The Virgin Islands Compensation Administration Checklist is a comprehensive guideline that outlines the necessary steps and considerations for managing compensation programs in the Virgin Islands. This checklist serves as a crucial tool for organizations and HR professionals, ensuring compliance, fair practices, and efficient administration of compensation plans. The checklist covers various key aspects, including the identification of employee job descriptions, reviewing market compensation data, salary benchmarking, salary structure creation, pay scale development, internal and external pay equity assessment, compliance with local laws and regulations, employee performance evaluation, budget allocation, and communication of compensation plans to employees. The Virgin Islands Compensation Administration Checklist aims to provide organizations with a systematic approach for establishing and maintaining competitive and equitable compensation packages. By following this checklist, companies can attract and retain top talent, foster employee satisfaction, and support overall business success. Types of Virgin Islands Compensation Administration Checklists: 1. Virgin Islands Exempt Employee Compensation Administration Checklist: This checklist focuses on managing compensation for exempt employees, who are typically salaried and exempt from overtime pay. It outlines specific considerations for determining salary levels, evaluating job descriptions, and complying with the Virgin Islands wage and hour laws. 2. Virgin Islands Non-Exempt Employee Compensation Administration Checklist: Designed for non-exempt employees, this checklist emphasizes compliance with the Virgin Islands minimum wage laws, overtime pay regulations, and record-keeping requirements. It covers topics such as calculating overtime rates, tracking work hours accurately, and ensuring fair compensation for hourly employees. 3. Virgin Islands Executive Compensation Administration Checklist: This checklist caters to executives and top-level management positions within organizations operating in the Virgin Islands. It addresses unique considerations regarding executive compensation structure, equity compensation, bonus plans, and contractual obligations. 4. Virgin Islands Compensation Audit Administration Checklist: This specialized checklist focuses on conducting internal audits of compensation practices in compliance with local laws and industry standards. It includes reviewing compensation policies, conducting pay equity analyses, ensuring proper documentation, and addressing any potential discrepancies discovered. In conclusion, the Virgin Islands Compensation Administration Checklist serves as a vital tool for organizations in the Virgin Islands to effectively manage compensation programs while ensuring compliance with local laws. By utilizing the appropriate checklist type, organizations can streamline their compensation practices, attract top talent, and maintain a fair and competitive compensation framework.

Virgin Islands Compensation Administration Checklist

Description

How to fill out Virgin Islands Compensation Administration Checklist?

Choosing the right legal papers design might be a battle. Obviously, there are plenty of web templates accessible on the Internet, but how do you get the legal form you need? Use the US Legal Forms website. The services provides a huge number of web templates, including the Virgin Islands Compensation Administration Checklist, that you can use for business and private demands. All of the kinds are checked by professionals and satisfy federal and state requirements.

If you are previously signed up, log in for your accounts and click on the Down load key to obtain the Virgin Islands Compensation Administration Checklist. Use your accounts to look through the legal kinds you have acquired formerly. Visit the My Forms tab of your accounts and acquire an additional duplicate of the papers you need.

If you are a new customer of US Legal Forms, allow me to share easy instructions for you to follow:

