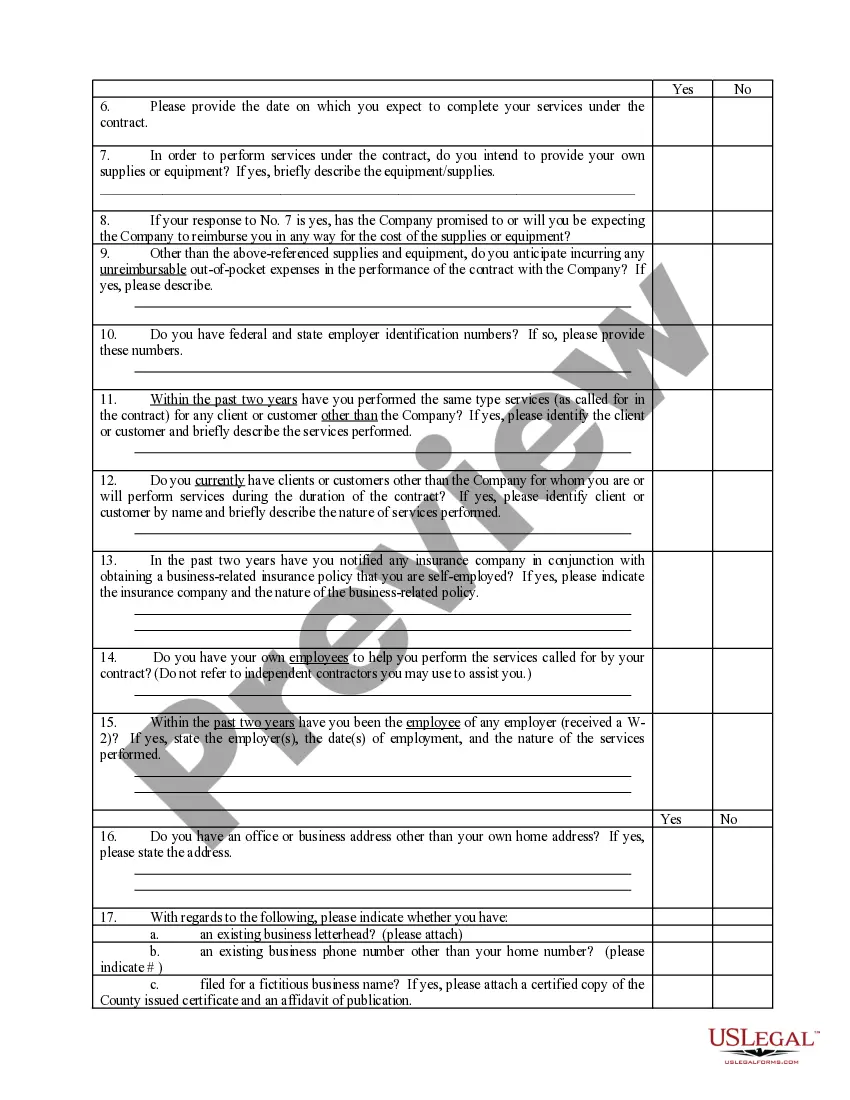

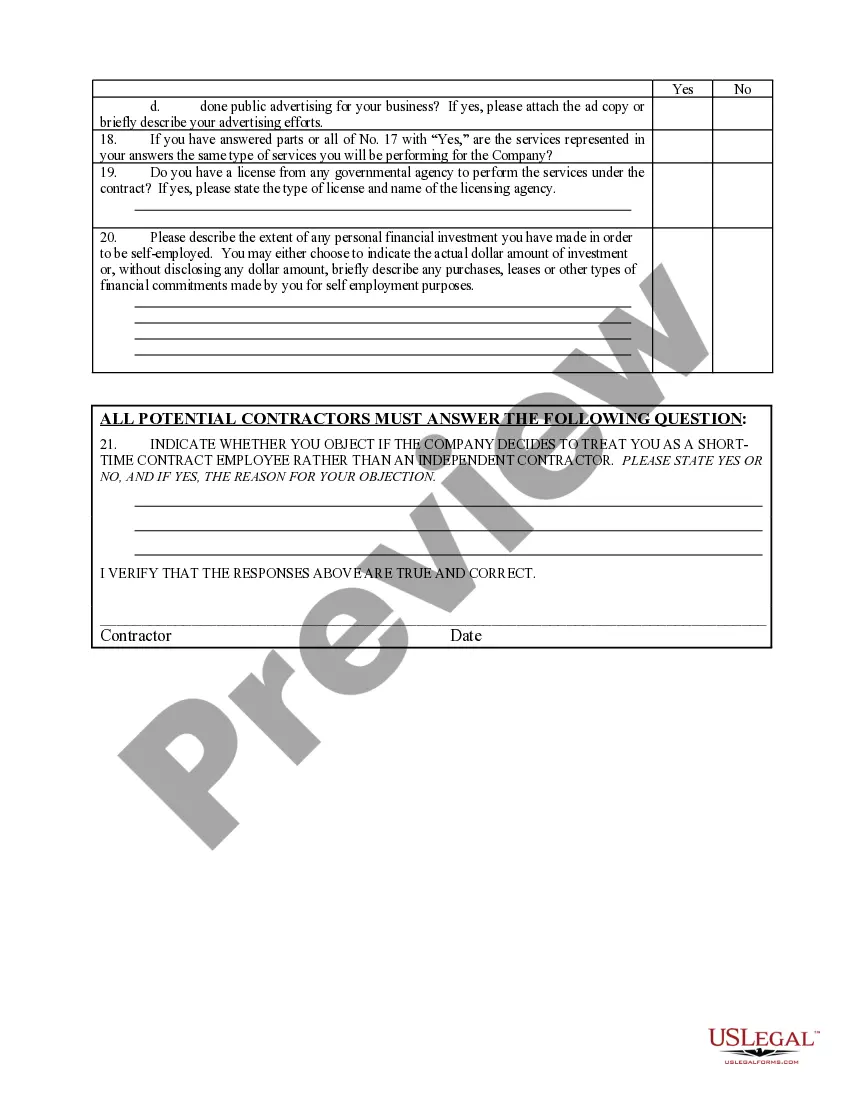

The Virgin Islands Self-Employed Independent Contractor Questionnaire is a comprehensive form used by individuals in the Virgin Islands who work as self-employed independent contractors. This questionnaire serves as an important tool for gathering essential information about an individual's employment status, business activities, income, and tax obligations. This questionnaire is designed to ensure that self-employed individuals in the Virgin Islands are properly classified and complying with tax regulations. By providing detailed answers to the questionnaire, contractors can demonstrate their status as self-employed and assert their eligibility for tax benefits and privileges. The Virgin Islands Self-Employed Independent Contractor Questionnaire covers a wide range of topics, including: 1. Personal Information: Name, address, contact details, and Social Security Number. 2. Business Details: Information about the contractor's trade or business, including the name, address, and type of services provided. 3. Classification Verification: Clarifying whether the contractor meets the criteria to be classified as self-employed or if they are deemed an employee under the Virgin Islands law. 4. Work and Client Information: Description of work performed, duration of contracts, names of clients/employers, and terms of engagement. 5. Income: Details of compensation received, such as business income, wages, tips, commissions, and any other sources of income. 6. Deductions and Expenses: Information about deductible business expenses, such as supplies, equipment, travel costs, and insurance. 7. Tax Obligations: Determining the contractor's responsibility for paying self-employment taxes, estimated tax payments, and reporting requirements. It is important to note that there may be different variations or versions of the Virgin Islands Self-Employed Independent Contractor Questionnaire, tailored to specific industries or tax reporting scenarios. For example: 1. Construction Industry Contractors Questionnaire: A specialized version of the questionnaire catering to construction contractors, involving additional questions related to permits, licenses, subcontractors, and construction-related expenses. 2. Professional Services Contractors Questionnaire: This variation focuses on contractors in fields like accounting, legal services, consulting, or healthcare, seeking specific information related to professional certifications, licensing, associations, and professional liability insurance. 