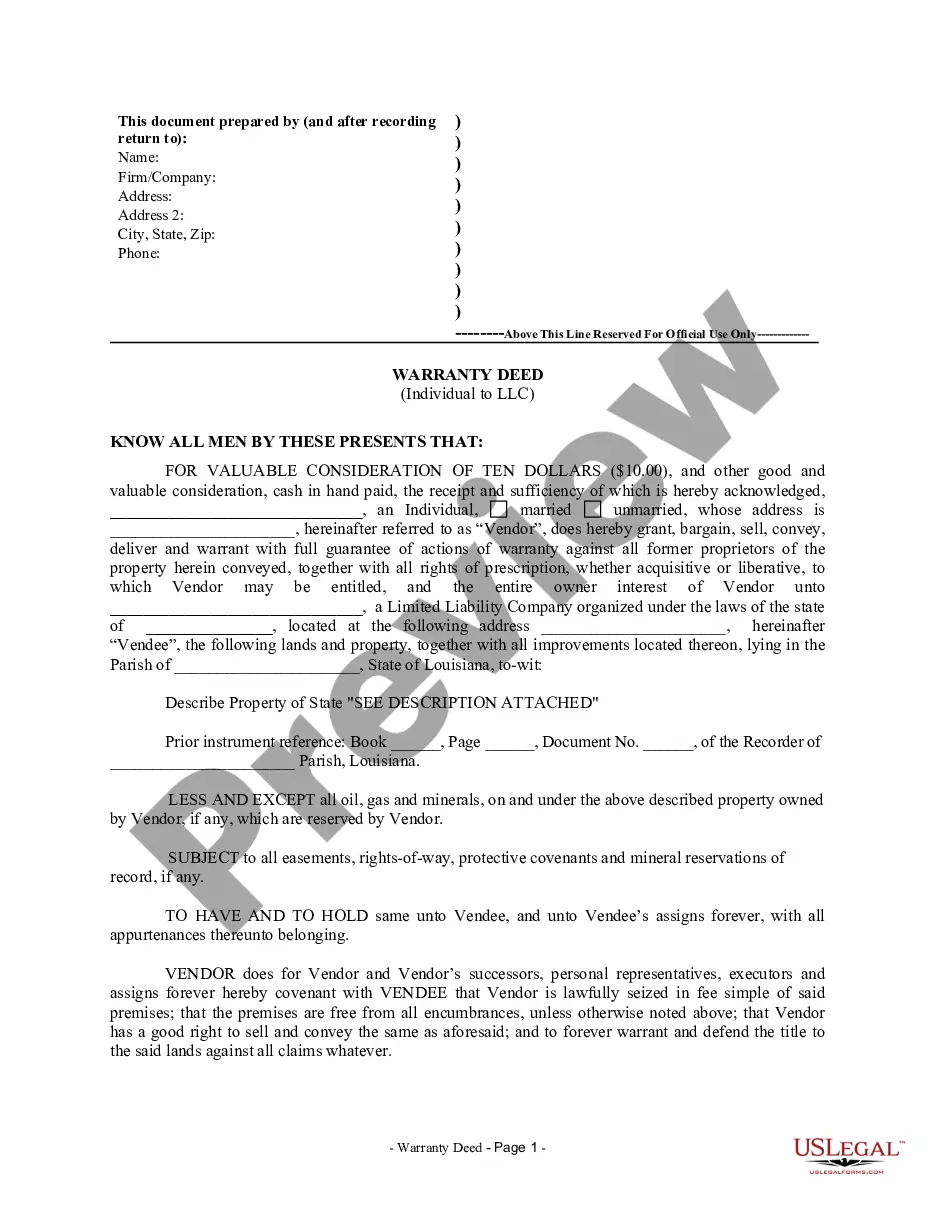

A Virgin Islands Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases is a legal document outlining the terms and conditions of employment between an executive and a company operating in the Virgin Islands. This agreement is designed to provide the executive with certain benefits, including deferred compensation and cost-of-living increases, in order to attract and retain top talent while ensuring their financial stability. Deferred compensation refers to a portion of the executive's salary or bonus that is set aside and paid at a later date, typically upon the occurrence of a specific event such as retirement, termination, or completion of a designated term. This arrangement allows the executive to defer their tax liability and potentially receive additional financial benefits in the future. Cost-of-living increases, on the other hand, aim to ensure that the executive's compensation is adjusted to reflect changes in the cost of living over time. This provision helps to protect the executive's purchasing power and maintain a fair and competitive compensation package in an evolving economic environment. There may be different types of Virgin Islands Employment Agreements of Executive with Deferred Compensation and Cost-of-Living Increases, each tailored to meet the specific needs and objectives of both the company and the executive. Some variations include: 1. Defined Benefit Deferred Compensation Agreement: This type of agreement guarantees a specific amount of deferred compensation to be paid to the executive upon the occurrence of the triggering event. The benefit is often calculated based on factors such as the executive's years of service, salary, and performance. 2. Defined Contribution Deferred Compensation Agreement: In this arrangement, the company contributes a certain percentage of the executive's salary or bonus into a deferred compensation account. The actual benefit that the executive will receive in the future is based on the performance and growth of the account over time. 3. Cost-of-Living Increases with Adjustable Base Salary: This agreement ensures that the executive's base salary is periodically adjusted in line with the changes in the cost of living. The adjustment may be based on a predetermined index, such as the Consumer Price Index (CPI), or other relevant economic indicators. 4. Combination Agreement: This type of agreement combines both deferred compensation and cost-of-living increases to provide the executive with a comprehensive and attractive compensation package. It may include elements from the aforementioned agreements, tailored to meet the unique circumstances and priorities of the executive and the company. It is crucial for both parties involved to consult legal and financial advisors to ensure that the terms and provisions of the Virgin Islands Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases are fair, compliant with local laws, and aligned with their mutual interests.