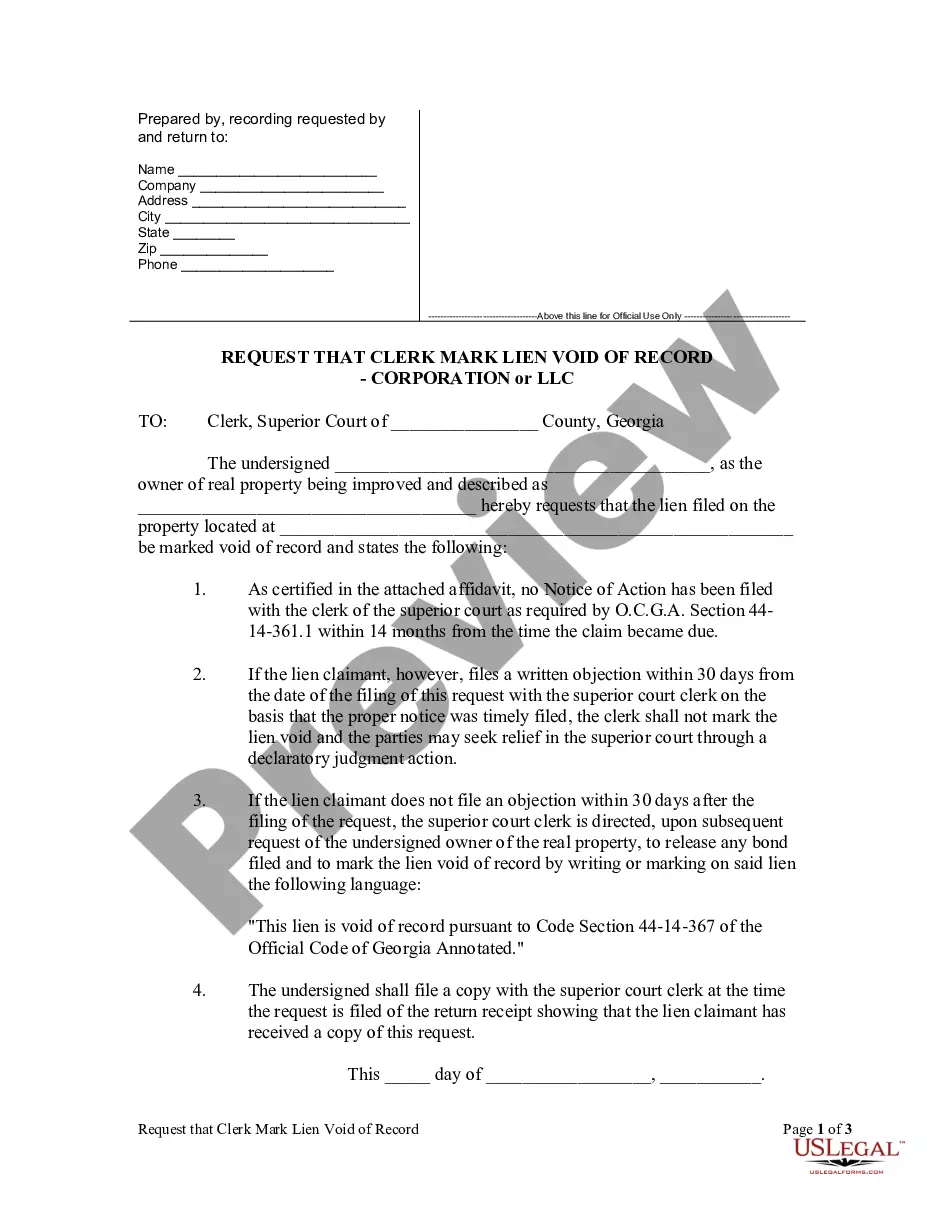

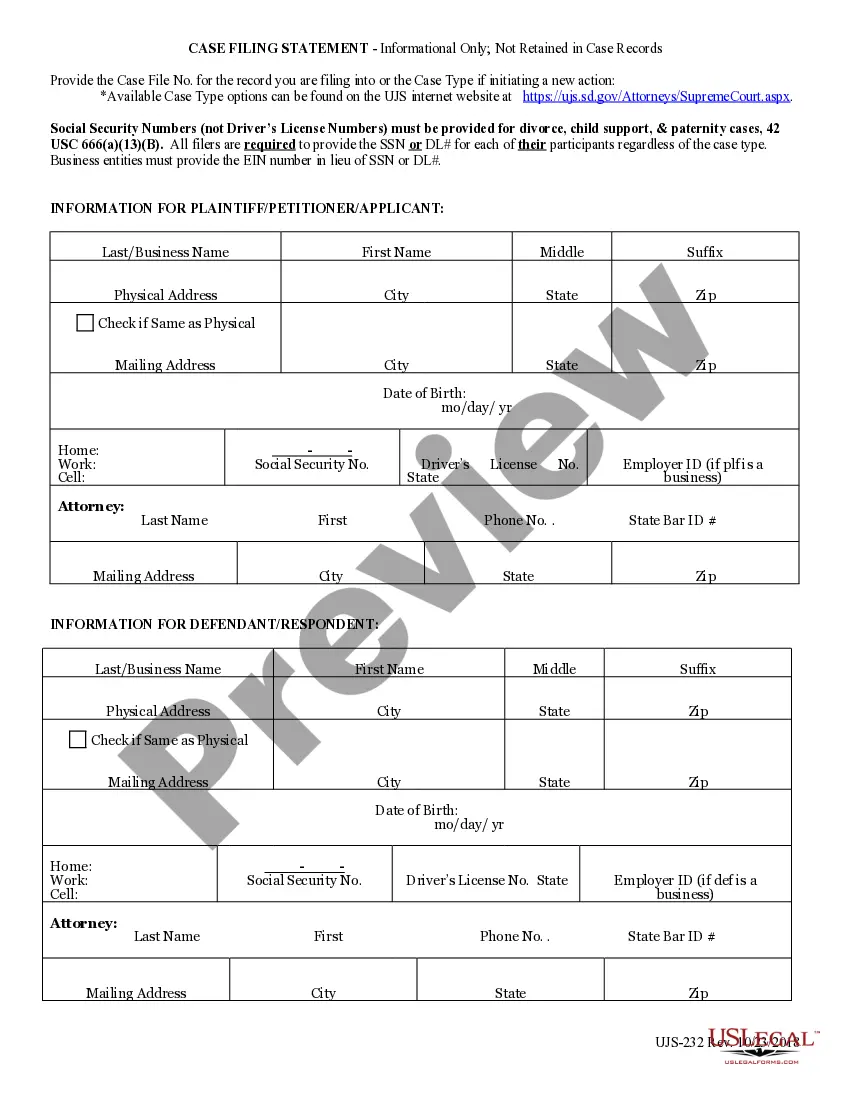

- Initial, make sure you have chosen the correct form for the metropolis/county. You are able to check out the form making use of the Review key and study the form information to guarantee this is the right one for you.

- When the form will not satisfy your preferences, take advantage of the Seach industry to get the correct form.

- When you are certain that the form is suitable, click on the Get now key to obtain the form.

- Opt for the rates prepare you need and type in the required information. Create your accounts and pay money for the order utilizing your PayPal accounts or bank card.

- Pick the submit formatting and down load the legal papers design for your device.

- Comprehensive, change and print and indication the acquired Virgin Islands Compensation Administration Checklist.

US Legal Forms will be the greatest collection of legal kinds that you can discover various papers web templates. Use the service to down load professionally-made papers that follow express requirements.