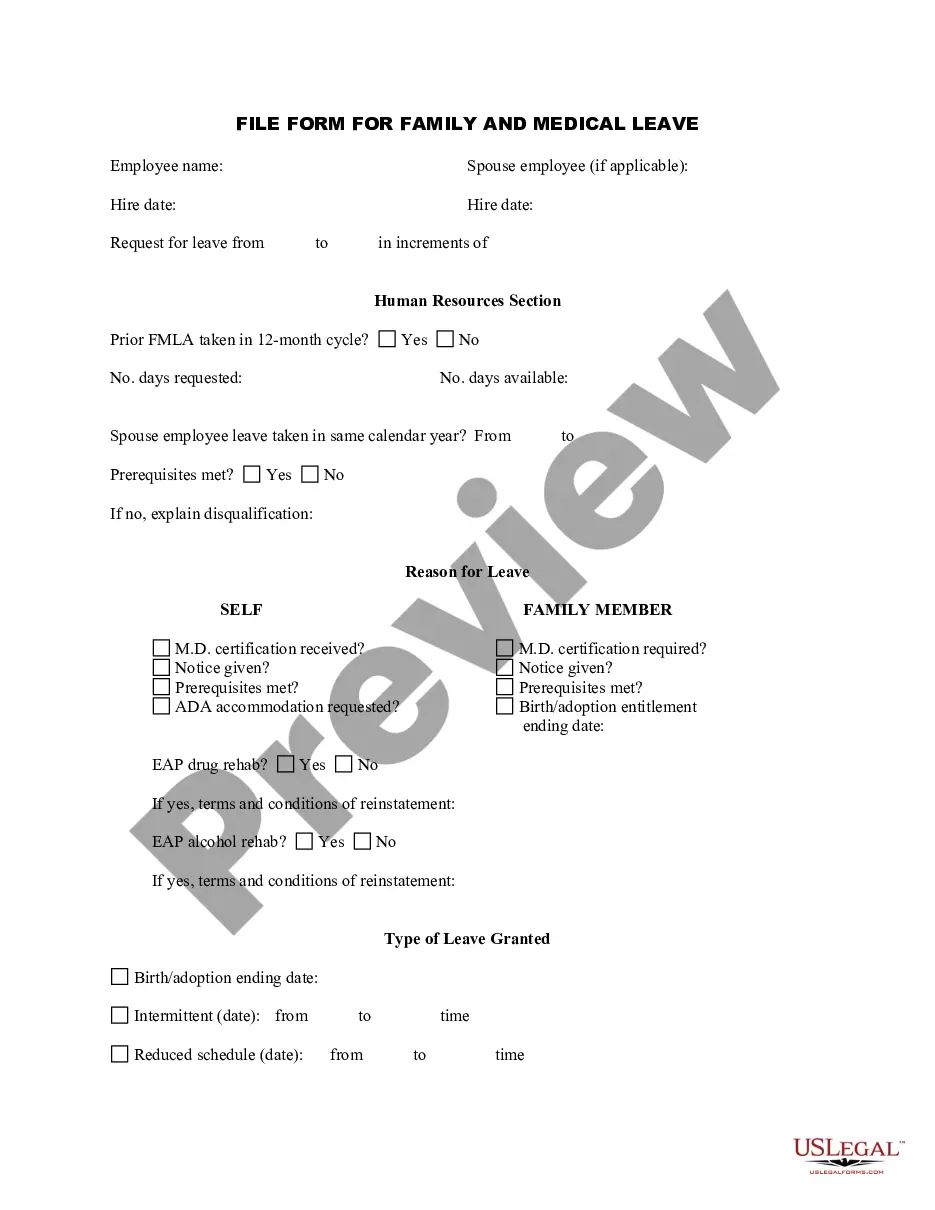

How to fill out Virgin Islands Liquidation Of Partnership With Sale Of Assets And Assumption Of Liabilities?