Virgin Islands Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases

Description

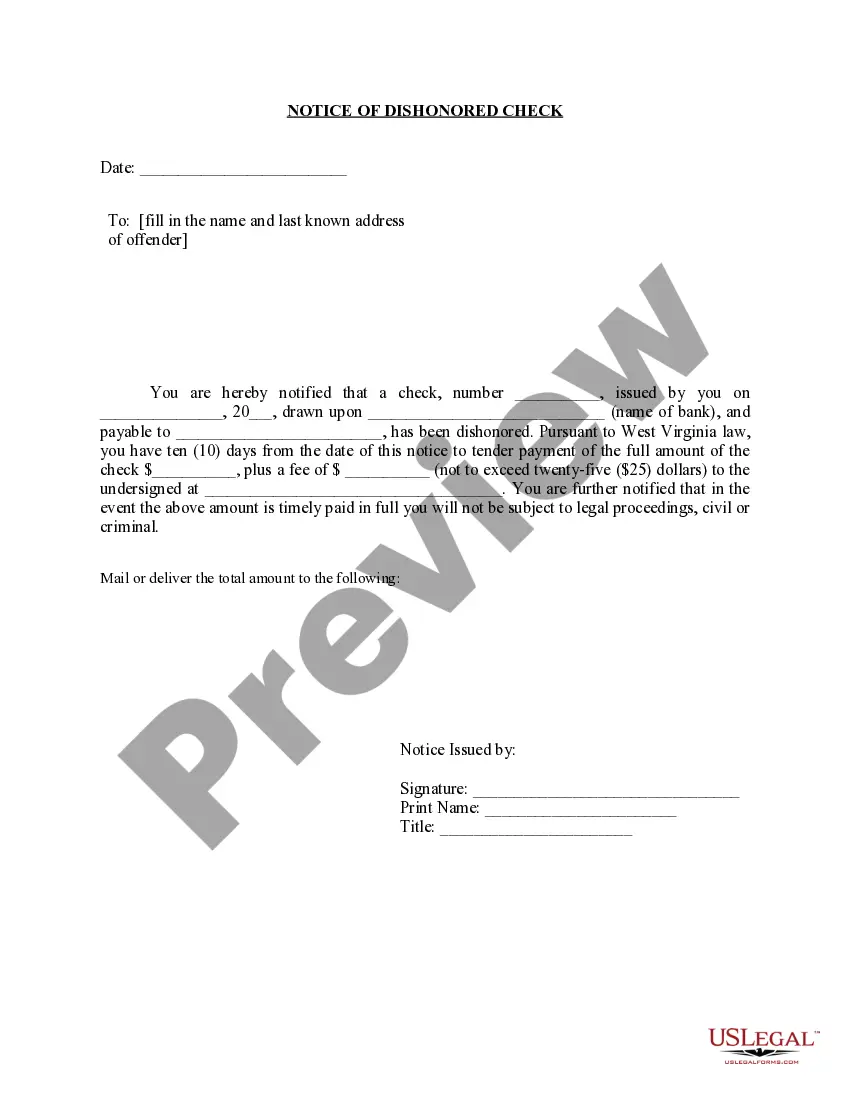

How to fill out Virgin Islands Employment Agreement Of Executive With Deferred Compensation And Cost-of-Living Increases?

Discovering the right legal papers format might be a struggle. Naturally, there are plenty of layouts available on the Internet, but how will you find the legal develop you need? Make use of the US Legal Forms site. The service provides a huge number of layouts, such as the Virgin Islands Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases, that can be used for organization and private requires. Every one of the forms are checked out by specialists and fulfill state and federal specifications.

If you are presently authorized, log in in your bank account and click the Acquire key to get the Virgin Islands Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases. Utilize your bank account to look from the legal forms you might have acquired previously. Go to the My Forms tab of your bank account and get yet another copy from the papers you need.

If you are a fresh customer of US Legal Forms, here are straightforward directions that you can adhere to:

- Very first, ensure you have chosen the correct develop for your metropolis/county. You may examine the shape utilizing the Review key and look at the shape outline to ensure it will be the right one for you.

- If the develop does not fulfill your preferences, utilize the Seach area to obtain the correct develop.

- Once you are certain that the shape is proper, click the Get now key to get the develop.

- Pick the costs program you want and enter the necessary information and facts. Build your bank account and pay money for the order making use of your PayPal bank account or bank card.

- Select the document format and acquire the legal papers format in your gadget.

- Complete, modify and print and indication the obtained Virgin Islands Employment Agreement of Executive with Deferred Compensation and Cost-of-Living Increases.