3. Gig Economy Contractors Questionnaire: Targeting individuals who work in the emerging gig economy, such as ride-share drivers, delivery service providers, or freelance digital platform workers, this version explores specific aspects relevant to these types of self-employment arrangements. These different versions of the Virgin Islands Self-Employed Independent Contractor Questionnaire may contain some industry-specific questions, allowing for a more tailored assessment and classification of individuals in those fields. In conclusion, the Virgin Islands Self-Employed Independent Contractor Questionnaire is an integral tool for self-employed individuals in the Virgin Islands to report their income, expenses, and crucial details related to their independent contractor status. By completing this comprehensive form accurately, individuals can ensure compliance with tax regulations and potentially benefit from various tax incentives and deductions provided for self-employed contractors.

Virgin Islands Self-Employed Independent Contractor Questionnaire

Description

How to fill out Virgin Islands Self-Employed Independent Contractor Questionnaire?

If you have to full, download, or print out authorized document templates, use US Legal Forms, the most important variety of authorized types, which can be found on the Internet. Take advantage of the site`s basic and practical research to get the documents you will need. Various templates for organization and personal functions are sorted by categories and suggests, or search phrases. Use US Legal Forms to get the Virgin Islands Self-Employed Independent Contractor Questionnaire within a number of mouse clicks.

If you are already a US Legal Forms consumer, log in in your profile and then click the Down load option to find the Virgin Islands Self-Employed Independent Contractor Questionnaire. You can even accessibility types you formerly delivered electronically in the My Forms tab of your respective profile.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have selected the form for the correct town/nation.

- Step 2. Take advantage of the Preview method to examine the form`s articles. Never overlook to read through the information.

- Step 3. If you are unsatisfied with the type, utilize the Research area towards the top of the display to find other variations of the authorized type format.

- Step 4. Once you have found the form you will need, go through the Get now option. Opt for the rates plan you choose and include your credentials to register to have an profile.

- Step 5. Method the deal. You can use your bank card or PayPal profile to perform the deal.

- Step 6. Choose the formatting of the authorized type and download it in your system.

- Step 7. Total, change and print out or indication the Virgin Islands Self-Employed Independent Contractor Questionnaire.

Every single authorized document format you purchase is yours permanently. You may have acces to each type you delivered electronically within your acccount. Click the My Forms section and select a type to print out or download yet again.

Be competitive and download, and print out the Virgin Islands Self-Employed Independent Contractor Questionnaire with US Legal Forms. There are many specialist and status-specific types you can utilize for your organization or personal requires.