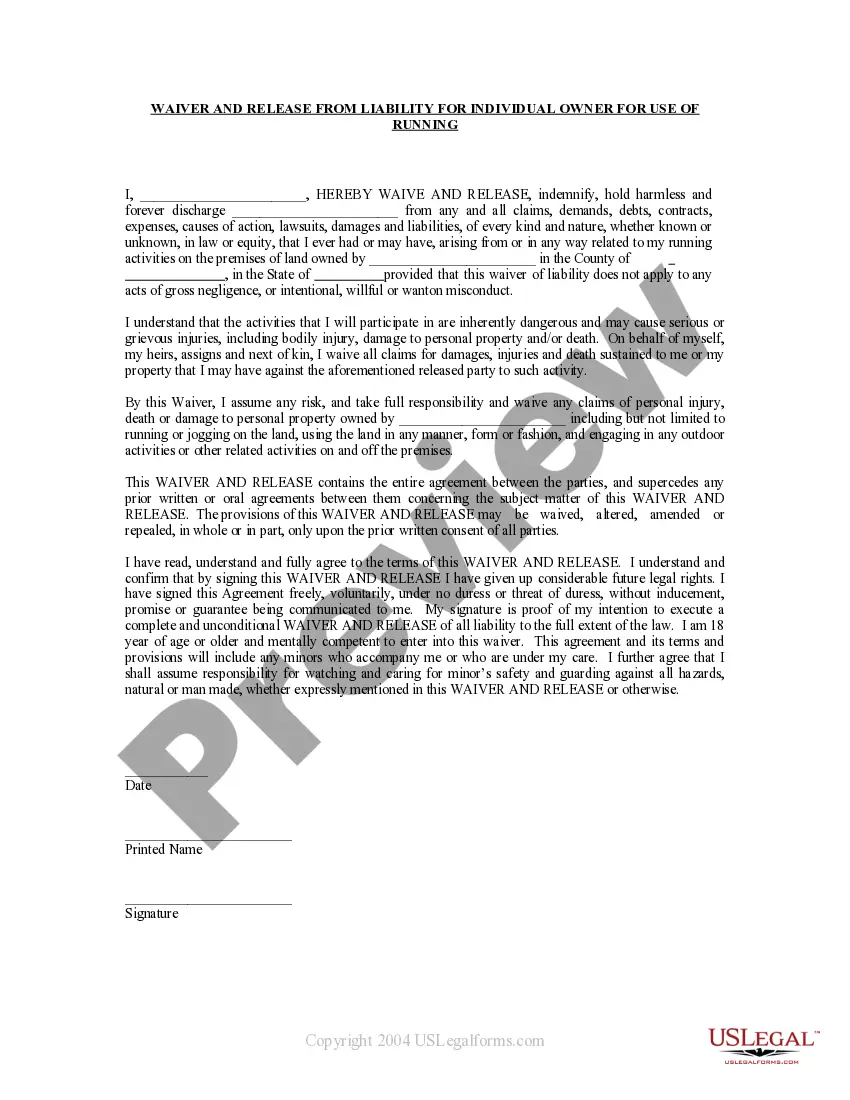

If you have to complete, download, or print authorized document templates, use US Legal Forms, the most important selection of authorized types, which can be found online. Take advantage of the site`s simple and practical research to get the paperwork you need. A variety of templates for company and personal purposes are sorted by types and claims, or search phrases. Use US Legal Forms to get the Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities within a number of mouse clicks.

If you are currently a US Legal Forms customer, log in for your account and then click the Download switch to obtain the Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities. You may also entry types you formerly delivered electronically from the My Forms tab of your account.

If you are using US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form to the correct town/region.

- Step 2. Make use of the Preview solution to examine the form`s content material. Do not overlook to read the information.

- Step 3. If you are unsatisfied with the type, utilize the Research discipline near the top of the display to discover other variations in the authorized type web template.

- Step 4. Upon having identified the form you need, click the Get now switch. Opt for the pricing strategy you favor and add your accreditations to register to have an account.

- Step 5. Procedure the deal. You should use your charge card or PayPal account to finish the deal.

- Step 6. Select the structure in the authorized type and download it on your gadget.

- Step 7. Total, change and print or sign the Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities.

Every single authorized document web template you get is the one you have for a long time. You have acces to each type you delivered electronically within your acccount. Go through the My Forms area and pick a type to print or download yet again.

Remain competitive and download, and print the Virgin Islands Liquidation of Partnership with Sale of Assets and Assumption of Liabilities with US Legal Forms. There are millions of skilled and express-particular types you may use for your personal company or personal needs.

Form popularity

FAQ

The purpose of liquidation is to ensure that all the company's affairs have been dealt with and all its assets realised. When this has been done, the liquidator will apply to have the company removed from the register at the Companies House and dissolved, which means it ceases to exist.

The liquidation period starts when the notice of the liquidator's appointment is filed. The liquidation must then be advertised in the Official Gazette in the BVI and one other national newspaper, and in a national newspaper in the main trading jurisdiction. The liquidator then takes control and custody of the assets.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

The liquidator needs to be an eligible individual, but need not be resident in the British Virgin Islands and may not be (nor have been for two years prior to the liquidation) a senior manager or a director of the company to be liquidated or an affiliated company.

Allow a creditor to force the company into a compulsory liquidation. This is the cheapest option in that it doesn't actualy cost you anything.

The answer is no, you cannot liquidate your own company, because you need to be a licensed insolvency practitioner to liquidate a company!

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

It can be completed in as little as 4 to 6 weeks. Allowing or applying for the company to be struck off the register is, on paper, a simpler and quicker process.

The creditors' voluntary liquidation processCompany is unable to pay its debts.A liquidator is appointed.The liquidator publishes a notice on the ASIC Published Notices website.Creditors are notified of the liquidation.Creditors' meeting.The administration of the liquidation begins.Completion.