US Legal Forms will be the biggest local library of legal forms where you can find various papers layouts. Make use of the company to acquire professionally-created papers that adhere to condition specifications.

Form popularity

FAQ

The Employee acknowledges and agrees that he is being offered a position of employment by the Company with the understanding that the Employee possesses a unique set of skills, abilities, and experiences which will benefit the Company, and he agrees that his continued employment with the Company, whether during the

An executive's employment agreement typically will set an effective date and state that the initial term of employment will be for a period of years subject to earlier termination under other provisions of the agreement.

An executive employment contract is an employment agreement between a company and an executive. These written contracts outline things like an executive's compensation, duties, bonuses, as well as competition, and confidentiality.

An executive compensation agreement is a binding contract between a company and one of its most important and powerful employees.

Remuneration is the total amount paid to an employee. It may include a salary or hourly rate, bonuses, commissions, or any other payment. In the view of the IRS, remuneration is the sum total of earnings and other taxable benefits and allowances.

(s) wages means all emoluments which are earned by an employee while on duty or on leave in accordance with the terms and conditions of his employments and which are paid or are payable to him in cash and includes dearness allowance but does not include any bonus, commission, house rent allowance, overtime wages and

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Company and Executive agree as follows:Employment; Duties and Responsibilities.Term.Board of Directors.Location.Base Salary.Incentive Compensation.Executive Benefits.Termination.More items...

: not remunerated : unpaid.

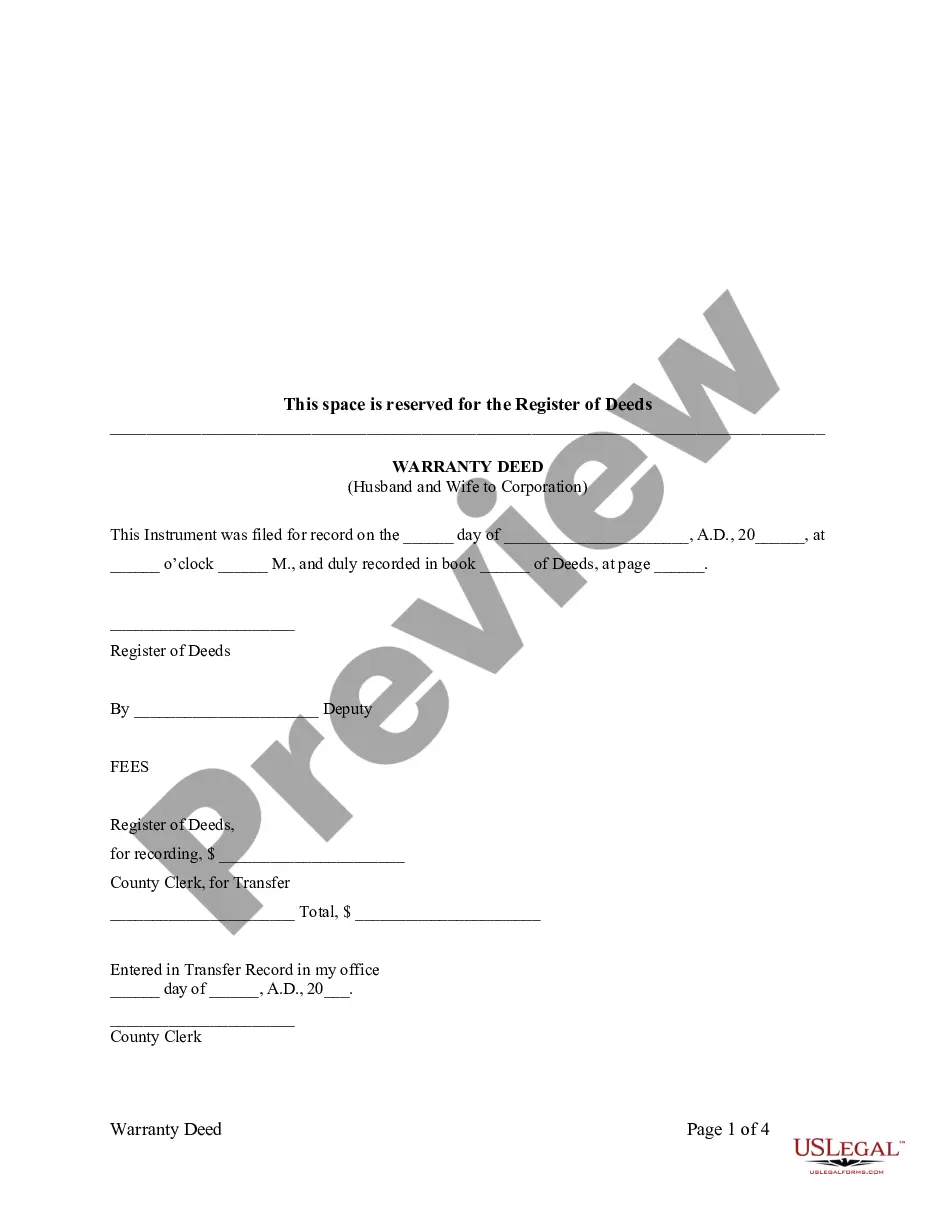

5 Key Considerations When Negotiating an Executive Employment AgreementProtect the Company's Confidential Information and Property.Restrictive Covenants Are Important, But Should Not Overreach.Set Clear Grounds and Procedures for Termination of the Agreement.More items...?

1feff In some states, remuneration does not include the premium portion of overtime payfor example, the "half" an hourly employee receives when working at a time-and-a-half pay rate.